- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Best Way to Add a Loan to My Credit Report

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best Way to Add a Loan to My Credit Report

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best Way to Add a Loan to My Credit Report

I currently have 7 credit cards, 1% utilization, 1 inquiry, 4 derogatories (that will fall off in late 2019) & 1 loan from Affirm that only reports to Experian (it was 12 months & will be paid off in Dec 2018). Two closed mortgage accounts will fall off of my credit report in Spring 2020. As you can see by my profile name, I want to buy a home in Spring 2020. So between now & then I need to diversify my account types in a way that will be most attractive to mortgage lenders.

I need a new car, but I'm self-employed & have had very unsteady income over the past couple years as I've cared for my mom with Alzheimers. So I don't think I will look attractive to auto lenders. But I do have cash to buy a car. And I have a $50K CD. So I'm seeking advice on a strategy to use either a paid-in-full car or the CD to get a secured loan & pay the least interest possible yet benefit from having a paid-as-agreed loan on my report at all 3 credit bureaus.

I've gathered puzzle pieces of how to do this from reading various posts & articles. But I don't have enough pieces to form the best strategy for me. I don't currently belong to a credit union, and I don't fall into any of the most common eligible groups. But I saw some sites today that gave me the impression that credit unions have found a way to partner with cause-related non-profits that you'd join for $10-$15 in order to qualify for their credit union (a loophole to expand their market I'm sure). But in general, I'm ignorant when it comes to loans, since I was salaried, then married, then single but caregiving & not making a steady income. I haven't been a lender's dream, so I've stuck with revolving credit up until now.

Another option is financing a $2,000-$2,500 laptop, but I'm not sure how financing a purchase like that (say through Dell) is reported or how to find out. That's the only thing I would use loan money for anyway.

Then another thing I read about today was getting a secured CD through your bank where you pay into the account every month for X months (at least 12) then get it back at the end.

As you can see, I have just enough knowledge to be dangerous & not enough to create a smart strategy. Any thoughts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Way to Add a Loan to My Credit Report

Happy to help. Will the two closed mortgage loans still be on your reports when you close on your new home? It sounds they will but I can't be sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Way to Add a Loan to My Credit Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Way to Add a Loan to My Credit Report

You have raised an interesting question. The short answer is that there is definitely a way to get an open loan on all three reports -- a loan that you will end up paying almost no interest on. So the good news is we can definitely help you do that if you end up deciding that is the right thing to do. You also have plenty of time to make that decision -- you do not need to do it now or even next month.

Given that you will have no installment account (closed or open) on two of the three bureaus, the right decision will probably to add one, since no loan of any kind will hurt the Credit Mix category and that's true for all FICO scoring models.

Do you have anyone in your extended family in the military? Grandfather, uncle, parents, whatever? If so I'll recommend joining Navy Fed CU. They have a nice product that would be perfect for you.

If not, don't worry, there are many other banks and CUs that will work.

Under mo circumstances should you attempt to get a "financing" loan (one possibility you raised). Those are often tagged by FICO as CFAs (Consumer Finance Accounts) and they actually harm your score. The loan I have in mind for you instead is a Share Secured Personal Loan. They are usually referred to as SSLs here on the forums.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Way to Add a Loan to My Credit Report

Okay, first, well-written, easy-to-understand response so thank you for that. And for the "hope factor" ... that's always a good foundation to lay down.

On the military front, I have no *living* relatives in the military. But my grandfather served in WWII, two uncles in Vietnam & Korea & my father was in the Air Force for 4 years right out of high school. My mom was one of 13 kids, so I actually never even met these uncles & because my dad's service was before I was born, I don't even think of having any family in the military. Do any of these count?

Sadly, I don't even yet know what falls under the category of "financing loan" of the things I mentioned. Just the financing of the laptop (which I would only be doing for the benefit of the loan reporting not for cashflow reasons)? Or do the CD or car title loans also fall into this camp?

On a separate, but perhaps related question, when researching I ran across another post that said lenders don't look fondly on Consumer Finance Accounts. They listed some CFLs like One Main Financial, Wells Fargo Financial, Citi Financial. But a question that wasn't answered is ... how would you even know that a lender you're looking at is a CFL. I know that's not the path we're walking down here, but it is a misstep I'd like to know to avoid any boo-boos on future decisions. Nothing worse than working hard to make a positive step & having it have negative implications.

I also read a long post a several months ago about Share Secured Personal Loans I think through Alliant (might be remembering that name wrong). But it seemed that they were considered on this forum to be the go-to option for SSLs, but they stopped offering them somewhere around 12/29/2017 & no one had identified an equally good replacement as of my reading the pinned update at the top of the post.

As I understood it at the time, the key factors were no penalty for paying it down early, low interest, maybe low minimum $$ amount, 12+ month term & didn't need any special qualifiers to join? Am I missing key factors you'd look for in the ideal scenario?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Way to Add a Loan to My Credit Report

@HomeBuyerSpring2021 wrote:Okay, first, well-written, easy-to-understand response so thank you for that. And for the "hope factor" ... that's always a good foundation to lay down.

