- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Transunion Credit Based Insurance Scores

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Free Transunion Credit Based Insurance Scores thru CK

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

@beutiful5678 wrote:Very helpful step-by-step instructions!

The dip in May was due to a 30-day late reporting (went Apr 852 --> May 789 --> Jun 852) and the score seems to have bounced back quickly. I think the two things helping my score (per the screenshot and link below) are the thickness and length of my history. I have 40 accounts, AAoA is 7.8, and AoOA is 12.1 years. (Unfortunately, along with that thick history I also have 70+ lates payments reporting - having multiple Stafford loans can be a blessing and a curse.)

My home insurance score "needs work" - it's probably a good thing that I don't own a home, LOL.

https://www.creditkarma.com/auto/i/insurance-scores-affect-car-insurance-rates/

I appreciate the info so far. More would be better. Hopefully SJ, BBS, CGID and others are willing to share.

From what I can tell so far TU CBIS:

1) Does not consider # accts reporting balances (my score stayed the same month to month regardless of # reporting.

2) Does consider time since most recent credit ap rather strongly (this includes HPs for CLIs)

3) Does consider recent BC openings with none in the last 24 months being optimal

4) Does consider AAoA (optimal value > 4.5 years) but not AoOA in general.

5) Uses a 5 year timeframe for charge offs, collections.

6) Looks at 60+ day lates only with focus on # 60+ day lates in the last 12 months and AoOA with a 60 + day late. Settled 30 day lates do not have a lingering impact.

7) Considers average CL but does not consider aggregate UT%.

8) Considers # of bank installment loans with < 6 being preferred

9) Does not appear to look at credit mix and file thickness (other than too many accts)

Provided below is a summary table of data from above posts. I'll add to it as more data becomes available. New posters can include as little or as much information as they are comfortable with. [last update 6/5/2018]

| Poster ID | * T_T * | * T_T * | *T_T* | B5678 | Gmood1 | HOhio | SubE | -BBS- | Sarge |

| TU Auto CBIS | 902 | 869 | 892 | 852 | 774 | 860 | 820 | 903 | 912 |

| TU Home CBIS | 950 | 917 | 931 | 698 | 847 | 897 | 850 | 912 | 823 |

| File Description | clean | clean | Clean | derog | clean | clean | clean | clean | clean |

| Average Age of Accounts (mo) | 186 | 205 | 212 | 92 | 35 | 76 | 14 | 91 | |

| Average card CL (optimal > $9k) | 20,100 | 23,600 | 24,100 | 360 | 17,900 | 10,200 | 6100 | 23,900 | |

| AG UT% | 2 | 3 | 3 | 62 | 2 | 3 | 1 | 1 | |

| # installment loans (optimal <6) | 1 | 1 | 1 | 1 | 3 | 0 | 1 | 1 | |

| Most recent BC opened (mo) | 46 | 79 | 86 | 4 | 7 | 15 | 7 | 13 | |

| # card aps < 12 mo | 0 | 0 | 0 | 2 | 6 | 0 | 3 | 0 | |

| # card aps < 24 mo | 0 | 0 | 0 | ? | 14 | 5 | 5 | 6 | |

| Most recent credit AP/HP (mo) | 46 | 6 | 13 | 3 | 2 | 7 | 7 | 13 | |

| # collections < 5 yr age | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 0 | |

| # Charge offs < 5 yr age | 0 | 0 | 0 | 6 | 0 | 0 | 0 | 0 | |

| # +60 day lates <12 mo age (opt < 5) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| most recent delinquency retail acct | n/a | n/a | n/a | 1 | n/a | n/a | n/a | n/a | |

| AoOA 60+ days late | n/a | n/a | n/a | 23 | n/a | n/a | n/a | n/a |

Based on the TU reason statements 30 day lates are not considered and focus for 60+ day lates is the last 12 months. Clearly there are differences between Auto and Home - otherwise no need for two models. Question is how to differentiate. B5678's much higher Auto score vs Home coupled with GMOOD1s higher Home score vs Auto might help shed some light on this but, more data is needed

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

TT, what's BC? And does AP/HP stand for application/hard pull?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

BC = Bank Card (likely includes credit cards in general as TU CBIS does not appear to differentiate store cards)

AP/HP = credit application with a hard pull. This includes CLI and other types of requests that receive a hard inquiry (pull).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

Thanks for the clarification.

