- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: 2.8% savings, no min, free checking, free ACH

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2.8% savings, no min, free checking, free ACH

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2.8% savings, no min, free checking, free ACH

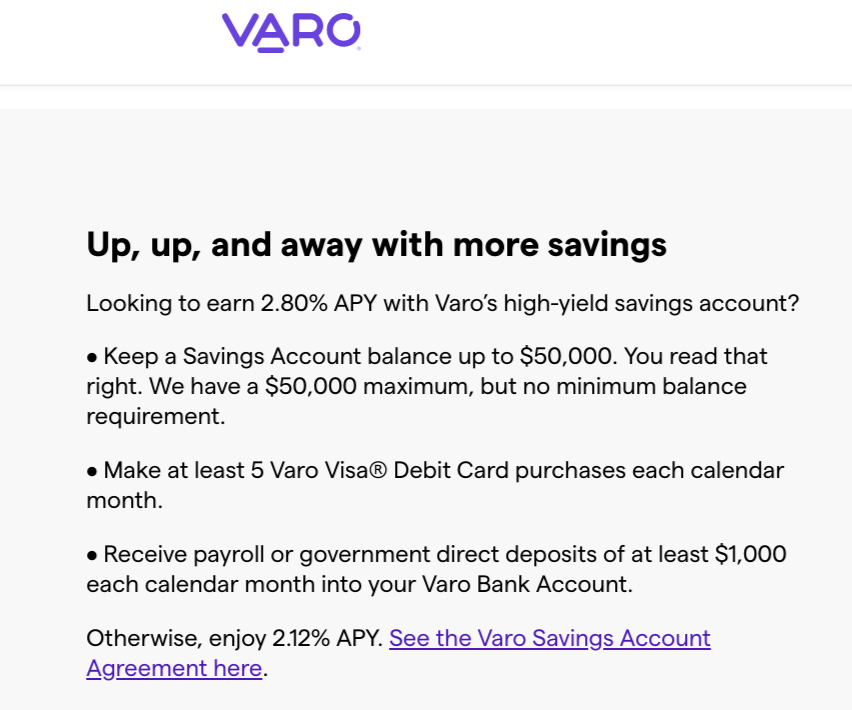

I found Varo Bank which offers 2.8% savings APY with no min but $50k max, free checking, free ach (according to DOC-limited to 10k/mo).

Only rea restriction to get the 2.8% is DD of $1,000/month and 5 debit card uses. That seems very easy for 2.8% which is one of the highest I've seen that doesn't come some rediculous $3k max or something.

They are backed by Bancorp Bank which research suggests they also partner with Chime and I'm sure many others.

Thoughts? Anyone use these guys?

AMEX CS Plat | NSL -- Chase Freedom Flex | $19,000

AMEX Gold | NSL -- Citi Double Cash | $10,000

AMEX HH NAF | $1,000 -- Uber Visa | $5,000

CSR | $29,000 -- USAA Plat | $8,000

USAA AMEX | $23,000 -- MB Boundless | $11,900 -- CFU | $3,600 -- PenFed Pathfinder | $10,000 -- MS Plat | NSL

BANKS:

NFCU | USAA | PenFed | Schwab Bank | First Bank | Chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.8% savings, no min, free checking, free ACH

I don't use a debit card because you get much less fraud protection with a debit card then you do with a credit card.

I don't think that the APR is worth the risk.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.8% savings, no min, free checking, free ACH

@IPIF wrote:I don't use a debit card because you get much less fraud protection with a debit card then you do with a credit card.

I don't think that the APR is worth the risk.

There definitely is, however, I have heard that some banks are starting to treat DCs like CCs in that sense, albeit rare. Additionally if you run your DC transaction as CREDIT (no pin required) there may be a way to dispute those. This would be important simply because if my DC # was compromised, the bad actors would be utilizing it with no pin and thus as CREDIT. I have NOT confirmed this but just a thought. I feel by not running it at gas stations or shady websites/phishing emails asking your PIN I think most folks should be okay.

Personally I only keep $100-$200 in my checking anyway, for that very reason of fraud.

Other hand: at this point with banks competing and the talk of a rate decrease from FED, fighting for an extra .8% APY for some folks may not be worth it.

AMEX CS Plat | NSL -- Chase Freedom Flex | $19,000

AMEX Gold | NSL -- Citi Double Cash | $10,000

AMEX HH NAF | $1,000 -- Uber Visa | $5,000

CSR | $29,000 -- USAA Plat | $8,000

USAA AMEX | $23,000 -- MB Boundless | $11,900 -- CFU | $3,600 -- PenFed Pathfinder | $10,000 -- MS Plat | NSL

BANKS:

NFCU | USAA | PenFed | Schwab Bank | First Bank | Chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.8% savings, no min, free checking, free ACH

Well, the obvious thing here is that by Federal law you're only allowed 6 withdrawals per month from a savings or money market account, go over that and most banks charge you a fee and/or restrict your account. So if Varo requires 5 debit card transaction per month to get that higher interest that only leaves you 1 transaction to move funds to checking or to another account.

