- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Can it really be 80 points?!?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Can it really be 80 points?!?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can it really be 80 points?!?

My husband and I are having to sell our home due to a relocation with his job. We called up our loan officer (who is super sweet) that helped us with our loan on our current home. She pulled our credit and said it was a 650 (our lowest, TU)! We were shocked as we work hard to remaind in good credit standing. She told us not to worry too much and see what we could do before we closed. We are building a house and will likely not close for 6-9 months, just need the pre-q to get the builder started.

She then called us back the next day and said that she was reviewing our actual credit report and that there was a collection from Comcast in the amount of $53 that was reported on all three, but double reported on TU. We were so upset because that should have never been in collections anyway since it was an error by Comcast when we closed our account. She advised us to call the collector and put it into dispute status (we didnt even know it was on there) and then take it up with Comcast. Called and put it in dispute and then went in person to Comcast to resolve it. In the end, Comcast pulled our bills and sided with us that it was indeed their error and they would have it fully removed from our credit report within 72 hours. They also gave us a letter confirming this action.

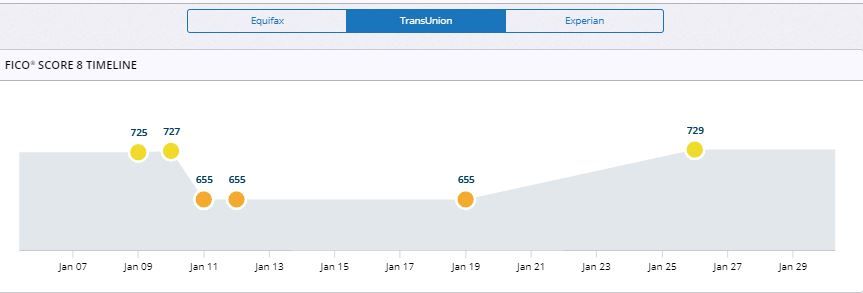

My question is, our LO said that alone could be dragging out TU score down 80 points! Can that really be? Since is was double reported? What are the chances that we will truly see an 80 point jump in a few days when it comes off?

TIA! <3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can it really be 80 points?!?

1st goal: 700 across the board

Starting Scores 01/19/2018

Equifax : 579

Transunion: 585

Experian: 602

Current 07/06/2018

Equifax:662

Transunion: 645

Experian: 683

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can it really be 80 points?!?

Interesting.

The only other negative that we have is a 30 day late payment report, which again is not accurate. We paid off a car late last year and for some reason they reported the very last payment as late (after 4 years of nothing ever being late). I think it just took them extra time to process. Not sure. We have a call into them as well to see what we can do about that. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can it really be 80 points?!?

@Anonymouswrote:

My question is, our LO said that alone could be dragging out TU score down 80 points! Can that really be? Since is was double reported? What are the chances that we will truly see an 80 point jump in a few days when it comes off?

80 something points from a single 30d late. (erroneous) When your profile is clean, a single Derog can be a big impact.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can it really be 80 points?!?

I had a score around 650 with one $36 dollar medical collection. My only derog on TU an EX. Disputed it, got it removed ..and my score jumped right at 80 points. I believe you can certainly see up to 80 points with that derogatory mark removed, depending on its age.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can it really be 80 points?!?

Wow! Well let's just hope that's true. She said it only went on there in December of last year so it is fairly new. I figured she was using a simulator that was way off but maybe she is right. We shall see. She's pretty good at her job, she closed the loan on the house we currently own in 24 hours! ![]()

Thanks so much! <3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can it really be 80 points?!?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can it really be 80 points?!?

1st goal: 700 across the board

Starting Scores 01/19/2018

Equifax : 579

Transunion: 585

Experian: 602

Current 07/06/2018

Equifax:662

Transunion: 645

Experian: 683

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can it really be 80 points?!?

We actually paid it off. We drive cars a long time around here so I dance a jig when we finish paying. ![]() We've got a call into VW to get it straightened out. She told us that was barely affecting us though and the collection was what she thought was the problem. There is almost a 65 point difference between our EQ/EX and then the TU, on which it is reported twice. I hate comcast.

We've got a call into VW to get it straightened out. She told us that was barely affecting us though and the collection was what she thought was the problem. There is almost a 65 point difference between our EQ/EX and then the TU, on which it is reported twice. I hate comcast.

Jess