- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- The "Which Banks Pull Which Report For Apps" list

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The "Which Banks Pull Which Report For Apps" list

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The "Which Banks Pull Which Report For Apps" list

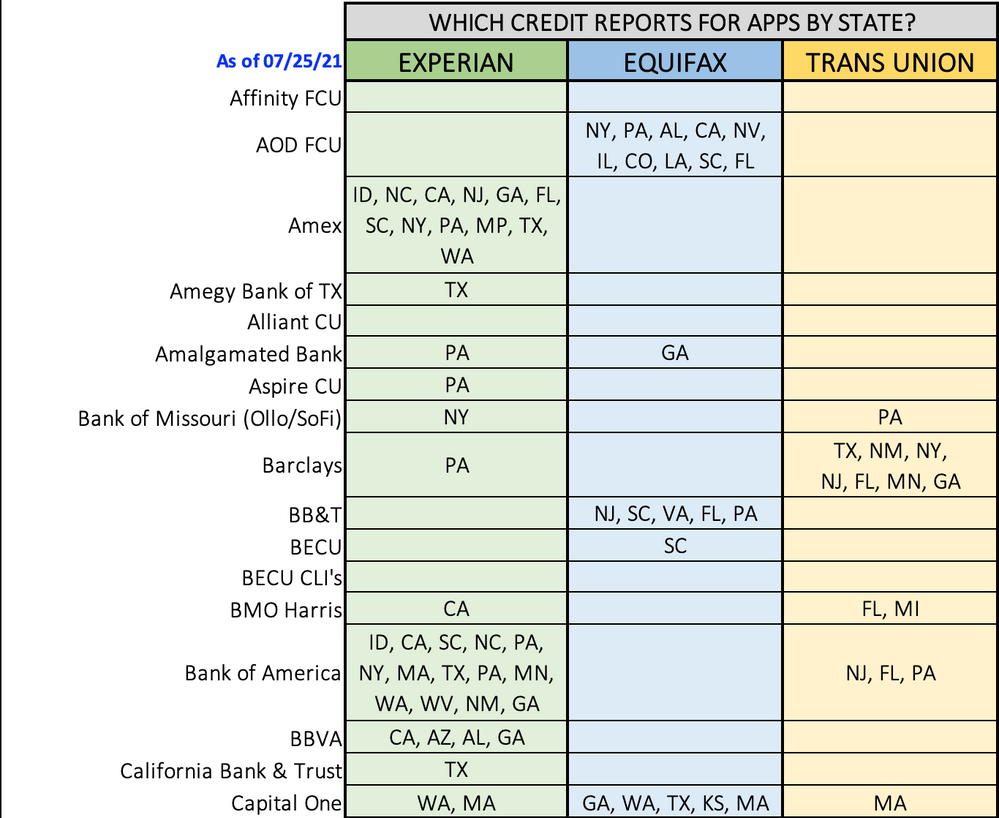

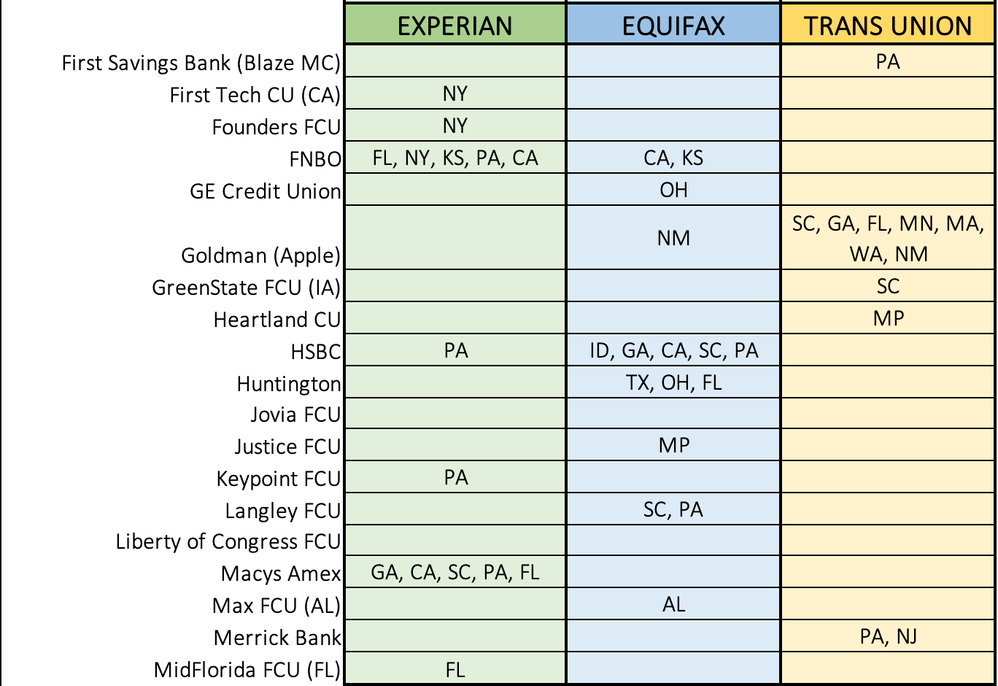

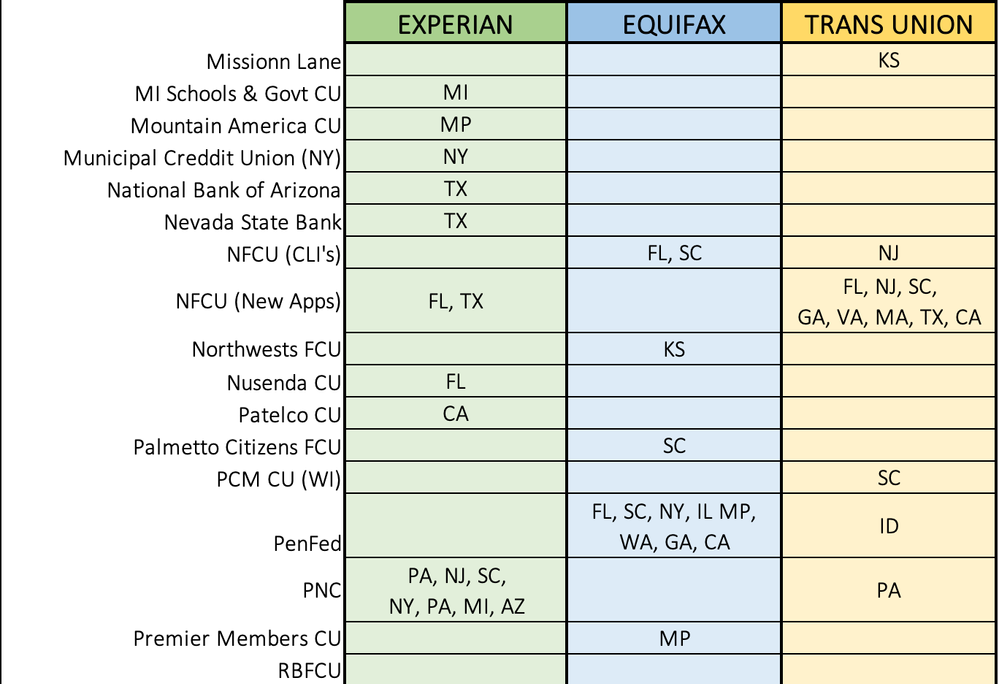

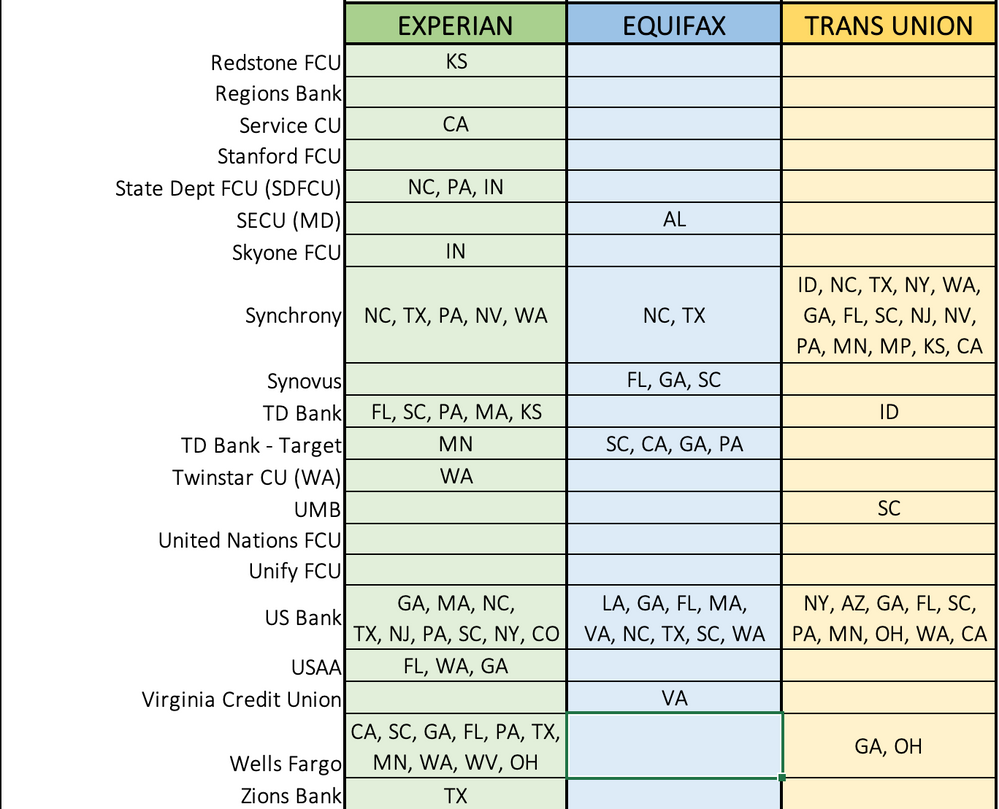

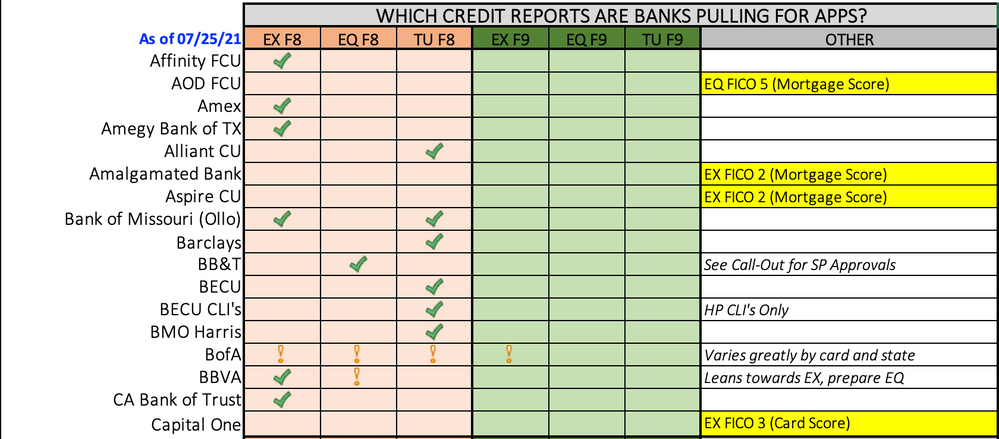

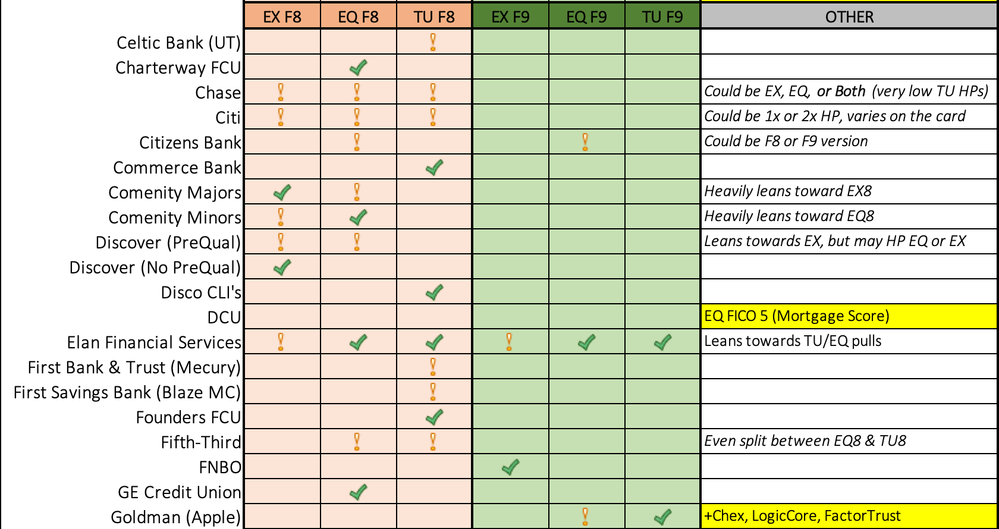

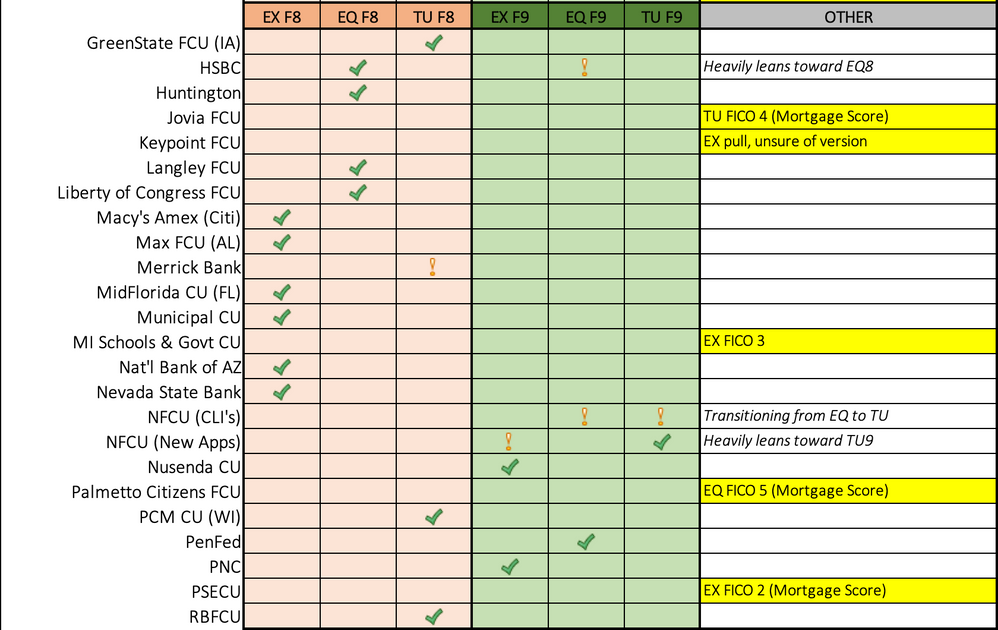

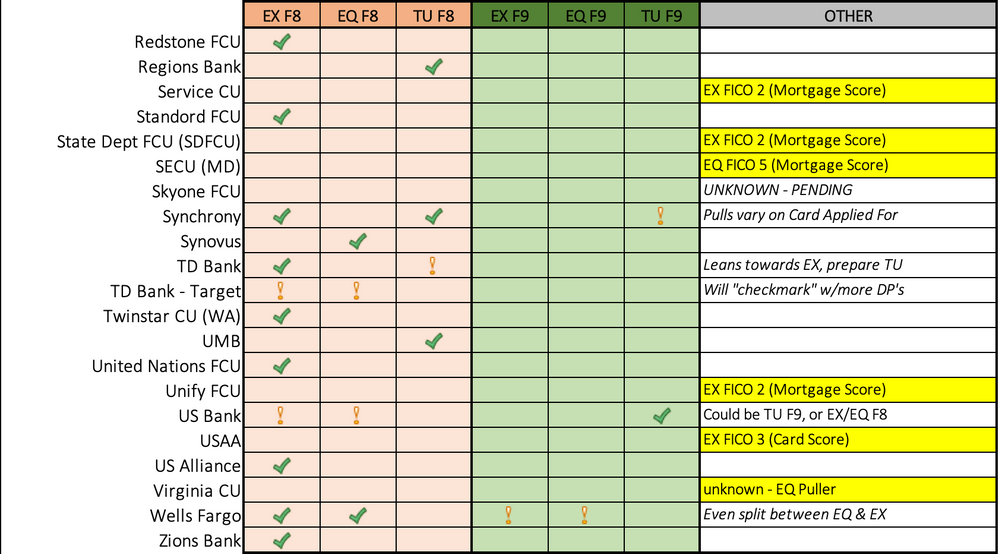

AS OF 07/25/21

