- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Impact on credit score by paying charge off CO

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Impact on credit score by paying charge off CO

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Impact on credit score by paying charge off CO

Happy Friday.

Two questions:

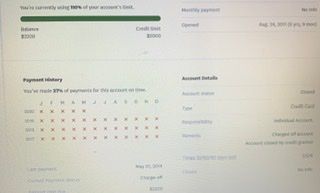

1. I'm trying to determine the impact to my scores if I pay off an outstanding charge off to USAA. The amount is $2280. Acct closed in 2015. Reporting negative every month. Due to fall off April 2021. I do want to eventually pay them because I would like to possibly use them for auto insurance or other things in the future. Should I pay now, and will it lower my score?

2. How likely would NavyFCU approve me for an auto loan with this outstanding balance to another credit union?

Credit Karma scores are 533 Tran and 535 EXperian FICO 8 is 568.

I have a Navy LOC that I'm planning to get to 27% before the end of the month (limit is 7k, balance 5230).

April sold home. Tons of late payments and paid off car in May, again tons of late payments.

I have 2 Capital One CCs - 2800 and 400 limit. The 400 is already at zero and I just paid the balance of 697 on the 2800 down to zero.

The only other installment account is a student loan.

One collection with Enhanced Recovery that I paid off. They removed from Experian, but not Equifax. Was $288.

DTI is 11%.

Thanks in advance for any input.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact on credit score by paying charge off CO

Hello,

I know Pre Covid-19 USAA was asking for 50% to settle debts no matter the age. Not sure if they are willing to take lower with the current events. But once it get a 0 balance, and they stop reporting your score will begin to increase. I would love to know what they tell you as far as paying it off goes, keep us posted.

I have received a navy federal auto loan with two charge offs before. You will get dinged points for have two 0 balanced credit cards, have one report a small balance of like $5 for optimal scoring.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact on credit score by paying charge off CO

Thank you .

I thought I read that the CLOC reported the same as credit cards? The $697 payment hasn't been reported yet so I can make a $20 charge. It won't report again until July 1st.,

I am okay with paying the full amount to USAA because I think I will need to in order to use them in the future. I haven't called them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact on credit score by paying charge off CO

@TC1212 wrote:Thank you .

I thought I read that the CLOC reported the same as credit cards? The $697 payment hasn't been reported yet so I can make a $20 charge. It won't report again until July 1st.,

I am okay with paying the full amount to USAA because I think I will need to in order to use them in the future. I haven't called them.

I'm not too familiar with what type of loans CLOC are so I'm sure the experts will chime in. As far as USAA, my gf has two chargeoffs that are both due to fall off in April 2021 but she still has insurance with them with no problems. But IMHO USAA insurance isn't what it use to be and I think you can get better rates elsewhere.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact on credit score by paying charge off CO

@Anonymous

I've heard that quite a few times now about their insurance. When I had it about 8 years ago the rates were amazing.

I will go ahead and charge $10 on my card now.

Enjoy your weekend.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact on credit score by paying charge off CO

Do a goodwill campaign to get the collection removed off of Experian.

Welcome to the forums!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact on credit score by paying charge off CO

@Anonymous @Thank you. I wrote the goodwill letter yesterday. Will pay off the account in mid-July.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact on credit score by paying charge off CO

And you may have to do it over and over and over and over and over again; don’t give up, have thick skin.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact on credit score by paying charge off CO

@Anonymous Thank you. Definitely will send lots of letters.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Impact on credit score by paying charge off CO

@TC1212 I definitely would follow @Anonymous advice he seems to be the Goto credit wiseman ![]() . I saw someone post welcome to the forum that may mean your new. Welcome to you. Being new around here myself I find birdman gives solid advice.

. I saw someone post welcome to the forum that may mean your new. Welcome to you. Being new around here myself I find birdman gives solid advice.

As for getting an account with USAA it may be a challenge to get in if you owe a active debt with them and no active products. I am a long time client and had one bad debt and could not open a checking with them until the debt stopped reporting. That's with other active good products for almost 17 yrs at the time. It may be different now it was a couple years ago. You could call and ask for a quote. They can tell you then if are eligible or not.

i think the advice would be the same with NFCU. You can get approved with COs but I do think it's type and age matter. The good news is because you have a credit product with them your internal score may help there decision since you have history with the CLOC. No promises and always remember the views expressed etc etc. YMMV

In the end while you may have a chance if you did nothing right away to foster a positive outcome and get your scores moving in the right direction would be to pay it off. 1-1.5 years is a lifetime in the credit world.

Good Luck

Good Luck