- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- financially wrecked - please advise my best moves

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

financially wrecked - please advise my best moves

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: financially wrecked - please advise my best moves

Good points there. You're exactly right about this market. Inflation being as high as it is, I can't realistically afford any credit card bills at all if I am to have a mortgage in the near future for the little one and myself. Thanks for the advice. ![]()

2024 Goal: To finally be debt free

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: financially wrecked - please advise my best moves

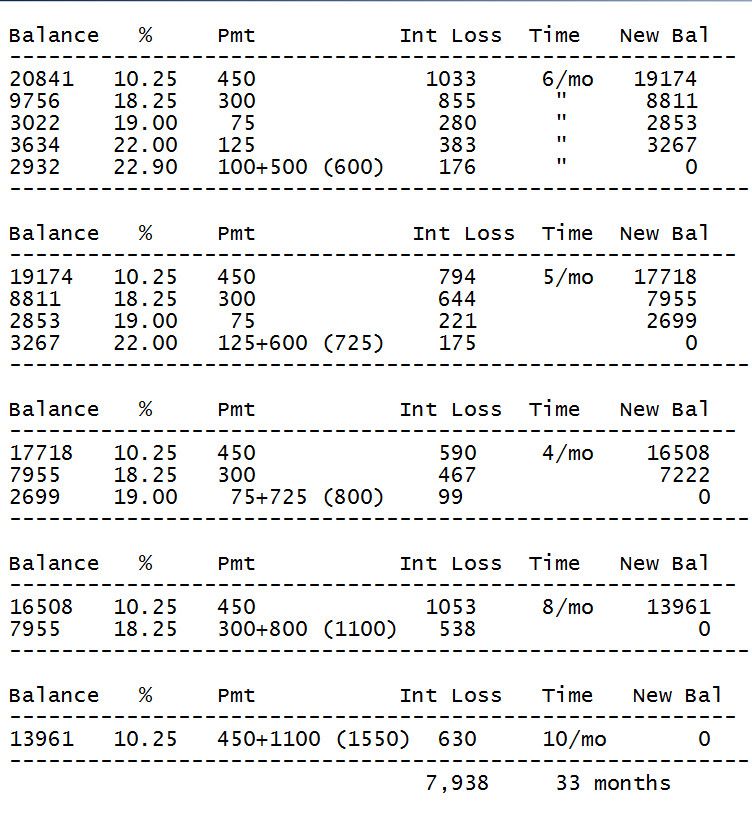

One saves the most money and gets out of debt faster when applying the most money they can to the highest interest debts first.

CC debt using high interest first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: financially wrecked - please advise my best moves

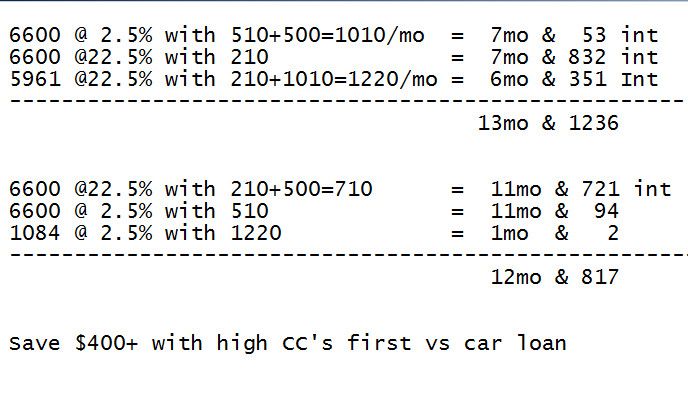

@Anonymalous wrote:The auto loan is 2.5%. Paying it off before your credit card debt wouldn't save you money.

