- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: What to do when you think you are a Victim of ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Victim of Identity Theft?? What To Do to Protect Yourself

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Victim of Identity Theft?? What To Do to Protect Yourself

First and foremost, you should determine if you are indeed a victim:

Look for the following items:

New accounts that you do not recognize appear on your credit report

Most identity thieves will try to open new accounts, such as a credit card, in your name. When this happens, your credit report reflects that a new "account" was opened. Check your credit report on a regular basis so that you can see if there are any unrecognizable accounts that were opened in your name. You are entitled to one free credit report each year from www.annualcreditreport.com.

If you pull your free annual reports you should carefully review the Names, addresses, and social security numbers that are associated with the file. Many times, the identity theif will apply for credit using your name and social security number, and will supply their address. In this way, credit cards, utilities, and even loans can be opened, and all of the mailings associated with the new account will go to the thief’s address.

There are unexplained withdrawals and charges on your banking, or credit card statements.

Identity thieves can tap into your current banking and credit card accounts by taking money from your bank account or by making a purchase with your credit card. All they have to do is call the bank and request online access by using your identity information such as your birthdate, social security number, and mother’s maiden name. Many times, the identity thief is someone we know or are even related to. Sometimes it can be a worker who has access to your home or property, such as a cleaning lady or a handyman. To avoid this type of identity theft, read through your statements carefully each month and call your bank or credit card company if there are questionable withdrawals or purchases. The more often you look at your financial statements, the better the chances are that you’ll notice unauthorized charges or fraudulent activity.

You haven't received your bills, statements or other important mail in a long time.

Identity thieves sometimes call your bank, Credit Card Company or lender to change your mailing address. This allows them to run up charges without you noticing for a while since you are not receiving statements in the mail.

You've received calls from debt collection agencies about products or services you didn't buy.

Thieves can use your personal information to apply for loans or a credit card in your name. This usually leads to unpaid bills that a debt collection agency will try to collect from you. In some cases, the thief can use your identity to solicit medical services, or give your information to a cop if they are stopped for speeding. Many times, the thief will give the medical provider your address, or their address. You may not know about the activity until you are issued a warrant, or if you are stopped by a cop for an un-related matter. In order to review your traffic history report, contact your insurance carrier. Ask them to review your traffic violation history with you, to determine if the information is correct. If your carrier tells you about incidents that you don’t remember, or were not involved in, you should immediately contact the police department who handled the incident.

What to do if you have determined that you are a victim of Identity Theft?

Step 1: Immediately contact the three credit reporting bureaus:

Equifax | Experian | TransUnion |

Ask them to place an Initial Fraud Alert on your credit report.

An initial fraud alert can make it harder for an identity thief to open more accounts in your name. When you have an alert on your report, a business must verify your identity before it issues credit, so it may try to contact you. The initial alert stays on your report for at least 90 days. You can renew it after 90 days. It allows you to order one free copy of your credit report from each of the three credit reporting companies. Be sure the credit reporting companies have your current contact information so they can get in touch with you.

According to the Fair Credit Reporting Act, Section 605A, an initial fraud alert will be active for 90 days, with no further documentation required.

- § 605A. Identity theft prevention

- (a) One call Fraud Alerts

- (1) Initial alerts. Upon the direct request of a consumer, or an individual acting on behalf of or as a personal representative of a consumer, who asserts in good faith a suspicion that the consumer has been or is about to become a victim of fraud or related crime, including identity theft, a consumer reporting agency described in section 603(p) that maintains a file on the consumer and has received appropriate proof of the identity of the requester shall -

- (A) include a fraud alert in the file of that consumer, and also provide that alert along with any credit score generated in using that file, for a period of not less than 90 days, beginning on the date of such request, unless the consumer or such representative requests that such fraud alert be removed before the end of such period, and the agency has received appropriate proof of the identity of the requester for such purpose; and

- (B) refer the information regarding the fraud alert under this paragraph to each of the other consumer reporting agencies described in section 603(p), in accordance with procedures developed under section 621(f).

- (2) Access to free reports. In any case in which a consumer reporting agency includes a fraud alert in the file of a consumer pursuant to this subsection, the consumer reporting agency shall -

- (A) disclose to the consumer that the consumer may request a free copy of the file of the consumer pursuant to section 612(d); and

- (B) provide to the consumer all disclosures required to be made under section 609, without charge to the consumer, not later than 3 business days after any request described in subparagraph (A).

