- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: "What's Hurting Your Score" Reasons

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

"What's Hurting Your Score" Reasons

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"What's Hurting Your Score" Reasons

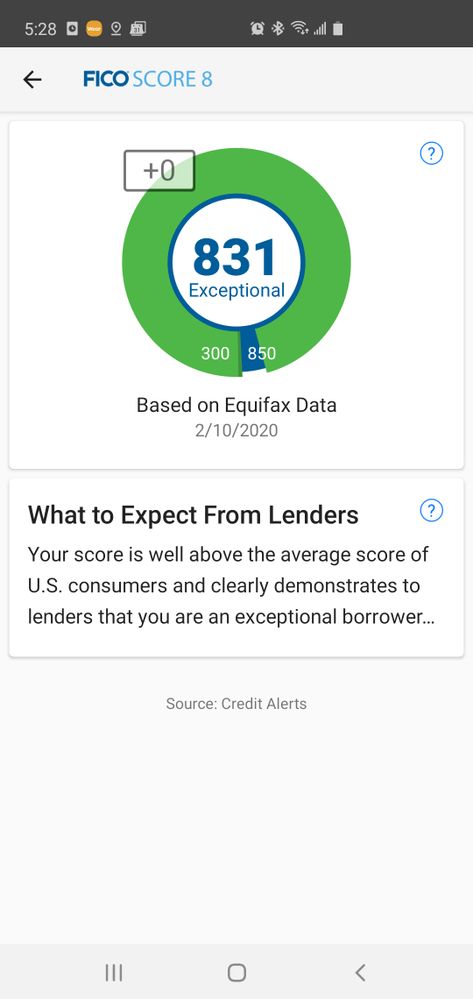

I was playing around with the FICO app and noticed that Equifax wasn't showing any indicators for "what's hurting." I have a clean profile so I thought it might be fun to see how the bureaus gauge different things.

Equifax: No "what's hurting" section

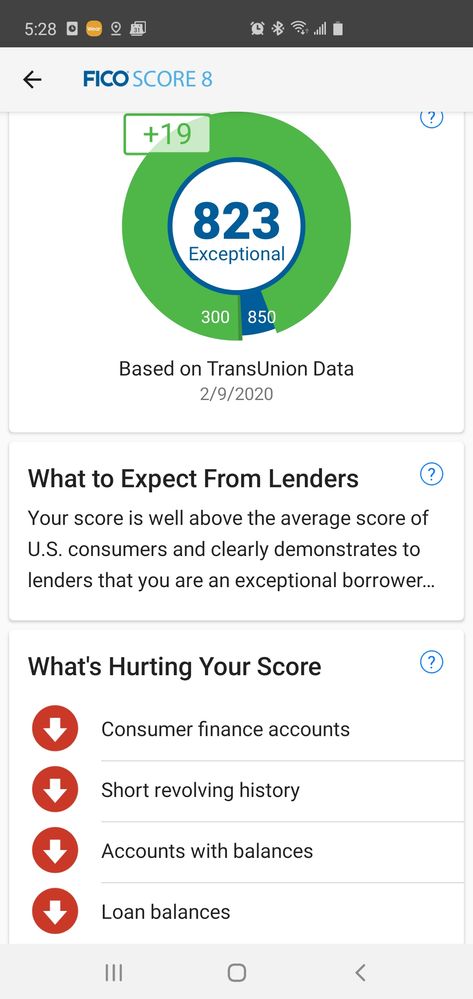

Transunion: Consumer finance accounts, short revolving history, accounts with balances, loan balances

Experian : Short account history, Short revolving history, Loan balances, High credit usage

Based on this, it would appear that TU sees CFA as a negative and the other two don't. I also have 4-5 cards carrying balances <$100 and an amex revolver that is ~20%. Transunion specifically calls out "accounts with balances " as a negative indicator. Interestingly, that 19 point increase alert is from a Citi card reporting a $0 balance from $65.

High credit usage called out on Experian but its unclear to me what that means. I'm assuming it is the same as accounts with balances.

I'll play around with balances this month to see how those change. Is the order they're listed in ranked?

As for account histories, here are my DP.

Overall Utilization: $3408/$112600 3%

Open Loans: 1 Auto - $7226/$30000 24%

AoOA - 16 years 0 months

AAoA- 7 years, 8 months

AoMR- 1 year, 5 months (my new Delta Reserve is not reporting yet)

INQ - 0 (Delta Reserve SP approval)

All 3 CB are reporting same revolving: 29 total, 19 bank issued

TU, EX reporting 8 installment loans, EQ is reporting 10

0 late, 0 delinquent

Last App: BECU 02-26-2020

Pronouns: He/Him/His

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "What's Hurting Your Score" Reasons

For me personally I noticed my EQ lags a month sometimes two months behind the others but it is odd it doesn't state a reason/reasons

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "What's Hurting Your Score" Reasons

Yeah I had never noticed before. It's probably just a glitch in the matrix. ![]()

Last App: BECU 02-26-2020

Pronouns: He/Him/His

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "What's Hurting Your Score" Reasons

@seattletravels wrote:I was playing around with the FICO app and noticed that Equifax wasn't showing any indicators for "what's hurting." I have a clean profile so I thought it might be fun to see how the bureaus gauge different things.

Equifax: No "what's hurting" section

Transunion: Consumer finance accounts, short revolving history, accounts with balances, loan balances

Experian : Short account history, Short revolving history, Loan balances, High credit usage

Based on this, it would appear that TU sees CFA as a negative and the other two don't. I also have 4-5 cards carrying balances <$100 and an amex revolver that is ~20%. Transunion specifically calls out "accounts with balances " as a negative indicator. Interestingly, that 19 point increase alert is from a Citi card reporting a $0 balance from $65.

High credit usage called out on Experian but its unclear to me what that means. I'm assuming it is the same as accounts with balances.

I'll play around with balances this month to see how those change. Is the order they're listed in ranked?

As for account histories, here are my DP.

Overall Utilization: $3408/$112600 3%

Open Loans: 1 Auto - $7226/$30000 24%

AoOA - 16 years 0 months

AAoA- 7 years, 8 months

AoMR- 1 year, 5 months (my new Delta Reserve is not reporting yet)

INQ - 0 (Delta Reserve SP approval)

All 3 CB are reporting same revolving: 29 total, 19 bank issued

TU, EX reporting 8 installment loans, EQ is reporting 10

0 late, 0 delinquent

Interesting. What's the CFA that TU is squawking about?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "What's Hurting Your Score" Reasons

In between my mortgage payoff and auto loan a few years ago, I did a lending club not knowing any better. ![]()

Last App: BECU 02-26-2020

Pronouns: He/Him/His

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "What's Hurting Your Score" Reasons

Negative reason codes for version 8 are terrible and once you get so high they don’t give you any.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "What's Hurting Your Score" Reasons

@Anonymous wrote:

Does lending club report on all three?

Negative reason codes for version 8 are terrible and once you get so high they don’t give you any.

Yep. It's on all 3. I dont think it's really much of an issue. Just interesting to see the difference the 3 call out as negative once you get all three in 800s.

Last App: BECU 02-26-2020

Pronouns: He/Him/His