- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: $90 Collections - Might fall out of escrow

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

$90 Collections - Might fall out of escrow

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

$90 Collections - Might fall out of escrow

My partner in 2016 switched from t-mobile to sprint. Apparently he still owed tmobile $90. We had no idea.

TLDR: Any suggestions??

They are reporting the debt happened in 2021! So long story short our first broker said oh no problem it's $90 lender won't care it won't impact anything at all. I called the debt collection and asked for proof of the debt. She confirmed it was from 2016 (so why 2021 on credit report?) but failed to send me a proof of debt letter I requested. It's $90, my partner has $110,000 in the bank + 0 debt for the last... 10 years or more. He would have paid it.

We swapped brokers because the first was slow and constantly had bad information. Our new broker just said holy cow, this is bad.

Transunion credit report hard pull:803

Exp and Equ: 704!!!

He said this is going to take us (well my partner, I'm not on the loan) from $3,500 to $3,900. And for anyone to say just wait a few months, this home has about $250,000 equity that is being gifted to us. If the sale doesn't happen by 7/31 we will no longer have the option to buy out the current amount owed. There is just no question, if our monthly rate is $3,900 we aren't going through with it (and he no longer qualifies, too).

Any ideas??? Our current broker thinks he can get the debt collection agency to delete it if we pay it but I am 99.9% sure that won't happen. They'll say they will and never delete it. I had it happen way back when for a few thousand dollars I owed. I agreed to pay the full amount + fees if it was removed. Asked for a letter, never sent anything. Asked more, nothing. Still reporting as bad so I paid it taking their word as good they'd delete it. Never deleted it. This is $90 bucks... It'll cost them more money to delete it I'm sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $90 Collections - Might fall out of escrow and lose $200k+ of gifted equity.

@CornChipPaws wrote:

My partner in 2016 switched from t-mobile to sprint. Apparently he still owed tmobile $90. We had no idea.

TLDR: Any suggestions??

They are reporting the debt happened in 2021! So long story short our first broker said oh no problem it's $90 lender won't care it won't impact anything at all. I called the debt collection and asked for proof of the debt. She confirmed it was from 2016 (so why 2021 on credit report?) but failed to send me a proof of debt letter I requested. It's $90, my partner has $110,000 in the bank + 0 debt for the last... 10 years or more. He would have paid it.

We swapped brokers because the first was slow and constantly had bad information. Our new broker just said holy cow, this is bad.

Transunion credit report hard pull:803

Exp and Equ: 704!!!

He said this is going to take us (well my partner, I'm not on the loan) from $3,500 to $3,900. And for anyone to say just wait a few months, this home has about $250,000 equity that is being gifted to us. If the sale doesn't happen by 7/31 we will no longer have the option to buy out the current amount owed. There is just no question, if our monthly rate is $3,900 we aren't going through with it (and he no longer qualifies, too).

Any ideas??? Our current broker thinks he can get the debt collection agency to delete it if we pay it but I am 99.9% sure that won't happen. They'll say they will and never delete it. I had it happen way back when for a few thousand dollars I owed. I agreed to pay the full amount + fees if it was removed. Asked for a letter, never sent anything. Asked more, nothing. Still reporting as bad so I paid it taking their word as good they'd delete it. Never deleted it. This is $90 bucks... It'll cost them more money to delete it I'm sure.

What CA is reporting the debt currently ? Also are you able to make a payment back to t-mobile, rather than the CA ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $90 Collections - Might fall out of escrow and lose $200k+ of gifted equity.

@pizzadude wrote:What CA is reporting the debt currently ? Also are you able to make a payment back to t-mobile, rather than the CA ?

The debt is being reported only under Experian and Equifax. His Transunion report doesn't have it and the mortgage company said his Transunion score was over 800pts. The company is "CONVERGENT OUTSOURCING" and the debt is from 2016 apparently... but it's being reported as of 2021. T-Mobile can't even pull up the old account! We were never notified. Absolutely wild we might lose this opportunity.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $90 Collections - Might fall out of escrow

