- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Pay off final installment loan or keep for rep...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Pay off final installment loan or keep for reporting?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay off final installment loan or keep for reporting?

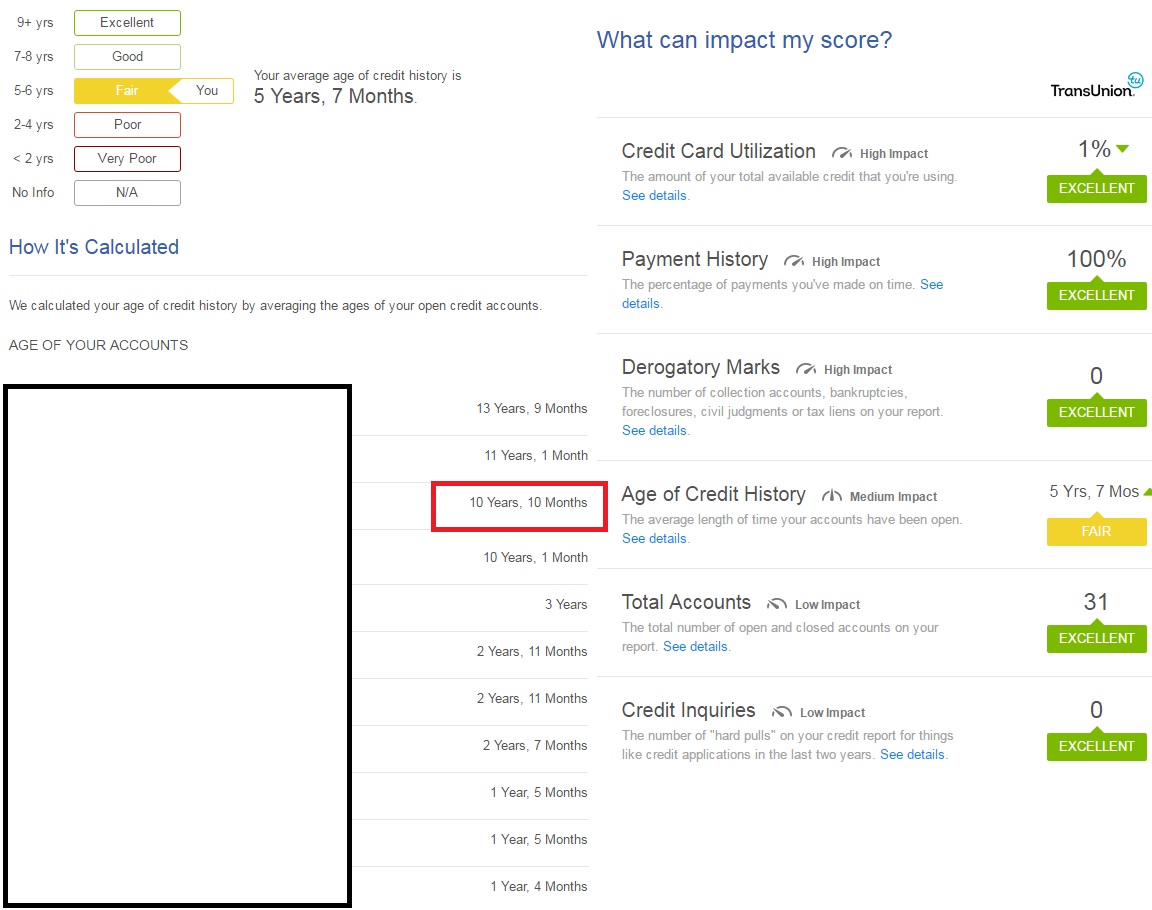

A few years back, I had a couple of setbacks and let my credit backslide to the point of being in the low 500s. I've clawed my way out of debt and into the best financial situation of my life, and I have a question about my last installment loan. I have utilization on my cards of less than 1% and paid off all my loans except my student loan. The loan is 10 years 10 months old (highlighted in red below), but I amazingly have a 2.25% interest rate on it. The current balance is only $2400 which I can easily pay off, but the interest on each monthly payment is only about $4. My snapshot of my credit factors is below, and as you can see the only area I'm hurting in is the average age of account.

