- myFICO® Forums

- Types of Credit

- Mortgage Loans

- February 2021 Closers

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

February 2021 Closers

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

February 2021 Closers

Hello all. I didn't see one of these around so I decided to start a thread for those of us closing in February. This is my third attempt at closing on my first home. Third time's the charm?

Copied from a former thread:

Purchase price -

% Down -

Product -

Mid score -

Rate -

Estimated Close Date:

Possible issues -

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: February 2021 Closers

Purchase price: $875,000

% Down: $0

Product: NFCU Homebuyers Choice Fixed

Mid score: 733

Rate: 4.125% (not locked)

Estimated Close Date: 2/26

Possible issues: 30 day late 8/2019 and 10/2017? I've peppered Target with GW letters to no avail in an attempt to get rid of the 8/2019 late.

We accepted the sellers counter offer about an hour ago. We're not entirely sure if we're going to move forward on the NFCU product. We're considering other options.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: February 2021 Closers

Good luck on closing. I hope it works out for you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: February 2021 Closers

Purchase price: $529,950

% Down: 10%

Product: Us Bank Conventional

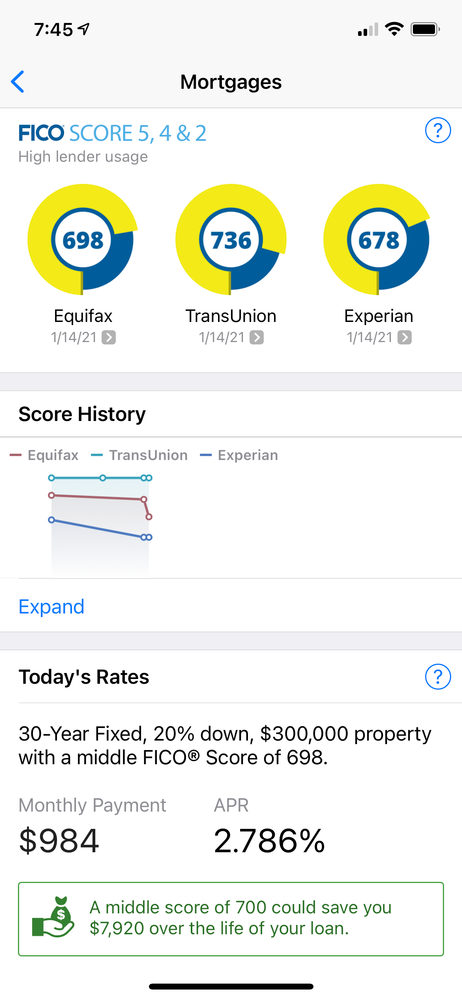

Mid score: 698

Rate: 2.99 (Locked)

Estimated Close Date: 2/26

Possible issues: I've been dealing with identity stuff that finally got resolved back in December. 2 days ago (before my last HP) they added an account to my reports tanking Equifax & Experian about 90 points. I was able to call Equifax & Transunion to get them removed bumping my score back up 88 points. Experian didn't change either way. Im

Hoping nothing gets added in the next week. Us Bank said the UW should pull my reports again the beginning of next week.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: February 2021 Closers

Purchase price - $285k

% Down - 3%

Product - 30 conv.

Mid score - 757

Rate - 2.875%(not locked)

Estimated Close Date: 12 Feb

Possible issues - house isn't finished being built at this time, waiting on appraisal, appraisal waiting on builder...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: February 2021 Closers

Purchase price - $440k

% Down - 3%

Product - 30 conv.

Mid score - 696 (mine) 705 (husband)

Rate - 2.99% (not locked)

Estimated Close Date: 2/19

Possible issues - Mistakenly charged $375 on a card with a $750 CL between the due date and statement date. 🤦♀️ My prior utilization was 1% worried it will drop my mortgage score. Last late payment was 12/2019 on ex husband's mortgage that my name still happed to be on. We were preapproved when we made the offer but I will be anxious about being denied until the papers are signed! 🤞🤞🙏🙏

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: February 2021 Closers

@Anonymous wrote:Purchase price: $875,000

% Down: $0

Product: NFCU Homebuyers Choice Fixed

Mid score: 733

Rate: 4.125% (not locked)Estimated Close Date: 2/26

Possible issues: 30 day late 8/2019 and 10/2017? I've peppered Target with GW letters to no avail in an attempt to get rid of the 8/2019 late.

We accepted the sellers counter offer about an hour ago. We're not entirely sure if we're going to move forward on the NFCU product. We're considering other options.

Roofing inspection scheduled for tomorrrow. The house was built in 1940 and the sellers listed the roof as a original. They bought the house in 2000 and had no roofing work done the entire time they've lived there. The general inspection happens on Thursday. My realtor is still working on scheduling chimney and pool inspections.

I hope everything runs smoothly. The sellers are showing strong signs of having seller's remorse. They're moving to be near their grandkids but have said they never really thought the house would sell.

@sxa001 wrote:Good luck on closing. I hope it works out for you!

Thank you. We'll need it ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: February 2021 Closers

@Anonymous wrote:Purchase price - $440k

% Down - 3%

Product - 30 conv.

Mid score - 696 (mine) 705 (husband)

Rate - 2.99% (not locked)Estimated Close Date: 2/19

Possible issues - Mistakenly charged $375 on a card with a $750 CL between the due date and statement date. 🤦♀️ My prior utilization was 1% worried it will drop my mortgage score. Last late payment was 12/2019 on ex husband's mortgage that my name still happed to be on. We were preapproved when we made the offer but I will be anxious about being denied until the papers are signed! 🤞🤞🙏🙏

I've totally done that in the past and it's burned me early in my home search process. Since then, I've created a calendar with dates cards are clear to use. I can't wait until the home buying process is over so I can stop being a huge ball of anxiety.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: February 2021 Closers

Purchase price - $459,900 appriased for $467,000 (inspections completed)

% Down - 0%

Product - NFCU Homebuyers Choice Fixed 30 yr conventional

Mid score - 739

Rate - 3.725% (not locked in)

Estimated Close Date: Feb 1ST

Possible issues - Consoluted an old student loan on to my Navient account and its showing up as a New account but loan officer says that shouldn't be a problem as its not in default status

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: February 2021 Closers

@nastalgia How is your experience with NFCU going? I'm not sure whether I'm going to move forward with them. I've found a local credit union that is providing the same rate and they say they're confident they can close on time. NFCU won't give me a firm commitment.