- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Minor setback today

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Minor setback today

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minor setback today

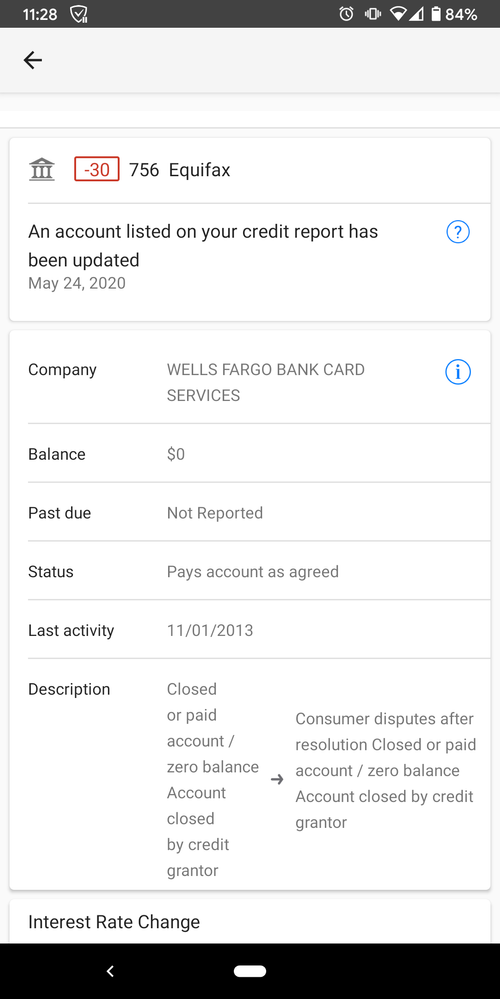

Just got an alert today for EQ. -30 points...

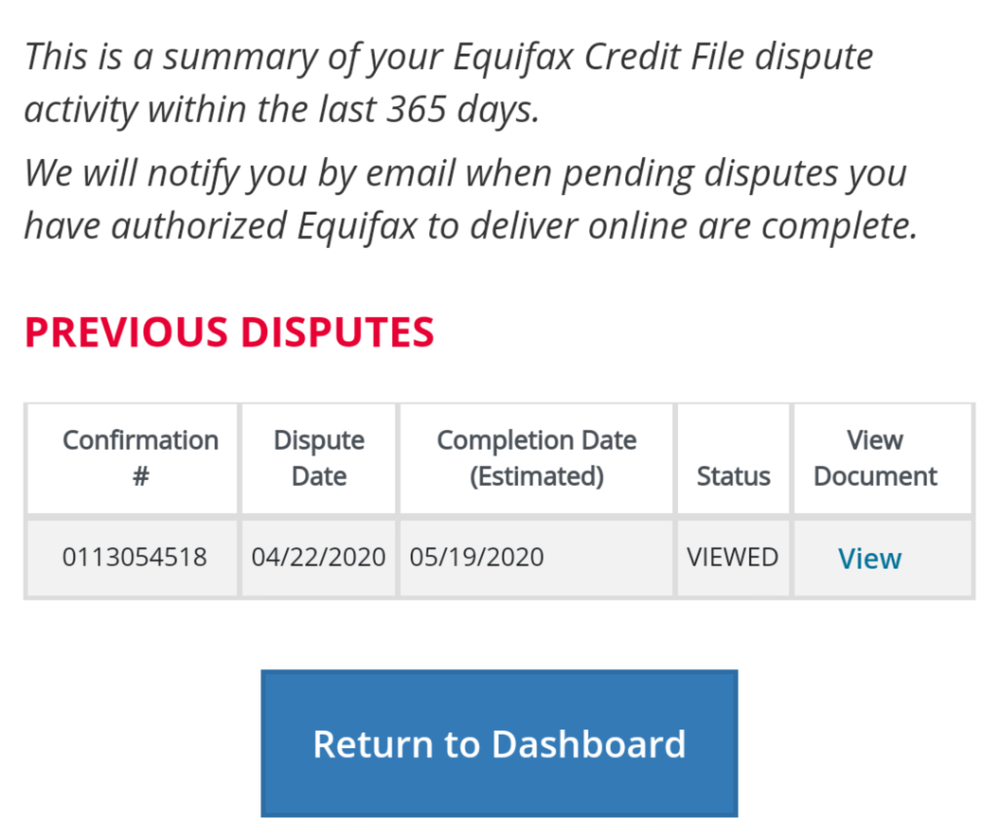

Only thing I can see that's different is in the comment section that says I disputed this (100% I haven't).

The only historical dispute was for a collection recently.

What's interesting is that I HAVE disputed on EX for EE and it came back in my favor, but what just happened on EQ?

I don't care TOO much, since it starts to drop off in Dec, but are they trying to pull something shady here?

Rebuild start: 5/15/19

Financial Institutions:

Wells Fargo | NFCU | Penfed

Products:

Discover It CB $2.1k | WF Propel $22.5k | PenFed PCR $20k | NFCU Platinum $10k | NFCU More Rewards $25k | NFCU Flagship $30k | NFCU CLOC $500 | NFCU SSL 60mo | NFCU Auto loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor setback today

What happened is that lender sent response to all three CRA.

EQ will not entertain EE, unless its 30 days or less, hence current status resulted in verification of all derogs present instead of removal.

What you're seeing there is more common response than removal.