The good news is that the consumer does not have to actually be a victim yet to ask for an initial fraud alert. If you have lost your wallet, or if you believe your information may have been compromised by a cyber-security breach by a financial institution, you can request this initial fraud alert at no cost to you. The fraud alert entitles you to access to a free credit report, as described in blue above.

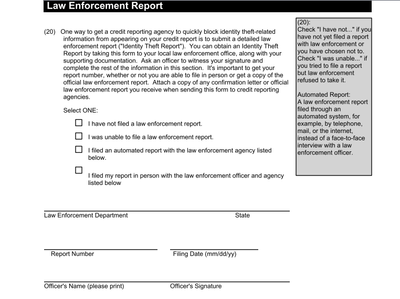

Step 2: File appropriate Identity Theft Reports with Law Enforcement, Postal Service, and FTC.

Having the identity theft report filed with law enforcement is the next step, especially if there are addresses, social security numbers, variations of your name, and other personal identity information that is not yours on your credit report.

Appropriately filed reports with the FTC, Law Enforcement, and the United States Postal Service will allow you to receive important benefits associated with having the erroneous information “blocked” from your credit file. These appropriately filed reports also entitle you to receive a free Security Freeze, which will limit the availability of your credit reports and will stop the thief from gaining new accounts in your name.

The benefits of doing an appropriate Identity Theft Report are as follows:

• You can get fraudulent information removed from your credit report in accordance with 605B

• stop a company from collecting debts that result from identity theft, or from selling the debt to another

company for collection in accordance with 615(g)

• place an extended fraud alert on your credit report in accordance with 605A

• get information from companies about accounts the identity thief opened or misused in accordance with 609 (e)

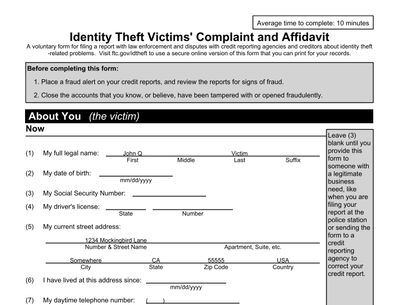

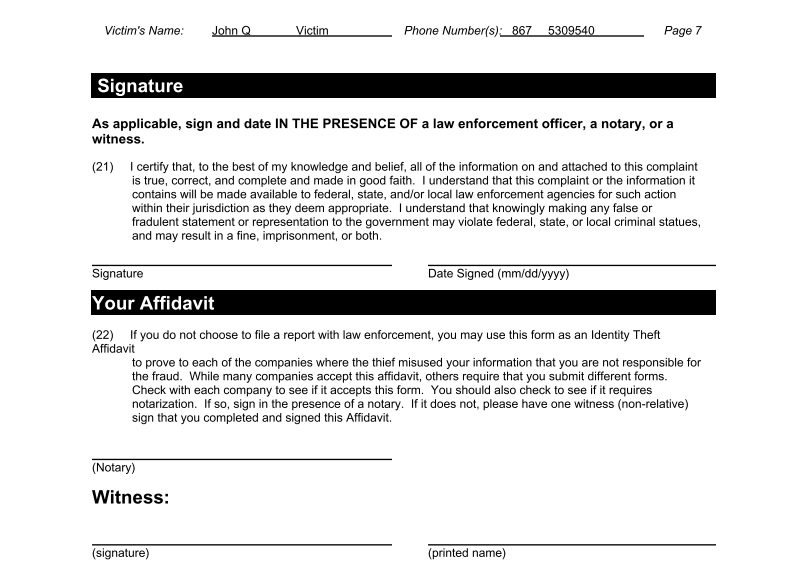

I recommend filing the FTC report first. Once you fill out the FTC report, the information will automatically be entered into the “Identity Theft Affidavit”. The Identity Theft Affidavit is a report that will need to be submitted to the local law enforcement officer in your jurisdiction. The link to access the Identity Theft Report at the Federal Trade Commission is: https://www.ftccomplaintassistant.gov/

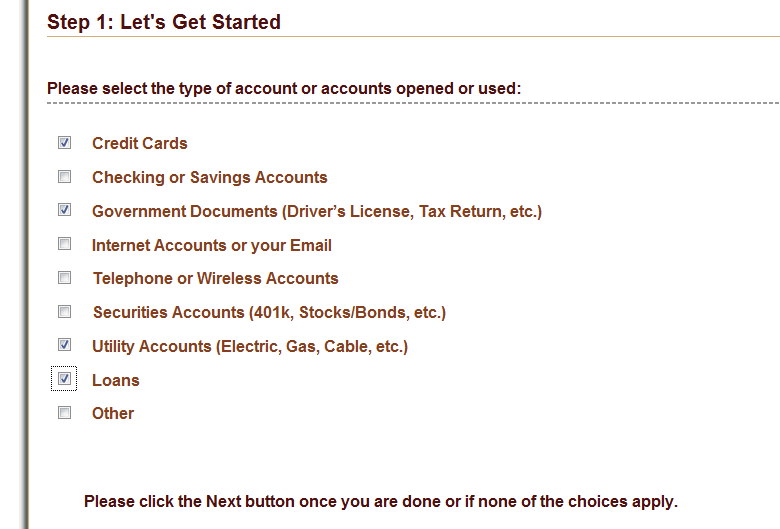

Once you click on that button you will be taken to this screen:

