- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Free Transunion Credit Based Insurance Scores thru...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Free Transunion Credit Based Insurance Scores thru CK

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

@iv wrote:

@Thomas_Thumb wrote:Update - My TU inquiry aged past 12 months last month. As hoped, I experienced some nice rebounds in both Auto and Home scores. These scores are still below my pre HP levels which suggests a lingering although lessened inquiry impact. I suspect the inquiries will impact TU CBIS scores for the full 2 years they are on a report.

Yup. Reason codes S21 through S45 make that fairly clear. (Over 2 full years is optimal, but there is a separate reason code for each month on the way there.)

Understood but, the reason codes don't provide quantitative insight on score change with inquiry aging.

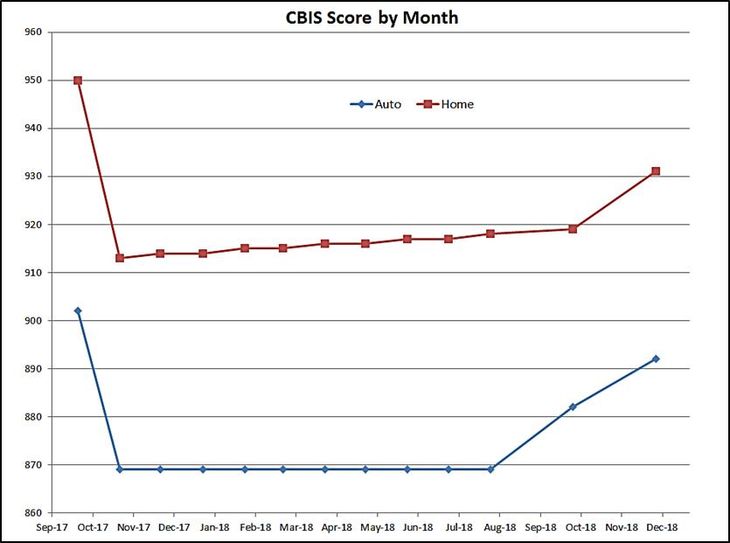

See chart and table below for quantification.

Some observations are:

1) Home score increased by one point every other month until the 13 month mark when it spiked up 12 points.

2) Auto score flat at 869 until 11 months age (10/2018) when it spiked 13 points (closed Kohls store card removed from report). Then spiked another 10 points at 13 months (lone INQ aged past 12 months) - This 2nd spike may have occurred a month earlier but, no score pulled in November).

3) As expected CBIS is not a credit score and as such does not react to changes in monthly utilization nor # of accounts with balances.

| Date | Auto | Home | INQ Age (mo) |

| Oct-17 | 902 | 950 | 40 |

| Nov-17 | 869 | 913 | 0 |

| Dec-17 | 869 | 914 | 1 |

| Jan-18 | 869 | 914 | 2 |

| Feb-18 | 869 | 915 | 3 |

| Mar-18 | 869 | 915 | 4 |

| Apr-18 | 869 | 916 | 5 |

| May-18 | 869 | 916 | 6 |

| Jun-18 | 869 | 917 | 7 |

| Jul-18 | 869 | 917 | 8 |

| Aug-18 | 869 | 918 | 9 |

| Oct-18 | 882 | 919 | 11 |

| Dec-18 | 892 | 931 | 13 |

Score update 3/2019 below- Home score back to increasing 1 point every other month. No increase in Auto

| Date | Auto | Home | INQ Age |

| Jan-19 | 892 | 932 | 14 |

| Feb-19 | 892 | 933 | 15 |

| Mar-19 | 892 | 933 | 16 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

Is this still a project that is being worked on? I can provide a lot of DP for you guys from the past 5 years (I had no idea this score even existed on CK all this time!). It's a bit weird to me though, that my insurance premiums have skyrocketed during the periods that the scores were at their best (between 911 and 926). I know there are other factors involved in the insurance premiums, but just odd nonetheless.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

@Duke_Nukem wrote:Is this still a project that is being worked on? I can provide a lot of DP for you guys from the past 5 years (I had no idea this score even existed on CK all this time!). It's a bit weird to me though, that my insurance premiums have skyrocketed during the periods that the scores were at their best (between 911 and 926). I know there are other factors involved in the insurance premiums, but just odd nonetheless.

