- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: Chase Sapphire Banking?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Sapphire Banking?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Banking?

@coreysw12 wrote:Unfortunately direct deposit isn't an option for me, I work for a small company where the owner processes payroll himself, and he's unwilling to get away from paper checks. Sometimes I've avoided the fee by transferring $500 from my brokerage by ACH, but it's hard to remember to do that every month.

There's this thing where you can schedule monthly transfers, though if you forget to make sure there's Money in that account as well, then you've got a problem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Banking?

I just upgraded my accounts to Sapphire banking. The debit card looks cool. Curious, do you know if the debit card is metal similar to the Sapphire credit cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Banking?

@TrueGeminiNC wrote:I just upgraded my accounts to Sapphire banking. The debit card looks cool. Curious, do you know if the debit card is metal similar to the Sapphire credit cards?

I believe you have to keep $1500 in the total checking to avoid monthly fee's (if no direct deposit/see other)

I believe it is Chase Savings for the $300 minimum

I currently have 7 digits in Sapphire checking so no fee's. but the interest rate is peanuts.

I will be moving the funds out real soon and close the account.

I used to have the regular savings, but closed it.

I keep the regular checking, and keep always at least $1500 minimum.

I do agree on the Schwab acct. I use use Schwab High Yield Checking as my main acct.

You just can't deposit cash. and I do not have a branch real close. (about 8.9 miles to be exact)

Chase is convenient, as it is close (3.9 miles) and never a line. BoA next door is THE WORST!!!!! (horrible line ..always)

I find US Bank to work real well, local branch treats me like family![]()

I do not keep a debit card tied to any accounts with a good amount of funds as it is a huge Security issue!.

I have a Schwab Debit card tied to a separate brokerage account that I can transfer funds quickly,

over mobile app if I need cash at a foreign ATM.

All this is subject to change, as my house is sold and I am moving very soon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Banking?

@M_Smart007 wrote:

@TrueGeminiNC wrote:I just upgraded my accounts to Sapphire banking. The debit card looks cool. Curious, do you know if the debit card is metal similar to the Sapphire credit cards?

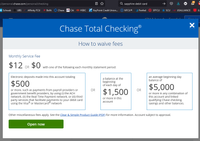

I believe you have to keep $1500 in the total checking to avoid monthly fee's (if no direct deposit/see other)

(click image to enlarge)

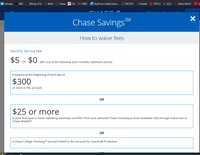

I believe it is Chase Savings for the $300 minimum

(click image to enlarge)

I currently have 7 digits in Sapphire checking so no fee's. but the interest rate is peanuts.

I will be moving the funds out real soon and close the account.

I used to have the regular savings, but closed it.

I keep the regular checking, and keep always at least $1500 minimum.

I do agree on the Schwab acct. I use use Schwab High Yield Checking as my main acct.

You just can't deposit cash. and I do not have a branch real close. (about 8.9 miles to be exact)

Chase is convenient, as it is close (3.9 miles) and never a line. BoA next door is THE WORST!!!!! (horrible line ..always)

I find US Bank to work real well, local branch treats me like family

I do not keep a debit card tied to any accounts with a good amount of funds as it is a huge Security issue!.

I have a Schwab Debit card tied to a separate brokerage account that I can transfer funds quickly,

over mobile app if I need cash at a foreign ATM.

All this is subject to change, as my house is sold and I am moving very soon.

Thanks for the response. Yes, I agree with the security risk you noted. For this reason, I actually have 2 checking accounts--one for deposits and another for withdrawals. The debit card is only linked to the withdrawls account and I move $$ to this account on an as needed basis to cover expenses and misc. spending.

I too struggled with socking such a large sum of cash away in an account that pays peanuts. Thus, I largely use the investment vehicles (automated & self-directed) to help meet the minimum requirements.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Banking?

Chase is my main financial institution and I leverage the same things that iced does from this thread.

I also don't pay any fees for it though as I have non-trivial assets there for the service (CPC now though I started Sapphire checking as soon as they made their announcement IIRC October 2018). Big banks get bad raps and some of that is deserved but I can't complain really at all with my Chase experience over the last decade.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Banking?