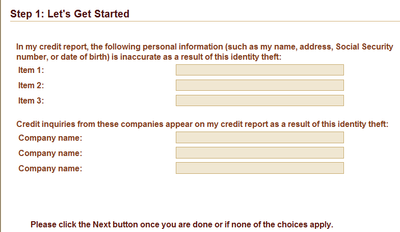

Enter all of the relevant information that you know about the crime:

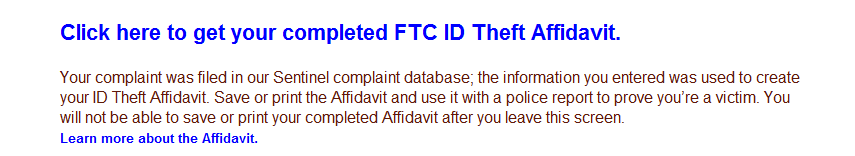

Once you have completed this portion of the report, Click on the button that says

Click here to get your completed FTC ID Theft Affidavit.

Your Identity Theft Affidavit will need to be signed in the prescence of either a Law Enforcement Agent, or a Notary Public.

With the ID theft Affidavit in hand, proceed to your local law enforcement office to file the police report.

Have your driver’s license and social security card with you, as well as a recent utility bill.

Next, you'll have to file an Identity theft report with the United States Postal Service at the following web address:

The link to access the postal inspectors ID Theft Report is: https://postalinspectors.uspis.gov/forms/IDTheft.aspx

The screen will look like this:

Using the postal service to conduct fraud is a federal crime, so you definately want to let the USPS know, especially if a PO Box was used during the identity theft.

In addition, if a law enforcement jurisdiction will not accept your report, the USPS is a viable way to make sure that your ID theft claim is appropriately documented.

From the Final Rule, an Identity Theft Report is defined as:

(a) The term ‘identity theft report’ means a report-(1)

that alleges identity theft with as much specificity as the

consumer can provide;

(2) that is a copy of an official, valid report filed by the consumer

with a Federal, State, or local law enforcement agency, including the United States Postal

Inspection Service, the filing of which subjects the person filing the report to criminal

penalties relating to the filing of false information, if, in fact, the information in the report

is false; and

(3) that may include additional information or documentation that

an information furnisher or consumer reporting agency reasonably requests for the

purpose of determining the validity of the alleged identity theft, provided that the

information furnisher or consumer reporting agency makes such request not later than

five business days after the date of receipt of the copy of the report form identified in

paragraph (2) or the request by the consumer for the particular service, whichever shall

be the later.

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What to do when you think you are a Victim of Identity Theft??

Step 3: Send the completed ID Theft Affidavit, Police Report, USPS Fraud report, copy of your Driver’s License or other Government issued ID, and a recent utility bill, or bank statement to each of the three Bureaus address listed below along with the following letter to these addresses.

In order to compel the Credit Reporting Agencies to issue you a free Security Freeze of your credit reports, so that the theif cannot continue to open accounts in your name, you should send the following sample letter to each of the bureaus.

This will stop the theif from obtaining new accounts in your name, and will prevent future theft of your identity for the next 7 years.

Its important to remember that once your reports are frozen, you will need to "thaw" your reports before applying for new credit.

The bureaus will provide you a thaw code that you can use, and can also provide you with an access code that potential lenders can use to access your report.

