- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Transunion Credit Based Insurance Scores

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

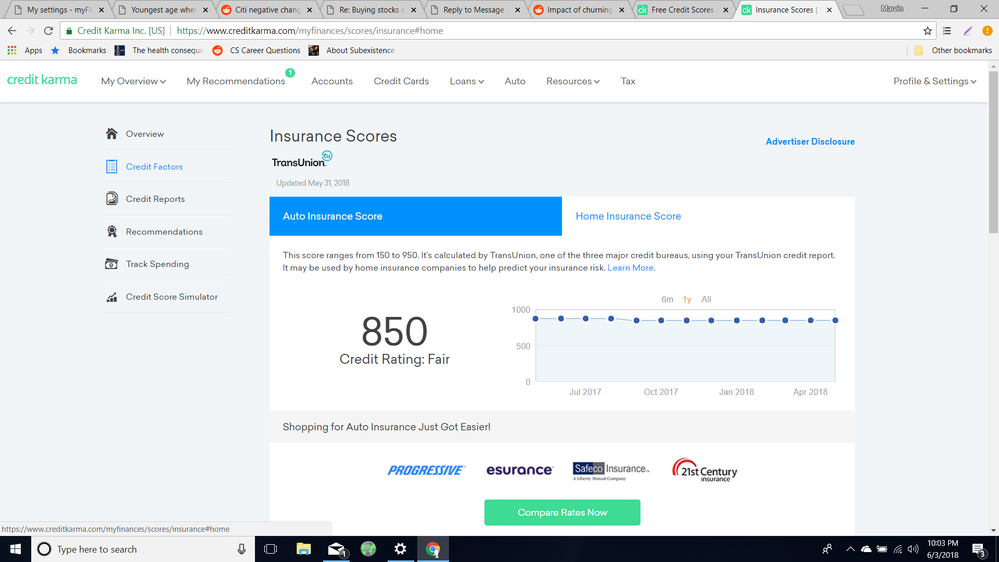

Free Transunion Credit Based Insurance Scores thru CK

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

@beutiful5678 wrote:

@Thomas_Thumb wrote:Based on the TU reason statements 30 day lates are not considered and focus for 60+ day lates is the last 12 months. Clearly there are differences between Auto and Home - otherwise no need for two models. Question is how to differentiate. B5678's much higher Auto score vs Home coupled with GMOOD1s higher Home score vs Auto might help shed some light on this but, more data is needed

Is this just open installment loans or total installment loans? I have 1 open installment loans and 30 total installment loans.

The information I found from TU does not clarify if installment loan count is open or open + closed. However, given high count is viewed negatively, my conclusion is open only as closed loans should not present an elevated risk of filing a claim - IMO.

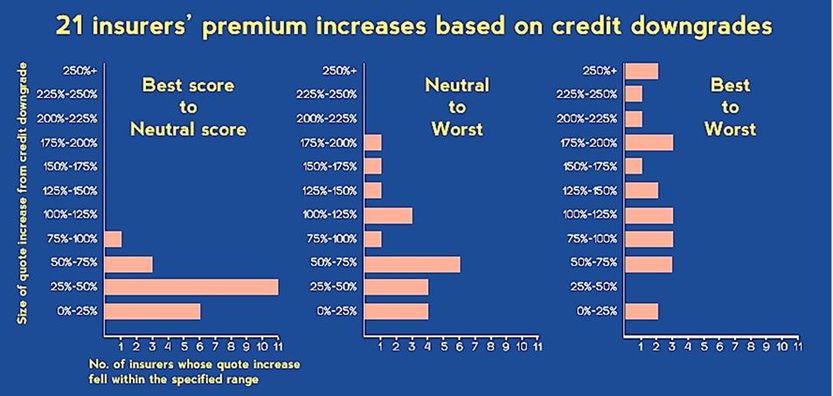

For those curious as to impact of CBIS score on insurance premiums, you may find the below chart and article link of interest.

