- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Planning ahead for Mortgage, Advice Welcomed!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Planning ahead for Mortgage, Advice Welcomed!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Planning ahead for Mortgage, Advice Welcomed!

I like to plan ahead, so I hopefully won't hit huge disappointing snags along the way when we begin in more than likely two years, sooner would be absolutely amazing, but don't want to rush a get shut-down. Rather wait and be more prepared.

Current

I have two charge off from 2017/2018, CC's, I paid them off in February of this year. So the chargeoff are on my credit, one shows paid in full, the other is settled for less than full amount.

I have one secured card since nov. of '18, current, never late, keep UTI at 30% or below

I have two installment loans I took out this year one for $9,500, other is the self lender $500.

Since I started my credit repair jouney February of this year, my scores have all been jumped to (give or take a few) 90 pts each on fico 8.

I've never had a mortgage in my name.

My husband, bad year of car payment history of last year. This year never been late. Car will be paid off next April. Nothing over 60 days late.

No charge offs. One collection from a dental bill in 2016, but only showing on one credit bureau. I have no idea what it is.

Another collection from Verizon, which will be paid by the end of this year.

Currently 3 CC, no lates, two relatively new (opened this year.) Third is 1 1/2 years old. No lates on any. Credit utilization kept below 30% except once one was at 90% paid off the very next billing cycle though.

One installment loan opened in April of this year for $17,000.

Has had mortagage for 12 years, never late once.

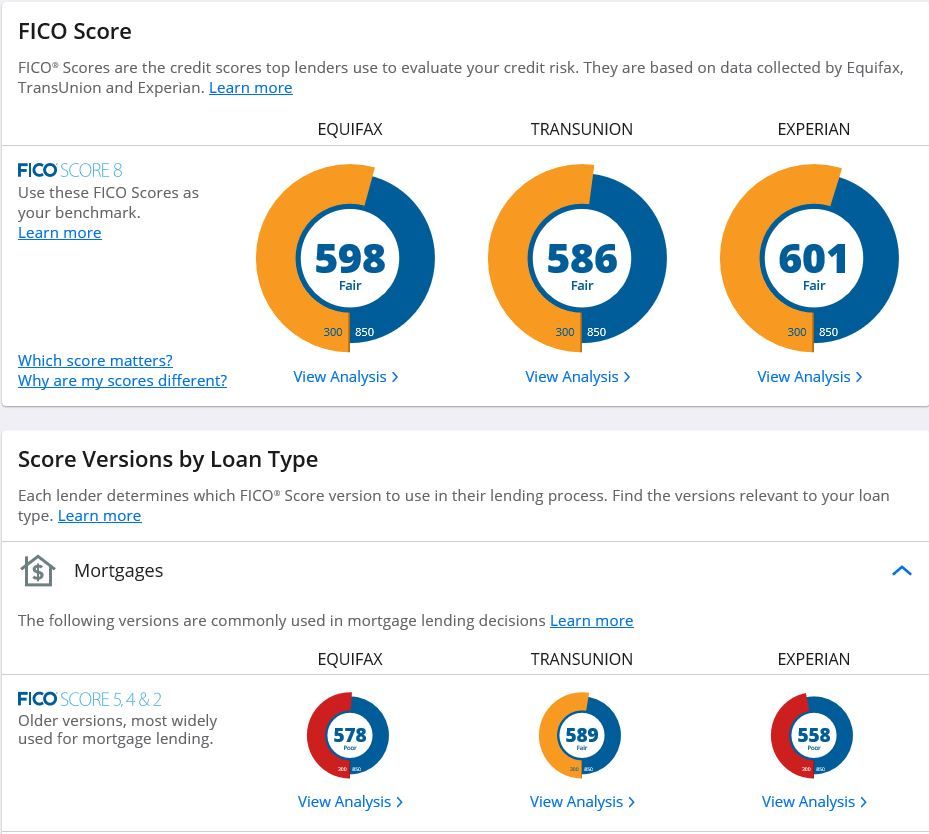

Those are my scores as of 5/20.

We are both employed full time, I have been employed by the same employer for 12 years, and he has been employed for with the same employer for the last 14 years.

