- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Need help with a plan to pay down high utilization

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need help with a plan to pay down high utilization

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

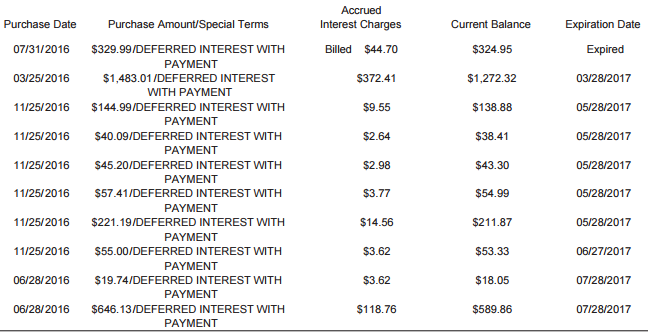

Great replies and I am going to address them oone at a time. I pulled Amazon and Lowes because they both have deferred interest, but I think those are the only 2. This is Amazon:

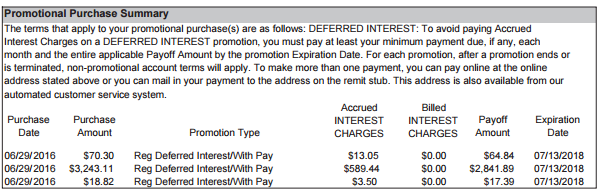

This is Lowes.

So, in light of that I think it is in my best interest to pay off these 2 and then put the rest towards the lower balanced cards and then the snowball method after that.

I have sock drawered all my cards. I also have about $1500 sitting in my Chase Checking.Savings as an emergency fund so I don't have to fall back on my cards in the even of an emergency. I have a few dollars each week going in to build that up too. Just in case.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

@K-in-Boston wrote:

It takes guts to admit. First thing would absolutely be to stop the bleeding if you are going to have retroactive interest coming up. Before doing anything, can you check to see if you prequals for:

Chase Slate

Citi Diamond Preferred

BOA BankAmericard

I check for prequals all the time. I never get them. I think once I douse this fire with a 10 grand shower I might start seeing some. I covered the retro interes in the post before this one. I had actually forgotten about that so I am glad you brought it up.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

@Dalmus wrote:

First thing I would do is pay off all the cards with a balance below $2,000... According to your spreadsheet, that is 7 cards. Depending on the minimum payment terms, that's getting rid of at least $175 in monthly minimums, probably more.

From there, I would then throw as much as I can at Amazon so you can avoid back interest if those promo periods expire.

After that, I would concentrate on paying off the next lowest balance card, and then the next, etc. The idea being that as you eliminate more minimum payments, you're able to pay off the next card quicker.

If you're able to work out a plan, that's preferable to BK.

Agreed. I can't help but think it will serve as a reminder in the future to not do this again.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

@jamesdwi wrote:of all the cards, the one with the highest need to pay down is Amazon the promotions are cool, and can save money but you get in trouble fast because if you miss the zero percent interest window they hit you with all accrued interest you would of paid, so missing by $10 can cost you 100's... I read the stories, I often use them, love amazon but always move heaven and earth to get it paid off on time.

step 1 check all your existing VISA/MC/AMEX/DISC for balance transfer deals, most of them do them even if your not new. If none you can apply for a new card with a 0% offer, but if not may need to bite bullet and transfer to another high interest card just to remove the interest bomb AMAZON will deliver, check your promotional offers statement under activities, "Interest Deferred, But not Charged" is the amount to be charged if not PIF in time.

after that is defused you can take a look at many of the pay off methods to pay down your cards, you aren't the first to need to pay off massive amounts of credit debts lots of posts here.

Most of mine are Synch cards which don't offer BT. However, I have a merchant account so I can shift balances to lower my APR but that is going to be a last ditch effort and only if it will actually work. I would love a new BT card with a high limit but if my history is any indicator, I would get one and if i do it will be a low limit.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

@Anonymous wrote:No judgement, we have all been through tough times.

Now ,y advice... google dave ramsey debt snowball plan. It is just what you need.

Dave Ramsey's plan is exactly what I have in mind once I fix the interest bomb that is coming.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

@peghede wrote:A chapter 7 might be in most ends best option, depends on your income and so on, no credit or debt is worth loosing health over it.try what ever u can but it might get there.