A recent analysis from OnlineAutoInsurance.com

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

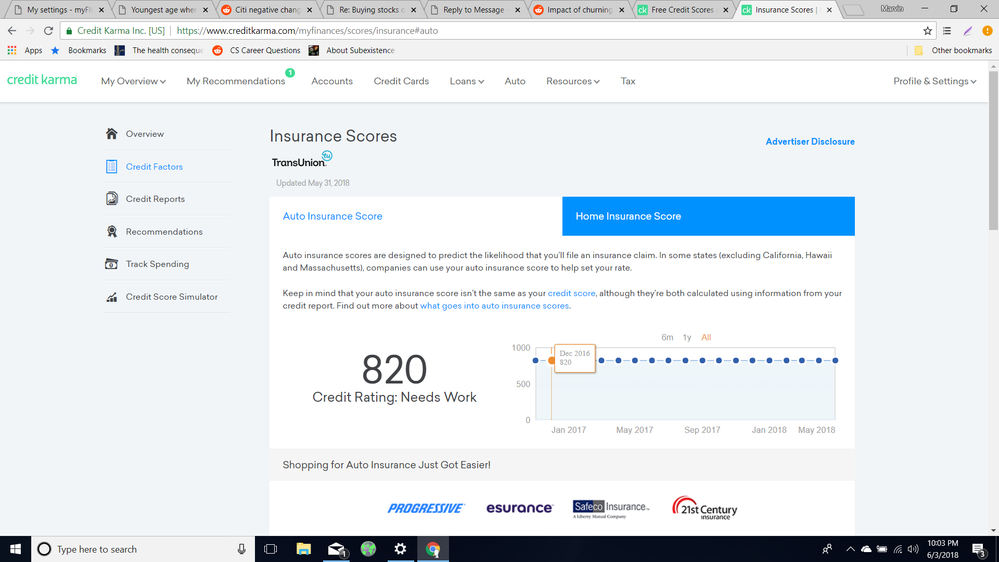

@Thomas_Thumb wrote:I went on CK to check out my VS 3 scores and found an easy link to CBIS scores from Transunion.

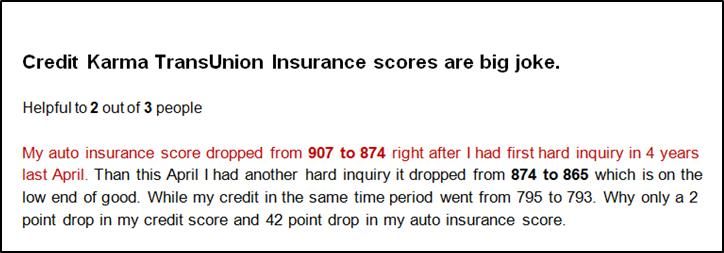

I was a bit shocked to see a major drop in score. I then clicked on "learn more about your insurance score" and was able to access my Home CBIS. A major hit on this score as well. One lousy inquiry drops my TU CBIS Auto score 33 points (902 to 869) and Property/Home score also dropped 33 points (950 to 917). [Note these two CBIS scores don't always change in unison but, the inquiry impact is the same]

I was looking through old files on CBIS and came across a poster comment from 2016 on CK's web site - pasted below. A bit strange that I had saved the comment and stumbled across it now - it also mentions a 33 point drop for going from zero to one HP. Then a further 9 points loss when an inquiry is added while one is already on file (similar to Gmood1's 10 point drop)

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

@Subexistence wrote:Why have my scores stayed consistent so long? Also do inquiries only impact score for 1 year or 2 years?

SubE,

Thanks for the score results. I'll add your data to the original table (prior page) with some placeholder estimates.

Can you add some profile data?

I suspect your CBIS scores are pre BCE CLI from 10,800 => $26,700. From other posts it looks as though your most recent CC/HP is 8/2017 with 6 CCs in the last 24 months, 1 CC in the last 12 months.

TransUnion CBIS scores are more stable than VantageScore or Fico credit scores. That's true regardless of profile. A few reasons for this include:

1) TU CBIS does not factor in # or % of cards reporting nor individual/aggregate utilization (neither are mentioned in TUs CBIS factor table - see 1st page). These attributes tend to fluctuate and influence credit scores accordingly.

2) TU CBIS has less attribute tiers than LN CBIS and VS/Fico. Fewer boundries, fewer fluctuations.