If anyone here is either active duty military or a veteran, Chase Military Banking program waives the normal $25 fee on their Premier Plus Checking with no minimum balance requirement. ![]() Also includes other fee waivers including fees on regular savings accounts.

Also includes other fee waivers including fees on regular savings accounts.

Here is the link to military banking: https://www.chase.com/digital/military/personal

Chase's banking levels are:

"Secure" ($4.95); "Total Checking" ($12); "Premier Plus" ($25); "Sapphire" ($25); "Private Client" ($35)

However, these fees can be waived with enough activity or balances. (For example, $15K or a mortgage loan required to waive $25 on Premier Plus and $75K required to waive $25 on Sapphire.) Anytime I've opened banking, if there were any fees I always made sure I knew the loopholes to try to avoid them. Life is too short to pay banking fees. Lol ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Banking?

@Aim_High wrote:If anyone here is either active duty military or a veteran, Chase Military Banking program waives the normal $25 fee on their Premier Plus Checking with no minimum balance requirement.

Also includes other fee waivers including fees on regular savings accounts.

Here is the link to military banking: https://www.chase.com/digital/military/personal

Chase's banking levels are:

"Secure" ($4.95); "Total Checking" ($12); "Premier Plus" ($25); "Sapphire" ($25); "Private Client" ($35)

However, these fees can be waived with enough activity or balances. (For example, $15K or a mortgage loan required to waive $25 on Premier Plus and $75K required to waive $25 on Sapphire.) Anytime I've opened banking, if there were any fees I always made sure I knew the loopholes to try to avoid them. Life is too short to pay banking fees. Lol

Thanks for sharing. Although I am not military, I did ask my banker if she could apply the military discount code to my account as another means to avoid the fees. ![]() . She politely declined.

. She politely declined.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Banking?

OP - I would look at PNC's Virtual Wallet, its designed exactly for what your currently using your Chase accounts for, and PNC has cheaper monthly fees.

The main purpose of Virtual Wallet is a bugeting tool at that links 3 accounts into 1 wallet feature.

A) Spend Account (Checking) - Everyday Spending w/Debit Card.

B) Reserve Account (2nd Checking) - its advertised purpose as a Short Term Savings, but can you use really for any Checking account purpose. I write my checks off this account, my Auto Pays come out of this account monthly. Its where I move accounted money to sit until reconciliation of an Auto Debit or Check clearence happens. This allows my Spend to be a completely real time available balance at all times.

C) Growth Account (Savings) - intrest dicitated based on how much you use your debit card on the Spend, or how much Direct Deposit you have coming into the account. The very base of the savings is no more than any Big Bank statement savings account. If you can meet the threshold with DD or Debit Card Spend then it increases to that of a very basic Money Market. Otherwords nothing to write home about, again typical of all these Big Corporate Banks.

The Virtual Wallet comes in 3 tiers

Basic, the most comparable to Chase Total Checking- 7$ a month or 500$ minimum or Direct Depost. This gives 2 free out-of network ATMs free a month, where PNC wont charge you. and PNC will refund up to 5$ of other banks fees and this is World Wide. Of course all PNC machines are free, including those in 7-11 nationwide.

Performance Spend (Middle tier) - Same features as Basic - however the monthly fee is 15$ and Minimum increases to 2500$. Gives a 10$ monthly ATM reimbursement and 5 waviers a month from OON fees from PNC.

Performance Select - (Top Tier) most comparable to Chase Sapphire - Same feature of basic VW - however monthly fee is 25$ and Minimum is 5000$. Never a PNC fee for OON ATM use, 20$ OON fee reimbursement, Free Domestic Wires, Free Cashiers Checks, Free Personal Basic Check, and up to 8 additional Checking/Savings accounts with no monthly fee, etc, etc, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Banking?

Given that the OP posted their original question 15 months ago I hope they managed to find a reasonable solution ;-)

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Banking?

@coldfusion wrote:Given that the OP posted their original question 15 months ago I hope they managed to find a reasonable solution ;-)

Ahhh .. I guess we were all tricked by the "resurrected old thread maneuver," @coldfusion. I see the OP @coreysw12 hasn't been back on the newly-updated thread either.

I just saw a similar one a few days ago. Someone reopened a thread about one year and a day or two later, so if you weren't looking closely, you might miss the change in year even if you were looking for it! ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.