Equifax Security Freeze and ID Theft Division P.O. Box 105788 Atlanta, GA 30348 800-685-1111

| Experian Security Freeze and ID Theft Division P.O. Box 9554 Allen, TX 75013 888-397-3742

| TransUnion Security Freeze and ID Theft Division P.O. Box 6790 Fullerton, CA 92834 888-909-8872

|

Here is the sample letter:

4/13/13

From: Your Name, Address, Phone Number Date of Birth: XXXX Social Security#: XXXXXXXX To: Credit Reporting Bureau

Dear Sir or Madam:

I am the victim of Identity theft and I am writing to compel a security freeze and extended fraud alert of my credit reports in accordance with the Fair Credit Reporting Act Section 605A(b). Enclosed with this request is the following documentation, as applicable:

1. Proof of my identity: A copy of my driver’s license and a recent phone bill in my name and mailed to my address.

2. Proof of my claim of identity theft: a) A copy of the appropriately filed Police report issued to me by the Local Law Enforcement containing the Police Report Number. b) A completed and notarized or signed by law enforcement officer FTC Identity Theft Affidavit. c)A copy of the FTC affidavit of complaint submitted to FTC on 04/3/13 d)A copy of the fraud report filed with the United States Postal Service.

Best Regards, Your Name Here

|

The full text of FCRA Section 605A which authorizes the extended alert is here:

(b) Extended Alerts (1) In general. Upon the direct request of a consumer, or an individual acting on behalf of or as a personal representative of a consumer, who submits an identity theft report to a consumer reporting agency described in section 603(p) that maintains a file on the consumer, if the agency has received appropriate proof of the identity of the requester, the agency shall – (A) include a fraud alert in the file of that consumer, and also provide that alert along with any credit score generated in using that file, during the 7-year period beginning on the date of such request, unless the consumer or such representative requests that such fraud alert be removed before the end of such period and the agency has received appropriate proof of the identity of the requester for such purpose; (B) during the 5-year period beginning on the date of such request, exclude the consumer from any list of consumers prepared by the consumer reporting agency and provided to any third party to offer credit or insurance to theconsumer as part of a transaction that was not initiated by the consumer, unless the consumer or such representative requests that such exclusion be rescinded before the end of such period; and (C) refer the information regarding the extended fraud alert under this paragraph to each of the other consumer reporting agencies described in section 603(p), in accordance with procedures developed under section 621(f). (2) Access to free reports. In any case in which a consumer reporting agency includes a fraud alert in the file of a consumer pursuant to this subsection, the consumer reporting agency shall – (A) disclose to the consumer that the consumer may request 2 free copies of the file of the consumer pursuant to section 612(d) during the 12-month period beginning on the date on which the fraud alert was included in the file; and (B) provide to the consumer all disclosures required to be made under section

|

Step 4: Blocking Information from your credit report that is the result of Fraud

In accordance with Federal Law, Credit Reporting Agencies are not allowed to report information about you if they have received an ID theft report identifying information as fraudulent.

The complete standard regarding ID Theft blocking of Fraudulent Credit Report Entries is here:

(a) Block. Except as otherwise provided in this section, a consumer reporting agency shall block the reporting of any information in the file of a consumer that the consumer identifies as information that resulted from an alleged identity theft, not later than 4 business days after the date of receipt by such agency of— (1) appropriate proof of the identity of the consumer; (2) a copy of an identity theft report; (3) the identification of such information by the consumer; and (4) a statement by the consumer that the information is not information relating to any transaction by the consumer. (b) Notification. A consumer reporting agency shall promptly notify the furnisher of information identified by the consumer under subsection (a) of this section— (1) that the information may be a result of identity theft; (2) that an identity theft report has been filed; (3) that a block has been requested under this section; and (4) of the effective dates of the block. (c) Authority to decline or rescind. (1) In general. A consumer reporting agency may decline to block, or may rescind any block, of information relating to a consumer under this section, if the consumer reporting agency reasonably determines that— (A) the information was blocked in error or a block was requested by the consumer in error; (B) the information was blocked, or a block was requested by the consumer, on the basis of a material misrepresentation of fact by the consumer relevant to the request to block; or (C) the consumer obtained possession of goods, services, or money as a result of the blocked transaction or transactions. (2) Notification to consumer. If a block of information is declined or rescinded under this subsection, the affected consumer shall be notified promptly, in the same manner as consumers are notified of the reinsertion of information under section 1681i (a)(5)(B) of this title. (3) Significance of block. For purposes of this subsection, if a consumer reporting agency rescinds a block, the presence of information in the file of a consumer prior to the blocking of such information is not evidence of whether the consumer knew or should have known that the consumer obtained possession of any goods, services, or money as a result of the block. (d) Exception for resellers. (1) No reseller file. This section shall not apply to a consumer reporting agency, if the consumer reporting agency— (A) is a reseller; (B) is not, at the time of the request of the consumer under subsection (a) of this section, otherwise furnishing or reselling a consumer report concerning the information identified by the consumer; and (C) informs the consumer, by any means, that the consumer may report the identity theft to the Bureau to obtain consumer information regarding identity theft. (2) Reseller with file. The sole obligation of the consumer reporting agency under this section, with regard to any request of a consumer under this section, shall be to block the consumer report maintained by the consumer reporting agency from any subsequent use, if— (A) the consumer, in accordance with the provisions of subsection (a) of this section, identifies, to a consumer reporting agency, information in the file of the consumer that resulted from identity theft; and agency from which the consumer information was obtained for resale. (e) Exception for verification companies. The provisions of this section do not apply to a check services company, acting as such, which issues authorizations for the purpose of approving or processing negotiable instruments, electronic fund transfers, or similar methods of payments, except that, beginning 4 business days after receipt of information described in paragraphs (1) through (3) of subsection (a) of this section, a check services company shall not report to a national consumer reporting agency described in section 1681a (p) of this title, any information identified in the subject identity theft report as resulting from identity theft. (f) Access to blocked information by law enforcement agencies. No provision of this section shall be construed as requiring a consumer reporting agency to prevent a Federal, State, or local law enforcement agency from accessing blocked information in a consumer file to which the agency could otherwise obtain access under this subchapter. Send the following letter and enclosures to the Credit Reporting Agencies in accordance with section 605 B of the Fair Credit Reporting Act, 15 U.S.C. § 1681g(e)