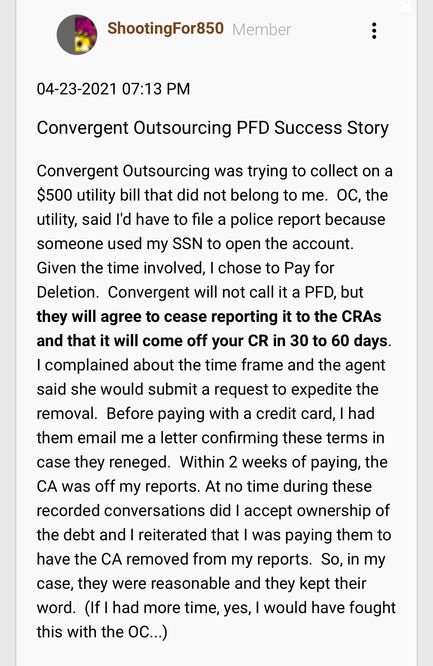

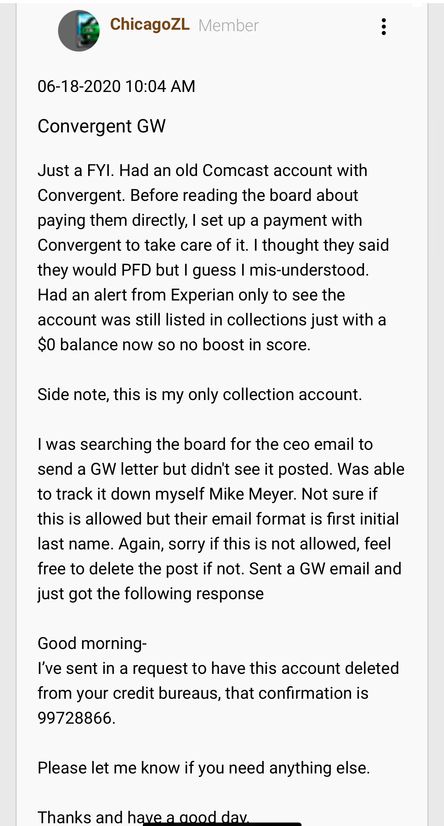

Just searching for a few minutes "Convergent outsourcing" i came across a couple success stories that may help you. Idk how to post links so i took screenshot of them. Hope you can figure this out soon.

This is through email.

This is through the phone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $90 Collections - Might fall out of escrow

@Veronik2019 wrote:Just searching for a few minutes "Convergent outsourcing" i came across a couple success stories that may help you. Idk how to post links so i took screenshot of them. Hope you can figure this out soon.

This is through email.

This is through the phone.

Thank you so much. I thought I searched the forms but clearly missed that first one you send. I just sent and seemed to have gone through. I am thinking it probably won't be deleted in time and we'll lose this opportunity but will post if I hear back to help others. I kind of think maybe this home wasn't meant to be

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $90 Collections - Might fall out of escrow

@CornChipPaws wrote:

My partner in 2016 switched from t-mobile to sprint. Apparently he still owed tmobile $90. We had no idea.

TLDR: Any suggestions??

They are reporting the debt happened in 2021! So long story short our first broker said oh no problem it's $90 lender won't care it won't impact anything at all. I called the debt collection and asked for proof of the debt. She confirmed it was from 2016 (so why 2021 on credit report?) but failed to send me a proof of debt letter I requested. It's $90, my partner has $110,000 in the bank + 0 debt for the last... 10 years or more. He would have paid it.

We swapped brokers because the first was slow and constantly had bad information. Our new broker just said holy cow, this is bad.

Transunion credit report hard pull:803

Exp and Equ: 704!!!

He said this is going to take us (well my partner, I'm not on the loan) from $3,500 to $3,900. And for anyone to say just wait a few months, this home has about $250,000 equity that is being gifted to us. If the sale doesn't happen by 7/31 we will no longer have the option to buy out the current amount owed. There is just no question, if our monthly rate is $3,900 we aren't going through with it (and he no longer qualifies, too).

Any ideas??? Our current broker thinks he can get the debt collection agency to delete it if we pay it but I am 99.9% sure that won't happen. They'll say they will and never delete it. I had it happen way back when for a few thousand dollars I owed. I agreed to pay the full amount + fees if it was removed. Asked for a letter, never sent anything. Asked more, nothing. Still reporting as bad so I paid it taking their word as good they'd delete it. Never deleted it. This is $90 bucks... It'll cost them more money to delete it I'm sure.

Collections report date it was assigned to them for collections. It does not impact removal date, that's always based on DOFD which again - different than date you're seeing.

If you want to know when it will be removed, have them pull a copy of free annual credit report, it should be there.

Meanwhile, it's their debt, so pay it regardless of removal, clearly with $100K on the bank, $90 isn't exactly a sacrifice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $90 Collections - Might fall out of escrow

@Remedios wrote:

@CornChipPaws wrote:

My partner in 2016 switched from t-mobile to sprint. Apparently he still owed tmobile $90. We had no idea.

TLDR: Any suggestions??

