- myFICO® Forums

- Types of Credit

- Mortgage Loans

- FHA & Student Loan calculation

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FHA & Student Loan calculation

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FHA & Student Loan calculation

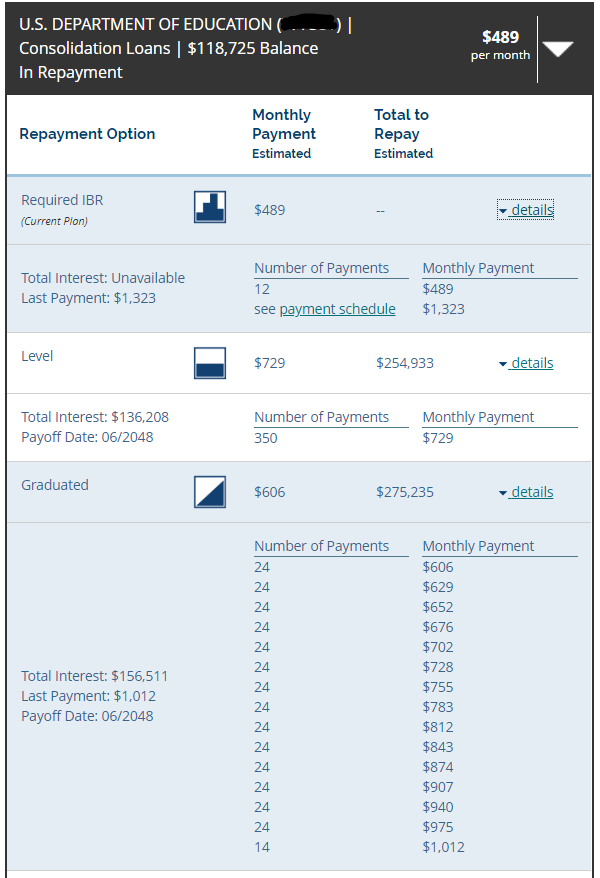

Since it will be a bit before we are eligible to apply for a mortgage, I figure this is a good time to look at options for restructuring my student loans so my DTI is within range. When we are eligible, FHA will be our only option. I am currently in required IBR but can leave that after 3 payments (may, june, july). I know FHA calls for either 1% of the outstanding balance, or the actual document payment, provided the payment will fully amortize the loan over its term.

What is not readily clear to me is how a graduated repayment plan is taken into consideration. Below is a snapshot from my Great Lakes SL. How will an UW view the Graduated option if I were to select it? I'm assuming that if I select that plan, the $606 will be what an UW sees on my CR. How would I provide proof of amoritzation?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA & Student Loan calculation

I was told we couldnt used the graduated amount(Thats what I provided at first to mortgage company).....only the standard amount that doesnt change over the life of the loan. But with you changing it before applying it might work because thats what they will see on credit report but my loan officer was able to figure out that the amount I was showing under the IBR plan would not completely amortize the loan. I assume yours would too if they took the time to calculate it but with it being a high number they might not.......it probably just depends on the mortgage company and how closely they look at it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA & Student Loan calculation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA & Student Loan calculation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA & Student Loan calculation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA & Student Loan calculation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA & Student Loan calculation

@Anonymous wrote:

We are in the process of attaining an FHA loan. They would not take into account a graduated payment. I’m also on an IBR plan. I did not need to switch plans for qualification. Instead, I received an estimate from my loan servicer of what my standard payment would be. This was enough for documentation purposes. They will use the standard amount in my dti calculations. Hope that helps.

I was wondering how did you make your lender accept the estimated letter. I submitted the same letter with all my loan details except that they did not want the word "estimated" shown on it. I don't know what else to do at this point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA & Student Loan calculation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FHA & Student Loan calculation

After calling FedLoan everyday for the last 4 days, they were able to switch me to Standard Repayment plan. The LO did not accept the standard repayment estimated amount so I called FedLoan to switch and have them expedite the process which typically takes 20 days. Then after a couple of hours I received the letter confirming my switch. I submitted that letter with the actual payment to the LO and I’m still waiting if we’re clear to close

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content