To get a better feel for what TU CBIS considers, review the code table on page one of this thread. Granted, the table is quite old but, it's the only one I have come across. Not sure how TU CBIS treats inquiries other than factoring in the age of the most recent HP under 24 months age and looking at QTY of bankcard applications in the last 12 months and 24 months.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

@Thomas_Thumb

From what I can tell so far TU CBIS:

1) Does not consider # accts reporting balances (my score stayed the same month to month regardless of # reporting.

2) Does consider time since most recent credit ap rather strongly (this includes HPs for CLIs)

3) Does consider recent BC openings with none in the last 24 months being optimal

4) Does consider AAoA (optimal value > 4.5 years) but not AoOA in general.

5) Uses a 5 year timeframe for charge offs, collections.

6) Looks at 60+ day lates only with focus on # 60+ day lates in the last 12 months and AoOA with a 60 + day late. Settled 30 day lates do not have a lingering impact.

7) Considers average CL but does not consider aggregate UT%.

8) Considers # of bank installment loans with < 6 being preferred

9) Does not appear to look at credit mix and file thickness (other than too many accts)

Provided below is a summary table of data from above posts. I'll add to it as more data becomes available. New posters can include as little or as much information as they are comfortable with.

Poster ID * T_T * * T_T * B5678 Gmood1 HOhio SubE ****** TU Auto CBIS 902 869 852 774 860 820 TU Home CBIS 950 917 698 847 897 850 File Description clean clean derog clean clean clean Average Age of Accounts (mo) 186 205 92 35 76 14 Average card CL (optimal > $9k) 20,100 23,600 360 17,900 10,200 4300? AG UT% 2 3 62 2 3 1 # installment loans (optimal <6) 1 1 1 3 0 1 Most recent BC opened (mo) 46 79 4 7 15 7 # card aps < 12 mo 0 0 2 6 0 2 # card aps < 24 mo 0 0 ? 14 5 8 Most recent credit AP/HP (mo) 46 6 3 2 7 9 # collections < 5 yr age 0 0 3 0 0 0 # Charge offs < 5 yr age 0 0 6 0 0 0 # +60 day lates <12 mo age (opt < 5) 0 0 0 0 0 0 most recent delinquency retail acct n/a n/a 1 n/a n/a n/a AoOA 60+ days late n/a n/a 23 n/a n/a n/a

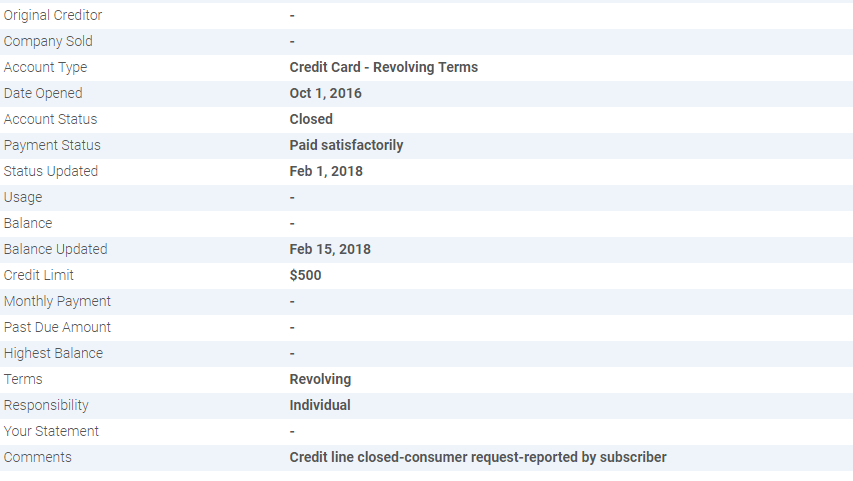

TT, since my CK CBIS report is based on May and thus based on the age of my accounts in May, I should not use their current age in June right? I think I need to subtract 1 month to account for this. Also do closed accounts factor into # card apps and average credit limit? Is there a website that lists average credit limit or do I have to compute it myself? What about line of credit that creditscore.com lists as revolving? I had one account where something weird happened in regards to being closed. I opened a secu card for $500 on October 2016. A few days later during the same month, the account number was compromised so I requested a new identical card. The original card was reported as closed and a new account opened up on my report with identical information. You can read my original story here which also happens to be my first post. https://ficoforums.myfico.com/t5/General-Credit-Topics/Secumd-scammed-me-into-making-new-accounts-wh...

