- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Cash-out Refinance for home improvement

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cash-out Refinance for home improvement

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash-out Refinance for home improvement

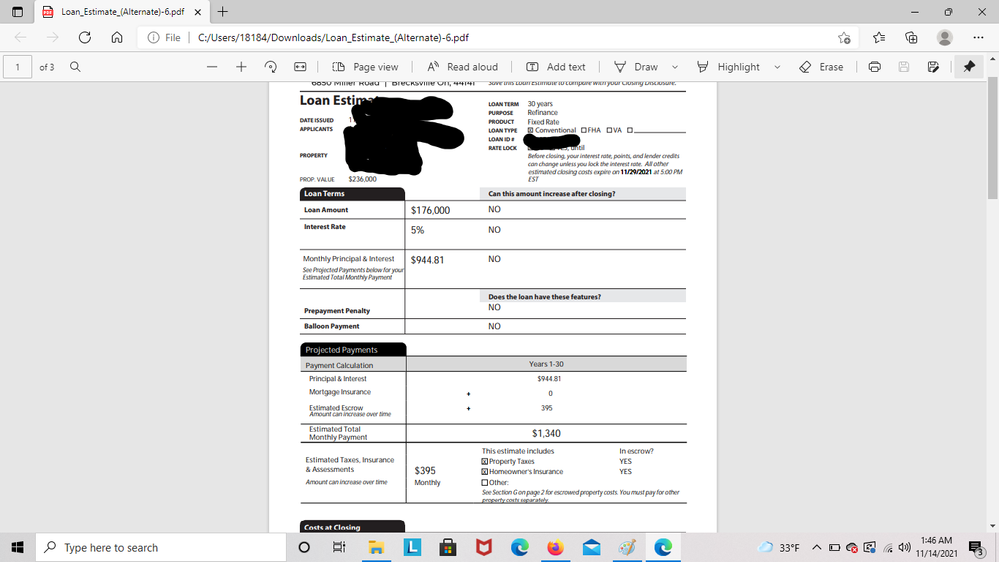

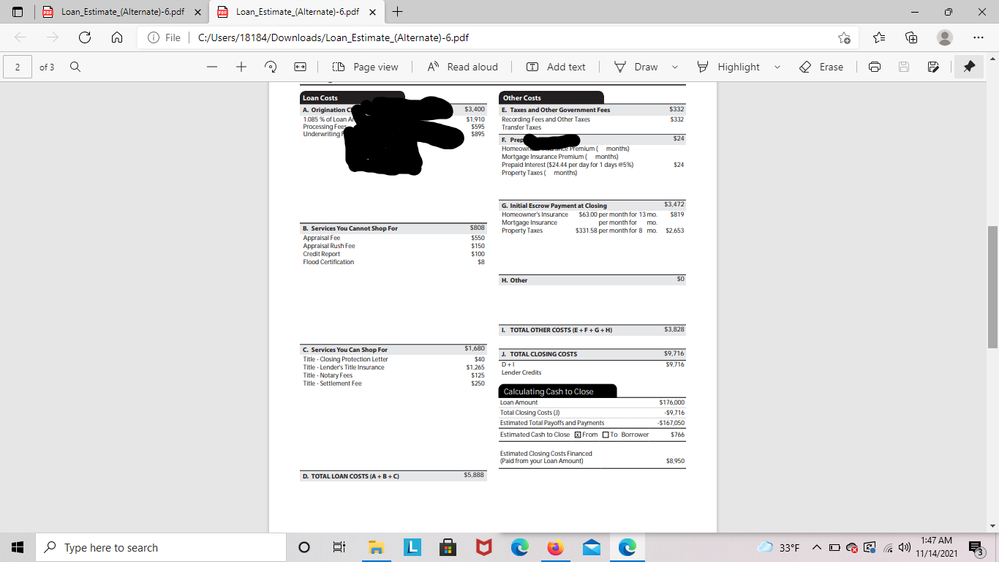

I have a 652 Middle score am I getting screwed on this Refi or is the high rate do to the poor mortgage score? Currently on year 23 of a USDA at 4.65. I have a Heloc for 25,000 and 132500 left on mortgage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash-out Refinance for home improvement

You're correct, it really is a terrible offer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash-out Refinance for home improvement

5 seems high.