|

In order to compel a block of the specific information that is the result of identity theft, you will need to request the block in writing, by submitting the following letter:

4/13/13

From: You Your name and Address Date of Birth: XXXXXXXX Social Security#: XXXXX

To: Credit Reporting Agency

Dear Sir or Madam:

I am the victim of Identity theft and I am writing to compel an identity BLOCK of items on my credit report that are not mine which resulted from the crime. Please BLOCK the following fraudulently created information from appearing in my credit report: Name: MyFico Forum Member Fraudulent Addresses: PO Box 2602, Somewhere, CA Unit XXXXX FPO Somewhere, CA

Accounts:

Fraudulent Credit Card Account # XXXXXXXX; Revolving Account Fraudulent Collection Agency Account ; Collection Account #XXXX Fraudulent Loan; Installment Loan; Account # XXXXXX In accordance with section 605 B of the Fair Credit Reporting Act, 15 U.S.C. § 1681g(e), I am requesting that you Permanently Block business records relating to the fraudulent accounts and identifying information identified above from appearing on my credit report.

Enclosed with this request is the following documentation, as applicable:

1. Proof of my identity: A copy of my driver’s license and a recent phone bill in my name and mailed to my address. 2. Proof of my claim of identity theft: a) A copy of the card issued to me by the Local Law Enforcement containing the Police Report Number. b) A completed and notarized or signed by law enforcement FTC Identity Theft Affidavit. c)A copy of the FTC affidavit of complaint submitted to FTC on 04/13/13 d)A copy of the fraud report filed with the United States Postal Service.

Best Regards, MyFico Forum Member

|

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What to do when you think you are a Victim of Identity Theft??

Step 5: Obtaining documents and evidence from the creditors of the fraudulent accounts

In order to compel the creditors of the fraudulent accounts to send you documents and applications related to the fraudulent accounts, you should request these documents in writing using the following letter to both request the documents, and compel this creditor to Cease and Desist all reporting of the account.

This notification to the creditor is especially important, because it prevents the creditor from transferring the debt or selling the debt to a collection agency. Any debt that is identified as fraudulent, is retained by that creditor and cannot be transferred or sold. When you contact these fraudulent creditors, you should send the letter to the address listed on your credit report.

Here is the sample letter used to compel the company to send your their records of the account:

Appendix C.8.a.: Consumer § 609(e) Letter for Fraudulent Transaction/Account Records

4/4/13

Name Adress City State, Zip

Credit Card Company

RE: Request for Records Pursuant to Section 609(e) of the Fair Credit Reporting Act

Dear Sir or Madam:

I am a victim of identity theft. XXXX acquired a {credit card, installment loan, mortgage, retail card} with account # XXXXX from your company using my information, without my consent. I do not remember signing any documents related to this account that appears on my credit report. This account resulted from identity theft. In accordance with section 609(e) of the Fair Credit Reporting Act, 15 U.S.C. § 1681g(e), I am requesting that you provide me copies of business records relating to the fraudulent activity identified above. The law directs that you provide these documents at no charge, and without requiring a subpoena, within thirty (30) days of your receipt of this request.

Enclosed with this request is the following documentation, as applicable:

2. Proof of my claim of identity theft: a. A copy of the police report number filed with the local law enforcement b. A completed and signed FTC Identity Theft Affidavit c. A copy of the Postal Service Fraud Form which was filed.

