- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Who to talk to about scoring error?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Who to talk to about scoring error?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who to talk to about scoring error?

UPDATE: Got a scoring alert that "A collections account has been removed from your report." First time I've gotten this alert, so hopefully my issue is now permanently resolved.

Hello,

In 2014 I recieved some charity care from a hospital. They originally billed me, but once my charity paperwork went through the balance was decreased to zero.

Over the past few years I keep getting a collections placed on my account from various agencies. I've always been able to dispute the collections by providing a copy of the letter I recieved confirming that my balance due is zero.

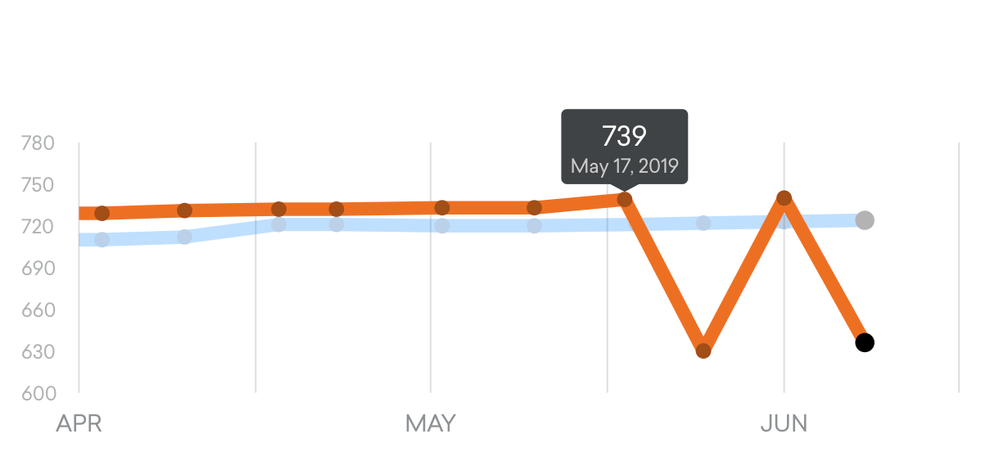

Recently however I keep getting scoring alerts from Transunion that my score has dropped about 50 points, but when I pull a report from MF, or directly from TU there is no additional derogetory information, and my score shows correct on MF. I'm fairly certain that this is due to the medical account from 2014, I recieved collections on EQ and EX at the same time in May.

I guess technically it doesn't actually affect my report, as no derrogatory information actually appears on my report, but I don't like the numbers. How do I go about stopping this from happening? Could this be a MF error?

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Who to talk to about scoring error?

@Kree wrote:

I guess technically it doesn't actually affect my report, as no derrogatory information actually appears on my report, but I don't like the numbers. How do I go about stopping this from happening? Could this be a MF error?

If your score is [significantly] changing, your report is changing. Scores are drawn on report data, so if you're seeing major score fluctuations it means you have major data fluctuations going on. Have you pulled copies of your real credit reports from the 3B, not from MF or another CMS? If not, I'd start with that. I'd be concerned with the constant introduction of a major negative item. Lenders don't know that it's in error, so they may see it and take AA. You need to get to the source and find out why the information keeps getting incorrectly reported. If you destroy the source, you destroy the problem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Who to talk to about scoring error?

@Anonymous wrote:If your score is [significantly] changing, your report is changing. Scores are drawn on report data, so if you're seeing major score fluctuations it means you have major data fluctuations going on. Have you pulled copies of your real credit reports from the 3B, not from MF or another CMS? If not, I'd start with that. I'd be concerned with the constant introduction of a major negative item. Lenders don't know that it's in error, so they may see it and take AA. You need to get to the source and find out why the information keeps getting incorrectly reported. If you destroy the source, you destroy the problem.

I've pulled my report directly from TU within minutes of getting one of these scoring alerts, and there has been no derogatory information present. Which is why I'm stumped, I can't dispute information that doesn't show up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Who to talk to about scoring error?

A few years back when my file was quite a bit thinner my student loans (positive impact) fell off due to the 10 year mark and my scores dropped about 40 points. The missing good loans and the AAoA significantly reduced which is what drove the decrease.

I thought it was because something came back to haunt me but after really digging it was because of that.

If you’re not seeing negative info reported then the source has to be something else.

Few other factors to keep in mind. How thick is the file? Have you added any new accounts recently? Has your DTI fallen to zero? Is everything positive that you know of actively present?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Who to talk to about scoring error?

@credit_is_crack wrote:

Has your DTI fallen to zero?

DTI doesn't affect your score as income isn't part of scoring. However, if your credit card balances fall to zero, there's likely to be noticeable impact on most FICO scores. And if there's no open installment loan, several scores can be negatively impacted.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Who to talk to about scoring error?

@credit_is_crack wrote:

I’m not sure what else is on the report but something to consider. Is it possible the score dropped because a really old account that was in good standing has fallen off?

I could see this happening once, not 5 times in as many months. Especially with it being the exact same score drop and increase every time.

Interesting update though (will edit first post), I just got a scoring alert that a collections account has been removed from my report.

First time I've gotten that alert. Previously, my score would just magically pop back up when I pulled a report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Who to talk to about scoring error?

Is the score that keeps bobbing up and down a Vantage or FICO score?

I ask in part because I've had my Vantage score, based on TU data, repeatedly bounce from mid 700s to low 600's (over 100 points at a time) simply for a small balance change on one of my cards. My FICO will stay fairly constant, or actually doing the opposite of the Vantage score - when I pay the card nearly off, Vantage plummets and FICO rises a few points, run up a balance, and the opposite happens.

May just be Vantage 3 weirdness?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Who to talk to about scoring error?

@Anonymous wrote:Is the score that keeps bobbing up and down a Vantage or FICO score?

True fico scores, the graphic in the initial post was captured right here on MyFico.com

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Who to talk to about scoring error?

@Kree wrote:Interesting update though (will edit first post), I just got a scoring alert that a collections account has been removed from my report.

It's important to remember that you're not getting a "scoring alert." You're getting an alert that a change happened to your credit report. That change may or may not have any bearing on your score. You are provided with a fresh updated score at the time. That score may be impacted by the report change alert reason, or it may have been impacted by other reasons that weren't alertable. The bottom line and what's crucial to comprehend is that it's not a scoring alert at all, simply a CR change alert.