- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Freelancing income

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Freelancing income

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Freelancing income

Hi mortgage specialists!

Both my Fiance and I make about $110k a year, and she has $15k bonus yearly for the last 4-5 years so $235k yearly combined.

I also freelance on the side in the same industry as my job (electrical engineering). For 2022 I have 70k income from freelancing and I can show bank statements to show this.

Since December 2022, I have been earning $3,000 weekly from a client every single week. I've been working with this client since september 2022. I have bank statements for this too.

Can I count this new income of $12,000 monthly for pre approval and final approval? So a total of $391,000 yearly income?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Freelancing income

Are you paid W-2 or 1099 for this income?

Either way it'll be considered a 2nd job, which requires you to have a 2-year history before it can be used to qualify. If you are paid via 1099 then you'll need to report the income on your Schedule C of your tax returns for 2 years and then a 2-year average of the net income is used to qualify. If you aren't paid 1099 because it's just you and the person paying you direct, then you still would need to report it on Schedule C of your tax returns for the past 2 years to use it to qualify. Have you been reporting this income on your tax returns?

In lieu of using Schedule C of your tax returns, there are programs that will use bank statement deposits for self-employed income to come up with an income calculation, but those programs are usually the option of last resort since they require larger down payment and have higher interest rates. Since it's a 2nd job it'd still require 2 years to be able to use.

How much of a sales price are you trying to qualify for? You might find that your $235k/year of income is sufficient.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Freelancing income

Rats. Not what I wanted to hear but thank you for the info.

I am paid 1099 for that income.

So just to confirm, even if we went with a bank statement option, they would want to see 2 years of it? Would they average over two years so even if $0 for 2021, but $70k for 2022 we could say average of $35k?

We would like to be able to consider up to $1.2M homes. All the "how much mortgage can you get approved for" calculators I use online like from Chase say about $930k. That accounts for a 6.6% rate, $7500 property tax, 300 PMI, $90k down, $1750 homeowners insurance, and $1350 month expenses for two cars and a student loan payment. We both have 0 credit card debt and no other loans/debt.

In northern California where we want to live, $930k would be limiting and also, I don't think the bid would be too strong if we are at our pre approved limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Freelancing income

Yes, since it's your 2nd job then it'd require a 2 year history. Doesn't matter the loan program, it's just a guideline that exists throughout the industry. You don't always have to have 2 years doing the same 2nd job, just a 2-year history of working a 2nd job.

But since your 2nd job is self-employment, then in order to use it as a 2nd job you'll need 2 years of the same self-employment. Reason being is most businesses fail within 2 years, so if you have that much history then underwriters assume it's likely to continue.

When using bank statements to qualify you have the option of using personal or business bank statements. The business related deposits in your personal bank statements usually are used at 100%, but with business bank statements they often are given a 50% haircut to account for business expenses (or if your CPA confirms a lower expense factor then that usually can be used).

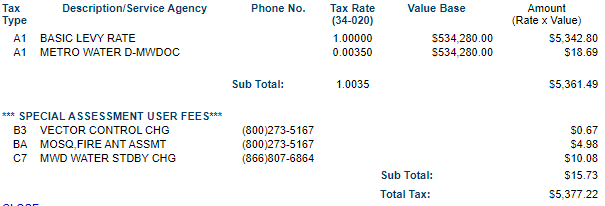

Further, property taxes in California will almost always be at least 1% of the sales price as that is the basic levy rate for any residential real estate in California. There is a homeowner's exemption that will knock $7k off the assessed value (saves a whopping $70/year in property taxes) but that is the most common exemption. So the $1.2MM sales price will have around $12k/year in taxes, possibly more if there are additional assessments. Most counties here will allow you to search for current property tax bills by entering in the property address and then will allow you to download or view the most recent property tax bill so you can see the tax rates.

For example below is a propery tax breakdown for a home in Orange County. The assessed value of the home started out at 100% of the sales price, plus can increase up to 3% per year (it could also decrease if home values were declining). You can see that the tax rate is 1.0035% of the sales price + flat taxes of another $15.73. If this was the tax bill for a $1.2MM home you were buying then the property taxes would be $11,971.755 + $15.73 = $11,987.485/year or $998.96/mo.

A lot of lenders here in California will just calculate property taxes at 1.25% of the sales price though, so that is a good rule of thumb to use but with documentation you should be able to convince your lender to use the actual property tax rate.

The online calculators that purport to let you know how much you can qualify for can be all over the place, as they can make some inaccurate assumptions. If you are trying to stretch how much you can qualify for then you'll absolutely need to speak with a loan officer and provide any needed documents to get a proper idea.

$235k/year of income with $1,350/mo of debt payments could qualify for a $1.2MM sales price but it'd probably be looking at more like a 10% down payment and using FHA financing to allow a higher debt to income ratio to qualify, plus in the highest cost counties the FHA and conforming loan limit maxes out at a $1,089,300 loan amount. In general, financing above that loan amount would require you to obtain a jumbo loan (usually requires a larger down payment) or you can do a 1st/2nd combo loan, which would still allow 5% down. Either way, the $930k loan amount estimate from Chase appears to be low.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Freelancing income

Interesting.

They aren't from a business account. Just my personal account. I don't have an LLC or any kind of corporation either. But it sounds like it's moot as I don't have 2 years yet.

I went with 0.71% tax rate because google said that was average for california. I should have done a bit more research into that one.

Thank you so much for the insight!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Freelancing income

You're welcome, a good loan officer should be able to provide you guidance to save some time with your reseach, but good on you for asking questions.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Freelancing income

Some will do it with a year. I closed last November on a bank statement mortgage with NASB.

They only required 12 mos but it did have to be business bank statements with 10% down. YMMV

Personal-

NFCU Platinum 50k | NFCU Flagship 20k | NFCU More Rewards 10k | NFCU NavChek PLOC 15k | PenFed Power Cash 25k | PenFed Gold 15k | PenFed Pathfinder 10k | PenFed OLOC 3K | GTE Financial CU 15k | VyStar CU Cash Back 25k | VyStar CU PLOC 15k | FNBO Evergreen 25k | FNBO 11.85K | BofA Cash Rewards 10.1k | Capital One Venture 13k | Capital One QS 7k | PNC Cash Rewards 15.5k | Citi Costco 8.5k | US Bank Cash+ 10k | Discover 14.8k | Discover 14.1k | Regions Cash 6k | Truist Enjoy Cash 9k | Truist Future 6.5k | Elan Max Cash 7k | Wells Fargo Reflect 20k | Fifth Third 7k | USAA PrefRew 15k | CFNA Tires Plus MC 8k | GM Rewards 3.5k | TD Bank Cash 3.5k | Amex BCP 3K | Lowes Store 30k | Sleep Number Store 13.5k | Home Depot Store 10k | Amazon Store 10k | Care Credit 15k | Walmart Store 6k | JCrew 25k | Jared 18.6k | HSN 4.1K | King Size 4k | Buckle 3.1k

Business-

Amex BBC 25k | Amex BBP 22k | Amex Business Platinum NPSL 30.4kPoT | Citizens Business Everyday 35k | Sams Club Business MC 25K | US Bank Business Plat 24k | Capital One Spark 2% 22k | Marcus GM Business 12.5k | Capital On Tap 2% 10k | Chase Ink 3k | Divvy 7k | PNC BLOC 50K | Citizens BLOC 50K | (Private) BLOC 75K | WEX Business Access Fuel 30k | Sams Bus Store 25k