This post is built to help others see which reports banks are pulling based on where you are -- all the data on here comes from MyFICO'rs posts. It is also aimed at Personal Credit Cards (VS/MC/DC/AX), but it does include 2 store card exceptions (Macy's & Target).

- GRID #1 = This list calls out which CRA (credit reporting agency) was pulled for specific states. These DP's (data points) are collected from approvals shared on this site. As more members share state DP's, I'll update the grid.

- GRID #2 = This list calls out which version of the credit report we're seeing pulled with consistent regularity (Fico 8, Fico 9, or even mortgage scores like EX2, EQ5, etc.).

This is a very YMMV situation.

Several other factors apply and vary by lender (things such as these reasons can heavily influence your application outcome - inquiry/new account sensitive, income, forgiveness for prior behavior, total available credit, age of report, credit seeking behavior, the state you live in, etc.). This is just to share what they are most likely to pull based on reported data points.

CALL-OUTS:

- Citi Bank: Most new apps/CLI's use EQ, but some cards reflect they will pull EX instead. Some members (like folks brand new to a Citi relationship, as a sample) have reported regular double-pulls, but this has not applied to everyone. When that happens be prepared for any combo (EQ/TU , EQ/EX, EX/TU)

- Chase Bank: Some users have reported that double-pulls are consistent, but some have also reported only single-pulls for new account. CLI's are single pulls. Expect a double pull, EQ & EX seem to be the preferred combo, but if you get prequalified via Credit Journey, TU seems to be the primary CRA pulled and it gets paired with EQ or EX. TU seems to be the least preferred CRA for Chase when Credit Journey is not involved.

- Comenity Bank: This bank has 2 core flavors of cards ("majors" vs "minors" if you will). Majors could be viewed as co-branded cards that offer a Visa/MC option. When applying for one of these, EX is the go-to. For store-cards that do not have the Visa/MC option, EQ is the go-to. No reports were found where Comenity processed a double-pull or pulled TU

- Navy FCU: Navy uses TU9 for new account HPs. Historically they exclusivly used EQ9 for CLI requests, but approval threads showcase Navy is transitioning from EQ9 to TU9 for CLI's. If a HP is required, plan that it could be a 60 TU9/40 EQ9 shot

- Synchrony Bank: Synchrony historically has exclusively pulled TU, but starting in 2019 reports reflected they pulled EX. As a sample their Verizon Credit Card has shown zero consistency with which CRA they pull. Some members report a single pull, double pull and a triple pull. When they pull a single and/or double, there does not seem to be a "primary" or "preferred" CRA.