^^^ This

Just looking at the Auto loan and the two highest interest credit cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: financially wrecked - please advise my best moves

$7900 in cumulative interest, yikes! OP is better off taking the personal loan saving $2700 in cumulative interest.

current minimums for avalanche/snowball method:

| apr % | balance | min pmt | ||

| Capital One QS | 22.9 | 2932 | 87 | 87 |

| Snyc Amazon Prime | 22 | 3634 | 118 | 118 |

| Pentagon FCU | 19 | 3022 | 60 | 60 |

| Discover | 18.25 | 9756 | 298 | 298 |

| NFCU Cash Rewards | 10.25 | 20841 | 421 | |

| Auto loan | 2.5 | 6610 | 510 | |

| extra payment $ | 600 | 600 | ||

| TOTAL | 2094 | 1163 |

use the $20000 personal loan to consolidate the four high interest cards ($19344) and apply extra ($656) to nfcu balance:

| apr % | balance | min pmt | |

| Personal loan | 11.25 | 20000 | 1163 |

| NFCU Cash Rewards | 10.25 | 20185 | 421 |

| Auto loan | 2.5 | 6610 | 510 |

| TOTAL | 2094 |

payment schedule:

| auto loan | balance | personal loan | balance | nfcu | balance | |||

| 2.5 | 6610 | 11.25 | 20000 | 10.25 | 20185 | |||

| 1 | -510 | 6114 | -1163 | 19025 | -421 | 19936 | ||

| 2 | -510 | 5617 | -1163 | 18040 | -421 | 19686 | ||

| 3 | -510 | 5118 | -1163 | 17046 | -421 | 19433 | ||

| 4 | -510 | 4619 | -1163 | 16043 | -421 | 19178 | ||

| 5 | -510 | 4118 | -1163 | 15030 | -421 | 18921 | ||

| 6 | -510 | 3617 | -1163 | 14008 | -421 | 18661 | ||

| 7 | -510 | 3115 | -1163 | 12976 | -421 | 18400 | ||

| 8 | -510 | 2611 | -1163 | 11935 | -421 | 18136 | ||

| 9 | -510 | 2107 | -1163 | 10884 | -421 | 17870 | ||

| 10 | -510 | 1601 | -1163 | 9823 | -421 | 17601 | ||

| 11 | -510 | 1094 | -1163 | 8752 | -421 | 17331 | ||

| 12 | -510 | 587 | -1163 | 7671 | -421 | 17058 | ||

| 13 | -510 | 78 | -1163 | 6580 | -421 | 16782 | ||

| 14 | -78 | 0 | -1595 | 5047 | -421 | 16505 | ||

| 15 | -1673 | 3421 | -421 | 16225 | ||||

| 16 | -1673 | 1780 | -421 | 15942 | ||||

| 17 | -1673 | 124 | -421 | 15658 | ||||

| 18 | -125 | 0 | -1969 | 13822 | ||||

| 19 | -2094 | 11846 | ||||||

| 20 | -2094 | 9854 | ||||||

| 21 | -2094 | 7844 | ||||||

| 22 | -2094 | 5817 | ||||||

| 23 | -2094 | 3772 | ||||||

| 24 | -2094 | 1711 | ||||||

| 25 | -1725 | 0 | ||||||

| cumulative interest | -98 | -1858 | -3230 |

| TOTAL | -5186 |

there is even another scenario with less cumulative interest. 1) using the personal loan to pay off discover. 2) then use a discover 0% balance transfer for the other three cards. 3) etc... its is all just a math problem and how complicated the OP is willing to get.

9/2022 $30000 |  8/2020 $20000 |  12/2018 $30000 |  8/2016 $30000 |  3/2016 $21000 |  5/2014 $20000 |  10/2007 $8900 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: financially wrecked - please advise my best moves

Thanks for charting the numbers out. Pretty generous work and I appreciate it! It can get overwhelming to try to figure out. I applied and got approved for the 20K from Penfed, except they bumped that 11.25% APR up to 12.45% on me... I still took the loan, because it's still a significant enough difference over my higher interest cards.

So, $20k will be in my bank account and ready to go to work by Wednesday. I'm shooting for the fastest way out of this debt (the cc's. the new Penfed loan, and my truck loan) with my available cash flow.

2024 Goal: To finally be debt free

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: financially wrecked - please advise my best moves

@iowe wrote:Thanks for charting the numbers out. Pretty generous work and I appreciate it! It can get overwhelming to try to figure out. I applied and got approved for the 20K from Penfed, except they bumped that 11.25% APR up to 12.45% on me... I still took the loan, because it's still a significant enough difference over my higher interest cards.

