- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: Advice To Pay Off Debt?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Advice To Pay Off Debt?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advice To Pay Off Debt?

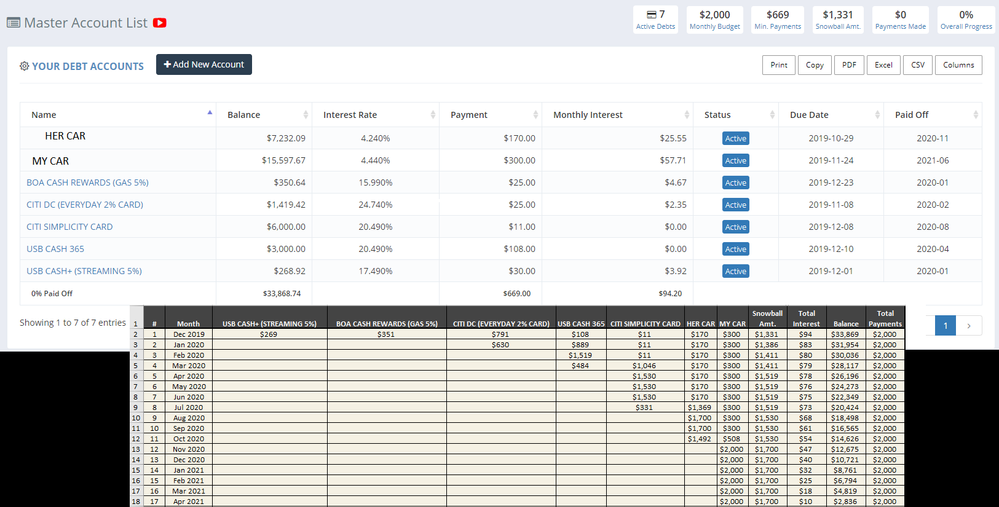

Hello Everyone I have a ugly chart I put together using the following websites for assistance.

1. Mint 2. Undebt.it 3. Credit Karma (yes I know but its what I have to work with)

The charts that is in the photo that you will see is from Undebt.it that is default set at $2000 going to debt. (this was just a estimate)

However the biggest debt credit cards on the photo is from "helping family". but anyway it's there unfortunately.

View This Image Here - Chart - https://imgur.com/iwtoPA0

My question is: What is the best thing to do to pay off everything?

The Snowball Method (based off Undebt.it) states that the 2 Balance Transfer Card should be paid off "last".

Basically we plan to dump all we have into the credit cards (most of the current 7,000 - 9,000k) but is unsure.

The savings is in "ALLY BANK @ $4,094.88 / 1.70 APY".

Well anyway thank you to anyone that provides some advice for us.

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice To Pay Off Debt?

Whew, lots of information going on in that chart. But here goes from my perspective.

First, I've always been of the mindset that one can't save money if one is in debt. So, I see you have over $8.8K in savings but have 3 CCs with APRs of 20-24%.

I could not tell what your CLs were on your cards so I focused on the CitiDC ($2.6K), CitiSimplicity ($7.3K) and USBank ($3.7K). If it were me, I would use at least $8K to pay the DC and USBank cards off immediately and put the remainder on the Simplicity.

I may be wrong but it looks as if you were just transferring debt via BTs from one card to another without really paying down the debt. So kudos to you for deciding you have to take a stance on this debt.

Again, this is JMHO and what I would do. Others will come along with other suggestions or even more solid advice.

GL2U

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice To Pay Off Debt?

Credit Limit = $6,250

This card gives us 2% Cash Back on all our "everyday purchasing". This card is used for "both of us". [This card has "always" been paid off at end of month.]

Citi Simplicity (7.3k) - Rate: Balance Transfer Rate 0% Until Dec 2020.

Credit Limit = $9,600

Your part correct that this was balance transferring many times, only because it was being paid by family members until they stopped paying us back for the assistance they gave us, we didn't want to pay stuff that wasn't ours so just kept paying the min. (I know that's bad, but it was annoying to pay stuff that isn't your debt)

U.S. Bank (3.7k) - Rate: Balance Transfer Rate 0% Until May 2021.

