- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Why the heck is Portfolio Recovery doing Soft pull...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why the heck is Portfolio Recovery doing Soft pull spams on my account?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why the heck is Portfolio Recovery doing Soft pull spams on my account?

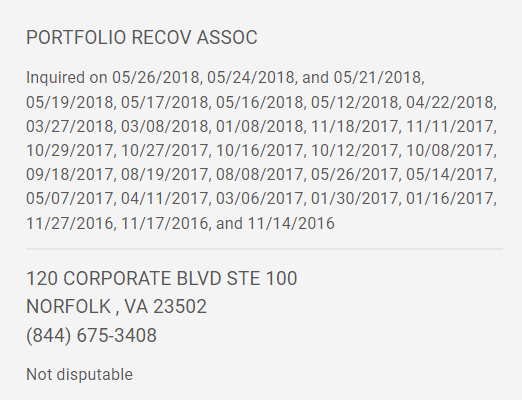

So I checked my credit report and looked on my soft pulls. Portfolio Recovery is spamming soft pulls. I do not owe anything to this company. Why would they be doing that???

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why the heck is Portfolio Recovery doing Soft pull spams on my account?

@Anonymous wrote:So I checked my credit report and looked on my soft pulls. Portfolio Recovery is spamming soft pulls. I do not owe anything to this company. Why would they be doing that???

Wow, they've been stalking you for 2 years! I mean, if they haven't reported anything in the last 2 years, it's probably a good thing. Although, I don't know why they're checking in on you to begin with. Seems kind of fishy.

![Comenity – Express Next Store Card : $5,000 [AU]](https://i.imgur.com/Pmmb7kq.jpg)

Officially collection free as of 3/19/19!!

STARTING SCORES: 377 (11/2013) & 580 (3/2018)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why the heck is Portfolio Recovery doing Soft pull spams on my account?

A debt collector only has permissible purpose to obtain a consumer's credit report if they have active collection authority.

FCRA 604(a)(3)(A).

If the debt collector does not have active collection authority on a debt of the consumer, they have no permissilbe purpose.

The FCRA requires that a party requesting a credit report must provide one or more of the permissible purposes set forth under FCRA 604 if the consumer has not provided express authorization to the CRA for the debt collector to obtain a credit report.

If there is no unpaid debt for which the debt collector has active collection authority, then they lack permissible purpose, and their inquiries are a violation of the FCRA.

You can dispute the inquiries if you provide clear showing of no active collection authority.

If the debt collector than verifies that they do, that would be a knowingly false statement that would subject them to civil liability and damages.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why the heck is Portfolio Recovery doing Soft pull spams on my account?

I've seen debt collectors do that when you have poor credit. They don't bother to add the colleciton they have until they see indications that you are starting to fix your credit or apply for new credit as they figure you now have money and an incentive to pay them when they ding you.

If you have good credit and they haven't added a collection or send you mail in that period, it does seem suspicious.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why the heck is Portfolio Recovery doing Soft pull spams on my account?

I am of the mind to give that number a call and find out why they feel the need for all the soft pulls.

I am unaware of any reason for me to be on a collection agency's radar.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why the heck is Portfolio Recovery doing Soft pull spams on my account?

Mel,

If its true that a debt buyer like Portfolio Recovery Associates must have a permissible purpose for even a soft pull, and its true that you don't have any debt that they own, I would just sue them for unauthorized access to your credit report in violation of the FCRA in federal court.

Don't represent yourself. Get a lawyer familiar with the FCRA. The statute has a attorney fees provision, so the lawyers who do this kind of work do not require you to pay their fees, they get their fees from the debt buyer they sue on your behalf.

The ifs in the first sentence are big ones. Portfolio Recovery Associates is one of America's largest debt buyers. It buys huge amounts of defaulted consumer debt from major banks, then collects by sending letters, making telephone calls, doing credit reporting and filing suit. Its possible that they could own a credit card or some other debt that is very old, even decade or so, which you might have forgotten. If they do own such a debt, they may have the right to do a soft pull. I'm certain that they would not have the right to report a negative item on your report if it is over 7 years since default but I'm not certain if the expiration of the 7 year period would end their right to access the report via a soft pull. Another possibility is mistaken identity or ID theft. A thief may have used your ID to obtain credit that Portfolio Recovery Associates now owns. Or Portfolio Recovery Associates may have you mixed up with someone who does have a debt with them. Its impossible to tell just from seeing them pull your report.

You might want to get a lawyer in your area that does FCRA suits to investigate and get professional advice on how to proceed in order to protect yourself and your credit report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why the heck is Portfolio Recovery doing Soft pull spams on my account?

How did you access the list of soft pulls on your report?

![Comenity – Express Next Store Card : $5,000 [AU]](https://i.imgur.com/Pmmb7kq.jpg)

Officially collection free as of 3/19/19!!

STARTING SCORES: 377 (11/2013) & 580 (3/2018)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why the heck is Portfolio Recovery doing Soft pull spams on my account?

A line of thought. I remember hearing that placing a collections on a credit report was considered contact, and that people could successfully sue for lack of dunning notice.

Soft pulls are viewable by the consumer just like any other part of a credit report. If soft pulls should count as collections efforts, then OP can sue for lack of proper notice. If it turns out not to be related to collections efforts, then OP can sue for misrepresentation.

A lawyer could tell OP if he could sue for both at the same time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why the heck is Portfolio Recovery doing Soft pull spams on my account?

@Kree wrote:A line of thought. I remember hearing that placing a collections on a credit report was considered contact, and that people could successfully sue for lack of dunning notice.

Soft pulls are viewable by the consumer just like any other part of a credit report. If soft pulls should count as collections efforts, then OP can sue for lack of proper notice. If it turns out not to be related to collections efforts, then OP can sue for misrepresentation.

A lawyer could tell OP if he could sue for both at the same time.

The courts that have ruled on the issue have ruled that credit reporting is not an initial communication that triggers a consumer’s right to request validation because it is not a communication directly with the consumer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why the heck is Portfolio Recovery doing Soft pull spams on my account?

@Queen_Etherea wrote:How did you access the list of soft pulls on your report?

Login to any CRA Dispute section and look. Then back out.