I've seen it posted numerous times in the scoring forum that retail cards ding insurance scores. Care to comment? ![]()

Here's my TU info:

- TU Auto CBIS: 860

- TU Home CBIS: 897

- File Description: clean

- Average Age of Accounts (mo): 76 (Pulled from myFICO rather than Karma due to their omission of closed accounts. Karma has me at 96 months including only my open accounts.)

- Average card CL: $10,150 ($9,400 if closed accounts are included)

- AG UT%: 3%

- # installment loans: 0 (open or closed)

- Most recent BC opened: 15 months

- # card aps < 12 mo: 0

- # card aps < 24 mo: 5

- Most recent credit AP/HP (mo): 7 months (CLI)

- # collections < 5 yr age: 0

- # Charge offs < 5 yr age: 0

- # +60 day lates <12 mo age (opt < 5): 0

- most recent delinquency retail acct: n/a

- AoOA 60+ days late: n/a

I see my auto score bumped up by 20 points in May. It's possible that it's due to accounts aging. Or maybe it's because a November inquiry reached six months in age.

My home score was at 912 last November and dropped to 894 after an inquiry. It's worked its way up by three points since then.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

@HeavenOhio wrote:Thanks for the clarification.

I've seen it posted numerous times in the scoring forum that retail cards ding insurance scores. Care to comment?

I see my auto score bumped up by 20 points in May. It's possible that it's due to accounts aging. Or maybe it's because a November inquiry reached six months in age.

My home score was at 912 last November and dropped to 894 after an inquiry. It's worked its way up by three points since then.

Thanks for the data.

Neither TU nor Fico CBIS models appear to differentiate between retail store cards and "Bank" cards other than TU mentioning it in a delinquency age metric. However, LexisNexis, the market leader in CBIS, does differentiate retail/store cards from Bank cards as evidenced in their reason code list. LN also calls out gas cards - FWIW.

It is important not to lump all CBIS models together. These models differ one from another. It's not all that different than what we encounter trying to compare VantageScore to Fico.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

Overall reporting utilization is less than 1%. Closer to 2% with hidden TLs.

No derogs or lates, file completely clean.

Two youngest bank cards reporting, were obtained 7 months ago. Two others 8 months ago. One at 10 months and another at 12 months.

Last HP April 2018.

Succesful card apps last 24 months reporting to TU is 14. Real number is closer to 20 total, with some hidden or not reporting to TU.

I have a total of 19 closed accounts still reporting.

3 active installment loans. 9 installment loans reporting.

Let me know if you need anything else.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

@Thomas_Thumb wrote:

Neither TU nor Fico CBIS models appear to differentiate between retail store cards and "Bank" cards other than TU mentioning it in a delinquency age metric. However, LexisNexis, the market leader in CBIS, does differentiate retail/store cards from Bank cards as evidenced in their reason code list. LN also calls out gas cards - FWIW.

It is important not to lump all CBIS models together. These models differ one from another. It's not all that different than what we encounter trying to compare VantageScore to Fico.

Thanks for the clarification. In the future, we can specifically mention LexisNexis when we say that retail cards cause a ding.

I've seen it posted here that in addition to gas cards, LN doesn't like retail cards for auto parts stores either.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

@Thomas_Thumb wrote:

I would pay to check my LexisNexis CBIS as well - but those scores are no longer available

The takeaway for me is CBIS models appear to be very sensitive to credit seeking relating to HPs alone. I shudder to think how the models would treat a bunch of new accounts (particularly store cards).