EE is not legally mandated or regulated. When you attempt it, you're at the mercy of CRA. It backfires more often than not, but people typically share success stories only.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor setback today

@Remedios wrote:What happened is that lender sent response to all three CRA.

EQ will not entertain EE, unless its 30 days or less, hence current status resulted in verification of all derogs present instead of removal.

What you're seeing there is more common response than removal.

EE is not legally mandated or regulated. When you attempt it, you're at the mercy of CRA. It backfires more often than not, but people typically share success stories only.

That's all well and good they're "proactive" in sending it out to all three, but "consumer disputes blah blah blah" isn't accurate. Maybe I'm slow, but without a dispute shouldn't EQ just file whatever WF sent in the garbage?

Edit:

@Remedios everything you said makes perfect sense had I actually disputed anything, including EE, with Equifax. How is the ball rolling with the assumption I have?

Rebuild start: 5/15/19

Financial Institutions:

Wells Fargo | NFCU | Penfed

Products:

Discover It CB $2.1k | WF Propel $22.5k | PenFed PCR $20k | NFCU Platinum $10k | NFCU More Rewards $25k | NFCU Flagship $30k | NFCU CLOC $500 | NFCU SSL 60mo | NFCU Auto loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor setback today

When requesting EE through EX, its treated as a dispute. EX would have sent query back to the lender, then granted your request, irrespective of response, because EE does not "fall" on the lender.

Additionally, lender sent response to other two CRA. Remember the part where EX treats it as a dispute?

Communication coming from lender to EQ indicates dispute, because that's how original request to EX was formatted, as a dispute (aka going back to original point).

Again, this is nothing new or surprising. EE is not a walk in the park, and for EX and EQ it tends to fails miserably one way or another, while TU typically gets it right when requested during a phone call and while speaking to a supervisor.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor setback today

EE can be really unpleasant honestly. EX screwed me over big time when I tried to request it on my repo. They sent a dispute to Ford which caused Ford to update it and then I was denied EE until the next month started. TU, on the other hand, I disputed it online and marked it as too old and it was gone in like half an hour!

Sorry that you got dinged. ![]() It sucks that FICO treats it as a fresh delinquency.

It sucks that FICO treats it as a fresh delinquency.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor setback today

@Remedios wrote:

When requesting EE through EX, its treated as a dispute. EX would have sent query back to the lender, then granted your request, irrespective of response, because EE does not "fall" on the lender.

Additionally, lender sent response to other two CRA. Remember the part where EX treats it as a dispute?

Communication coming from lender to EQ indicates dispute, because that's how original request to EX was formatted, as a dispute (aka going back to original point).

So much discussion between these paragraphs remain, imo...

Again, this is nothing new or surprising. EE is not a walk in the park, and for EX and EQ it tends to fails miserably one way or another, while TU typically gets it right when requested during a phone call and while speaking to a supervisor.

I really appreciate your time so far!

So there isn't anything to hold a CRA responsible to verify that a dispute was generated?

A lazy lender decides rather than wait to see if 2 more disputes come they can just make an assumption that they are and the CRAs follow suit?

So in reality, everyone needs to know that it's possible you don't have to dispute on all 3, just 1 bureau because you could have unsuccessful disputes on the remaining 2 for any 1 dispute and they're deemed legitimate.

That's what I'm hearing anyhow.

Rebuild start: 5/15/19

Financial Institutions:

Wells Fargo | NFCU | Penfed

Products:

Discover It CB $2.1k | WF Propel $22.5k | PenFed PCR $20k | NFCU Platinum $10k | NFCU More Rewards $25k | NFCU Flagship $30k | NFCU CLOC $500 | NFCU SSL 60mo | NFCU Auto loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor setback today

@Anonymous wrote:EE can be really unpleasant honestly. EX screwed me over big time when I tried to request it on my repo. They sent a dispute to Ford which caused Ford to update it and then I was denied EE until the next month started. TU, on the other hand, I disputed it online and marked it as too old and it was gone in like half an hour!

Sorry that you got dinged.

It sucks that FICO treats it as a fresh delinquency.

That makes sense to me. It was isolated.

You disputed on EX and got rammed by Ford via EX. Legitimate and unfortunate.

TU it worked out, great!

If you disputed on EX and got rammed on TU for it, wouldn't that seem suspicious?

Edit:

If my tone is coming across snarly I am a bit, not because it happened (again this will fade away in Dec), but because they CAN do this and some poor sap is going to make a mistake that they might have to live years with.

I still vote its shenanigans.

Rebuild start: 5/15/19

Financial Institutions:

Wells Fargo | NFCU | Penfed

Products:

Discover It CB $2.1k | WF Propel $22.5k | PenFed PCR $20k | NFCU Platinum $10k | NFCU More Rewards $25k | NFCU Flagship $30k | NFCU CLOC $500 | NFCU SSL 60mo | NFCU Auto loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minor setback today

@PicoFico they didn't do anything wrong. You initiated the process that frequently goes sideways, because it's not a regulated or mandated process.

The best you can do is to leave it alone.

You got a partial resolution in your favor, stop while you're still ahead.

Neither CRA or lender made an error, or there are any shenanigans there.

In fact, shanenigan is when we get things removed early, not the other way around.

As far as initiating dispute with with one CRA on any account resulting in correction on all three, sometimes with different results...well, that falls under "common knowledge".

It's the nature of automated dispute and response system.

There is a reason some of us keep typing same thing over and over, which is "Never mess with accurate info"