- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

401k no match

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k no match

I maxed out my Roth IRA for the year and I need help deciding what percentage to adjust my 401k to. My employer does not match and it’s pre tax.

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 401k no match

If you cap earlier in the year, you can put the extra that comes back to you into traditional brokerage accounts. That’s what I do.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 401k no match

Here is the formula I use. If you’re under 50, max is $19K this year. 50 and over, you can add an additional $6K (catchup contribution). So, I’ll assume you’re under 50 and use $19K vs $25K.

The below formula is based on how many pay periods there are.

Monthly - $1,583.33 ($19K/12)

Semimonthly - $791.66 ($19K/24)

Biweekly - $730.76 $19K/26)

Weekly - $365.38 ($19K/52)

Or for true simplicity, use the 401K calculator at this link

https://www.paycheckcity.com

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 401k no match

The big wins are lowering your AGI for income tax, and putting as much money as you can into a tax-advantaged savings vehicle, which by definition is better than putting it in the standard brokerage account. Much cheaper to put income producing assets there and that helps when it comes to diversification.

Because it is capped it is a time limited and therefore scarce resource: that is one of the primary reasons for my wanting to move my consulting to my own corp and then go build myself a quality 401k (go go profit sharing).

Ideally if your income supports it cap it like clockwork.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 401k no match

I agree with all the advice given here.

My employer only matches 2%. It's nice, but it is only a small benefit. And good for you on maxing out your Roth. My employer offers a traditional 401k as well as a Roth, but I would guess that about 1% (or less) of my co-workers take advantage of it. Why? Because they don't want to pay taxes on it now. They need their money for cigarettes, alcohol, starbucks, etc. Others don't understand how a Roth works and those are the ones I try to reach out to, should they bring up the subject.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 401k no match

