- myFICO® Forums

- Types of Credit

- Mortgage Loans

- What Refi Option would you take?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What Refi Option would you take?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What Refi Option would you take?

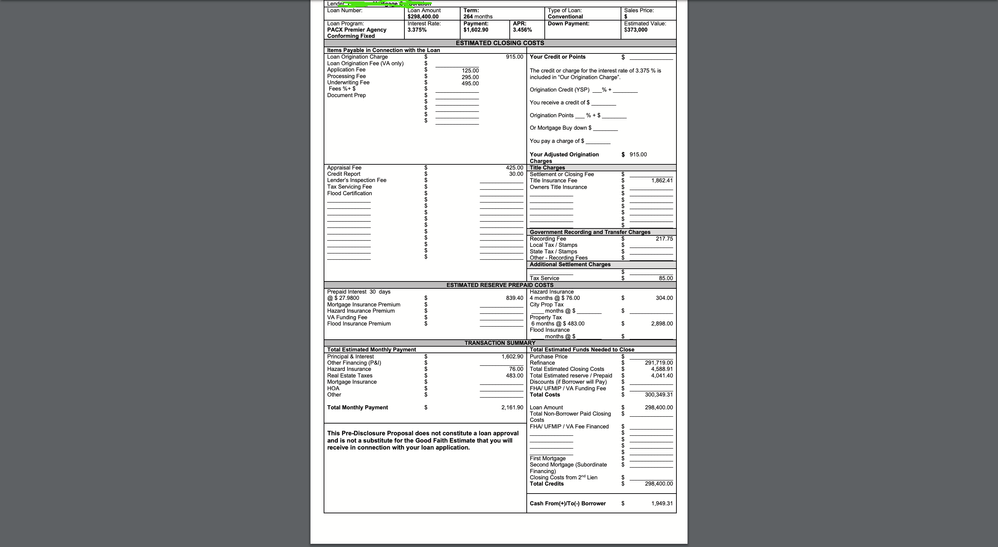

29 Years left on a 30 year loan.

Estimated Value of House is $373K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Refi Option would you take?

I would refi to the lowest possible 30 year fixed rate you can find & then make extra payments towards your principle every month.

Here's why.

If you take on a 15 year mortgage you're committed to that payment so you won't have any flexibility if money gets tight for some reason.

But, if you go with the 30 yr option, you can make extra payments & pay off your loan sooner while giving yourself the ability to drop back to a lower payment if money gets tight.

VA, FHA, USDA. Jumbo, Conventional.

CAIVRS Expert.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Refi Option would you take?

@VALoanMaster wrote:I would refi to the lowest possible 30 year fixed rate you can find & then make extra payments towards your principle every month.

Here's why.

If you take on a 15 year mortgage you're committed to that payment so you won't have any flexibility if money gets tight for some reason.

But, if you go with the 30 yr option, you can make extra payments & pay off your loan sooner while giving yourself the ability to drop back to a lower payment if money gets tight.

+ Many.

Honestly I wish I'd understood that back in 2015 when I took a 15 year fixed even at 3.25%, admittedly my DTI was basically not much (~17% backend) but when I was out of work between 12/17 and 8/18 or so I wound up floating some balances and wound up with 27k eventually on the HELOC by 12/18 before I managed to absolutely smash it in 1/19.

If I'd been $800/month give or take smaller, that's on the order of $9600 less on the debt outlay... and now I'm doing a refinance to a 30 year fixed anyway which is costing me another ~$1K out of pocket when I could've just gone this route the first time and not worried about it.

Even better, some lenders will absolutely let you advance the payment date if you're making additional regular payments. Vis a vis my auto loan which I have been paying ahead now doesn't have a due date till 9/21, and so while I'm pooling cash for all this mortgage crap that I'm trying to get done right now I can just let that slide at in my case 3.85% for now and keep that extra money for downpayment / closing costs. No reason this might not apply to your loan servicer too and if it does, well in my case the math would've come out to more like $1818x12 which was 2/3 of my debt over that time period and would've been cheaper to "finance" that way than on the HELOC.