I would think you would want to be in the 3s to make it worth while.

GL!

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash-out Refinance for home improvement

@IluvuscOH wrote:I have a 652 Middle score am I getting screwed on this Refi or is the high rate do to the poor mortgage score? Currently on year 23 of a USDA at 4.65. I have a Heloc for 25,000 and 132500 left on mortgage.

I would definitely check with other financial institutions including local credit union's.

My middle score is in the same range as yours and I'm locked in at 3.2% for the refi I'm currently working on getting.

Interest rates change daily, so you may find better or worse rates than I locked in at.

Ask the lending institutions to quote you for different terms. Also, your rate will be higher the closer to 80% loan to value you get... so for example, I was told if I only borrowed 74% loan to value my rate would have been 3.05% -- I'm taking 80% to consolidate debt and update area's of the house that need attention.

I opted for a 15 year term on the loan partially because it offered 1% lower interest than the 30 year loan, as well as because I was rolling in debt (at 30 years at 4.1%, mathematically the debt I was rolling in would cost more than the credit card rates for my projected 5 year payoff).

It could be well worth it for you to consider how much you really need to cash out, as well as how long you truly need to pay it back. If you're 23 years into a 30 year loan, and don't borrow more than the original loan you could potentially still have a lower payment with a 15 year loan than the payments you've been currently making.

Starting Score: EQ:608, EX:617, TU:625

Current Score 3/11/2020: EQ:695, EX:703, TU:720

Goal Score: 740+

Take the myFICO Fitness Challenge

Member of the Synchrony Bank giveth then Taketh away April 2020 Club! $86,900 in available credit gone without warning.

Newest Account July 8, 2020 -- Last HP October 24, 2020 -- Gardening Goal: August 2022 and reach 0/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash-out Refinance for home improvement

You are getting absolutely hosed. 5% with a full point plus in origination is out of this world bad. Holy smokes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash-out Refinance for home improvement

Granted rate is high especially with discount points but based on the OP's score on a CNV cash out (not a re-fi) you're closer to 4% than some are saying you should be in the 3's. If you're not doing a CO because of the HELOC and you're subordinating it then you're getting the screws turned on you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash-out Refinance for home improvement

@IluvuscOH wrote:I have a 652 Middle score am I getting screwed on this Refi or is the high rate do to the poor mortgage score? Currently on year 23 of a USDA at 4.65. I have a Heloc for 25,000 and 132500 left on mortgage.

To be fair, the Fannie Mae Loan Level Price Adjusters (LLPAs) for your scenario are pretty high. You have a hit of 2.625% for a cash out refi to 80% LTV (loan to value) with a score from 640 to 659 and a 3% hit for an LTV of 75 - 80% with a 640 to 659 mid score.

So you have a total of 5.625% in hits which means a lender has to charge a high enough rate to cover those hits and also make money which is why your rate is going to be higher than the national average.

VA, FHA, USDA. Jumbo, Conventional.

CAIVRS Expert.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash-out Refinance for home improvement

@chiefone4u wrote:

@IluvuscOH wrote:I have a 652 Middle score am I getting screwed on this Refi or is the high rate do to the poor mortgage score? Currently on year 23 of a USDA at 4.65. I have a Heloc for 25,000 and 132500 left on mortgage.

I would definitely check with other financial institutions including local credit union's.

My middle score is in the same range as yours and I'm locked in at 3.2% for the refi I'm currently working on getting.

Interest rates change daily, so you may find better or worse rates than I locked in at.

Ask the lending institutions to quote you for different terms. Also, your rate will be higher the closer to 80% loan to value you get... so for example, I was told if I only borrowed 74% loan to value my rate would have been 3.05% -- I'm taking 80% to consolidate debt and update area's of the house that need attention.

I opted for a 15 year term on the loan partially because it offered 1% lower interest than the 30 year loan, as well as because I was rolling in debt (at 30 years at 4.1%, mathematically the debt I was rolling in would cost more than the credit card rates for my projected 5 year payoff).

It could be well worth it for you to consider how much you really need to cash out, as well as how long you truly need to pay it back. If you're 23 years into a 30 year loan, and don't borrow more than the original loan you could potentially still have a lower payment with a 15 year loan than the payments you've been currently making.

Thanks for the suggestion local credit union gave me 3 percent interest on a 15 year.