Please provide all records relating to the fraudulent account, including:

Please send these records to me at the above address.

In addition, please cease and desist all reporting of this fraudulent account to the three Credit Reporting Bureaus.

In addition, I authorize the law enforcement officer who is investigating my case to submit this request on my behalf and/or receive copies of these records from you. The law enforcement officer’s name, address and telephone number is (insert info here) . Please also send copies of all records to this officer.

If you have any questions concerning this request, please contact me at the above address.

Sincerely,

MyFICO forum member

Enclosures:

|

Once you receive this information from the creditors, you can forward it to the law enforcement officer who is working your case. They can use this as evidence to prosecute the theif, and get "restitution" for you, the victim.

Step 6: Obtaining information from debt collectors who conducting collection on a fraudulent account, and stopping them from selling or transferring the debt

In order to compel a debt collector attempting to collect on the fraudulent accounts to send you all information related to the fraudulent accounts that you “would otherwise be entitled if the consumer were not a victim of identity theft, but wished to dispute the debt under provisions of law applicable to that person, which includes debt verification under FDCPA 809(b), you should make request that request in writing using the following letter.

Also, you want to make sure that you notify them in accordance with 615(g) of FCRA that the account is disputed as Fraudulent, so that they cannot sell, or transfer the debt.

To do this, you will need to send each of the Debt Collectors that are trying to collect on a debt that you suspect arose from Identity theft the following letter:

Appendix C.8.a.: Consumer § 615(g) Request to Provide Information Related to Identity Theft 4/4/13 Name Adress CityState, Zip Debt Collector RE: Request for Information Pursuant to Section 615(g) of the Fair Credit Reporting Act Dear Sir or Madam: I am a victim of identity theft. {Suspect} acquired a {loan, credit card, cell phone, utility account, etc..} with account #XXXX for whom the Original Credit is {insert Original Creditor's name here} which you are attempting to collect on.

In accordance with section 615(g) of the Fair Credit Reporting Act, I am requesting that you provide me all information related to the fraudulent accounts that I would otherwise be entitled if I were not a victim of identity theft, but wished to dispute the debt under provisions of law . Enclosed with this request is the following documentation, as applicable:

a. A copy of the police report number filed with the local law enforcement b. A completed and signed FTC Identity Theft Affidavit c. A copy of the Postal Service Fraud Form which was filed.

Please send verification of the debt to the above address.

In addition, please be advised that this notification of identity theft additionally precludes you from selling, transferring, or placing the debt for collection with any other party, pursuant to the provisions of FCRA 615(f).

If you have any questions concerning this request, please contact me at the above address.

Sincerely,

My Fico Forum Member

|

In addtion, you want to let the Original Creditor know that you are disputing the validity of the debt, in accordance with the Identity Theft Provisions.

The great thing about notifying the Collection Agency and the Original Credit about the fraudulent account is that not only can you compel the CA and Original Creditor to send all transactions and account applications, but you effectively block them from transferring or selling the debt to a different collection agency.

Appendix C.8.a.: Consumer § 615(g) Request to Provide Information Related to Identity Theft 4/4/13

Name Adress CityState, Zip

Original Creditor

RE: Request for Information Pursuant to Section 615(g) of the Fair Credit Reporting Act

Dear Sir or Madam:

I am a victim of identity theft. XXXX acquired a {credit card, loan, type of service, cell phone account.. etc} with account with ( ), for which you are attempting to collect via _____ Collection Agency for this alleged debt which you claim I owe. In accordance with section 615(g) of the Fair Credit Reporting Act, I am requesting that you provide me all information related to the fraudulent accounts that I would otherwise be entitled if I were not a victim of identity theft, but wished to dispute the debt under provisions of law.

Enclosed with this request is the following documentation, as applicable:

2. Proof of my claim of identity theft: a. A copy of the police report number filed with the local law enforcement b. A completed and signed FTC Identity Theft Affidavit c. A copy of the Postal Service Fraud Form which was filed.

Please send all records associated with this alleged debt to the above address.

In addition, please be advised that this notification of identity theft additionally precludes you from selling, transferring, or placing the debt for collection with any other party, pursuant to the provisions of FCRA 615(f). If you have any questions concerning this request, please contact me at the above address.

Sincerely,

My Fico Forum Member

|

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What to do when you think you are a Victim of Identity Theft??

Step 7: Medical Identity Theft

How to determine if you are a victim of medical identity theft?