Besides the fact that I won't use debit either, any account that lets me I disable the debit card, and when opening an account if they offer the option I click No do NOT send me a debit card..

I've been very happy with Memory Bank, an online only division of Republic Bank - 1.62% on checking with unlimited transactions and 2.45% on money market w/6 transactions. I keep most funds in MM and transfer to checking a couple times per month to pay bills, and no debit card usage nonsense to get those rates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.8% savings, no min, free checking, free ACH

@DaveInAZ wrote:Well, the obvious thing here is that by Federal law you're only allowed 6 withdrawals per month from a savings or money market account, go over that and most banks charge you a fee and/or restrict your account. So if Varo requires 5 debit card transaction per month to get that higher interest that only leaves you 1 transaction to move funds to checking or to another account.

Besides the fact that I won't use debit either, any account that lets me I disable the debit card, and when opening an account if they offer the option I click No do NOT send me a debit card..

I've been very happy with Memory Bank, an online only division of Republic Bank - 1.62% on checking with unlimited transactions and 2.45% on money market w/6 transactions. I keep most funds in MM and transfer to checking a couple times per month to pay bills, and no debit card usage nonsense to get those rates.

Dave that's a good thought. I assumed that APY would be in tandum with a Checking Account as I don't think I've seen a debit with Savings Account but you may be right. Always good insight from you on these things.

I have looked into Memory as well and liked what I saw. My main stash is with Penfed and I really wasn't sure I wanted to go thru the @$$ pain of moving everything for .45% which wouldnt give me a whole lot. I've been using USAA as my "hub", which works great for the 1 day early pay and no ACH fees but for the right price I could be convinced to move the main stash.

AMEX CS Plat | NSL -- Chase Freedom Flex | $19,000

AMEX Gold | NSL -- Citi Double Cash | $10,000

AMEX HH NAF | $1,000 -- Uber Visa | $5,000

CSR | $29,000 -- USAA Plat | $8,000

USAA AMEX | $23,000 -- MB Boundless | $11,900 -- CFU | $3,600 -- PenFed Pathfinder | $10,000 -- MS Plat | NSL

BANKS:

NFCU | USAA | PenFed | Schwab Bank | First Bank | Chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.8% savings, no min, free checking, free ACH

@CBartowski wrote:Dave that's a good thought. I assumed that APY would be in tandum with a Checking Account as I don't think I've seen a debit with Savings Account but you may be right. Always good insight from you on these things.

I have looked into Memory as well and liked what I saw. My main stash is with Penfed and I really wasn't sure I wanted to go thru the @$$ pain of moving everything for .45% which wouldnt give me a whole lot. I've been using USAA as my "hub", which works great for the 1 day early pay and no ACH fees but for the right price I could be convinced to move the main stash.

Ah, well from the promo you posted it sounded like the debit transactions needed to come from the savings account. But you're right, you normally don't get a debit card for a savings account, and when I go to Varomoney.com it says "make at least 5 Qualifying Debit Card Purchases from the Varo Bank Account", so it sounds like they figure you'll open both checking & savings and the debit transactions + DD in checking count for the higher interest for savings. I'm just a little leery of these bank accounts I've never heard of, I was leery of Memory Bank until I saw they were an affiliate of Republic Bank which is fairly well known.

I also have accounts with Penfed, basic share, Premium Savings and HELOC. But when you say you're hesitant to move things for only .45% higher interest do you mean Penfed Premium? Their 6 day hold on funds would be no-go for me, I just keep $500 or so there for payments on my HELOC, I keep twice as much in my Amex Savings (2.1%), and that's pretty much just for payments on my Amex cards.

I'd love to have a USAA account, but no military or family affiliation. Doesn't USAA offer decent saving accounts? Have you looked at DCU? 6.17% for the first $1k in savings, a nice rainy day stash, but I have a car loan with 1/2 pt. discount for a (partial) payroll DD going into checking & paying the car loan online from checking, so easy for me to add the savings.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.8% savings, no min, free checking, free ACH

@DaveInAZ wrote:

@CBartowski wrote:Dave that's a good thought. I assumed that APY would be in tandum with a Checking Account as I don't think I've seen a debit with Savings Account but you may be right. Always good insight from you on these things.

I have looked into Memory as well and liked what I saw. My main stash is with Penfed and I really wasn't sure I wanted to go thru the @$$ pain of moving everything for .45% which wouldnt give me a whole lot. I've been using USAA as my "hub", which works great for the 1 day early pay and no ACH fees but for the right price I could be convinced to move the main stash.

Ah, well from the promo you posted it sounded like the debit transactions needed to come from the savings account. But you're right, you normally don't get a debit card for a savings account, and when I go to Varomoney.com it says "make at least 5 Qualifying Debit Card Purchases from the Varo Bank Account", so it sounds like they figure you'll open both checking & savings and the debit transactions + DD in checking count for the higher interest for savings. I'm just a little leery of these bank accounts I've never heard of, I was leery of Memory Bank until I saw they were an affiliate of Republic Bank which is fairly well known.

