- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Is a lender able to see soft pulls in a credit sco...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is a lender able to see soft pulls in a credit score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is a lender able to see soft pulls in a credit score?

I'm new to the world of American credit reporting and I still have some questions.

I know hard pulls received in your credit report will be visible to anyone querying your date, and besides will hurt your score.

But in the case of receiving several soft pulls for applying pre-qualify credit cards, does a lender have access to the amount of soft pulls received or do we only have access to this data?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is a lender able to see soft pulls in a credit score?

@Fernando1 wrote:I'm new to the world of American credit reporting and I still have some questions.

I know hard pulls received in your credit report will be visible to anyone querying your date, and besides will hurt your score.

But in the case of receiving several soft pulls for applying pre-qualify credit cards, does a lender have access to the amount of soft pulls received or do we only have access to this data?

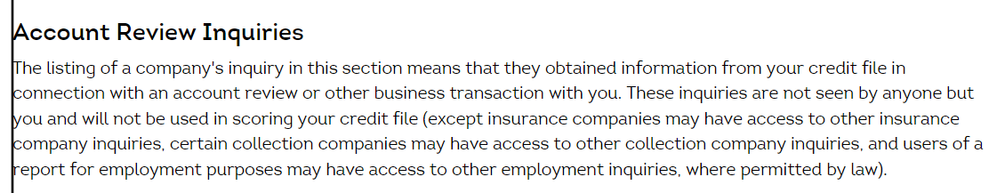

they're only seen by you

3/6, 5/12, 14/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is a lender able to see soft pulls in a credit score?

@GZG wrote:

@Fernando1 wrote:I'm new to the world of American credit reporting and I still have some questions.

I know hard pulls received in your credit report will be visible to anyone querying your date, and besides will hurt your score.

But in the case of receiving several soft pulls for applying pre-qualify credit cards, does a lender have access to the amount of soft pulls received or do we only have access to this data?

they're only seen by you

Would that not be the case if a full credit report is pulled? I know a soft inquerie is not going to cost points, but I thought a full credit report would be seeable by a lender. I am almost certain the full 3B reports obtained by mortgage lenders has these soft pulls listed, or at least used to. Credit card issuers do not get the more detailed reports, but it seems like I remember them being on my mortgage pulls.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is a lender able to see soft pulls in a credit score?

@sarge12 wrote:

@GZG wrote:

@Fernando1 wrote:I'm new to the world of American credit reporting and I still have some questions.

I know hard pulls received in your credit report will be visible to anyone querying your date, and besides will hurt your score.

But in the case of receiving several soft pulls for applying pre-qualify credit cards, does a lender have access to the amount of soft pulls received or do we only have access to this data?

they're only seen by you

Would that not be the case if a full credit report is pulled? I know a soft inquerie is not going to cost points, but I thought a full credit report would be seeable by a lender. I am almost certain the full 3B reports obtained by mortgage lenders has these soft pulls listed, or at least used to. Credit card issuers do not get the more detailed reports, but it seems like I remember them being on my mortgage pulls.

Nope, I think you're conflating things @sarge12. Any lender CC or otherwise that obtains a full credit report is able to view everything, except SPs. As far as mortgage lenders, not unless you supplied your own personal hard copies or online reports to them for viewing.