- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Navy Federal Mortgage Issue with a New Credit ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Mortgage Issue with a New Credit Card!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Navy Federal Mortgage Issue with a New Credit Card!

Hello, forum group

Hope all is well for everyone.

I opened a business credit card in the process of financing my home via Navy Federal Credit Union (NFCU). Am I under the risk of jeoparding my mortgage or am I going to be okay?

Please note that this question only applies to NFCU mortgage. I've seen other financial institutions DO a soft pull few days prior to closing, so I'm hoping someone who has experience or knowledge with NFCU only answers this question.

I am currently under the process of purchasing a townhome via Navy Federal Credit Union's (NFCU) 100% financing mortgage. I first applied for pre-qualification in February. Prior to the application, I studied and cleaned up my credit score by not applying for a credit card 6 months prior to applying for a mortgage and paying down all the credit card debt. So, when they ran the hard pull, there was no new credit opened last 6 months with near zero balance on my credit card. I was told that I had a strong credit score (+770). Strong track record of employment and taxes. I also provided all the documents they requested up-front in timely manner. So, no issues at all up to this point. ( fyi, my score was not impacted nor my credit utilization - came back up to 770 a week after)

My loan type is 100% Homebuyers Choice 30 year fixed with 3% down to avoid PMI.

Now I signed a contract a couple of weeks back and been working with loan processor to close a townhouse by the end of April. During the process, my car broke down and was bad enough that I had to replace the engine... Foolish of me, I decided to apply for a business credit card (Capital O** S***k) and use the credit card to pay for the repair (only reason I applied is to get the $500 sign-up bonus.... dumbest thing you could ever do before closing). So, all said and done. I have opened a business credit card. I have no issues with paying off the whole balance. Does anyone know if NFCU will do another credit pull including soft pull that could jeopardize my mortgage process? Does business credit card gets counted or revealed when they soft pull the credit report? If this is going to be a problem, what would you guys recommend me to do in order to close the mortgage safely? I'm also planning on calling my loan officer or processor to find this out as well.

I know I made a wrong move and just want you guys opinion on this to save my mortgage process. Thank you a bunch!

Also, as a side question, when NFCU says no PMI for 100% homebuyers choice, is it truly no PMI or is there a catch?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Mortgage Issue with a New Credit Card!

My apologies for posting duplicate topic..

I am new to this and I believe I messed somethign up ...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Mortgage Issue with a New Credit Card!

@Anonymous wrote:Hello, forum group

Hope all is well for everyone.

I opened a business credit card in the process of financing my home via Navy Federal Credit Union (NFCU). Am I under the risk of jeoparding my mortgage or am I going to be okay?

Please note that this question only applies to NFCU mortgage. I've seen other financial institutions DO a soft pull few days prior to closing, so I'm hoping someone who has experience or knowledge with NFCU only answers this question.

I am currently under the process of purchasing a townhome via Navy Federal Credit Union's (NFCU) 100% financing mortgage. I first applied for pre-qualification in February. Prior to the application, I studied and cleaned up my credit score by not applying for a credit card 6 months prior to applying for a mortgage and paying down all the credit card debt. So, when they ran the hard pull, there was no new credit opened last 6 months with near zero balance on my credit card. I was told that I had a strong credit score (+770). Strong track record of employment and taxes. I also provided all the documents they requested up-front in timely manner. So, no issues at all up to this point. ( fyi, my score was not impacted nor my credit utilization - came back up to 770 a week after)

My loan type is 100% Homebuyers Choice 30 year fixed with 3% down to avoid PMI.

Now I signed a contract a couple of weeks back and been working with loan processor to close a townhouse by the end of April. During the process, my car broke down and was bad enough that I had to replace the engine... Foolish of me, I decided to apply for a business credit card (Capital O** S***k) and use the credit card to pay for the repair (only reason I applied is to get the $500 sign-up bonus.... dumbest thing you could ever do before closing). So, all said and done. I have opened a business credit card. I have no issues with paying off the whole balance. Does anyone know if NFCU will do another credit pull including soft pull that could jeopardize my mortgage process? Does business credit card gets counted or revealed when they soft pull the credit report? If this is going to be a problem, what would you guys recommend me to do in order to close the mortgage safely? I'm also planning on calling my loan officer or processor to find this out as well.

I know I made a wrong move and just want you guys opinion on this to save my mortgage process. Thank you a bunch!

Also, as a side question, when NFCU says no PMI for 100% homebuyers choice, is it truly no PMI or is there a catch?

Hi and welcome

First, yes NFCU does a pull prior to closing to ensure nothing has changed on your CR. I’m not 100% sure, but I thought I read somewhere that business CCs are hidden tradelines so I’m sure someone knowledgeable on this aspect will answer.

March 2018, I got the 100% financing, no down payment, no PMI loan. It’s no PMI.

Out of curiosity, with your excellent scores, why did you select home buyers choice? Doesn’t that have a 1.75% funding fee?

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Mortgage Issue with a New Credit Card!

CreditInspired,

Thank you for your reply.

I remember in the forum somewhere people were commenting that NFCU only pulls once (either hard or soft). So I was hoping to get a clear answer if someone had gone through the same thing.

What could happen if they find out? does it automatically dismiss my loan process? or will they be considering the mortage?

And to answer your question, I choose HBC because of the 100% and no PMI at first. Then I realize they charge 1.75% funding fee. So, I spoke to my loan officer what it takes to remove the 1.75% funding fee. Found out that I need to contribute at least 3% down to remove. So, theoretically, I'm paying 1.25% more for a 3% down payment compare to not putting down any money with 1.75% funding fee. Also, when I choose to put 3% down, not only removed the funding fee, but also lowered my interest rate as well. (not sure lower interest rate was due to the down payment or just rate adjustment) .