I have heard even closed accounts count towards your AAoA, but I have not experienced that. As soon as I've closed accounts, my AAoA has taken a hit, but the only accounts I've closed were definitely good ones to close - builder cards with a high fee and low limit for example or relatively high interest auto loans. My concern is that if I close my student loan, my AAoA will take a big hit because it's my 3 oldest debt with a huge jump of about 7 years from it to the rest of my more recent credit. Because the interest is so minimal, and the payment is very small too ~$130/month should I just let it stick around and keep paying it to maintain my AAoA? My other concern is that it will be my only reporting installment soon (the Chase auto loan below was recently paid off and will drop off the report soon), so after closing it I will only have revolving credit. I know "mix" of credit is important for your score as well, so that's a concern for me. Part of me would love to just pay it off so literally no debt appears on my credit report which would be the first time since I was 18 years old - and I'm in my early 30s now!

As of today, my credit score is 836, so I wouldn't be decimated if it dropped a few points. Because I'm so thrilled to be at this point though, I want to keep the score as high as possible for when I eventually will need credit again. We put our mortgage in my wife's name to keep any big debt off my report for when we are ready to move up into a bigger place because my income is a little over double what her's is. I obviously pay a huge portion of the mortgage (~71%), but according to the credit bureaus it's not my debt. Curious what credit savvy people here think about my situation!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay off final installment loan or keep for reporting?

If you're not concerned about score, pay it off. One less payment each month.

As soon as I've closed accounts, my AAoA has taken a hit

That's because you're using Credit Karma. They include only open accounts in AAoA. In the Fico world, where it matters, all accounts are included.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay off final installment loan or keep for reporting?

Thoughts on changing the mix of credit to have no installment accounts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay off final installment loan or keep for reporting?

Do whatever makes sense for your overall financial health. Don't let score trump everything else. The impact to Credit Mix from paying off your only installment is a small one. If the impact is significant then your real problem lies elsewhere with bigger issues with your credit profile that you need to address instead of worrying over this.

@MTSN wrote:I have heard even closed accounts count towards your AAoA, but I have not experienced that. As soon as I've closed accounts, my AAoA has taken a hit,

Closing does not immediately impact AAoA. How are you determining that your AAoA dropped? You always need to consider your sources. Credit Karma does not provide AAoA. It only considers open account so it acutally provides AAoOA. FICO models and most creditors consider AAoA, not AAoOA.

@MTSN wrote:As of today, my credit score is 836

You don't have just one score. There are many scoring models used by creditors out there and for most models you have a score with each of the 3 major CRA's. Credit Karma provides 2 scores: a TU VantageScore 3.0 and an EQ VantageScore 3.0. Those are only relevant to creditors that use those specific scores. Most creditors use one of the FICO models. If you want to know where you stand with a creditor score-wise then you need to know the scoring model and the CRA used in the decision for the credit product and you need to pull that specific score. You cannot use a score generated by one model to determine a score generated by a different model.

An 836 with a VantageScore 3.0 should be a very good score and it sounds like you're fretting over nothing IMO. Pull your FICO 8's. 740-760 is generally the range where best terms are offered with FICO 8 so anything over that is just gravy.

@MTSN wrote:We put our mortgage in my wife's name to keep any big debt off my report for when we are ready to move up into a bigger place because my income is a little over double what her's is.

Don't just assume that debt is bad. Installments like a mortgage are not assessed the same as revolving debt. A mortgage can actually be beneficial.

@MTSN wrote:Thoughts on changing the mix of credit to have no installment accounts?

Not worth worrying over IMO. If you wanted to keep an installment long term then you should have been on the mortgage IMO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay off final installment loan or keep for reporting?

@takeshi74 wrote:Do whatever makes sense for your overall financial health. Don't let score trump everything else. The impact to Credit Mix from paying off your only installment is a small one. If the impact is significant then your real problem lies elsewhere with bigger issues with your credit profile that you need to address instead of worrying over this.

@MTSN wrote:I have heard even closed accounts count towards your AAoA, but I have not experienced that. As soon as I've closed accounts, my AAoA has taken a hit,

Closing does not immediately impact AAoA. How are you determining that your AAoA dropped? You always need to consider your sources. Credit Karma does not provide AAoA. It only considers open account so it acutally provides AAoOA. FICO models and most creditors consider AAoA, not AAoOA.

@MTSN wrote:As of today, my credit score is 836

You don't have just one score. There are many scoring models used by creditors out there and for most models you have a score with each of the 3 major CRA's. Credit Karma provides 2 scores: a TU VantageScore 3.0 and an EQ VantageScore 3.0. Those are only relevant to creditors that use those specific scores. Most creditors use one of the FICO models. If you want to know where you stand with a creditor score-wise then you need to know the scoring model and the CRA used in the decision for the credit product and you need to pull that specific score. You cannot use a score generated by one model to determine a score generated by a different model.

