- myFICO® Forums

- Types of Credit

- Mortgage Loans

- UNDERSTANDING MY VA COE !

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

UNDERSTANDING MY VA COE !

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDERSTANDING MY VA COE !

Hello,

I bought a home back in 2019 for $305,000. (i refinance the $305k home in 2020 into an IRRRL).. which means I dont have to live in the property.

-My downpayment was $0

-The VA Loan Limit in New Jersey is: $822,375

-My COE is: Basic Entitle is $36,000. My COE also states: Additional entitlement is available for most loans in excess of $144,000. In such cases, the entitlement amount is 25% of the VA lon limit for the county where the property is located.

Im not too sure how much entitlement i used already. I want to buy a second home for $280k with my VA loan with a $0 downpayment.

Is this still doable? If not, how much can I afford to put on a home with $0 dowpayment, while keeping my first home that was refinanced into an IRRRL?

thank you! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UNDERSTANDING MY VA COE !

THe IRRRL is an Interest Rate Reduction Refinance Loan and it's quite likely you've used the entire entitlement for this loan, however; you may still have some extra VA entitlement in order to purchase a new primary residence, but you are better off checking with your friendly local mortgage expert so he can check on that for you.

Thanks for your service to our country.

Licensed NC Mortgage Loan Originator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UNDERSTANDING MY VA COE !

How much do you think i would have left, and will i be able to take out a $280k loan without a downpayment, while still keeping my current IRRRL $305k loan/residence?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UNDERSTANDING MY VA COE !

Not always, but usually the amount entitlement a VA loan uses up is 25% of the original loan amount, so if the original loan was $305,000 then there is a good chance you've used up $76,250 in entitlement.

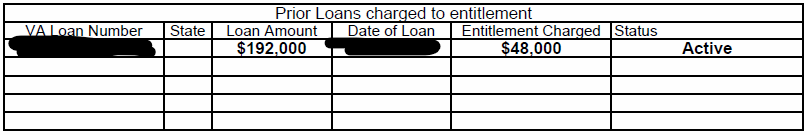

Your current Certificate of Eligibility will say how much entitlement your existing VA loan is using up. Have you obtained a new one? For example it may look like the below:

Assuming you have used up $76,250 in entitlement that means you'll need to deduct that from 25% of the county loan limit to determine your remaining entitlement. If the county you are buying in has a county loan limit of $822,375 then 25% of that is $205,593 minus $76,250 of used entitlement = $129,343 in remaining entitlement. Multiply that by 4 and that is the max sales price you'd be eligible for 100% financing on, which comes out to $517,372.

If you haven't used up any entitlement then VA doesn't have a limit on what you'd be eligible to finance without a down payment, it'd just come down to how much you could qualify for and if there is a lender out there that would do that high of a loan amount (most cap out at $1,500,000 to $3,000,000).

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UNDERSTANDING MY VA COE !

Thank you very much for the response. Does that mean that I am able to take out a second VA loan with my remaining entitlement if the $305k home I live in is under an IRRRL? Or would I have to sell my $305k home under the IRRRL and then be able to use the remaining of my entitlement? I was to own 2 homes (my current one and a second home for less than $280k)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: UNDERSTANDING MY VA COE !

You can only buy a primary residence with a VA mortgage. VA mortgages cannot be used to buy 2nd homes/vacation properties or investment properties.

Located in Southern California and lending in all 50 states