- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Pay down credit cards or Put to Down Payment

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Pay down credit cards or Put to Down Payment

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay down credit cards or Put to Down Payment

After filing cht 7 in 2008 and waiting FOREVER for the USDA to foreclose, I have FINALLY been preapproved for a $180k FHA loan. My deed was transferred out of my name on 2/21/14 so, according to underwriting, I should be able to submit the formal loan request as of 2/22/17!!

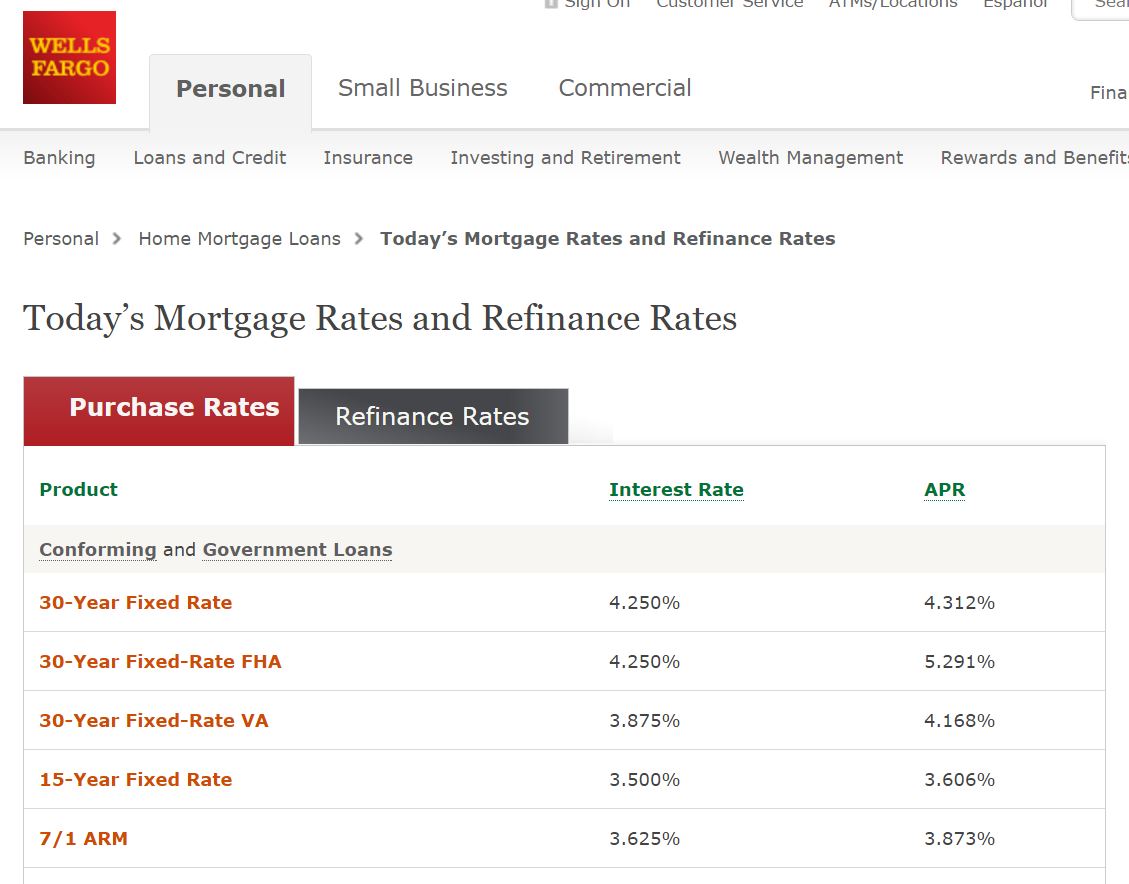

She gave me a proapproval letter going FHA with a 4.25 interest and 5.11 APR? Should I shop this because it seems kind of high? Also, would it be better to use my income tax and pay down my credit cards or hold it for a larger down payment? With the loan my current DTI would be right around 40%

Current FICO 667

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay down credit cards or Put to Down Payment

APR is going to be high because of mortage insurance premium (MIP) and up front mortgage insurance premium (UFMIP). The UFMIP is charged by FHA to every single loan that is originated and the MIP is a monthly charge. That's the reason why the APR is pretty high for all FHA loans. I would shop around, not only for interest rates, but also for fees as well. I would pay down the credit cards to where they're all at least under 50% utilization. I would assume the lender is giving you the worst case scenario for the interest rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay down credit cards or Put to Down Payment

This is actually my question, I can pay off my balances more aggressively or save more for my downpayment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay down credit cards or Put to Down Payment

Pay down your balances to where you're utilizing 10% of your credit (Ideal). If not, I'd pay them down to where you're utilzing less than 50% of your credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay down credit cards or Put to Down Payment

@Anonymous wrote:This is actually my question, I can pay off my balances more aggressively or save more for my downpayment.

that really isnt a mortgage question... but a financial advice question.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay down credit cards or Put to Down Payment

@DallasLoanGuy wrote:

@Anonymous wrote:This is actually my question, I can pay off my balances more aggressively or save more for my downpayment.

that really isnt a mortgage question... but a financial advice question.

HI, I didnt write the original post. I just said I have the same question. It is a mortgage question if you are choosing between raising your score or having more of a down payment. I read somewhere here that for FHA, anything over a certain score does not make much of a difference on your interest. In that case, it's better to save more for the down if I already surpassed that socre, but thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay down credit cards or Put to Down Payment

4.25% is high right now for FHA. We were able to lock at 3.75%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay down credit cards or Put to Down Payment

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay down credit cards or Put to Down Payment

@Sbrooks1 wrote:

Today's FHA rate I believe is 4.25

Nope, still sitting at 3.75%. It has bumped up to 3.80/3.85% for a couple of days over the past few weeks but keeps dropping back down to 3.75%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pay down credit cards or Put to Down Payment

@Anonymous wrote:

@Sbrooks1 wrote:

Today's FHA rate I believe is 4.25Nope, still sitting at 3.75%. It has bumped up to 3.80/3.85% for a couple of days over the past few weeks but keeps dropping back down to 3.75%.

Where are you getting the 3.75% from. Am I not looking in the right place for an FHA rate?