- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex nextstep

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex nextstep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex nextstep

As a data point, I noticed that I no longer have an offer for the loan.

My EX score reported by Amex has dropped a few points to 755 due to new accounts reporting (was previously in the 760s) so I'm not sure if this made a difference or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex nextstep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex nextstep

@Anonymous wrote:

The docs were all signed electronically. I think there were just one or two forms (tos). I don't think Ive updated income to Amex since I got my Blue card several years ago, so I'm not sure what they think it is. I'm betting they probably relied more on my credit report, though, as the offer was half of my debt load, and my payment to are never late. Uncle, perhaps the offer just expired?

That's very possible... I only mention that my score has taken a slight 'hit' as a data point for others.

Until more of us take the offer (or get the offer) all we can really do is speculate about what drives it. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex nextstep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex nextstep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex nextstep

Good information in this thread. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex nextstep

Is there anyone who has accepted this offer had a report yet? If this one gets reported could you please report it to this thread for me and I'll do the same.

Data points – 92k income, $54k mortgage (64k loan), 21k revolving (more than half is 0% APR.), 3233% utilization appeared on my credit report that was used to determine approval. (Now due to payments, credit limit increases and new account my utilization will be around 10-15% - so should be a real nice boost in my scores next month or maybe not since I did open three new accounts, not counting the next steps loans), 706 FICO EX score from my American Express account at the time I accepted the loan. No open installment account, 5 to 7 paid and closed installment accounts. no collections. One paid off charge-off from installment from 2011. Only have the American Express every day credit card and I haven't had the card for approximately 18 months. Balance was about $10,000 with a limit of $24,000 (on report) but had just made a $1000 payment to bring the actual balance to $9000. News account open five months ago. Five new revolving accounts opened past 2 years ( Will be eight next month). got approved for two Bank of America credit cards including my second better balance reward card and the Upromise card from Barclay. ( off-topic not related to thread but I had $12, 000 limit between two bank of America credit cards - 5k, 7k - the start of the month then one day last week I applied for two cards and credit limit increases on the two cards I had. Only got one inquiry Out of the entire deal. my national education Association rewards card was approved for $9000 and my better balance rewards (2nd!) card was approved for $9000. My oldest card from 2013 was increased from $7000-$11,700 and my card from 2015 was increased from $5000-$9300. $18,000 a new credit and $9000 in credit limit increases for a total of $27,000 in new credit. So $12k to $ $39 in 1 hp was pretty amazing!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex nextstep

@Vegas4Play wrote:

@jgodfrey82 wrote:

I log into my amex account today and get offered a pre-approved "nextsteps" consolidation loan by amex.. 8.9% rate, up to 25k, they send the funds direct to other credit cards with no fees at all no prepay and no origination. Faq said it would not even show up on my reports unless I default and payments are fixed with 3 payment schedule options. I've never seen this amex product before and no search results were found when I searched. Anyone?

I am admittedly carrying a large debt load right now renovating a home I'll sell next month, my scores have gone down quite a bit due to the new balances but I won't go over 50% total util. Maybe the new debt triggered it. They are also offering me a 50k plat upgrade on my BRG and send me merchant financing offers all the time, so I'm guessing I'm good with amex. I'm almost interested to accept just to see how/if it reports.Ok so dear mom lost her Amex EDP so I login to request a replacement.

Low and behold I see the Next Step Loan pop up for 25K at 7.99...I'm like what the????? Amex really

So I go to google and not much, then found this thread. Called mom to ask if I can experiment. She said go on, _____ go on, just dont apply for any cards for me.