An 836 with a VantageScore 3.0 should be a very good score and it sounds like you're fretting over nothing IMO. Pull your FICO 8's. 740-760 is generally the range where best terms are offered with FICO 8 so anything over that is just gravy.

@MTSN wrote:We put our mortgage in my wife's name to keep any big debt off my report for when we are ready to move up into a bigger place because my income is a little over double what her's is.

Don't just assume that debt is bad. Installments like a mortgage are not assessed the same as revolving debt. A mortgage can actually be beneficial.

@MTSN wrote:Thoughts on changing the mix of credit to have no installment accounts?

Not worth worrying over IMO. If you wanted to keep an installment long term then you should have been on the mortgage IMO.

Thank for the helpful response. There are actually quite a few reasons why I didn't want to be on the mortgage, but some of the big ones are: I have a couple of small side businesses that have extremely high liability where if someone was injured I didn't want many assets in my name, so my vehicles are owned by my LLC and the house isn't in my name. The other main reason is that our current place isn't where we want to live forever, but it's in a hot area that will rent well or will sell when we're ready. When we're ready to move up, we'll be buying something much more expensive, so it makes sense for me to have no debt on my report in combination with my much higher income since I will be putting the new one in my name solely (at that point I will have sold the high liability businesses). I have had and then paid off mortgages, and it generally didn't seem to have much impact one way or another on my score but it obviously does affect debt to income ratios.

I paid for my score here on the site yesterday, and the FICO 8 shows a 792 which should mean I'll be fine for when I need credit. It looks like a lingering 30 day late still shows up on that score from 5.75 years ago, and the simulator shows right at the 7 year mark my score would jump up to 843 if all else remains constant LOL. I'm not so concerned about it being perfect, but it does feel good to gain over 300 points in a couple of years and I want to keep it as high as practicable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay off final installment loan or keep for reporting?

FYI - I went ahead and paid off my student loan, so I now have zero debt on my report - no credit card debt, student loan, car, mortgage, etc. My score took a 15 point hit on FICO 8 because I have no installment loans on my report. I still qualify for the best rates since I have 760+ scores, but it was a bummer to get dinged for going to zero debt. I have no regrets however, and it's a great feeling seeing straight zeros on my report for the first time in about 16 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay off final installment loan or keep for reporting?

Absolutely!

I'm sure CK showed your AAoA dropping as a result of closing that 11 year loan, but rest assured that under FICO scoring that your AAoA is still growing at the same rate even with that account and any others that you've closed.

If you ever need to get back 15-30 points for not having an open installment loan reporting, search the share secure loan technique on the forum here and you'll be able to get those points back in a cycle or two, depending on how quick it reports.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay off final installment loan or keep for reporting?

@MTSN wrote:FYI - I went ahead and paid off my student loan, so I now have zero debt on my report - no credit card debt, student loan, car, mortgage, etc. My score took a 15 point hit on FICO 8 because I have no installment loans on my report. I still qualify for the best rates since I have 760+ scores, but it was a bummer to get dinged for going to zero debt. I have no regrets however, and it's a great feeling seeing straight zeros on my report for the first time in about 16 years.

1. Congratulations!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

2. Thank you for coming back to the thread and updating us on what happened.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay off final installment loan or keep for reporting?

Congrats that you made a decision that made you feel good.

As others have mentioned, there's an easy way to get the benefit of having an open loan that is mostly paid, while paying maybe 1-2 dollars in interest per year. That would get you at least 20 more points, probably 30.

That way you'll achieve both your goals: being basically debt free but also gaining a big scoring benefit too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay off final installment loan or keep for reporting?

@Anonymous wrote:Absolutely!

I'm sure CK showed your AAoA dropping as a result of closing that 11 year loan, but rest assured that under FICO scoring that your AAoA is still growing at the same rate even with that account and any others that you've closed.

If you ever need to get back 15-30 points for not having an open installment loan reporting, search the share secure loan technique on the forum here and you'll be able to get those points back in a cycle or two, depending on how quick it reports.

There is an outside chance I will be applying for a mortgage soon, so I'm ok with no installment loans at this time to ensure my DTI is 0. We're closing on selling our house in 3 weeks, and we're on the fence of buying or renting for the next place. Where we live the real estate market has gone crazy the last few years, and although it's been good to us (this will be the second property we've made a big gain on), I'm not sure it's wise to invest in more real estate while the market is at the top so to speak. It seems the market is cooling a bit, so it could be nice to rent and wait to see what happens with prices and interest rates over the next 6-12 months (and after the election of course). That's the main reason I wanted to get my DTI at 0, maximize my scores, and have a lot of cash on hand in case we do spot a good deal we can be ready to pounce on it.