- myFICO® Forums

- Types of Credit

- Mortgage Loans

- calculating closing costs

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

calculating closing costs

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

calculating closing costs

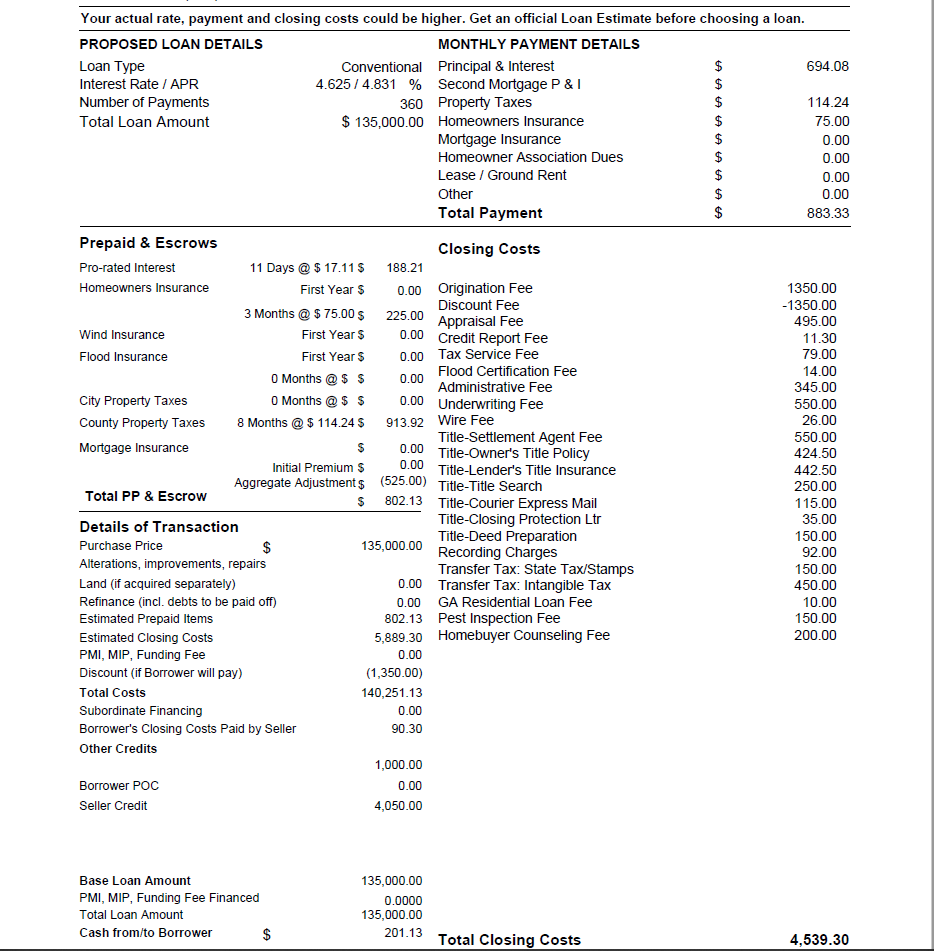

can someone help me read this im about to go into underwriting if im reading this right i only have to bring 200 dollars to close?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: calculating closing costs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: calculating closing costs

I was looking over your Fee Sheet and it appears that you buying a home with $0 down payment, seller paid closing costs, and getting an great rate and not paying monthly PMI! How is that? If the lender can pull this off, Man I'll pull up stakes and switch companies!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: calculating closing costs

@homeloanexpert wrote:I was looking over your Fee Sheet and it appears that you buying a home with $0 down payment, seller paid closing costs, and getting an great rate and not paying monthly PMI! How is that? If the lender can pull this off, Man I'll pull up stakes and switch companies!

well we took a first time homer buyers course in september and finally got our certificate in february and were given a list of lenders who give special down payment assistance programs or money through our counties down payment assistance for anyone who took the course this lender works with people who took this course with this special program we were preapproved for

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: calculating closing costs

My questions to you would be ...

1 - did you give the seller an Earnest Money Deposit ?

2 - did you give the Lender a check at application to cover Credit Report & Appraisal?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: calculating closing costs

@JVille wrote:

YES!!!! Based on this Closing Cost Sheet that is exactly what it looks like. I looked it over and I see no read flags at all. But just in case Review it with your LO to cover any questions.

My questions to you would be ...

1 - did you give the seller an Earnest Money Deposit ?

2 - did you give the Lender a check at application to cover Credit Report & Appraisal?

yes the earnest money check was given about 10 days ago and the lender called me this morning and took my credit card to pay for the appraisal actually

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: calculating closing costs

Looks like a Fabulous Loan I too an wondering about the lack of PMI either upfront or as a monthly premium. This is obviously a some type of 1st Time Buyer Program. Congratulations!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: calculating closing costs

What is the name of the program and lender you chose throught them if you dont mind sharing. I want to see if we have something like that here in Houston, TX. Sounds like a win. Congrats by the way!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: calculating closing costs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content