- myFICO® Forums

- Types of Credit

- Mortgage Loans

- FHA Mortgage Insurance, for a limited time or life...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FHA Mortgage Insurance, for a limited time or life of loan?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FHA Mortgage Insurance, for a limited time or life of loan?

As a result of a foreclosure in 2016, I had to use an FHA loan to get into my new house in 2021. Additionally, I ended up putting down quite a bit down payment due to FHA loan limit and final purchase price.

LTV (based on original value) = 74.79%

I've heard that the mortgage insurance can be removed after I reach a certain LTV but also heard that it is required for the life of the loan because of the prior foreclosure.

Or I can wait until 2023, when I would have met the 7 year criteria to refinance to a conventional loan but who knows what rates will be by then.

Anyone that can shed some light on this one for me?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Insurance, for a limited time or life of loan?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Insurance, for a limited time or life of loan?

@Bonaccan wrote:As a result of a foreclosure in 2016, I had to use an FHA loan to get into my new house in 2021. Additionally, I ended up putting down quite a bit down payment due to FHA loan limit and final purchase price.

LTV (based on original value) = 74.79%

I've heard that the mortgage insurance can be removed after I reach a certain LTV but also heard that it is required for the life of the loan because of the prior foreclosure.

Or I can wait until 2023, when I would have met the 7 year criteria to refinance to a conventional loan but who knows what rates will be by then.

Anyone that can shed some light on this one for me?

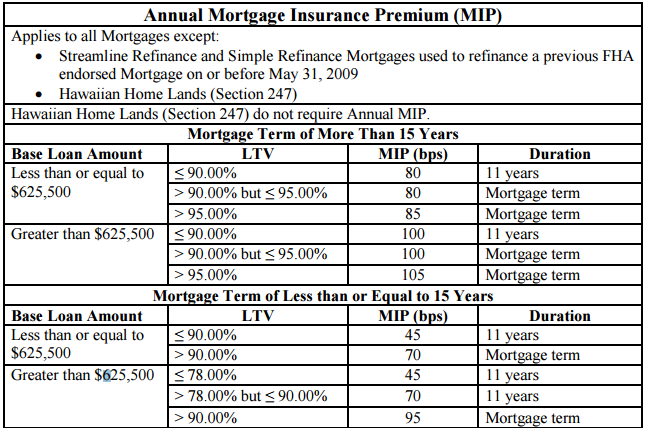

Last I heard the rules on MIP with FHA loans are:

if less than 10% down = MIP for the life of the loan

If more than 10% down = MIP for 10 years (on a 30y).

Hope that helps.

P.S. the dropping of PMI on conventional loans is based on the LTV % which people can get confused with when they have a FHA loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Insurance, for a limited time or life of loan?

@Bonaccan wrote:As a result of a foreclosure in 2016, I had to use an FHA loan to get into my new house in 2021. Additionally, I ended up putting down quite a bit down payment due to FHA loan limit and final purchase price.

LTV (based on original value) = 74.79%

I've heard that the mortgage insurance can be removed after I reach a certain LTV but also heard that it is required for the life of the loan because of the prior foreclosure.

Or I can wait until 2023, when I would have met the 7 year criteria to refinance to a conventional loan but who knows what rates will be by then.

Anyone that can shed some light on this one for me?

With 10% or more down, the MI on an FHA loan will last for 11 years. The only way out of it is to refinance.

VA, FHA, USDA. Jumbo, Conventional.

CAIVRS Expert.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA Mortgage Insurance, for a limited time or life of loan?

Yup, looks like I'm under the 11 year scenario!

Thanks again all for the responses!