Credit Limit = $8,200

Honestly this is more on the GF (Girlfriend) this was on a Credit Union Credit Card at 1st that was "No Fee to get CASH" she used this money to assist a family member, and yet again stuck with the debt, did a balance transfer to avoid the higher APR from the credit union because it was available to me, the balance transfer was recently completed like last month.

Bank of America Cash Rewards Card

Credit Limit = $15,000 - "(Only used for GAS for both of our cars getting a 5% Cash Back on GAS).

There is still more credit cards that I have that has been locked up in a case for no longer use (same with her credit cards.)

NOTE: typed this on a phone so hope the information is there that you needed.

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice To Pay Off Debt?

if you are not planning on dipping into your checking/savings, then your "Snowball Payment Schedule" is just fine. although, personally I would pay the simplicity off before the usbank because technically it's interest free period expires first. you are not going to do much better than less than $100 of interest on $37000 debt: most of your monthly interest is coming from your car payments, you are paying virtually no credit card interest.

the biggest challenge for you seems to be to stop adding debt. it looks like you picked up 7000 in cc debt from just a few months ago when a debt payment plan was suggested for you.

9/2022 $30000 |  8/2020 $20000 |  12/2018 $30000 |  8/2016 $30000 |  3/2016 $21000 |  5/2014 $20000 |  10/2007 $8900 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice To Pay Off Debt?

"the biggest challenge for you seems to be to stop adding debt. it looks like you picked up 7000 in cc debt from just a few months ago when a debt payment plan was suggested for you"

Response: Tell me about it, lol ![]() - however thats what I get for being nice to family members I guess.

- however thats what I get for being nice to family members I guess.

But this is what I have done so far today paying down some stuff. waiting for next payroll for us this month (Decemember).

(hopefully keep the spending down on the CITI DOUBLE CASH CARD).

- https://imgur.com/kYfDD4G - Updated Chart -

P.S - "Car Insurance" was removed from the "USB Cash + Credit Card" now directly coming out of checking instead.

Why? it was only for the 1st down payment of switching car insurance, credit card only gave it 1% cash back anyways vs the $4 for using Checking Account.

Anymore advice? or how is this path now?

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice To Pay Off Debt?

Does anyone have any comments on the changes? would like the advice very much. - Thank You.

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice To Pay Off Debt?

@JetOneTV wrote:

My question is: What is the best thing to do to pay off everything?

The Snowball Method (based off Undebt.it) states that the 2 Balance Transfer Card should be paid off "last".

Basically we plan to dump all we have into the credit cards (most of the current 7,000 - 9,000k) but is unsure.

I did the Snowball Effect on my debts and cleared almsot $65k in 10 months, which you look like you have less than that.

I did the lowest balance to high balance vs the Avalanche because it allowed me to clear all my smaller CC, that just had balances hanging and I couldn't use them since they were maxed out most times.

I also agree that if you can use it, take the money (the $8k) from your savings to speed up the payoff. I know you did for family and don't want to pay more than the minimum, but you don't want the debt you have to double due to interest. That way that $7-9k (not sure where that number came from versus teh $2k/mo you have budgeted) you can put towards debt will then go to replenish/grow your savings. I did the math and it appears your CCs are approx. $11k, you could take the savings and payroll and pay it off in 2-3 months, and only have your cars left. Then any additional money can go towards them to pay them off in no time (looks like 3-10 months, depending on the numbers you are using for debt repayment - the $7-9k or the $2k).

Again regarding the family debt, I would pay it off and make note of the amount you paid in principal and interest and start sending certified letters requesting payment for the debt (and gathering acknowledgement of the debt, if you go to court it will be in your favor) and look into taking them to court if they refuse to pay. Sometiems we don't want to do that, in that case as well, pay it and move on, maybe find out if you can write it off as an unpaid debt (like complanies do) and send them a debt forgivenness letter (through the IRS) that requires them to count that forgiveness as income on their taxes.

Hope it helps!

Starting Score: EQ644; TU633; EX632

Starting Score: EQ644; TU633; EX632Current Score: EQ704; TU714; EX707

Goal Score: 750+

Take the myFICO Fitness Challenge 2019