Why are those scores no longer available?

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

@Thomas_Thumb wrote:

Poster ID * T_T * * T_T * B5678 Gmood1 HOhio ****** ****** TU Auto CBIS 902 869 852 774 860 TU Home CBIS 950 917 698 847 897 File Description clean clean derog clean clean Average Age of Accounts (mo) 186 205 92 35 76 Average card CL (optimal > $9k) 20,100 23,600 363 17,900 10,200 AG UT% 2 3 62 2 3 # installment loans (optimal <6) 1 1 3 0 Most recent BC opened (mo) 46 79 4 7 15 # card aps < 12 mo 0 0 2 6 0 # card aps < 24 mo 0 0 2 14 5 Most recent credit AP/HP (mo) 46 6 3 2 7 # collections < 5 yr age 0 0 3 0 0 # Charge offs < 5 yr age 0 0 6 0 0 # +60 day lates <12 mo age (opt < 5) 0 0 0 0 0 most recent delinquency retail acct n/a n/a 1 mo n/a n/a AoOA 60+ days late n/a n/a 23 mo n/a n/a

Based on the TU reason statements 30 day lates are not considered and focus for 60+ day lates is the last 12 months. Clearly there are differences between Auto and Home - otherwise no need for two models. Question is how to differentiate. B5678's much higher Auto score vs Home coupled with GMOOD1s higher Home score vs Auto might help shed some light on this but, more data is needed

Is this just open installment loans or total installment loans? I have 1 open installment loans and 30 total installment loans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

@Subexistence wrote:

@Thomas_Thumb wrote:

I would pay to check my LexisNexis CBIS as well - but those scores are no longer available

The takeaway for me is CBIS models appear to be very sensitive to credit seeking relating to HPs alone. I shudder to think how the models would treat a bunch of new accounts (particularly store cards).

Why are those scores no longer available?

I suspect LN no longer offers CBIS to consumers because the major insurance companies "suggested" they discontinue the practice. Given the limited revenue from consumers purchasing the score, why antagonize your primary customers? Also, unlike denials for credit, disclosure of scores/reasons for high insurance premiums is not required by law.

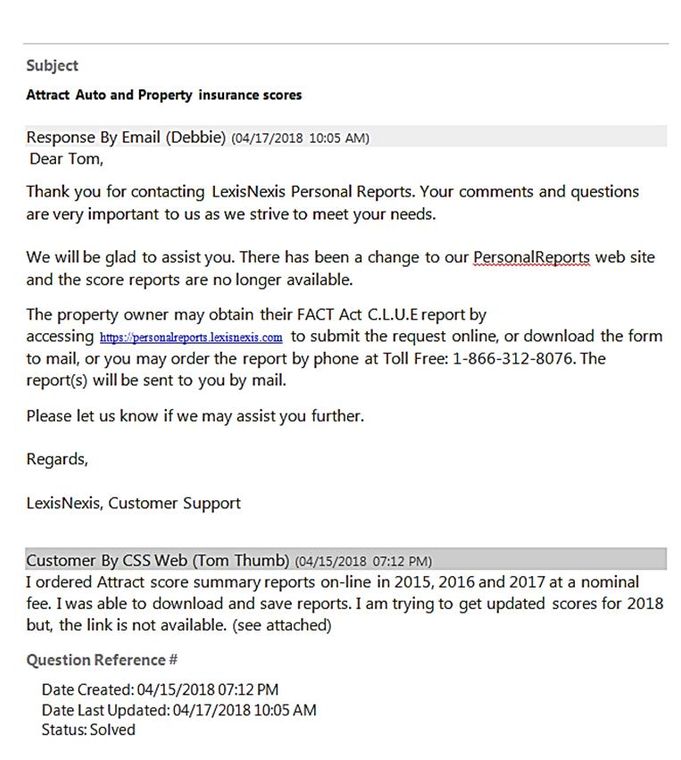

I wrote LexisNexis a note about this. Below is their response:

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950