So, $20k will be in my bank account and ready to go to work by Wednesday. I'm shooting for the fastest way out of this debt (the cc's. the new Penfed loan, and my truck loan) with my available cash flow.

Congrats ![]()

It will save you money and make a few less debt payments

Good luck with the plan and stick too it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: financially wrecked - please advise my best moves

@iowe wrote:Thanks for charting the numbers out. Pretty generous work and I appreciate it! It can get overwhelming to try to figure out. I applied and got approved for the 20K from Penfed, except they bumped that 11.25% APR up to 12.45% on me... I still took the loan, because it's still a significant enough difference over my higher interest cards.

So, $20k will be in my bank account and ready to go to work by Wednesday. I'm shooting for the fastest way out of this debt (the cc's. the new Penfed loan, and my truck loan) with my available cash flow.

what bums!

changing up the interest on you like that. /:

last tip: when you get the money, call each card you intend to pay off and ask for a "payoff amount." in my experience, each card gave me a number that was good for seven days. that number included any trailing interest. then obviously, when each statement cuts, check to ensure there is no trailing interest.

9/2022 $30000 |  8/2020 $20000 |  12/2018 $30000 |  8/2016 $30000 |  3/2016 $21000 |  5/2014 $20000 |  10/2007 $8900 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: financially wrecked - please advise my best moves

Gotcha. Thanks. Will that cause any kind of "paid lesser balance than what was owed on account" messages on my credit reports if lesser than the full balance?

2024 Goal: To finally be debt free

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: financially wrecked - please advise my best moves

@iowe wrote:Gotcha. Thanks. Will that cause any kind of "paid lesser balance than what was owed on account" messages on my credit reports if lesser than the full balance?

no, because you ARE asking for a full "payoff amount" which includes accrued interest. it will usually be more than the "last statement" balance. if you just pay the "last statement" balance, on the next statement you will have trailing interest for the days in this period you carried a balance. whether you decide to ask for payoff amount or not, be sure to check your next statement for trailing interest.

you are NOT asking for a "settlement amount" for less than you owe which would result in "paid lesser..." notation.

last last tip: you have a pretty generous limit with discover. discover always has two balance transfer options available to me, 0%/12mo with a 3-4% fee, or 4.99%/15mo with $0 fee. in 9-12 months you might want to think about balance transferring that nfcu balance for 4.99% at $0 fee, will save you some more in cumulative interest.

| apr % | balance | int $ per mo |

| 10.25 | 17000 | 145 |

| 4.99 | 17000 | 71 |

9/2022 $30000 |  8/2020 $20000 |  12/2018 $30000 |  8/2016 $30000 |  3/2016 $21000 |  5/2014 $20000 |  10/2007 $8900 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: financially wrecked - please advise my best moves

Hello Guys ![]()

I wanted to bump my thread and check in with where I'm at on this debt mountain. This is what the current picture looks like. I am close to paying off the Discover card. From there, I have some choices to make. I have a 0% Promo APR 14 month 5% transfer fee, or a 6.99% 17 month 0% transfer fee balance transfer offer on the Discover card. The Discover card has a $19,300.00 limit, so I could fit a large portion of the balance currently on the NFCU CashRewards card if not all of it by the time I pay off the current Discover balance. I'm not concerned with my FICO score at the moment, just getting out of this debt the fastest most efficient way, as I'm sitting in the 740's on all three bureaus. The current Discover balance will be paid off within the next 4 weeks.

Does it make a difference to do a balance transfer now from the NFCU card to the Discover card, even with Discover carrying a balance currently? Is it beneficial or inconsequential to pay Discover off first if I plan to use it for a balance transfer?

If I do use the Discover card balance transfer, how much of the NFCU card balance should I request to move onto it?

What are my smartest next steps?

Thanks all of you guys!

| apr % | balance | min pmt | ||

| Penfed Personal Loan | 12.8% | 17,737.49 | 672.56 | |

| Discover (limit: 19,300.00) | 18.25% | 1871.10 | 83.00 | |

| NFCU Cash Rewards (limit 24,000.00) | 10.25% | 20,534.77 | 411.00 |

2024 Goal: To finally be debt free