Other than paying all of our bills/loans on time, is there anything else we could do. His scores are about 50 points higher than mine. We have no intentions of opening any new lines of credit, only me if I could eventually get approved for a non-secured CC.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning ahead for Mortgage, Advice Welcomed!

I got my mortgage 3 years after filling bk.

I had no trouble at all.

Do a lot of looking around without hard credit pulls but wait until at least 3 years after you fix your debts.

It all depends on the loans you currently will have and you need to stay perfect from here on out.

Income to debt ratio plays a huge part in the process as well.

Have 2 credit cards and prove you can pay them on time. Just charge a small amount each month, wait for the statement, pay them off then charge another small amount and so on.

Try and have 20 percent to put down and most lenders will work with you depending on your income and credit worthyness.

You can do this. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning ahead for Mortgage, Advice Welcomed!

@Anonymous wrote:I like to plan ahead, so I hopefully won't hit huge disappointing snags along the way when we begin in more than likely two years, sooner would be absolutely amazing, but don't want to rush a get shut-down. Rather wait and be more prepared.

Current

I have two charge off from 2017/2018, CC's, I paid them off in February of this year. So the chargeoff are on my credit, one shows paid in full, the other is settled for less than full amount.

I have one secured card since nov. of '18, current, never late, keep UTI at 30% or below

I have two installment loans I took out this year one for $9,500, other is the self lender $500.

Since I started my credit repair jouney February of this year, my scores have all been jumped to (give or take a few) 90 pts each on fico 8.

I've never had a mortgage in my name.

My husband, bad year of car payment history of last year. This year never been late. Car will be paid off next April. Nothing over 60 days late.

No charge offs. One collection from a dental bill in 2016, but only showing on one credit bureau. I have no idea what it is.

Another collection from Verizon, which will be paid by the end of this year.

Currently 3 CC, no lates, two relatively new (opened this year.) Third is 1 1/2 years old. No lates on any. Credit utilization kept below 30% except once one was at 90% paid off the very next billing cycle though.

One installment loan opened in April of this year for $17,000.

Has had mortagage for 12 years, never late once.

Those are my scores as of 5/20.

We are both employed full time, I have been employed by the same employer for 12 years, and he has been employed for with the same employer for the last 14 years.

Other than paying all of our bills/loans on time, is there anything else we could do. His scores are about 50 points higher than mine. We have no intentions of opening any new lines of credit, only me if I could eventually get approved for a non-secured CC.

Thank you!

Hey! I'd check out the rebuilding forum but also be careful on the credit cards! They can be a snag because not only will you get a hard-pull but they're tempting if you don't have the best history of credit usage. You should try to have 3 revolving lines of credit in your name prior to applying that have been reporting positive tradelines and history for at least a year. If you're at least 2 years out, follow the rebuilding forum but know that those who apply heavily for credit are probably NOT looking for mortgage loans in the near future. You don't want hard pulls within 12 months of an application without very high income and credit scores. It can be overlooked if you're over 680 or so, but your rebuild will take longer as you didn't have a lot of tradelines, and now you have even fewer.

The best thing you can do is let time hit those derogatories and not add any more to your report right now. You'll be fine in 24 months or so if you don't add more lates. Your husband should ensure no more lates AT ALL, especially installment lates. I highly recommend doing a budgeting software so you're not missing paymnets in the interim. Also, another thing that will really help getting ready for an application is saving for payment shock--wherever you're living right now, IF the payment is lower than the mortgage you'll be seeking, you save the difference starting as soon as possible. This allows you to know whether you can truly comfortably afford the payment and it also helps you up your funds available to close.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning ahead for Mortgage, Advice Welcomed!

Congrats on your rebuild and refocused attention to detail. You're on your way -- others will chime in, but I've heard your mid-mortgage should be 620 minimum before considering mortgage financing. What is your time table?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Planning ahead for Mortgage, Advice Welcomed!

Thanks everyone!

I have put all payments on automatic payments, so none will be late.

And definitely noted to have no hard pulls especially 12 months out from applying for mortgage.

2 years isn't set in stone, but its the quickest I was thinking we would have our credit in decent shape, and a good downpayment saved up.

Honestly, fincances wasn't an issue, we both have good paying jobs for our area. It was just dumb credit care on my end. Which I have learned from...