Victims may:

- get a bill for medical services they didn’t receive;

- be contacted by a debt collector about medical debt they don’t owe;

- see medical collection notices on their credit report that they don’t recognize;

- find erroneous listings of office visits or treatments on their explanation of benefits (EOB);

- be told by their health plan that they’ve reached their limit on benefits; or

- be denied insurance because their medical records show a condition they don’t have.

If you believe someone may have stolen your identity to obtain medical services, this can hinder your ability to get life insurance, and unpaid medical bills can go into collections. There are several ways this can happen including:

Your insurance card is stolen by someone from your wallet

A former spouse or step-child gives an expired medical insurance card under your employer's healthcare plan to their doctor

Take advantage of your rights under the HIPAA Privacy Rule.

Some medical providers and health plans believe they would be violating the identity thief’s HIPAA privacy rights if they gave victims copies of their own records. That’s not true. Even in this situation, patients have the right to get a copy of their records.

The originator of the information must correct the inaccurate or incomplete information, and notify other parties, like labs or other health care providers, that it knows received the incorrect information. If an investigation doesn’t resolve the dispute, patients can ask that an explanation of the dispute be included in their records.

- The HIPAA Privacy Rule gives people the right to copies of their records maintained by covered health plans and medical providers. Patients may ask for copies of their medical and billing records to help identify the impact of the theft, and to review their records for inaccuracies before seeking additional medical care. There is no central source for medical records, so patients need to contact each provider they do business with – including doctors, clinics, hospitals, pharmacies, laboratories and health plans. For example, if a thief got a prescription filled in your patient’s name, the victim may want the record from the pharmacy that filled the prescription and the health care provider who wrote the prescription. Explain that there may be fees and mailing costs to get copies of medical or billing files.

- Patients have the right to have their medical and billing records amended or corrected. You should write to their health plan or provider to dispute the inaccurate information contained in your health records. When you write to your health plan, send in copies of (they should keep the originals) any documents that support your position. Your letter should identify each disputed item, the reasons for disputing it, and a request that each error be corrected or deleted. You may want to include a copy of their medical or billing record with the items in question circled. Also send in your Identity Theft Report, and Affidavit of Identity theft, outlining the description of the ID theft.

- Patients have the right to an accounting of disclosures from their medical providers and health plans. An accounting of disclosures may help indicate to patients whether there has been an inappropriate release of their medical information. An accounting is a report of certain disclosures made of the patient’s medical information by the medical provider or health plan. Although some disclosures that occur often or as a matter of routine – for example, a doctor’s disclosure of treatment information to another health care provider or payment information to an insurer for reimbursement – do not need to be included in the accounting, it would include information that may be helpful, like misdirected faxes or e-mails or any information released based on an invalid patient authorization.

The law allows you to order one free copy of the accounting from each of their providers and health plans every 12 months. The accounting is a record of:

- the date of the disclosure;

- the name of the person or entity who received the information;

- a brief description of the information disclosed; and

- a brief statement of the purpose of the disclosure or a copy of the request for it.

What you should do:

Notify your health plan if you suspect medical identity theft. Getting a list of benefits paid in their name can help you determine whether there are any fraudulent charges. You should also read your Explanation of Benefits (EOB) statements that health plans send after treatment, and check that the claims paid match the care you received. You should also verify that the name of the provider, the dates of service, and the services provided are correct. Patients should report discrepancies to their health plan.

If you find medical collections on your credit report, send the following letter to the Collection Agency who is attempting to collect the bill:

Appendix C.8.a.: Consumer § 615(g) Letter for Fraudulent Transaction/Account Records

[Date]

[Your Name] [Your Address] [Your City, State, Zip Code]

[Name of Company] [City, State, Zip Code]

RE: Request for Records Pursuant to Section 615(f) of the Fair Credit Reporting Act [Description of fraudulent account]

Dear Sir or Madam:

I am a victim of identity theft. The thief acquired medical services in my name with {medical provider} using an {expired, stolen, fraudulently obtained, etc} insurance card. You are attempting to collect the debt associated with this medical identity theft. I do not owe these alleged debts, and did not receive any services from {the Medical Provider}.

{include if former spouse or stepchild} Furthermore, I have no current relationship with and am not responsible for the medical debt of the thief, nor was I responsible at the time service was rendered.

In accordance with section 609(e) of the Fair Credit Reporting Act, 15 U.S.C. § 1681g(e), I am requesting that you provide me copies of business records relating to the fraudulent [transaction/account] identified above. The law directs that you provide these documents at no charge, and without requiring a subpoena, within thirty (30) days of your receipt of this request. I am enclosing a copy of the relevant federal law and the Federal Trade Commission’s business education publication on this topic.