On the military front, I have no *living* relatives in the military. But my grandfather served in WWII, two uncles in Vietnam & Korea & my father was in the Air Force for 4 years right out of high school. My mom was one of 13 kids, so I actually never even met these uncles & because my dad's service was before I was born, I don't even think of having any family in the military. Do any of these count?

Any of those relatives make you eligible for NFCU membership. If you apply for membership by phone or in-person at an NFCU branch they typically will not ask for proof of eligibility or they will just ask which branch your relative served in; if you apply via the online application it asks for documentation. In any event you should get the DD-214 for your father since as next of kin that would be easiest to obtain and NFCU periodically audits accounts and will close them if you cannot prove eligibility. You can obtain his/their DD-214 here: Veterans' Service Records

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Way to Add a Loan to My Credit Report

Thanks Maize!

As far as CFAs, the best way to guess whether an account will be tagged as such by FICO as such is as follows. A credit card, even a store card, is not a CFA. That's because you can use a credit card for many different things -- and if you pay the balance to zero it still stays open. An ordinary vanilla personal loan (secured or unsecured) from a regular bank or CU is not a CFA -- because you can use the money for many different things. Nor is an auto loan or a home loan (etc.).

A CFA is where you are wanting to buy a particular item (a sofa at Rooms To Go, a washer/dryer at Best Buy, a laptop at ACME Computers, etc.) and that store offers you a special "financing" deal, basically a loan but only for that particular item. (And we are not talking about a car here.) It is also possible that the general personal loans offered by some of the shadier or more more recent lenders (Lending Tree, etc.) might be tagged by FICO as a CFA (opinion is mixed here).

A general personal loan from Navy or Alliant or any number of well established banks or CUs will not be tagged as a CFA.

If you do go the route of opening a personal loan, the term in your case should be at least 24 months (you mention 12 months). If you opened a 12 month loan next month it would close before you bought your house, which would not be ideal.

We can walk you through the steps if you go that route. But take Maize's advice and try to get in with Navy first. If you do, we can tell you exactly what to do.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Way to Add a Loan to My Credit Report

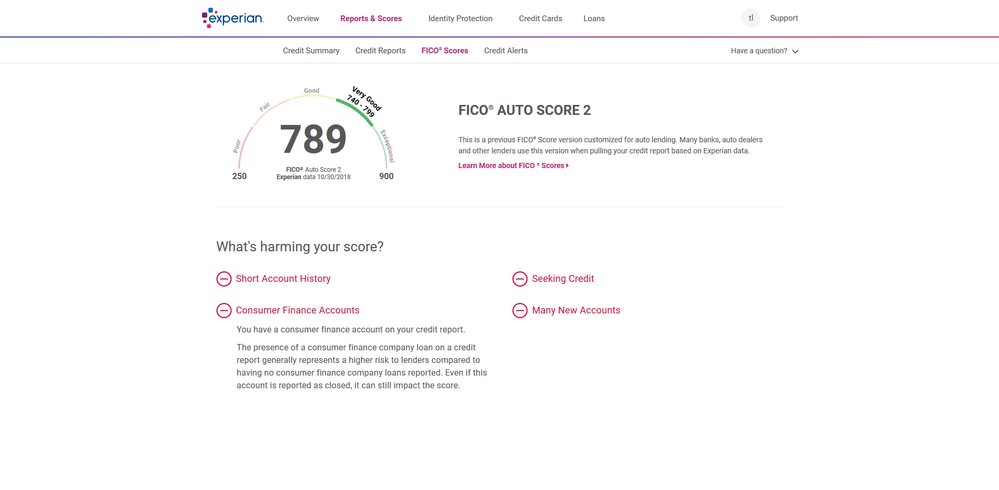

I am not so sure that Alliant's SSL does not report at a CFA I have no store cards and only one installment loan a SSL from Alliant. The following screenshot shows a CFA is affecting my score on Experian. I have seen the same alert on other sites as well.

How ever I am sure the points gained far out weigh the points lost.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Way to Add a Loan to My Credit Report

Very strange. Can you list all the accounts that are on your EX report?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Way to Add a Loan to My Credit Report

All open accounts showing on my Experian credit report as of today.

Open Accounts

ALLIANT CREDIT UNION SSL (Installment)

AMEX BCE CC

BK OF AMER BBR CC

BLISPAY CC

CAPITAL ONE Quick Silver

CC CAPITAL ONE Venture CC

CHASE CARD Freedom CC

CHASE CARD Freedom CC

CHASE CARD CSP CC

CITI DC CC

DISCOVER IT CC

NFCU GO Rewards CC

PENFED Plat Cash Rewards CC

US BANK Cash+ CC

Closed Accounts

CHASE CARD Slate CC

CAPITAL ONE Quick Silver CC

FIFTH THIRD BANK Trio CC

ESN/HARLEY DAVIDSON Installment Loan Closed September 2012

NATIONWIDE BANK Installment Loan Closed June 2016