- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Re: What type of mortgage should we aim for?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What type of mortgage should we aim for?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What type of mortgage should we aim for?

My wife and I are about to start seriously looking to buy a home. We will be considered 1st home buyers as we have not owned our own home in the past 3 years however it appears we will be just outside of any downpayment assistance options.

We are looking to put as little down as possible but can put 3.5% down if we have to.

Our combined GMI is $96k and our monthly debt is $850 - $550 in car loans and the rest are CC's which we hope to pay off shortly.

On Experian I pulled my scores today, which are as follows - EXP 714, EQ 707, TU700 (not sure if these are mortgage specific scores) my wife has scores of 800+ across the board. I have 2 charge offs with BOFA on my CBR which were settled for less than balance owed in May 2022.

Homes are still relatively cheap in our part of the country so a purchase price of around $220k is likely.

We are NFCU members so the homebuyers choice is available but I'm having a hard time figuring out if an FHA or conventional loan would be better for us. Does anyone have some quick tips or rules of thumb when it comes to figuring out which product we should be aiming for, that would be excellent!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What type of mortgage should we aim for?

Generally with higher credit scores (700+) and low down payments, conventional financing works out to have an overall lower monthly payment. Interest rates are typically higher on conventional loans vs. FHA loans, but with higher scores the PMI on conventional loans is cheaper than FHA which makes the total payment more competitive.

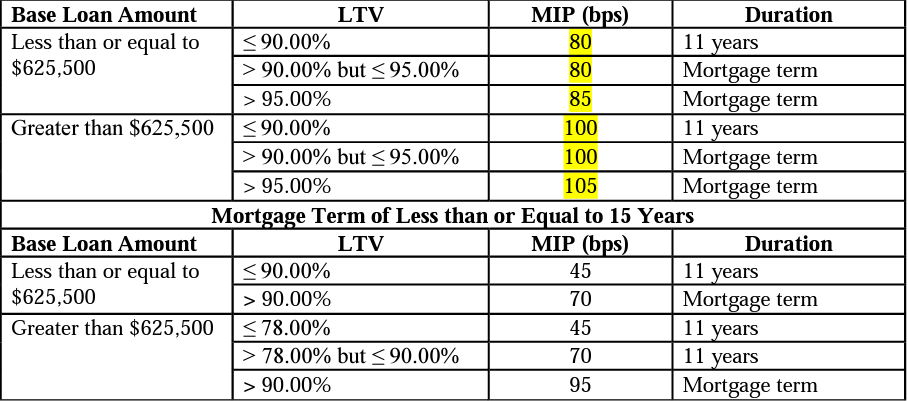

Conventional mortgages interest rates and PMI are much more sensitive to credit scores than FHA is. With FHA you are charged the same amount of MI (it's not called PMI since it's not "private") no matter what the credit score is - a 1.750% upfront mortgage insurance premium (UFMIP) + a variable amount of annual MI depending on the loan amount and your loan-to-value (LTV) (below is an FHA mortgage insurance chart), whereas conventional PMI is all based on your credit score + your LTV. The lower the LTV & higher the credit score, the cheaper PMI will be with conventional financing.

Current FHA annual MI chart:

There are some lenders out there, like I believe NFCU, that offer 100% financing or high LTV financing without having to pay PMI. You'll notice with a lot of those programs that your interest rate is higher than if you opted to go with a conventional program where'd you'd pay PMI. A higher interest rate isn't necessarily a bad thing, because the monthly payment can still be less than taking a conventional loan with PMI. You'll just need to compare all the options you want to consider.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What type of mortgage should we aim for?

@ShanetheMortgageMan wrote:Generally with higher credit scores (700+) and low down payments, conventional financing works out to have an overall lower monthly payment. Interest rates are typically higher on conventional loans vs. FHA loans, but with higher scores the PMI on conventional loans is cheaper than FHA which makes the total payment more competitive.

Conventional mortgages interest rates and PMI are much more sensitive to credit scores than FHA is. With FHA you are charged the same amount of MI (it's not called PMI since it's not "private") no matter what the credit score is - a 1.750% upfront mortgage insurance premium (UFMIP) + a variable amount of annual MI depending on the loan amount and your loan-to-value (LTV) (below is an FHA mortgage insurance chart), whereas conventional PMI is all based on your credit score + your LTV. The lower the LTV & higher the credit score, the cheaper PMI will be with conventional financing.

Current FHA annual MI chart:

There are some lenders out there, like I believe NFCU, that offer 100% financing or high LTV financing without having to pay PMI. You'll notice with a lot of those programs that your interest rate is higher than if you opted to go with a conventional program where'd you'd pay PMI. A higher interest rate isn't necessarily a bad thing, because the monthly payment can still be less than taking a conventional loan with PMI. You'll just need to compare all the options you want to consider.

I love it when I learn something new! Thanks @ShanetheMortgageMan

I did some follow up and sure enough...NFCU does have Mortgage Options without PMI even without 20% down like traditional expectations. I was not aware this was an option unless you were going VA so to have this alternative is a great money saver. Thanks for the education!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What type of mortgage should we aim for?

@ShanetheMortgageMan Is Navy actually waiving PMI or doing a single premium payment as part of closing costs?

I found this on their site:

Navy Federal Credit Union Mortgage offers the Homebuyers Choice Loan to first-time home buyers. This loan does not require a down payment or PMI. An additional one-time funding fee may be added to the loan balance, but the funding fee can be waived if you opt for a higher interest rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What type of mortgage should we aim for?

@Meach7 wrote:@ShanetheMortgageMan Is Navy actually waiving PMI or doing a single premium payment as part of closing costs?

I found this on their site:

Navy Federal Credit Union Mortgage offers the Homebuyers Choice Loan to first-time home buyers. This loan does not require a down payment or PMI. An additional one-time funding fee may be added to the loan balance, but the funding fee can be waived if you opt for a higher interest rate.

That's basically the same thing as PMI. With conventional financing PMI can take one of a few forms - the most common is a monthly amount added to your monthly mortgage payment but sometimes you can opt to pay a single premium at closing in lieu of having any monthly PMI. The single premium option results in less total PMI being paid over the life of the loan than the more common monthly mortgage insurance. For example a 2.6% single premium PMI fee vs. paying .64%/year would breakeven at the 4 year mark. If you think you'll be in your new mortgage for awhile (longer than 4 years) then this saves the most money overall.

You can also select a split premium option, where you pay a smaller single premium at closing + a smaller monthly amount. This option is usually selected with there is more available cash at closing but a lower monthly payment is preferred. This usually results in paying more total PMI than the single premium, but less than only paying the monthly amount.

Then lastly there is lender paid PMI (LPMI), which is where you can take a higher rate or pay a fee and the lender pays PMI. If you opt for the higher rate than this usually offers a lower total monthly payment than doing the monthly mortgage insurance option, but it's for the life of the loan so your payment will never reduce like it would when the monthly amount eventually stops. If you want a lower payment and only think you'll be in the mortgage for a short time then this could make the most sense.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What type of mortgage should we aim for?

Shane,

Thank you for all your great advice and informaiton in these posts.

We submitted a pre-approval with Navy FCU and were approved for their 100% financing around 7.125% (of course this is changing due to rates) up to around 270k. My score is 699 and a bump to 720 would get us in to their best financing which is somewhere betwee 6.5% and 7% (I think). So that's my focus while we look is to try and get my score bumped because any reduction is a good reduction!