- myFICO® Forums

- Types of Credit

- Mortgage Loans

- March 2021 Closers Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

March 2021 Closers Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

March 2021 Closers Thread

Copied from a former thread:

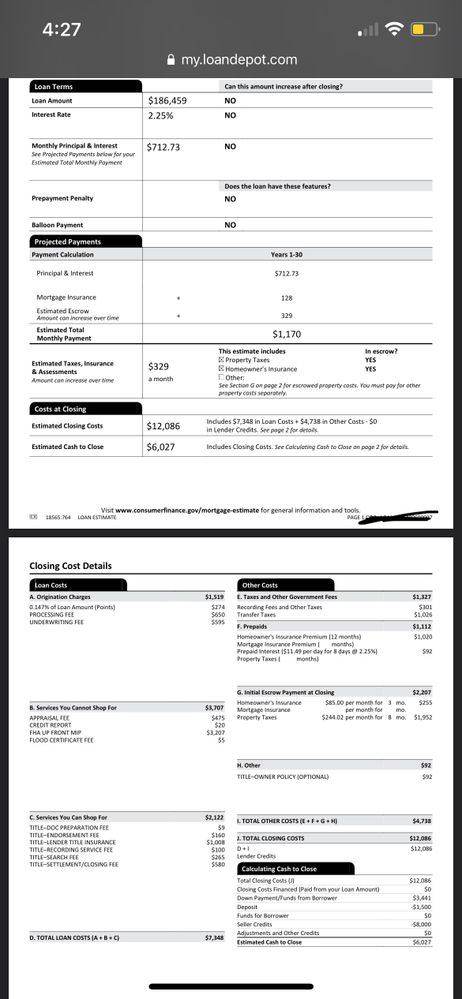

Purchase price - $189k

% Down - 3.5

Product - FHA

Mid score - 654

Rate - 2.25( not locked)

Estimated Close Date: 03/23/21

Possible issues - self employed (in underwriting). Waiting on conditional approval . Offer has been accepted on the house 6% seller concessions

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Closers Thread

Thank you for starting this thread. So excited but nervous at the same time.

Purchase price - $314k (New Construction)

Sellers Credit - $10K

% Down - 3.5

Product - FHA

Mid score - 629 (tried to get it up since I signed my contract in June 2020 but it wouldn't budge)

Rate - Not sure what it is but will update once notifed by lender

Estimated Close Date - Walk-Through scheduled for 3/24 and hoping to close after. Did not receive settlement date yet due to FHA and condo guidelines (waiting for settlement office to reach out for updates)

Possible issues - I have not gone through underwriting yet nor has the appraisel been ordered. Due to this being a condo and FHA requires all of the units to be finshed before paperwork can be submitted to FHA for approval. Everything at this point is up in the air but my lender has pulled my credit again since June to start the loan process.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Closers Thread

Purchase price - $550,000 ($70,000 over list of $480,000)

Sellers Credit - 0

% Down - 20%

Product - Conventional 30-year

Mid score - 716 (TU Fico 4)

Rate - 2.50% (APR 2.626%) with 1.257% in points

Estimated Close Date - March 10

We used Better Mortgage and their Real Estate arm for the whole process; we recieved $2000 in closing costs reimbursed for using the pair, plus our Better RE agent gave us a 1.5% credit toward closing costs, too, in the amount of $8,250. With the $500 referral credit I recieved from a colleague that also used Better Mortage, we're saving $10,750 in closing costs.

Total Rev: $182,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Closers Thread

Purchase price - $929K

% Down - 33% (from equity of the sell of our current house) + owner financing the remaining balance of $275K

Product - FHA

Mid score - 627 (recently paid down multiple items so score is climbing. Goal is to be at 640 before closing to get the lower rate)

Rate - 3.125% with lower score- goal is to be at 640 for 2.875%

Estimated Close Date: 03/15/21

Possible issues - DTI at 53.5%. DU approved without issues. I had a job change less than 6 months ago however it's the same industry. I doubled my base salary but commission is now paid quarterly as opposed to monthly. LO feels with the significant down payment we should be fine. Also the DTI seems scary but my husband is not on this mortgage and he makes just about the same $ as I do ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Closers Thread

So I'm officially closing on March 10th and it's all going quickly!!!

Purchase price: 520k sales price (offered 550k - waiting on appraisal to see what the final price will be)

% Down: 5 percent down and put 20K in the earnest deposit account

Product: Conventional

Mid score: 737 EQ -- UGH my mortgage scores got tanked when they pulled my credit, but somehow I still got the 2.5% phew!!