Here is what my creditscore.com shows

In any case I have updated my side of the table due to my paypal card I opened in October 2017. I will update my signature with my account history link. Below is the link and in the first post is my account history.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

SubE,

Average CL should be for open accounts only. I suggest computing average CL based on revolving CCs only - exclude the PLOC. I can't say for sure that the metric excludes PLOCs but, for sake of a consistent methodology let's go with that approach. I'd suggest you calculate manually using CLs from the most recent data available that is prior to the CBIS pull date.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

| Poster ID | * T_T * | * T_T * | B5678 | Gmood1 | HOhio | SubE | ****** |

| TU Auto CBIS | 902 | 869 | 852 | 774 | 860 | 820 | |

| TU Home CBIS | 950 | 917 | 698 | 847 | 897 | 850 | |

| File Description | clean | clean | derog | clean | clean | clean | |

| Average Age of Accounts (mo) | 186 | 205 | 92 | 35 | 76 | 14 | |

| Average card CL (optimal > $9k) | 20,100 | 23,600 | 360 | 17,900 | 10,200 | 6,160 | |

| AG UT% | 2 | 3 | 62 | 2 | 3 | 1 | |

| # installment loans (optimal <6) | 1 | 1 | 1 | 3 | 0 | 1 | |

| Most recent BC opened (mo) | 46 | 79 | 4 | 7 | 15 | 7 | |

| # card aps < 12 mo | 0 | 0 | 2 | 6 | 0 | 3 | |

| # card aps < 24 mo | 0 | 0 | ? | 14 | 5 | 5 | |

| Most recent credit AP/HP (mo) | 46 | 6 | 3 | 2 | 7 | 7 | |

| # collections < 5 yr age | 0 | 0 | 3 | 0 | 0 | 0 | |

| # Charge offs < 5 yr age | 0 | 0 | 6 | 0 | 0 | 0 | |

| # +60 day lates <12 mo age (opt < 5) | 0 | 0 | 0 | 0 | 0 | 0 | |

| most recent delinquency retail acct | n/a | n/a | 1 | n/a | n/a | n/a | |

| AoOA 60+ days late | n/a | n/a | 23 | n/a | n/a | n/a |

By number of card apps, you mean inquiries on TU right? I took average age of accounts from creditscore.com summary and then computed it myself and instead for 14.625 if I included both closed secu CCs and the PLOC. I assume that the creditscore.com calculation ignores PLOC or it rounds 14.625 to 14.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

Sub, you definitely want TU data because these are TU scores. I used current data from Karma because it would have been updated when the scores were updated. The exceptions were utilization and AAoA because Karma reports those incorrectly.

I did the utilization by hand because it's easy. Remember that all fractions round up. I grabbed the TU AAoA from myFICO because I had it available. If you have to fall back on another bureau to get an accurate AAoA, make sure it's reporting exactly the same accounts that TU is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

@HeavenOhio wrote:Sub, you definitely want TU data because these are TU scores. I used current data from Karma because it would have been updated when the scores were updated. The exceptions were utilization and AAoA because Karma reports those incorrectly.

I did the utilization by hand because it's easy. Remember that all fractions round up. I grabbed the TU AAoA from myFICO because I had it available. If you have to fall back on another bureau to get an accurate AAoA, make sure it's reporting exactly the same accounts that TU is.

gotcha

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

TT, cool thread topic. I never even knew that CK provided anything other than TU/EQ VS 3.0 scores. These auto and home insurance scores are completely new to me. Here are my data points. Let me know if you need anything else:

TU Auto CBIS: 903

TU Home CBIS: 912

Clean File

AAoA: 91 months

ACL: $23,928

AG UT: 1%

Open installment loans: 1 (mortgage)

Most recent BC opened: 13 months

CC apps < 12 mo: 0

# CC apps < 24 mo: 6 (this will drop to 3 in a few weeks)

Most recent HP: 13 months