Not all insurance companies consider CBIS when setting premiums. Also, California, Hawaii and Massachusetts don't allow CBIS to be used as a factor in setting premiums. I use State Farm and they do use CBIS as do many other insurers.

https://www.statefarm.com/simple-insights/saving/these-7-factors-determine-car-insurance-premiums

If you are willing and able to add your data in a table format that would be great. Any details that appear to correlate to abrupt shifts in score would be helpful. Also, I am still trying to get a handle on main differences between the Auto and Home algorithms.

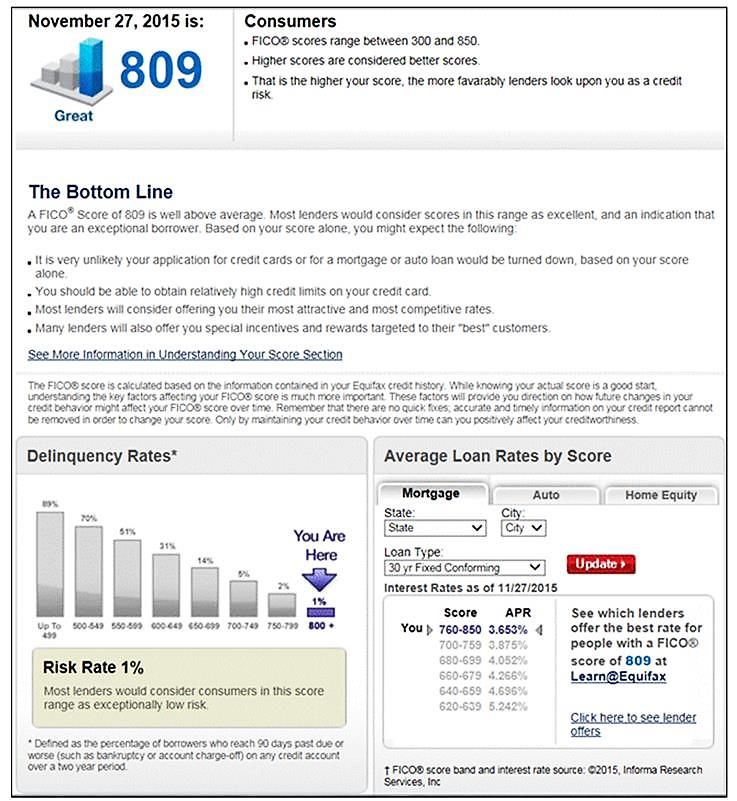

Side note: As stated upthread a couple times CBIS is not concerned with utilization or #/% of cards with balances. Again, CBIS is used as a predictor in likelihood of filing a claim (claim frequency). True credit scoring models (VantageScore & Fico) look at default risk (based on delinquency rate for a 90 day late).

Below is a rating table for LexisNexis CBIS which came with my LN reports. The table is rather basic and insurance companies group score into finer increments for evaluating risk. (refer to the below graphs). I have added a side by side comparison of my TU and LN CBIS scores from 2017. Wish I could get updated LN scores but, access was removed in 2018 before I could get my yearly update.

| Scoring Model | Auto | Home | Scale |

| TransUnion CBIS | 902 | 950 | 150 - 950 |

| LexisNexis CBIS | 940 | 870 | 300 - 997 |

Chart directly below from West Bend Insurance.

...

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

Thomas_Thumb ... in keeping with "high risk" you will have to pay more for your insurances! GADS, a MyFicoer who can't keep max insurance scores!!! In truth, what a lot of nonsense and warrants a "RANT" but I won't! One inquiry ... any excuse to charge us more?! With Max FICO 8 Scores (which are NOT insurance scores) I changed insurance carriers for 2019 and the insurance company actually saved me $490 (using same specfications as previous insurance) and the insurance company informed my that they could not give me their best rates due to my Insurance Scores (go figure)? As I age the benefits of being tired keep me from ranting as much so you all get a repreive, but ...!!! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

@Anonymous - Congrats on lowering your rates.

Do you have access to TU CBIS scores through CK? If so, what are your Auto and Home scores?

As has been mentioned earlier TU CBIS uses information from your TU credit report. In contrast LN uses information from your EQ credit report and LN's own sources. At one point I had a table of insurers and what CBIS score each used, if any. I thought I saved it but, I can't locate it. I know State Farm uses CBIS from LN.

Unfortunately with Auto insurance you can't use a pay for delete strategy to remove derogatories (as in moving violations). These black marks have had a negative impact on my premiums. However, my last one aged off late last year and premiums have dropped considerably![]()

I did come across a "trick" three years ago that works kind of like a PFD. If you get lower level moving violation (speeding ticket less than 20 mph over posting) don't pay it upfront. Appear in court and they will offer you a deal - if your file shows no similar violation in the last year. The deal is:

You can pay a surcharge fine and no plea is entered. The incident is "shelved" and not placed on your viewable traffic history report. If you go a year without another citation the incident is closed without a verdict and stays off the viewable report permanently. However, if you do receive another citation then the ticket goes on your viewable file permanently along with a guilty verdict.