Other conventional loan had lower rates but realize their minimum down payment is 5%, which I didn't want to pay.

Let me know what your take on this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Mortgage Issue with a New Credit Card!

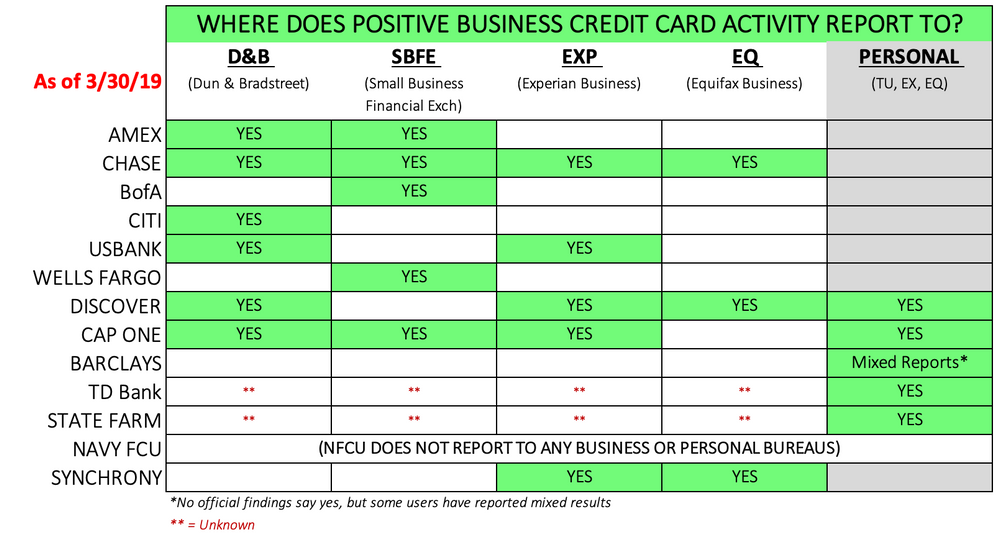

The 1 issue I see is you chose to open the Capital One Spark Card which is a Business Card that DOES report to Personal Credit ... Other Business Cards like AMEX, Chase, Bank Of America ... DO NOT Report to Personal Credit and is hidden. I'm not sure how that will affect the Mortgage process ...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Mortgage Issue with a New Credit Card!

@Anonymous wrote:CreditInspired,

Thank you for your reply.

I remember in the forum somewhere people were commenting that NFCU only pulls once (either hard or soft). So I was hoping to get a clear answer if someone had gone through the same thing.

What could happen if they find out? does it automatically dismiss my loan process? or will they be considering the mortage?

And to answer your question, I choose HBC because of the 100% and no PMI at first. Then I realize they charge 1.75% funding fee. So, I spoke to my loan officer what it takes to remove the 1.75% funding fee. Found out that I need to contribute at least 3% down to remove. So, theoretically, I'm paying 1.25% more for a 3% down payment compare to not putting down any money with 1.75% funding fee. Also, when I choose to put 3% down, not only removed the funding fee, but also lowered my interest rate as well. (not sure lower interest rate was due to the down payment or just rate adjustment) .

Other conventional loan had lower rates but realize their minimum down payment is 5%, which I didn't want to pay.

Let me know what your take on this.

I didn’t pay anything down with my 100%, no PMI, conventional mortgage. I wonder if it’s because I did a 3/5 ARM.

IMHO, even when another pull is done, as long as nothing affects your DTI ratio, you have nothing to worry about. The big worries are if someone buys a car, make a large purchase, etc.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Mortgage Issue with a New Credit Card!

CreditInspired,

Thanks for your honest opinion. It's possible that they waved the funding fee since you are doing ARM (bank loves ARM!). I realized that they can be very flexible in their fees if you are well qualified.

I feel the same way, but wanted some opinion. As long as I pay off all the balance, I believe I will be fine. I almost had to buy a car though if I didn't fix it up. Question, Even with 0 down, how much did the closing cost you? Did you also use RealtyPlus for extra cash back?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Mortgage Issue with a New Credit Card!

Thanks for the chart. This is great....

I will be paying off all my balance at least and see what other people say about the soft pull before closing with NFCU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Mortgage Issue with a New Credit Card!

@Anonymous wrote:CreditInspired,

Thanks for your honest opinion. It's possible that they waved the funding fee since you are doing ARM (bank loves ARM!). I realized that they can be very flexible in their fees if you are well qualified.

I feel the same way, but wanted some opinion. As long as I pay off all the balance, I believe I will be fine. I almost had to buy a car though if I didn't fix it up. Question, Even with 0 down, how much did the closing cost you? Did you also use RealtyPlus for extra cash back?

Yes, used Realty Plus and loved my Coldwell Banker (CB) RE Agent. What was really wonderful was the $1900 cash back to my savings account. NFCU said 6-8 weeks. It was less than 10 days. I was grinning from ear-to-ear. It went toward my new wood floors. Are you using RealtyPlus?

The crazy part about closing cost was NFCU estimated a crazy $13.8K (they did warn me they estimate on the high side but I still had to show those funds were available). I pulled way more from my 403b than I needed to. At least I wasn’t penalized because I’m over 59.5.

My closing cost was low because I paid 0 points and 0 origination fee. My home owners insurance (condo) was only $272 annually because the master policy covered a lot of stuff. The seller gave $1.8K in closing and CB rebated me $450. My EMD was $2.5K so I only had to bring $3.4K to the table. I felt pretty darn good!

What is your closing cost like?

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting Score: 567

Starting Score: 567