- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Fico 9 48 pt increase, Should I care?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Fico 9 48 pt increase, Should I care?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fico 9 48 pt increase, Should I care?

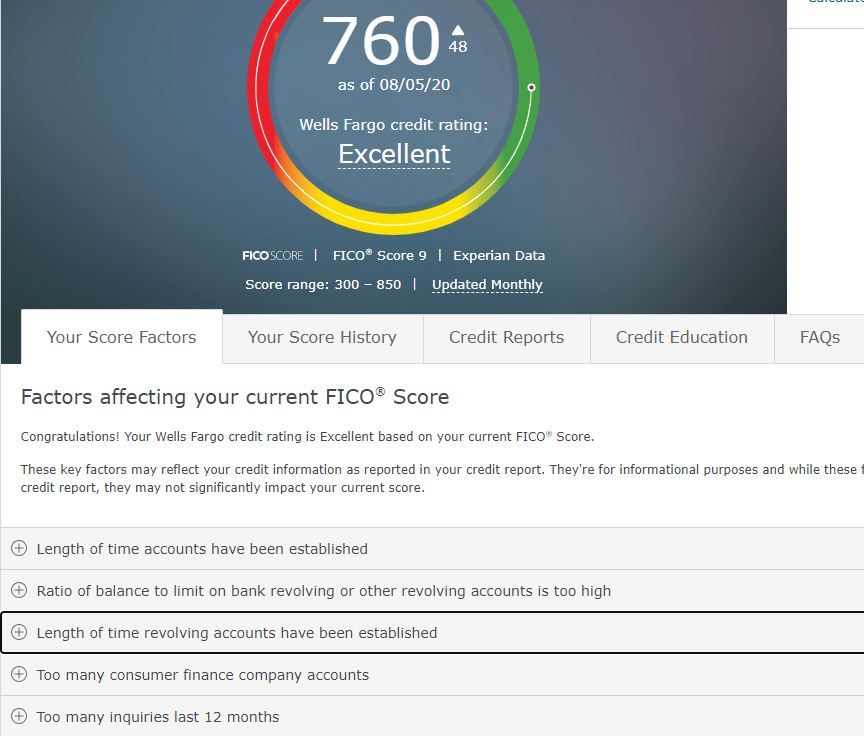

Well my Fico 9 score jumped from 712 to 760 and along with it some scoring factors of affecting my report: CFA and too many Inquires. Should I even care about Fico 9? Seems 100% of my past cc and current ccs and loan were done on Fico 8.

The CFA code is garbage and should be abolished and 5 Inq became unscoreable on July 2020 and my new Inq is from June 28 2020

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 9 48 pt increase, Should I care?

@Remedios Wrong section can you move?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 9 48 pt increase, Should I care?

@AllZero wrote:Congratulations on your success! If a lender uses FICO 9 that you want credit from, yes you should care. If not, no need to worry.

Thanks, but feel the FCA and too many inq would put off lenders. Not applying for anything within the next 9 months but still

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 9 48 pt increase, Should I care?

@AzCreditGuy wrote:@Remedios Wrong section can you move?

As an FYI if you need help from a mod you can also just click on the 3 dots on the upper right of your message, from the menu select "Report Inappropriate Content", then type in what it is you want and submit.

The title is a bit misleading as that isn't intended just to be used to flag inappropriate content, it's really meant to be used whenever you need help from a mod for any reason. If Remi isn't available one of the other mods who is online at the moment will be more than happy to help.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 9 48 pt increase, Should I care?

@AzCreditGuy wrote:

@AllZero wrote:Congratulations on your success! If a lender uses FICO 9 that you want credit from, yes you should care. If not, no need to worry.

Thanks, but feel the FCA and too many inq would put off lenders. Not applying for anything within the next 9 months but still

Lenders really don't seem to care about CFAs anywhere near as much as those of us who notice the codes on our score factors do. They're extremely common and they're also an extremely minor ding.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 9 48 pt increase, Should I care?

@Anonymous I agree because we are the ones working on making our credit great again. I’ve never had a CFA loan on my report until this year when I got a SOFI loan. While SOFI states they are not a CFA and don’t report as such, the research one does brings up CFA are bad and the ramifications of not being able to get a traditional loan. I only had 4 codes showing up BEFORE on my Fico 9 factors 1 which was too many accounts that was dropped for too many CFA and now they added too many inquires in the last 12 months.

Now that the debt is down to 8% UTI when I look at these codes my debt might as well be back to the 30% it was. Consumers get dinged for credit too high, credit too low, not using credit, etc Should be a declaimer once you get down to and below 9% codes are BS.

I had a defining moment where these codes meant nothing , I applied for Dish services and the rep came back that I qualified at the highest tier that I was even offered a security service, it was the moment where I realized my hard work is paying off and these codes are meaningless.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico 9 48 pt increase, Should I care?

They're not meaningless per se, lenders just choose to ignore the codes. Remember, the codes are just reasons for points being lost on the score. If people like me can get up to 20 decent cards with a BK on their report, then someone who is getting a less than 10 point ding for something minor like a CFA (most people who have ever financed their new vehicle with a dealer 0% interest offer has had or currently has one, and the frequency is going up dramatically as fintech companies like Affirm start offering 0% financing on a myriad of different products from all kinds of different manufacturers) or a few inquiries will be fine with all but the most stringent of lenders. Even if a lender claims to be sensitive to something on the denial letter, they usually just copy and paste the FICO reason codes rather than the real reason that they don't like something else about your profile.

I try not to really stress about the nuances of the scores. I have a CFA (Best Egg loan that I took out specifically to *help* my credit) and I was ticked at the time but now it's just meh. I'm in the 770-810 range on my primary FICO scores and lenders usually have their lowest interest tier around 730-760 anyway. It is nice watching my scores go up but I don't sweat the fluctuations anymore.