They are reporting the debt happened in 2021! So long story short our first broker said oh no problem it's $90 lender won't care it won't impact anything at all. I called the debt collection and asked for proof of the debt. She confirmed it was from 2016 (so why 2021 on credit report?) but failed to send me a proof of debt letter I requested. It's $90, my partner has $110,000 in the bank + 0 debt for the last... 10 years or more. He would have paid it.

We swapped brokers because the first was slow and constantly had bad information. Our new broker just said holy cow, this is bad.

Transunion credit report hard pull:803

Exp and Equ: 704!!!

He said this is going to take us (well my partner, I'm not on the loan) from $3,500 to $3,900. And for anyone to say just wait a few months, this home has about $250,000 equity that is being gifted to us. If the sale doesn't happen by 7/31 we will no longer have the option to buy out the current amount owed. There is just no question, if our monthly rate is $3,900 we aren't going through with it (and he no longer qualifies, too).

Any ideas??? Our current broker thinks he can get the debt collection agency to delete it if we pay it but I am 99.9% sure that won't happen. They'll say they will and never delete it. I had it happen way back when for a few thousand dollars I owed. I agreed to pay the full amount + fees if it was removed. Asked for a letter, never sent anything. Asked more, nothing. Still reporting as bad so I paid it taking their word as good they'd delete it. Never deleted it. This is $90 bucks... It'll cost them more money to delete it I'm sure.

Collections report date it was assigned to them for collections. It does not impact removal date, that's always based on DOFD which again - different than date you're seeing.

If you want to know when it will be removed, have them pull a copy of free annual credit report, it should be there.

Meanwhile, it's their debt, so pay it regardless of removal, clearly with $100K on the bank, $90 isn't exactly a sacrifice.

Paying $90 acknowledges the debt. You do understand the issue, right? We would have paid it for the last 6 years if we were notified. I pulled up the bill from T-Mobile in their store and it's penalties from a .06 cent underpayment so they didn't turn off the plan and added late payment fees/disconnect fees for lines that had been ported over. Yet they have a copy of our final bill where it said its closed and balance is $.0 the store employee thinks it was an error on tax that was automatically adjusted. $90 is literally nothing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $90 Collections - Might fall out of escrow

@CornChipPaws wrote:

Any ideas??? Our current broker thinks he can get the debt collection agency to delete it if we pay it but I am 99.9% sure that won't happen. They'll say they will and never delete it. I had it happen way back when for a few thousand dollars I owed. I agreed to pay the full amount + fees if it was removed. Asked for a letter, never sent anything. Asked more, nothing. Still reporting as bad so I paid it taking their word as good they'd delete it. Never deleted it. This is $90 bucks... It'll cost them more money to delete it I'm sure.

There is a process called a rapid rescore, where if you can get the creditor to put it in writing that the collection has been deleted (not will be, but has) then the credit bureaus will update the information within 2-3 days of the credit vendor (the company your loan officer used to check your credit) submitting the letter to them. You might have to negotiate getting a letter like that from them using pay-for-delete.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $90 Collections - Might fall out of escrow

@ShanetheMortgageMan wrote:

@CornChipPaws wrote:

Any ideas??? Our current broker thinks he can get the debt collection agency to delete it if we pay it but I am 99.9% sure that won't happen. They'll say they will and never delete it. I had it happen way back when for a few thousand dollars I owed. I agreed to pay the full amount + fees if it was removed. Asked for a letter, never sent anything. Asked more, nothing. Still reporting as bad so I paid it taking their word as good they'd delete it. Never deleted it. This is $90 bucks... It'll cost them more money to delete it I'm sure.

There is a process called a rapid rescore, where if you can get the creditor to put it in writing that the collection has been deleted (not will be, but has) then the credit bureaus will update the information within 2-3 days of the credit vendor (the company your loan officer used to check your credit) submitting the letter to them. You might have to negotiate getting a letter like that from them using pay-for-delete.

My loan officer just explained that to me today. He explained it before I guess but I was seeing red. The funny thing is if you try to call any convergent outsourcing company (their parent or partner) all lines say "we are closed" and hang up this week. He's pissed... I'm pissed ... we are all pissed. We found out today from T-Mobile the billing error isn't even on our account because it is a different name. He suggested we prepay some points and just sue the debtor ... unless they are closing shop. Strange, even the company that owns them has a down phone line. Crazy this is a mistake from 2016 that popped up just now.

thann you for the efforts. We shall see. I might have to send life alert to this debtor though it's like they've fallen.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $90 Collections - Might fall out of escrow

They will delete it. It normaly takes 30 days for the deletion to happen.