- Wells Fargo: EX tends to be the 'go-to' CRA for this bank. Some card types (like Propel) have been known to pull EX + EQ. Reports have been noted that if someone applied with all CRA's frozen, when the applicant called back in to move forward they'd be advised to unlock EQ only. This is an extreme YMMV case

HOW TO READ IT:

- Some banks are religiously consistent with which CRA (and version) they pull. If that bank row has a green check-mark, then this is one of those "religiously consistent"' pullers

- Some banks bounce between 2 CRA's, but which one they pull seems to vary based on the state you reside along with the specific card you applied for. These are marked with the yellow exclamation points - it just means "prepare that it could be either one of the bureau's with an exclamation point"

- If you see a bank listed with a green check-mark and yellow exclamation points, it means that a large part of the time they lean towards the green check-mark, but at times they will fall to a secondary report (locked reports, the bank getting errors when trying to pull their primary option, split credit profiles, state residency, etc)

GRID #1 - WHICH REPORT IS PULLED BASED ON YOUR STATE?

GRID #2 - WHICH BANK USES WHICH REPORT VERSION?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Banks using FICO8 vs FICO9 for Apps

@credit_is_crack wrote:So I went on a mini-spree recently and the one thing I noticed is that more and more banks appear to have migrated to using the FICO 9 version instead of FICO 8. Just wanted to share in case anyone was curious (as I know a lot of us apply based on our best foot). This is YMMV - some folks see auto increases from F8 < F9, some see auto decreases. Not sure what's driving the divide though. I'm referring to the core FICO 8 & 9 score, not the bankcard or specialized versions.

As a sample my scores as of todays report (03/18/19):

EXPERIAN -- FICO8 (765) < FICO9 (798)

EQUIFAX -- FICO8 (764) < FICO9 (797)

TRANS UNION -- FICO8 (783) < FICO9 (800)

My "Price you pay" letter descriptions from apps over last 8-10 months. Some were for new apps, some for CLI's or mergers (Navy is known to use TU for new apps and then EQ for CLIs, I'm sure a few others do that too).

- Bank of America, TU F8 (new app)

- Amex, EX F8 (new app & SP CLI)

- Citibank, EQ F8 (SP CLI)

- Chase, EX F8 (new app)

- USAA, EX F2 (HP CLI) - get with it USAA!

- PNC Bank, EX F9 (new app)

- US Bank, TU F9 (new app)

- Synovus, EQ F9 (new app)

- Navy FCU, EQ F9 (HP CLI)

- PenFed FCU, EQ F9 (SP CLI)

- FNBO, EX F9 (SP CLI)

Great information! Thanks for sharing!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Banks using FICO8 vs FICO9 for Apps

Thx CIC

Wells Fargo uses EX09 for checking/savings. Dunno about credit tho

>5/2023 All 3 reports 840ish (F8) F9s = 850 but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Banks using FICO8 vs FICO9 for Apps

@Meanmchine wrote:Thx CIC

Wells Fargo uses EX09 for checking/savings. Dunno about credit tho

Anybody know who Wells Fargo uses for credit card apps? Could be EX09 or TU 09 but don't want to assume

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Banks using FICO8 vs FICO9 for Apps

Updated to include Fifth-Third Bank

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Banks using FICO8 vs FICO9 for Apps

@credit_is_crack wrote:

@Meanmchine wrote:Thx CIC

Wells Fargo uses EX09 for checking/savings. Dunno about credit tho

Anybody know who Wells Fargo uses for credit card apps? Could be EX09 or TU 09 but don't want to assume

They Pulled my EX9 when they approved me Sep of last year 2018.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Banks using FICO8 vs FICO9 for Apps

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Banks using FICO8 vs FICO9 for Apps

@JR_TX wrote:

@credit_is_crack wrote:

@Meanmchine wrote:Thx CIC

Wells Fargo uses EX09 for checking/savings. Dunno about credit tho

Anybody know who Wells Fargo uses for credit card apps? Could be EX09 or TU 09 but don't want to assume

They Pulled my EX9 when they approved me Sep of last year 2018.

Thanks for the info @JR_TX and @FicoGuy2019. I added it to the list

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: List of FICO Scores Banks Are Using For Apps/CLIs?

BUSINESS; Amex | Citi

F8 Current F8s ~750 Best Ever F8s ~775

TOTAL PERSONAL CL > $350k and TCL > $365k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: List of FICO Scores Banks Are Using For Apps/CLIs?

Very helpful....thank u