I suppose the upside is I would finally get approved for an unsecured Discover. lol

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

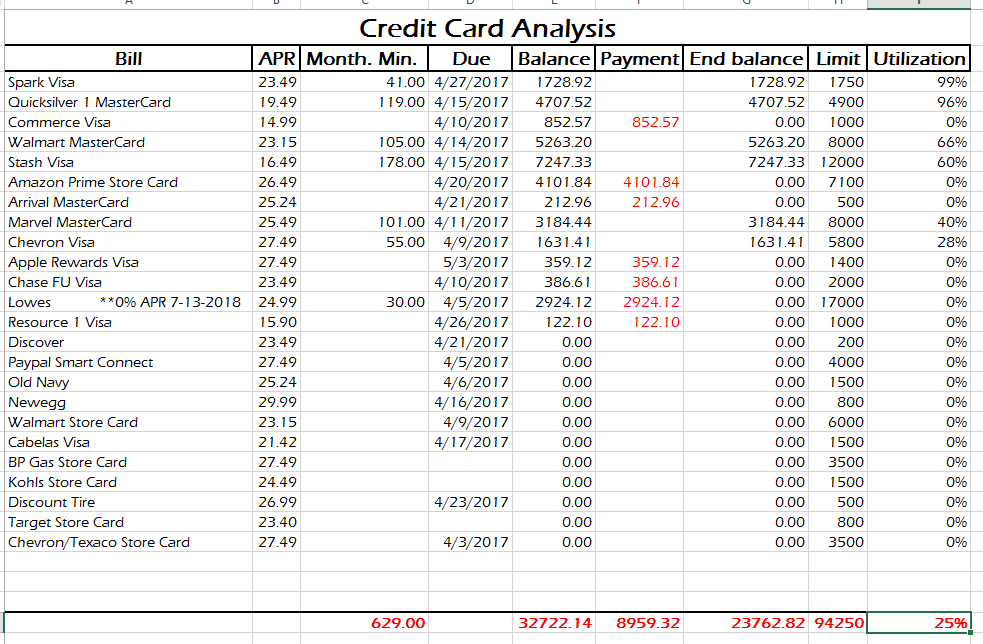

So this is my revised plan for the 10k I have to put on this right now. Thoughts?

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with a plan to pay down high utilization

@K-in-Boston wrote:

On phone so can't edit. Saw you posted your plan while I was typing. Wouldn't you rather pay the Marvel off instead of the Lowe's? That would save you about $700 over the course of a year, eliminate a bit of your monthly payment, and leave you will lots of time to pay off a balance on a promo APR.

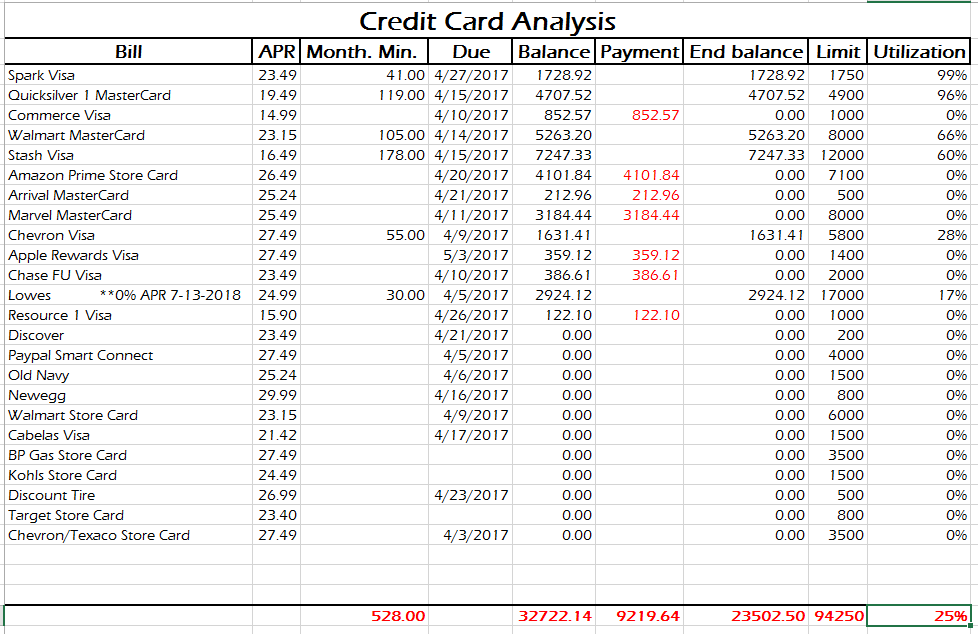

Thats a great idea. I forgot Lowes got me 24 months 0%. I could pay them off in January next year. See, great minds working together! Thanks for the idea! So this is revised.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18