- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Paying on personal loan

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paying on personal loan

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paying on personal loan

Hopefully I have this question in the right area.

I have a loan through Lending Club that I have been paying on for about a year. On some months a big portion of my payment goes toward the principle and on other months it's almost even toward both interest and principle...I am trying to figure out when is best time to pay on my loan to where a big portion goes on the principle?

In example, is it best to pay 3 weeks before due due or a week before due date or even just pay it a couple of days before? Or does it even help?

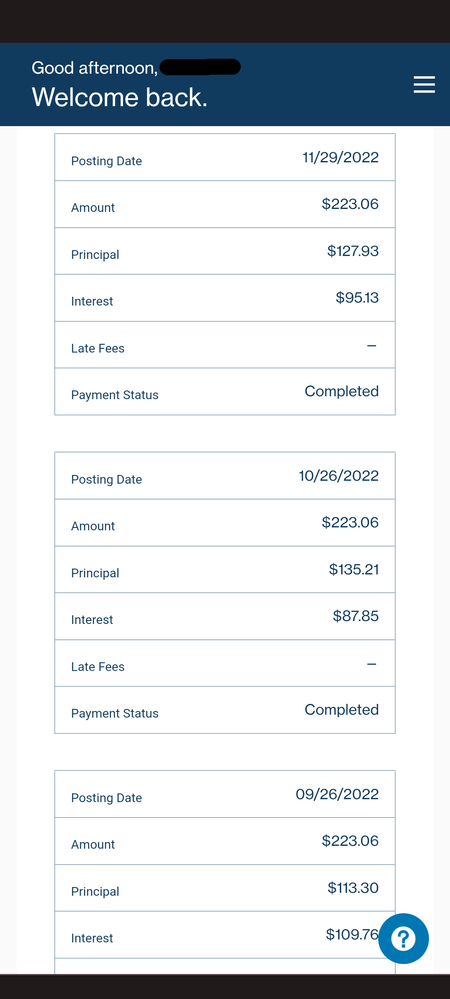

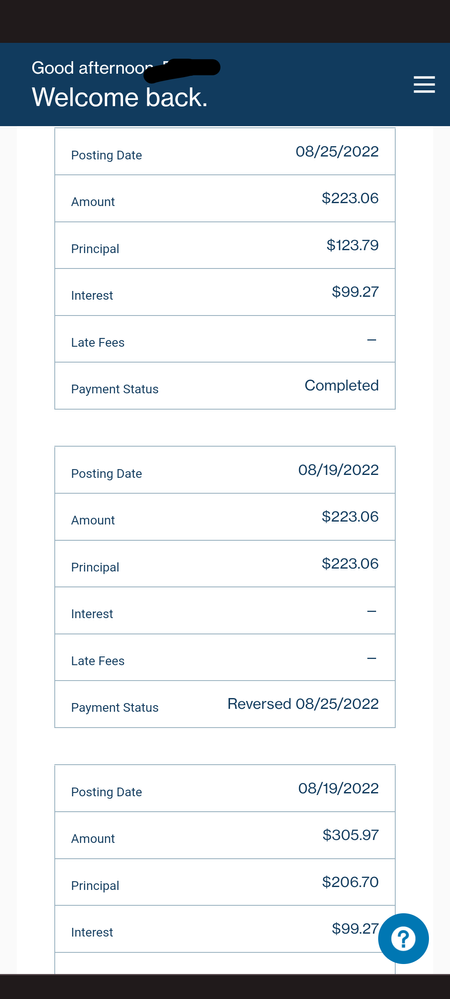

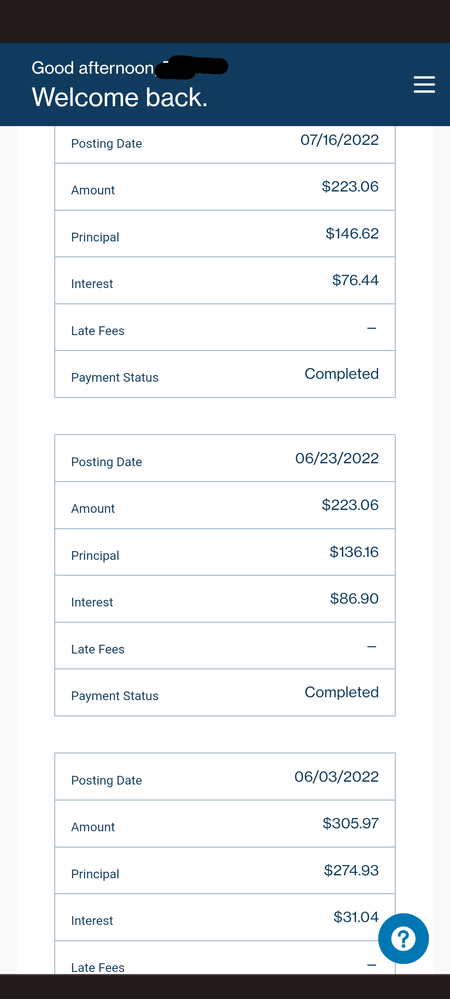

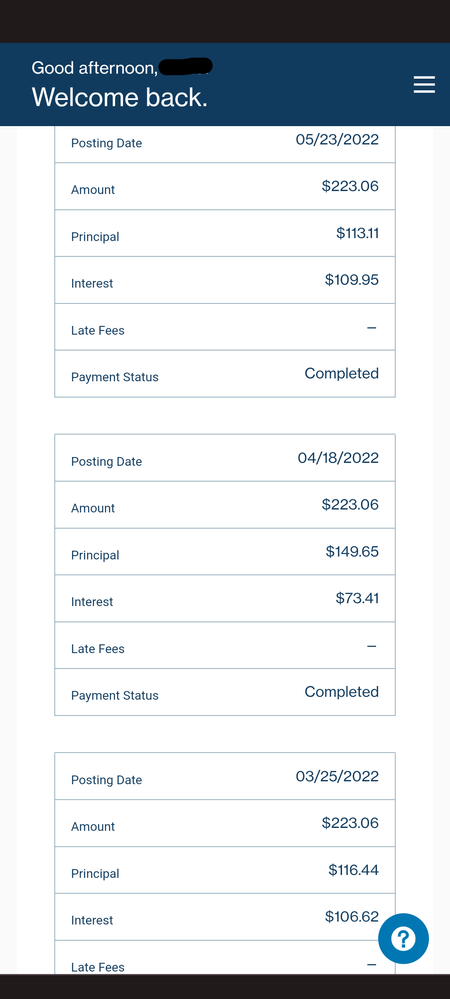

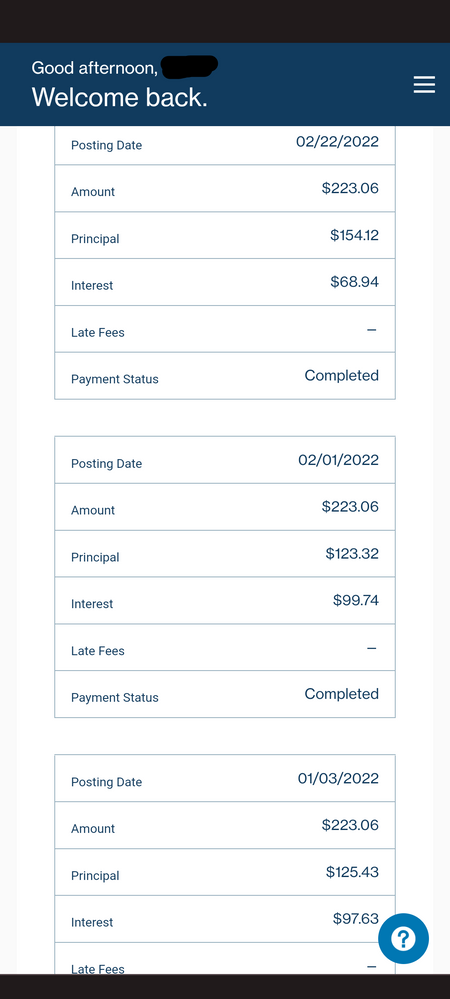

The below charts are from LC website showing my posted payments and how much went toward principle and how much went toward interest...

Thank you in advance for your feedback

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying on personal loan

I'm not sure how exactly it works, but I think a good approach is to pay twice a month if you're able to. I know that works with auto loans and helps cut down on interest.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying on personal loan

