- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: Started the process

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Started the process

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Started the process

So after giving my tax returns to a local lender and having them run me and my wifes credit giving and also them our 3 most recent bank statements we got a preapproval letter for 150k with 3.5% down for fha we are looking at a few properties this weekend but we are really leaning on buying my parents old house that they are about ready to put on the market we will be buying in the stone mountain/lithonia GA area i will update this thread as we move along in the process

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started the process

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started the process

Good luck! We started in late November and hopefully we are in the final stretch with 2 weeks until closing. I’m pretty nervous. We got a FHA loan also, so if you have any question, just ask!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started the process

Hello,

Good to hear you have decided to become a homeowner this year. I wanted to let you know that unless you are self employed, FHA does not require tax returns. Only 30 days paycheck stubs, 2 years W2s, and be able to verify your employment with your employer via VOE. Make sure you ask your Loan Officer if their company requires a 4506-T pulled and transcripts from the IRS received before you fund. IF so you could be in trouble. My company and many other lenders no longer require IRS transcripts if you are a cookie cutter W2 wage earner.

Best wishes to you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started the process

@homeloanexpert wrote:Hello,

Good to hear you have decided to become a homeowner this year. I wanted to let you know that unless you are self employed, FHA does not require tax returns. Only 30 days paycheck stubs, 2 years W2s, and be able to verify your employment with your employer via VOE. Make sure you ask your Loan Officer if their company requires a 4506-T pulled and transcripts from the IRS received before you fund. IF so you could be in trouble. My company and many other lenders no longer require IRS transcripts if you are a cookie cutter W2 wage earner.

Best wishes to you!

what do you mean FHA doesn’t require them? I’m going through something horrible and I was told that FHA required my tax returns. Now they are threatening to not approve it because of my tax returns. This is coming from FHA not my lender, at least that’s what they are telling me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started the process

@lanah, if you read what @homeloanexpert wrote, he said that his company & other lenders do not require tax returns, he didn't mention anything that FHA requires. Every company has different criteria's yet similar concept. If your current lender is requiring more than what you are able to give, then explore other lenders. I've literally read 4-5 recent posts of you venting about the same thing, and I'm sorry that you're going through such a stressful situation -- but if possible, just take a breather and know that you have options out there. You aren't entitled to just one lender.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started the process

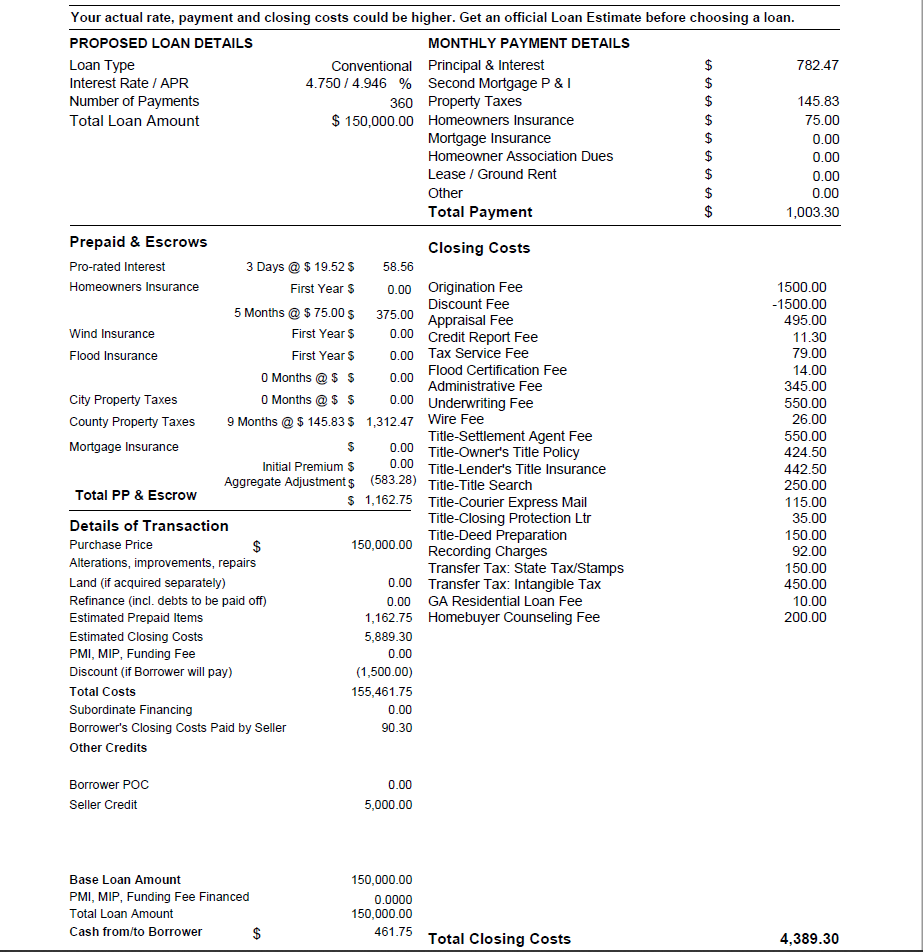

Just an update we got approved for an even better preapproval from another bank of $150k conventional loan that pays 3% down and all we have to do is put down 500 dollars and pay closing fees but my mom whose a broker says we can probably get the seller to pay this so this is really great news for us we are just about ready to put an offer down on a house we narrowed it down to 2 houses gotta make a choice so hopefully sometime this week lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started the process

Great news for you. I love the Stone Mountain area, stayed there last Winter for a week.

(Solicitation is taboo on myFico)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started the process

we put an offer in for a house and after a little back and forth they accepted our counter offer 135k with $4050 in closing costs from the seller can anyone tell me how much we can expect to pay in closing fees going by my original pre approval they gave for 150k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Started the process

oh also forgot we put a $1000 dollar earnest money deposit