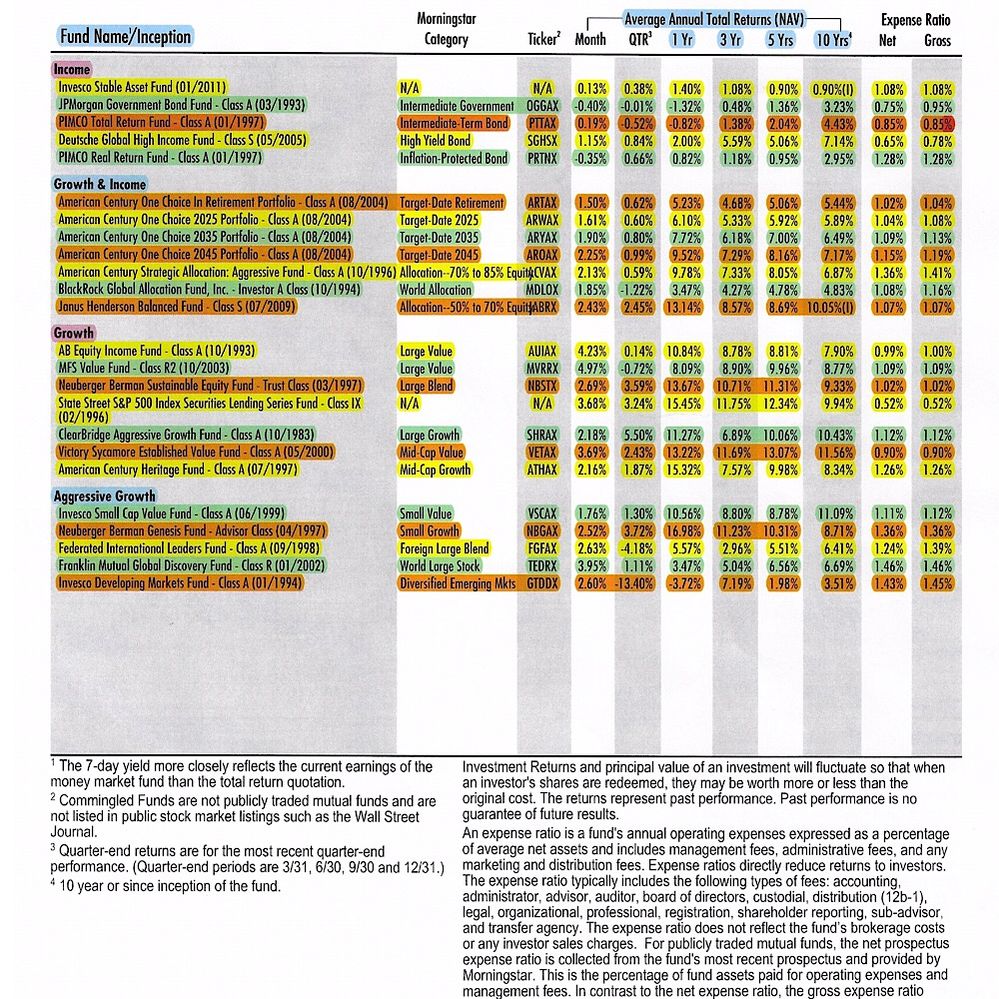

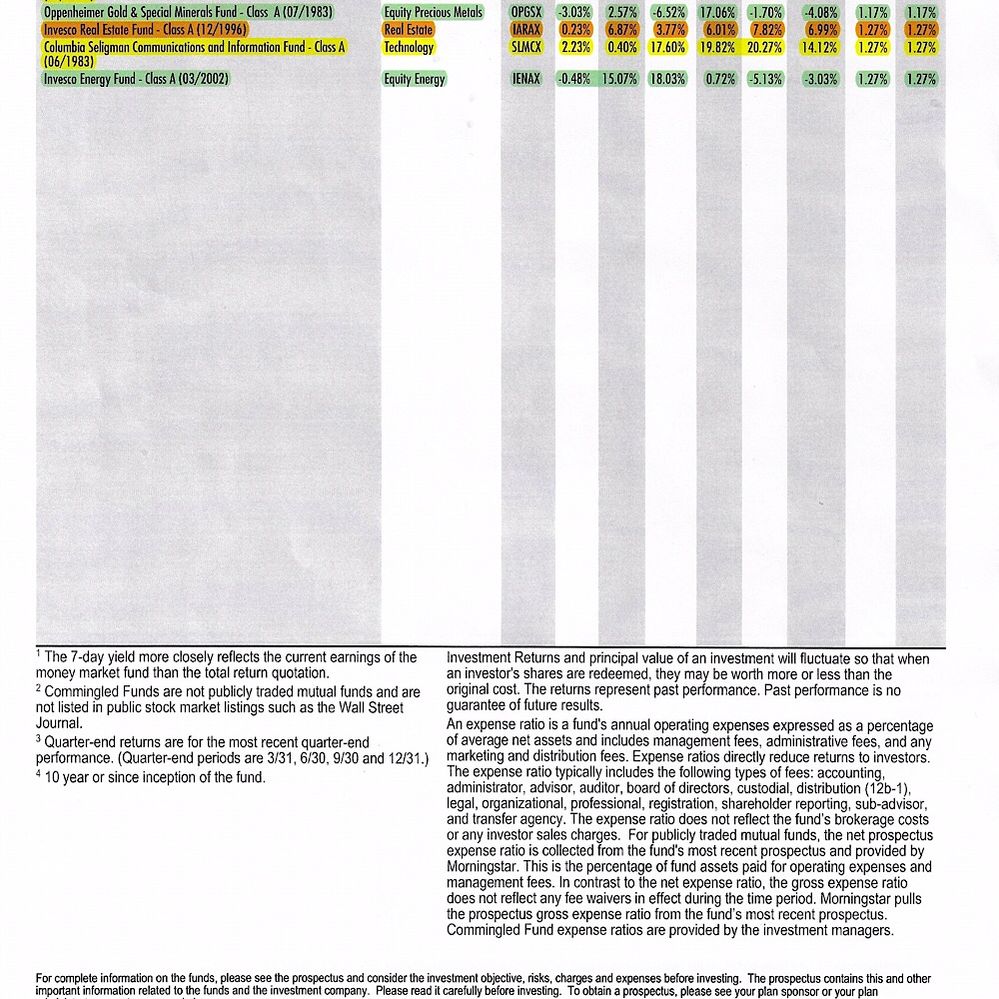

I have to potentially disagree with above posts urging 401K contributions. There are

some common situations where a non-matched 401K is a poor choice for savings.

A couple important considerations:

1. What is the difference between your current tax bracket and where you expect to retire

at ? (Takes some guesswork and uncertainty)

2. What are the expenses for investments offered in the 401K?

3. What are the quality of the investments within the 401K?

When you eventually withdraw from a 401K, you will pay taxes at your ordinary income

bracket. As a comparison, if you had invested that money in a regular taxable account,

you will pay capital gains rates on the gains made. Generally, if you can't reasonably

expect to be in a lower tax bracket in retirement than you are when you defer a

non-matched 401K contribution, it is advantageous to invest the money outside

of the 401K.

Many small employer 401Ks have horrible investment options with annual ERs (expense

ratios) above 1%. As a comparison, index funds at a major brokerage average ~.04% ER.

Index funds are generally very tax efficient in a taxable account, generating only small

annual qualified dividend payments that will be taxed at cap-gains rates, while most of

the gains will be deferred until you eventually sell.

A 401K is a great vehicle, but there are some situations where it isn't the best choice.

Generally it is always worth getting any matching offered, but beyond that you have to

evaluate it carefully.

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 401k no match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 401k no match

Not really, but it depends on how long you think you'll be with your current

employer. 401K accounts are locked in before age 59.5 unless you leave the

employer. Some plans will allow roll overs while still employed after age 50.

A 401(k) plan cannot permit in-service distributions of employee

elective deferral accounts prior to age 59½. ... However, an age

restriction does not apply to an account balance that was

previously rolled over from a prior employer's plan or from an IRA.

In fact, rollover accounts often are unrestricted.

This board is great resource for credit topics, but there are much better places

for investment/retirement savings topics. Bogleheads.org would be one good

place for investing questions. What I posted is not just my opinion, but is widely

held conventional wisdom - Making unmatched contributions to a poor 401K is

very situational.

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 401k no match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content