It would help if you placed the loan amount and the APR %.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying on personal loan

most loans accrue interest daily, so generally a lower balance from one day to the next will accrue less interest. without the particular terms of your loan, it is hard to be precise. the higher number of days, between payments, the more interest accumulates at the higher balance. although there were some anomolous payments in Jun and Aug.

| date | pmt | principal | interest | days diff |

| 11/29/22 | 223.06 | 127.93 | 95.13 | 34 |

| 10/26/22 | 223.06 | 135.21 | 87.85 | 30 |

| 09/26/22 | 223.06 | 113.3 | 109.76 | 32 |

| 08/25/22 | 223.06 | 123.79 | 99.27 | 6 |

| 08/19/22 | 223.06 | reversed | 8/25/22 | 0 |

| 08/19/22 | 305.97 | 206.7 | 99.27 | 34 |

| 07/16/22 | 223.06 | 146.92 | 76.44 | 23 |

| 06/23/22 | 223.06 | 136.16 | 86.9 | 20 |

| 06/03/22 | 305.97 | 274.93 | 31.04 | 11 |

| 05/23/22 | 223.06 | 113.11 | 109.95 | 35 |

| 04/18/22 | 223.06 | 149.65 | 73.41 | 24 |

| 03/25/22 | 223.06 | 116.44 | 106.62 | 31 |

| 02/22/22 | 223.06 | 154.12 | 68.94 | 21 |

| 02/01/22 | 223.06 | 123.32 | 99.74 | 29 |

| 01/03/22 | 223.06 | 125.43 | 99.63 | -- |

In example, is it best to pay 3 weeks before due due or a week before due date or even just pay it a couple of days before? Or does it even help?