I also have accounts with Penfed, basic share, Premium Savings and HELOC. But when you say you're hesitant to move things for only .45% higher interest do you mean Penfed Premium? Their 6 day hold on funds would be no-go for me, I just keep $500 or so there for payments on my HELOC, I keep twice as much in my Amex Savings (2.1%), and that's pretty much just for payments on my Amex cards.

I'd love to have a USAA account, but no military or family affiliation. Doesn't USAA offer decent saving accounts? Have you looked at DCU? 6.17% for the first $1k in savings, a nice rainy day stash, but I have a car loan with 1/2 pt. discount for a (partial) payroll DD going into checking & paying the car loan online from checking, so easy for me to add the savings.

I am with you 100% on PF's 6 day hold. I posted a thread a while ago asking for other options and AMEX and a few others rose to the top for places just to stash it. I dont see having a 6 day hold as "liquid" I could pull my brokerage into cash quicker than that. Yea, I have the PF Prem Online Savings at 2%.

I've seen DCU and considered as well. I really dislike USAA's accounts, they have NO high interest anything. If you putin $1mn they'll give you 1.42%, just checked, $10k-25k is .2%. If someone else has has other DPs it would be appreciated, but I have been distancing myself from them for a while with no competitive bank accounts and the insurance being grossly over what I get elsewhere for similar coverage. I still want to maintain my USAA relationship obviously as well as NavyFed and PenFed but none of them are terribly competitve anymore sadly. One day they'll bounce back, I hope.

AMEX CS Plat | NSL -- Chase Freedom Flex | $19,000

AMEX Gold | NSL -- Citi Double Cash | $10,000

AMEX HH NAF | $1,000 -- Uber Visa | $5,000

CSR | $29,000 -- USAA Plat | $8,000

USAA AMEX | $23,000 -- MB Boundless | $11,900 -- CFU | $3,600 -- PenFed Pathfinder | $10,000 -- MS Plat | NSL

BANKS:

NFCU | USAA | PenFed | Schwab Bank | First Bank | Chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.8% savings, no min, free checking, free ACH

@CBartowski wrote:

@DaveInAZ wrote:

@CBartowski wrote:Dave that's a good thought. I assumed that APY would be in tandum with a Checking Account as I don't think I've seen a debit with Savings Account but you may be right. Always good insight from you on these things.

I have looked into Memory as well and liked what I saw. My main stash is with Penfed and I really wasn't sure I wanted to go thru the @$$ pain of moving everything for .45% which wouldnt give me a whole lot. I've been using USAA as my "hub", which works great for the 1 day early pay and no ACH fees but for the right price I could be convinced to move the main stash.

Ah, well from the promo you posted it sounded like the debit transactions needed to come from the savings account. But you're right, you normally don't get a debit card for a savings account, and when I go to Varomoney.com it says "make at least 5 Qualifying Debit Card Purchases from the Varo Bank Account", so it sounds like they figure you'll open both checking & savings and the debit transactions + DD in checking count for the higher interest for savings. I'm just a little leery of these bank accounts I've never heard of, I was leery of Memory Bank until I saw they were an affiliate of Republic Bank which is fairly well known.

I also have accounts with Penfed, basic share, Premium Savings and HELOC. But when you say you're hesitant to move things for only .45% higher interest do you mean Penfed Premium? Their 6 day hold on funds would be no-go for me, I just keep $500 or so there for payments on my HELOC, I keep twice as much in my Amex Savings (2.1%), and that's pretty much just for payments on my Amex cards.

I'd love to have a USAA account, but no military or family affiliation. Doesn't USAA offer decent saving accounts? Have you looked at DCU? 6.17% for the first $1k in savings, a nice rainy day stash, but I have a car loan with 1/2 pt. discount for a (partial) payroll DD going into checking & paying the car loan online from checking, so easy for me to add the savings.

I am with you 100% on PF's 6 day hold. I posted a thread a while ago asking for other options and AMEX and a few others rose to the top for places just to stash it. I dont see having a 6 day hold as "liquid" I could pull my brokerage into cash quicker than that. Yea, I have the PF Prem Online Savings at 2%.

I've seen DCU and considered as well. I really dislike USAA's accounts, they have NO high interest anything. If you putin $1mn they'll give you 1.42%, just checked, $10k-25k is .2%. If someone else has has other DPs it would be appreciated, but I have been distancing myself from them for a while with no competitive bank accounts and the insurance being grossly over what I get elsewhere for similar coverage. I still want to maintain my USAA relationship obviously as well as NavyFed and PenFed but none of them are terribly competitve anymore sadly. One day they'll bounce back, I hope.

Completely agree about PenFed. Their lack of free checking account is a dealbreaker for an online only bank. I am now considering US Bank with its free Gold Checking with my Cash+ card and keep PenFed only for their high yield savings.