- myFICO® Forums

- Types of Credit

- Mortgage Loans

- So my mortgage finally reported to all three and I...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

So my mortgage finally reported to all three and I took a pretty big score hit.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So my mortgage finally reported to all three and I took a pretty big score hit.

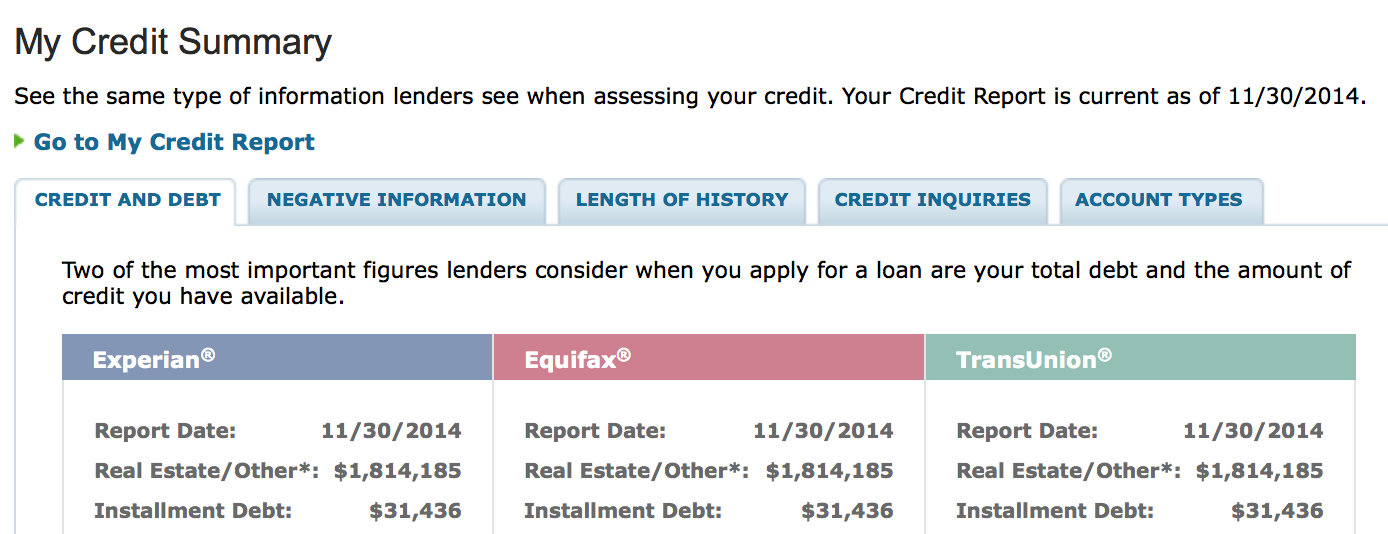

So at time of application in march I was sitting pretty at about 780-810 between the three (TU being my strongest EQ being weakest). My mortgage reported and I dropped down to 738. It also makes me sick to my stomach to see the amount im in debt on my credit and fears of some AA from the cards now that this monstor is reporting, while the stock market is good I want to pull some out of stock and pay it down more, broker says I have some room to avoid capital gains. My accountant professes so say "money is cheap to borrow, borrow all you can and invest" but I just feel like Im heading for disaster. Any opnions on that advise? also my quesiton is, refinancing part of the goal would be to get me in to a better rate as well as put some more down. But im worried with the score drop I wont get as good of interest rate as I have now. Mortgage broker said last wednesday he saw rates as low as 3.1 and would lock me in whenever im ready. But he hasnt run my credit yet and im sure that 3.1 is with perfect credit, which looking at my score I dont seem to have anymore. The installment loan is also pretty recent (6 months) but I have paid it way down from where it was. Credit UTL is at about 8% will probably report closer to 20% though now that Christmas shopping is apon us. Then after the first of the year should be back to normal. Thanks guys! I know this isnt the normal questions for this board. But I just want a 3rd party opinion from people who arent trying to earn my business.

Amex Biz Platinum NPSL I Lowes Business 42k I Amex Simply Cash + $22,500 I Chase Ink 21K I B of A World Points $20,500 I B of A Bus MasterCard 16k I Amex SPG 3K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So my mortgage finally reported to all three and I took a pretty big score hit.

...are those FICO 08 scores or something else?

Helpful Links: Do I Qualify? | Mortgage Calculator | USDA Mortgages | Opt Out | FICO Versions

Last HP: 11/04/15 | myFico 3B Jun 10 '15:FICO8 EQ - 752 | TU - 763 | EX - 750

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So my mortgage finally reported to all three and I took a pretty big score hit.

Those look like USAA CCMP score so not real FICO scores. What are your actual FICOs? I found that my actual score hit from mortgage reporting was not near as bad as what USAA reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So my mortgage finally reported to all three and I took a pretty big score hit.

I bit the bullet today and had him run my CR and see what he could do. Still waiting his reponse. Also curious to lender reported score. AS yess thats USAA which I just read further and realised it was a plus score not an FICO score. I more used it just to make sure everything was correct on the reports more than anything.

Amex Biz Platinum NPSL I Lowes Business 42k I Amex Simply Cash + $22,500 I Chase Ink 21K I B of A World Points $20,500 I B of A Bus MasterCard 16k I Amex SPG 3K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So my mortgage finally reported to all three and I took a pretty big score hit.

@awp317 wrote:I bit the bullet today and had him run my CR and see what he could do. Still waiting his reponse. Also curious to lender reported score. AS yess thats USAA which I just read further and realised it was a plus score not an FICO score. I more used it just to make sure everything was correct on the reports more than anything.

I think you need to sit tight, continue making all your payments on time, and allow your mortgage and any other new accounts age while not applying for anything new. Your points will come back.

NFCU Cash Rewards $14K | Chase Sapphire Preferred $5K | Amex Blue Cash Preferred $6K | Cap1 Quicksilver One Visa $9K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So my mortgage finally reported to all three and I took a pretty big score hit.

Took the inquriy hit, Can come down from 4.6 to 4.2. Not enough to warrant the process, to get it to 3.1 I would have to drop my loan balance to below 650k and I dont want to put that much down. The only thing is to lesson the payment I have to refinance. I can put any amount I want in a lump payment, but it wont change my payment just reduce the principle balance, and he told me its not the over all amount that banks care about its the montly payment, he said if you could find a bank to do it you could have a 10 million dollar loan and if your payments were only 500 a month, thats the only number they would really pay attention to. So Im going to hold off for a while. The loan will be a year old in march. Was just approved Monday for a new car loan at 2.4% which was prime for the bank on the vehicle and amount so I guess the banks arent too scared of it, and I really dont need any more revolving credit. I just dont want them to start reducing my limits.

Something he did suggest and IM not sure I want to do it, but he said that I could get a mortgage in just my name and DW could get a loan (note he said loan, not mortgage) in just her name on the same house in essance splitting the loan in two. I never knew you could do that. If we did it that way with money down we could get to 3.1%. But my non mathmatical mind thinks of that is really a 6.2% loan then. Is that right?

Amex Biz Platinum NPSL I Lowes Business 42k I Amex Simply Cash + $22,500 I Chase Ink 21K I B of A World Points $20,500 I B of A Bus MasterCard 16k I Amex SPG 3K.