I had an opprtunity to try this tactic in early 2016 and again in early 2018 - it worked! ![]() These two incidents are not present in the data base insurers access - nor are they referenced in LN's dossier file

These two incidents are not present in the data base insurers access - nor are they referenced in LN's dossier file ![]() .

.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

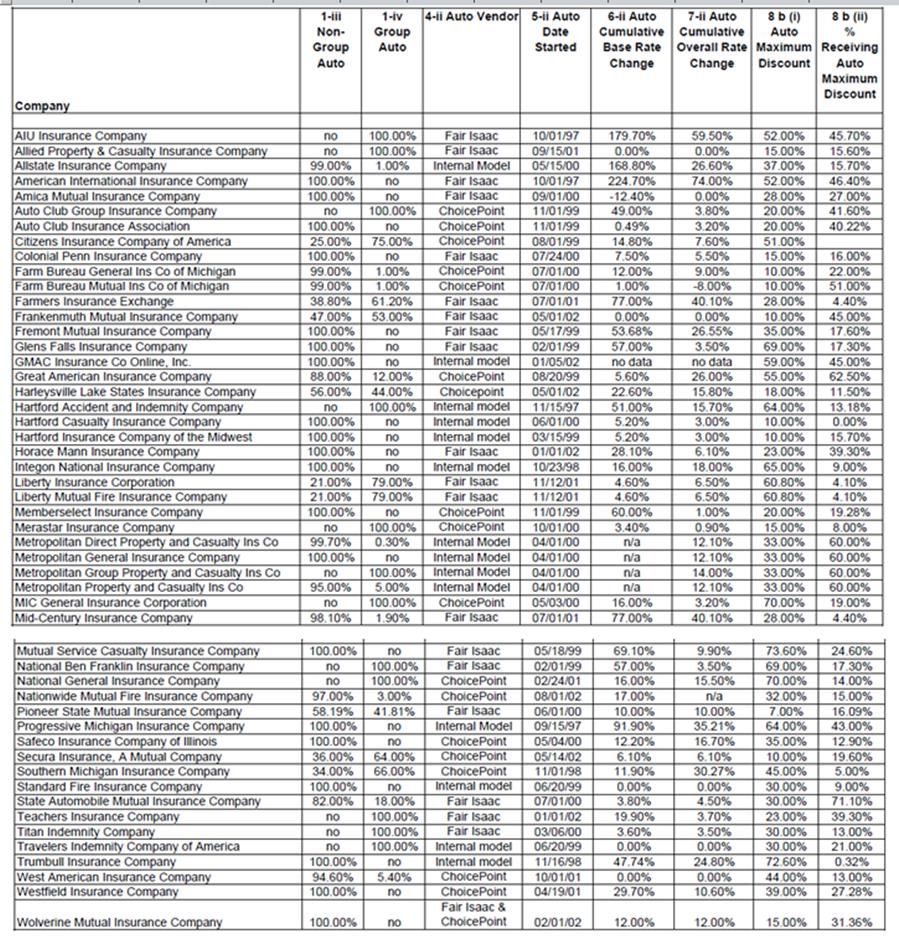

Pasted below is an ancient table listing insurance companies and the CBIS model they use. Choice Point is LN. A lot show Fair Isaac but, many have of those have been migrated to TU or LN over the last 15 years. An up to date table would be welcome.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

I'm going through auto insurance renewal right now. My Progressive agent asked for their guys to re-evaluate my renewal based on my improved credit since last Fall. The Progressive people said that I'm already at their highest rating of "A1" and if they reevaluate it wouldn't make my rates any cheaper (could actually make them worse if they find something odd).

I'll get you some DP to look at soon.

I'm going insurance shopping this week and may have more info to provide...

Question: Do they only look at the primary's insurance score, or do they consider everyone's insurance score on the policy as well?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

In my discussion with State Farm it was the primary's score only. I have a bundled policies: cars + home + other items with an umbrella. My wife was primary by default because her name was listed 1st. On joint ownership policies default is to list the older person 1st unless instructed otherwise.

Ask progressive who they use for CBIS and see if they will tell/show you your actual score along with the score range.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950