- myFICO® Forums

- Types of Credit

- Mortgage Loans

- How do you show P&L?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How do you show P&L?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you show P&L?

i m interested to know how you show p&l for the past year and two months until feb 28. i have very minimal busines jan-mar nov-dec but make 45k gross in 1099 misc income. i had 29k in gross for tax year 2015 but net income of only $400 ? ( contract labor/biz miles/office supplies/rent deducted on sch C. ) no depreciation/home biz / entertainment expense deductions

would be interested in kmowing if p & l helps getting fha loan upto $120k

am i considered low income with myy gross income?

Edit: I moved your message to start a new thread OP so others would see it an answer right away.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you show P&L?

A P&L isn't used to determine qualifying income. A P&L is required for an FHA loan if more than 1 quarter has elapsed since the most recent tax return filing. The reason it's needed is to determine if the net profit is still being maintained.

If you applied now, you'd only be able to use $400/year of income, which wouldn't qualify for anything. You'll need to file your 2016 tax returns if you want to use more qualifying income. Then after you file, your 2015 & 2016 income will be averaged to determine the amount of your qualifying income. Keep in mind if income taxes are owed in 2016, you'll need to pay those in full or set up a payment plan with the IRS (which will be included in your debt-to-income ratio).

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you show P&L?

ok so net for 2015 is $400 & gross is $29k ; do they average gross or net for 2016? now i m told you can put back 0.24cents of mileage deductions back towards income. for tax year 2016 & .22 cents towards tax year 2015. in all if true that adds $10k back for 2015 in income. so when averaging , do i account for 10k plus $400 for 2015 tax year. what about 2016 tax year if same applies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you show P&L?

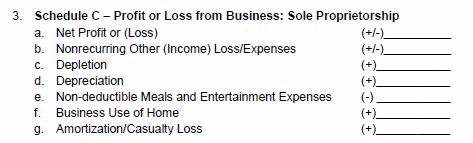

It's always net, adding back depreciation, depletion, depreciation on mileage, amortizatino/casualty loss, and use of home. You also deduct meals/entertainment expenses (since you only claim 50% of them on the tax return).

If 2016 is greater than 2015, then you average. If 2016 is less than 2015, then usually you'll only use 2016's income (if the decline is 20% or more, sometimes the income won't even be used at all, just depends on the reason for the decline).

Located in Southern California and lending in all 50 states