Rate : 2.5% and 2.768 APR (not a single penny for points)

PMI: Anywhere from $160-$192 depending on the final price after it appraises

Estimated Close Date: March 10th

Possible issues: None so far. I feel like the universe took pity of me and made this happen. I hope everything goes smoothly. I'm adding the breakdown on my progress below.

Feb 6 - Found home

Feb 7 - Put in offer

Feb 8 - Offer accepted late afternoon and contract was ratified.

Feb 9 - Sent more docs to LO, started process w/ title company & sent earnest deposit via wire

Feb 10 - Title company confirmed receipt of earnest deposit, home inspection done & got home insurance

Feb 11 - File went into underwriting around noon

Feb 12 - Received conditional approval this morning - they don't need anything from me so far. They're waiting for appraisal and title company. Appraisal is happening today and report should be ready next week. Termite inspection was done today. No termites!

Everything is moving sooooo quickly, but the sellers are moving out of state and I had offered them to stay extra, so even though I'm now closing on March 10th. I wont have the keys until around the end of March. I feel like when mothers can’t touch their baby and the baby is in an incubator lol. AHHHHH and there is a president’s day sale everywhere. I feel like buying stuff for the house, but I’m saving every single penny and will not be bad LOLOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Closers Thread

Received initial disclosures yesterday, also got homeowners insurance quotes and signed contract back from seller. Loan is in underwriting now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Closers Thread

Purchase price - $419k

% Down - 5%

Product - Conventional

Mid score - 698

Rate - 3.0 (not locked)

Estimated Close Date: 03/15/21

Possible issues: Have two old collections (6 1/2 yers old) and they are reporting that the full balance is my monthly payment, when i do not have a payment arrangement with them, nor have i ever paid them a penny. LO said she does not think it will be an issue

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Closers Thread

Purchase price - $250k (15.5k under listing price | 1941 true colonial, 3,950 sq.ft.)

Sellers Credit - $7K

% Down - 0

Product - USDA

Mid score - 760

Rate - 2.45% (Locked)

Estimated Close Date - 3/30/2021

Other Info - Listed for $265.5, $4,000 seller credits. Initial offer of $245,500 w/$7,000 sellers credit. They countered with $255,500 w/$7000 seller credit. I countered back with $250,000 w/$7,000 seller credits and they accepted. This process took 2 days.

It should be noted that the market isn't the same everywhere. Where I am buying is still a sellers market, but not quite as hot and there is only slightly more inventory. I also happened to do some "oppo" research and discovered the owner has lived away from the house for 6 years, has a tenent, is not a great landlord, and is pretty loaded as he is the president of a hospital system many states away. I had a gut feeling that he is really motivated to sell and that's why I came in a bit aggressively, but we landed on what I really wanted. $265.5 was too high for the area and comps were right at around $250k, so got what I was initially after all along. It helps that I am an analyst both by career and nature and we have been studying the market since early 2019 and it helped IMMENSELY.

The reason I went with USDA is because it is a strategic move. Currently own existing home, but it is only in my wife's name, so doesn't count to my DTI. Her name won't be on the new mortgage for now because she has been a stay at home mom for 18 years and only bring student loan debt and no income. I don't want to move twice, so I wanted to get a new house, then finish the last few remodeling items on the existing home, sell it and enjoy the crazy sellers market in the area where our current home is. We will then take the equity from that sale, roll most of it over into the principal of of the new home to get it below 80% LTV, then refinance under a convention to get out from under PMI. This should happen within 8 months. By using the USDA, we don't have to lock thousands we'd spend on the down payment of the new home into the equitiy of the new home. Instead, we can spend it on the remaining remodeling of existing home.

Just got a conditional approval through the USDA GUS this morning, with the conditions being the appraisal that will happen before the end of next week, clear title, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Closers Thread

Received Conditional Approval today!

Here are conditions

-Document to show 2020 taxes filed

- proof of tax owed paid to IRS

- document and/or Letter of explanation for large deposit $5518

-Homeowners insurance

How can I provide documentation showing taxes were filed? Can I do this through the IRS website? I contacted my tax preparer to find out if he has any documentation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Closers Thread

@Anonymous wrote:Received Conditional Approval today!

Here are conditions-Document to show 2020 taxes filed

- proof of tax owed paid to IRS

- document and/or Letter of explanation for large deposit $5518

-Homeowners insurance

How can I provide documentation showing taxes were filed? Can I do this through the IRS website? I contacted my tax preparer to find out if he has any documentation.

Did they file your taxes electronically? or via paper?