- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Second Mortgage showing as Personal Loan

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Second Mortgage showing as Personal Loan

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Second Mortgage showing as Personal Loan

So I purchased a house in Texas and closed on Feb 5, 2020. They offered a first time homebuying program which puts the down payment/closings costs the builder did not cover into a second mortgage (they waited until I was at the closing table to show me that paperwork). Anyways, the caviat to this that it is on my credit reports but I cannot make ANY payments on it until I either pay off the main mortgage loan or sell the house (which goes back to paying off the first mortgage loan). I have always paid early and made extra principal payments each month to the first mortgage which lowers the balance but the balance obviously never changes on the 2nd mortgage loan. My question is how do I get an underwriter to understand this? I am in the process of buying a 2nd house in Nevada that is being built.

Thanks in advance for advice.

Happy Holidays!

Current Score: 819 TU 795 EQ 796 EX

Goal Score: 820 Across the board

First Premier CL $600 BAL $0, Lane Bryant CL $750 BAL $0, Credit One AMEX CL $600 BAL $0, NFCU Visa CL $11,100 BAL $0, Capital One QuickSilver CL $2000 BAL $0,Capital One Savor CL $3000 BAL $0,Discover CL $10,000 BAL $0,Ashleys Homestore CL $3500 BAL $0,

Bobs Furniture AKA Wells Fargo CL $3100 BAL $0,LATE PAYS/COLLECTIONS/BANKRUPTCIES/CHARGEOFFS/JUDGEMENTS 0

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Second Mortgage showing as Personal Loan

@TXPocohontas wrote:So I purchased a house in Texas and closed on Feb 5, 2020. They offered a first time homebuying program which puts the down payment/closings costs the builder did not cover into a second mortgage (they waited until I was at the closing table to show me that paperwork). Anyways, the caviat to this that it is on my credit reports but I cannot make ANY payments on it until I either pay off the main mortgage loan or sell the house (which goes back to paying off the first mortgage loan). I have always paid early and made extra principal payments each month to the first mortgage which lowers the balance but the balance obviously never changes on the 2nd mortgage loan. My question is how do I get an underwriter to understand this? I am in the process of buying a 2nd house in Nevada that is being built.

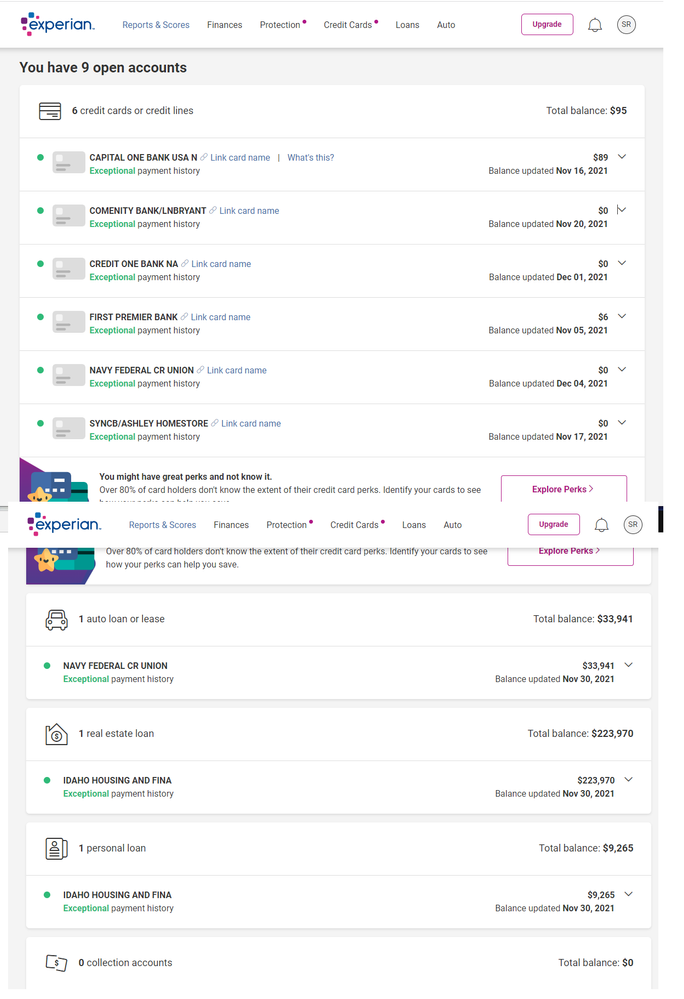

Here is my Experian to give you an idea.

Thanks in advance for advice.

Happy Holidays!

What exactly do you need to explain? Is the underwriter asking about it? What are they asking?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Second Mortgage showing as Personal Loan

@dragontears Yes. Asking why I am not paying on it. Just want to make sure this does not mess up my loan approval.

Current Score: 819 TU 795 EQ 796 EX

Goal Score: 820 Across the board

First Premier CL $600 BAL $0, Lane Bryant CL $750 BAL $0, Credit One AMEX CL $600 BAL $0, NFCU Visa CL $11,100 BAL $0, Capital One QuickSilver CL $2000 BAL $0,Capital One Savor CL $3000 BAL $0,Discover CL $10,000 BAL $0,Ashleys Homestore CL $3500 BAL $0,

Bobs Furniture AKA Wells Fargo CL $3100 BAL $0,LATE PAYS/COLLECTIONS/BANKRUPTCIES/CHARGEOFFS/JUDGEMENTS 0

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Second Mortgage showing as Personal Loan

@TXPocohontas wrote:@dragontears Yes. Asking why I am not paying on it. Just want to make sure this does not mess up my loan approval.

Generally when you have a silent 2nd mortgage like this it means there are no monthly payments required and the loan is usually forgiven in 3 to 10 years depending on the program.

For example:

https://www.idahohousing.com/documents/down-payment-and-closing-cost-assistance-programs.pdf

This shows the loan has a tiered forgiveness feature where the loan is forgiven at 10% per year.

You should have signed a note at closing with all of the terms for this loan. You may need to provide a copy to the u/w.

VA, FHA, USDA. Jumbo, Conventional.

CAIVRS Expert.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Second Mortgage showing as Personal Loan

@TXPocohontas wrote:@dragontears Yes. Asking why I am not paying on it. Just want to make sure this does not mess up my loan approval.

I just realised you said you bought a home in Texas but the lender used an Idaho DPA program?

VA, FHA, USDA. Jumbo, Conventional.

CAIVRS Expert.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Second Mortgage showing as Personal Loan

@VALoanMaster Yes. Loan Depot sold my loan 30 days later to HomeLoanServ aka Idaho Housing.

Thank you for the valuable information. 😃

Current Score: 819 TU 795 EQ 796 EX

Goal Score: 820 Across the board

First Premier CL $600 BAL $0, Lane Bryant CL $750 BAL $0, Credit One AMEX CL $600 BAL $0, NFCU Visa CL $11,100 BAL $0, Capital One QuickSilver CL $2000 BAL $0,Capital One Savor CL $3000 BAL $0,Discover CL $10,000 BAL $0,Ashleys Homestore CL $3500 BAL $0,

Bobs Furniture AKA Wells Fargo CL $3100 BAL $0,LATE PAYS/COLLECTIONS/BANKRUPTCIES/CHARGEOFFS/JUDGEMENTS 0