Enclosed with this request is the following documentation, as applicable:

1. Proof of my identity: A copy of my driver’s license, other government-issued identification card, or other proof of my identity; and

2. Proof of my claim of identity theft: a. A copy of the police report about my identity theft; and b. A completed and signed FTC Identity Theft Affidavit or alternative affidavit of fact.

Please provide all records relating to the fraudulent [transaction/account], including:

Please send these records to me at the above address.

In addition, please be advised that this notification of identity theft additionally precludes you from selling, transferring, or placing the debt for collection with any other party, pursuant to the provisions of FCRA 615(f).

Please cease and desist all reporting of this fraudulent account to the three Credit Reporting Bureaus.

In addition, I authorize the law enforcement officer who is investigating my case to submit this request on my behalf and/or receive copies of these records from you. The law enforcement officer’s name, address and telephone number is: [insert officer name, address and telephone]. Please also send copies of all records to this officer.

If you have any questions concerning this request, please contact me at the above address.

Sincerely,

MyFico Forum Member

Enclosures: [List only those items that you are enclosing]

|

Here is the letter you might send to the Doctor's Office who provided the service:

Appendix C.8.a.: Consumer § 609(e) Letter for Fraudulent Transaction/Account Records

[Date]

[Your Name] [Your Address] [Your City, State, Zip Code]

[Name of Company] [City, State, Zip Code]

RE: Request for Records Pursuant to Section 609(e) of the Fair Credit Reporting Act [Description of fraudulent account]

Dear Sir or Madam:

I am a victim of identity theft. The thief acquired medical services in my name with {medical provider} using an {expired, stolen, fraudulently obtained, etc} insurance card. I do not owe these alleged debts, and did not receive any services from {the Medical Provider}.

{include if former spouse or stepchild} Furthermore, I have no current relationship with and am not responsible for the medical debt of the thief, nor was I responsible at the time service was rendered.

In accordance with section 609(e) of the Fair Credit Reporting Act, 15 U.S.C. § 1681g(e), I am requesting that you provide me copies of business records relating to the fraudulent [transaction/account] identified above. The law directs that you provide these documents at no charge, and without requiring a subpoena, within thirty (30) days of your receipt of this request. I am enclosing a copy of the relevant federal law and the Federal Trade Commission’s business education publication on this topic.

Enclosed with this request is the following documentation, as applicable:

1. Proof of my identity: A copy of my driver’s license, other government-issued identification card, or other proof of my identity; and

2. Proof of my claim of identity theft: a. A copy of the police report about my identity theft; and b. A completed and signed FTC Identity Theft Affidavit or alternative affidavit of fact.

Please provide all records relating to the fraudulent [transaction/account], including:

Please send these records to me at the above address.

In addition, please be advised that this notification of identity theft additionally precludes you from selling, transferring, or placing the debt for collection with any other party, pursuant to the provisions of FCRA 615(f).

In addition, I authorize the law enforcement officer who is investigating my case to submit this request on my behalf and/or receive copies of these records from you. The law enforcement officer’s name, address and telephone number is: [insert officer name, address and telephone]. Please also send copies of all records to this officer.

If you have any questions concerning this request, please contact me at the above address.

Sincerely,

MyFico Forum Member

Enclosures: [List only those items that you are enclosing]

|

If you have any problems getting the Creditors to send you the documents, do not dispair, keep sending the requests, and if they do not comply, send a complaint via Email to 609erecords@ftc.gov.

Also keep in mind that the FTC maintains a comprehensive guide that is very similar to mine. The guide can be found Here.

Best of Luck!

I am going through this process at the moment, with some ID theft experienced by my husband. If you have any additional information to add, please feel free to PM me with the relevant information, and I will include it in this guide.

Good LUCK to everyone who is a victim. It will be a roller coaster, but keep in mind that the laws are designed in your favor, so that you can fully recover from the theft.

In rare cases, you may have to file for a new social security number, if your info is being used to claim government benefits. For these cases, I do not know a lot of information, you'll have to contact the Social Security Administration.

References: Most of the information used here is available via the FTC at www.ftc.gov. In addition, special thanks are in order to RobertEG for helping to straighten out the legal references used in the letters. A complete copy of the Fair Credit Reporting Act can be found here.

If you want to follow my journey with helping DH clear up his ID theft issues, Click Here.

Good Luck All!

Your friendly Moderator,

Webbhopper

Filed Chapter 13 on 6/1/2017 after job loss. Discharged 6/1/2022.

Goal: Gardening!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content