for example with a loan balance of $1000 @ 19.99% apr with a due date of the 28th:

| day | pmt | int | balance | vs. | day | pmt | int | balance |

| 1 | 0 | 0.55 | 1000.55 | 1 | 0 | 0.55 | 1000.55 | |

| 2 | 0 | 0.55 | 1001.10 | 2 | 0 | 0.55 | 1001.10 | |

| 3 | 0 | 0.55 | 1001.64 | 3 | 0 | 0.55 | 1001.64 | |

| 4 | 0 | 0.55 | 1002.19 | 4 | 0 | 0.55 | 1002.19 | |

| 5 | 0 | 0.55 | 1002.74 | 5 | 0 | 0.55 | 1002.74 | |

| 6 | 0 | 0.55 | 1003.29 | 6 | 0 | 0.55 | 1003.29 | |

| 7 | -100 | 0.55 | 903.84 | 7 | 0 | 0.55 | 1003.84 | |

| 8 | 0 | 0.50 | 904.34 | 8 | 0 | 0.55 | 1004.39 | |

| 9 | 0 | 0.50 | 904.83 | 9 | 0 | 0.55 | 1004.94 | |

| 10 | 0 | 0.50 | 905.33 | 10 | 0 | 0.55 | 1005.49 | |

| 11 | 0 | 0.50 | 905.82 | 11 | 0 | 0.55 | 1006.04 | |

| 12 | 0 | 0.50 | 906.32 | 12 | 0 | 0.55 | 1006.59 | |

| 13 | 0 | 0.50 | 906.81 | 13 | 0 | 0.55 | 1007.14 | |

| 14 | 0 | 0.50 | 907.31 | 14 | 0 | 0.55 | 1007.69 | |

| 15 | 0 | 0.50 | 907.81 | 15 | 0 | 0.55 | 1008.25 | |

| 16 | 0 | 0.50 | 908.30 | 16 | 0 | 0.55 | 1008.80 | |

| 17 | 0 | 0.50 | 908.80 | 17 | 0 | 0.55 | 1009.35 | |

| 18 | 0 | 0.50 | 909.30 | 18 | 0 | 0.55 | 1009.90 | |

| 19 | 0 | 0.50 | 909.80 | 19 | 0 | 0.55 | 1010.46 | |

| 20 | 0 | 0.50 | 910.30 | 20 | 0 | 0.55 | 1011.01 | |

| 21 | 0 | 0.50 | 910.79 | 21 | 0 | 0.55 | 1011.56 | |

| 22 | 0 | 0.50 | 911.29 | 22 | 0 | 0.55 | 1012.12 | |

| 23 | 0 | 0.50 | 911.79 | 23 | 0 | 0.55 | 1012.67 | |

| 24 | 0 | 0.50 | 912.29 | 24 | 0 | 0.55 | 1013.23 | |

| 25 | 0 | 0.50 | 912.79 | 25 | 0 | 0.55 | 1013.78 | |

| 26 | 0 | 0.50 | 913.29 | 26 | 0 | 0.56 | 1014.34 | |

| 27 | 0 | 0.50 | 913.79 | 27 | 0 | 0.56 | 1014.89 | |

| 28 | 0 | 0.50 | 914.29 | 28 | -100 | 0.56 | 915.45 | |

| total pmt | total int | diff | total pmt | total int | ||||

| -100 | 14.29 | 1.16 | -100 | 15.45 |

making one payment 3 weeks before the due date saves $1.16 interest. in this example the difference is insignificant, but when scaled up it can potentially save a significant interest.

9/2022 $30000 |  8/2020 $20000 |  12/2018 $30000 |  8/2016 $30000 |  3/2016 $21000 |  5/2014 $20000 |  10/2007 $8900 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying on personal loan

The short answer is: it's best to pay as early as possible so there's less time of accruing interest at the higher balance amount.

Amex Cash Magnet: 18k

Fidelity Visa: 16.5k

Apple Card: 4.25k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying on personal loan

@pinkandgrey wrote:The short answer is: it's best to pay as early as possible so there's less time of accruing interest at the higher balance amount.

^^^ This

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying on personal loan

The months of June and August, was a payment error regarding another loan with them. LC kept posting the wrong amount to this account and they had to reverse it.

Thank you for your feedback.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying on personal loan

Thank you for feedback.

That's what I was kinda thinking that it was probably better to pay it as early as possible. I will start doing that and see what kind of results I get from that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying on personal loan

@Annabe wrote:Hopefully I have this question in the right area.

I have a loan through Lending Club that I have been paying on for about a year. On some months a big portion of my payment goes toward the principle and on other months it's almost even toward both interest and principle...I am trying to figure out when is best time to pay on my loan to where a big portion goes on the principle?

In example, is it best to pay 3 weeks before due due or a week before due date or even just pay it a couple of days before? Or does it even help?

The below charts are from LC website showing my posted payments and how much went toward principle and how much went toward interest...

Thank you in advance for your feedback

The more you pay, the more they'll apply to principal. E.g, when you doubled up on the 19th, they applied all of the 2nd payment to principal. So just pay as much as possible as soon as possible, and that will be the way to accelerate the paying down of the principal (and reduce the amount of interest).

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687