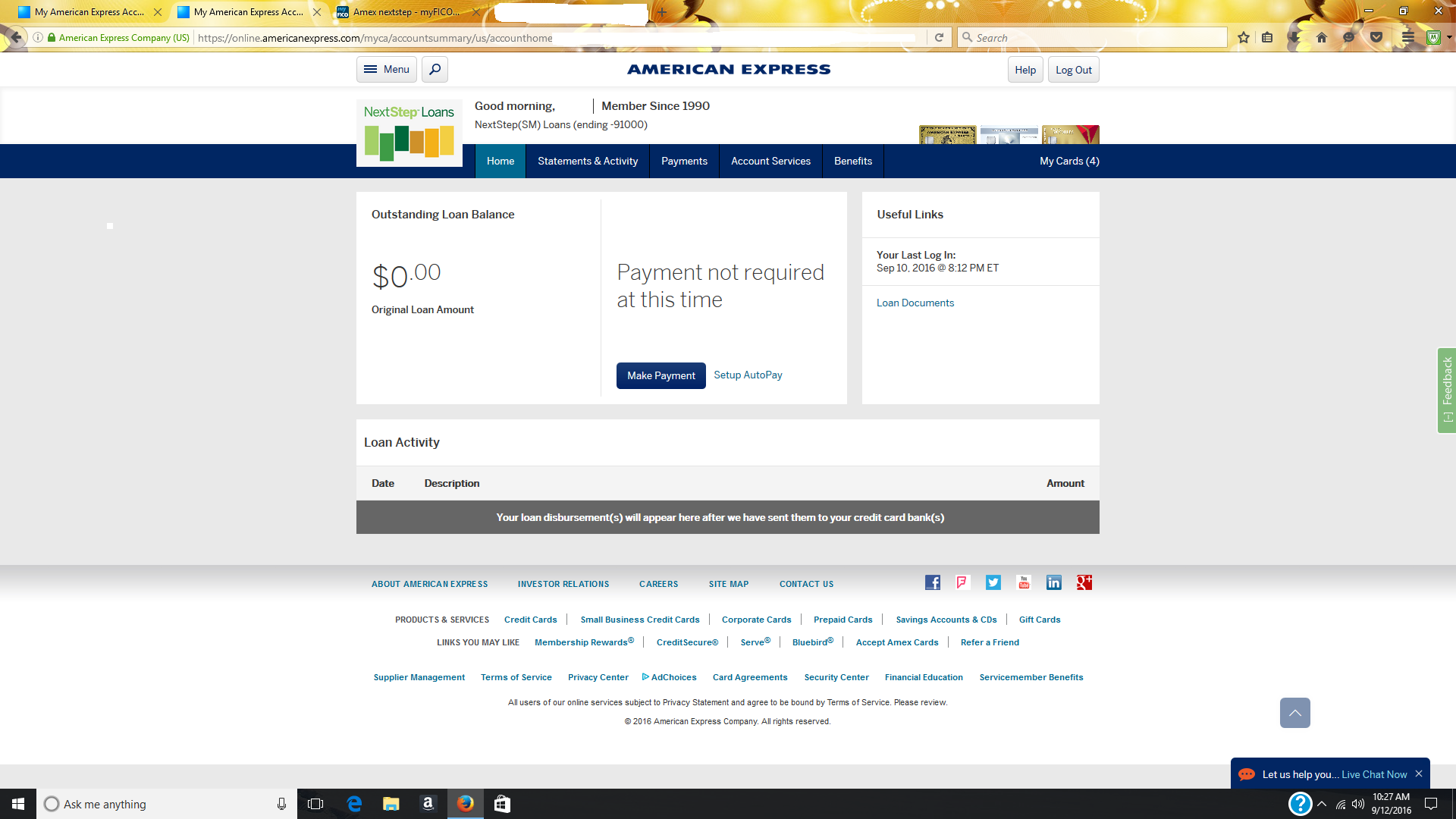

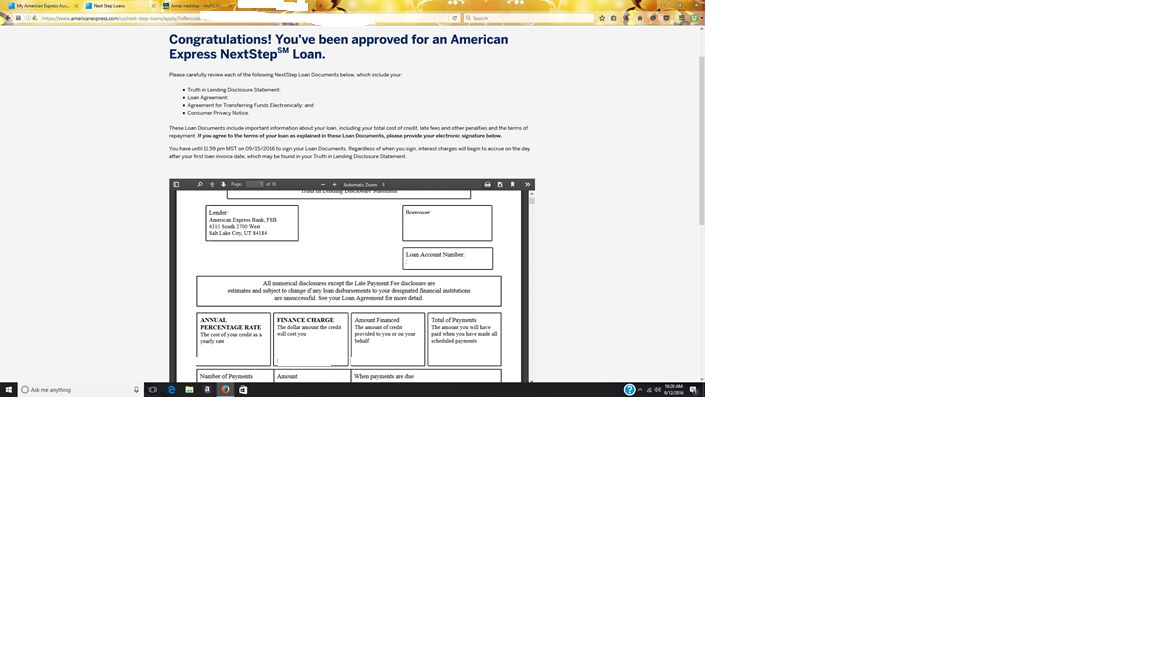

@Anonymous I ask what balance she has, said 4K on Discover I'm like ok. So I plug in the info and APPROVED ( not like I expected any other outcome) Printed loan docs, signed electronically. 4K @ 7.99 12 months (will pay it off way before then). So far no hits to credit it went really smotth and easy shows in account as Next step loan up in the corner where cards are listed.

Update: I just checked Mom's Creditkarma and EQ shows American Express TSR as an unsecured loan. Reports on TU as Amex as an unsecured loan. So it will report ( not hidden).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex nextstep

I logged into hubby's Amex Clear account a few minutes ago and he has been pre-approved for a NextStep loan. Idk if this has been reported before but it looks like you can now use the loan 2 different ways (1) debt consolidation and as a (2) personal loan. IIRC, in the beginning it was only for debt consolidation.

I know there was also some confusion as to whether the NextStep loan was hidden. The below verbiage is taken straight from Amex's site.

"You must be pre-approved for a loan offer in order to apply. Your pre-approved APR and loan amount are based on your credit worthiness and other factors. Pre-approved APRs will be between 6.98% and 19.97%. Not all customers will be pre-approved for the lowest APR or the highest loan amount. If you are approved for and accept a NextStep Loan, we will report the loan information to credit bureaus, which may have an impact on your credit score."

I hope this information is valuable to someone. Enjoy your evening everyone and see you around the forum!![]()