- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Chase checking/savings offer

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase checking/savings offer

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase checking/savings offer

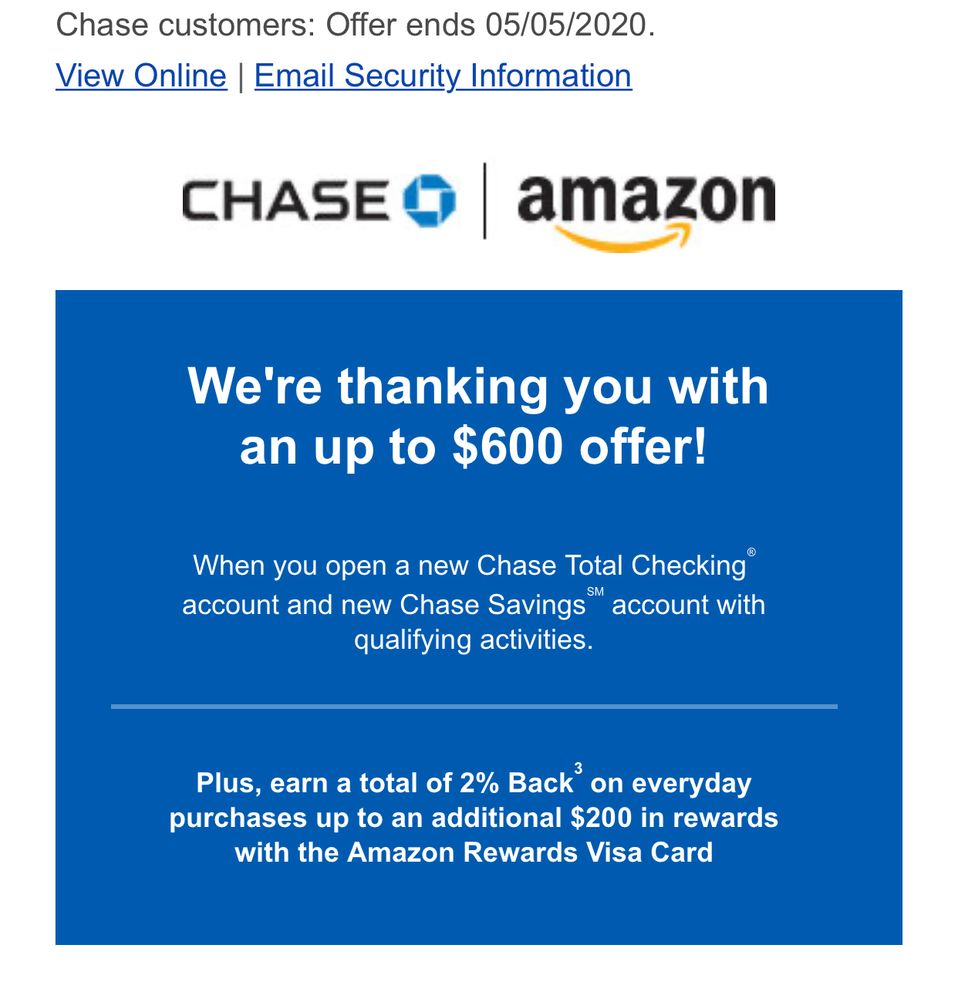

I have the Amazon Chase credit card, and I recently got an email from Chase with an offer of $600 if I open both a checking and savings account. The money requirement for the savings account is no big deal, and I would use direct deposit for the checking account. Is this a good deal, or is Chase worth avoiding for checking and savings accounts?

Any opinions?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase checking/savings offer

12 Monthly Service Fee or $0 with one of the following, each monthly statement period: Direct deposit totaling $500 or more made to this account or a balance at the beginning of each day of $1,500 or more in this account.

If you can meet all the guidelines, it sounds like a good deal. I saw that but don't want to dedicate that much is DDs to them right now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase checking/savings offer

I've had the same offer for several months. I haven't bothered to jump on it because:

1. Tying up $15k in a savings account for 6 months isn't practical for me (I'd have too little left over for emergencies)

2. Splitting my already thin paycheck's direct deposit into another account would crimp the budget too much

3. Chase's savings APY is abysmal. I'd have to close the accounts after earning the SUB. Not worth the hassle.

4. Unlike a credit card SUB, deposit account SUBs are taxable.

It's a pretty good deal if you can swing it, if you thinking of switching banks anyway, or don't mind opening an account for 6 months, but it's not really worth keeping long term, especially the savings which earns something like 0.01%... what a joke.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase checking/savings offer

@Jnbmom wrote:12 Monthly Service Fee or $0 with one of the following, each monthly statement period: Direct deposit totaling $500 or more made to this account or a balance at the beginning of each day of $1,500 or more in this account.

Or an average beginning day balance of $5,000 or more in any combination of this account and linked qualifying Chase checking, savings, and other balances

If you can meet all the guidelines, it sounds like a good deal. I saw that but don't want to dedicate that much is DDs to them right now.

One ACH for $500 will satisfy the requirement... Chase counts those as direct deposits, just not when it comes to bonuses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase checking/savings offer

I've had a Chase CC for a few years, and just recently opened a Checking/Savings almost a year ago for a similar offer. I mainly did it only for the checking because I knew I could swing that requirement, but ended up opening both. I've not had any complaints so far, everything seems to run pretty smooth just about like any other Bank.

If a person has the funds to tie up with them for both SUBs, then I'd say go for it. In that sense $600 isn't something to say no too.

I just couldn't put that much into savings for that long, so i lost out on that one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase checking/savings offer

I passed on this offer (and the similar $900 bonus they offered a few months ago), though with rates falling again it's marginally more tempting. In the unlikely case that interest rates everywhere go back to sub-1%, this becomes a slam-dunk (it's effectively 3.33% for $15,000), but with some places still offering 1.7ish right now, the extra $160 is nowhere near enticement enough to do this. Why? Well...

The main thing holding me back from it is I absolutely despise the idea of opening an account just to rake in a bonus and then abandoning use of it. After I cash the check, there's just no reason to leave a single penny in a Chase savings account, putting me in exactly the above nightmare scenario. If they upped their rates to be at least competitive, I'd do it today (or wait for the $900 offer to come around again), but this is a one-night-stand sort of offer as it stands. No thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase checking/savings offer

If you're looking for a bank I've been using Chase for 10 years now without any of the stupidity I experienced with BOFA.

I'm not saying there aren't better places out there when it comes to customer service, but their infrastructure has worked flawlessly and they've been able to do everything I've needed from a financial institution other than this most recent mortgage go around where they weren't competitive at all even with their alleged CPC discount but they're chasing jumbo loans and I didn't want one of those.

The only problem is their rates do suck but it's why I also keep minimal amounts in their checking account and no savings account since I'm not getting offer to open one (go figure, they have plenty of my money on paper already). For my use case as a financial clearing house, they've been gold.

Out of all the big banks I think they're the best personally, BOFA is sketchy AF, Wells still hasn't fixed their reputation, and US Bank's infrastructure is laughably bad. I don't have enough experience with Citi to opine but I sort of doubt I'm missing much there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase checking/savings offer

Chase doesn't offer Checking Line of Credit (CLOC). You couldn't pay me for the hassle for moving my banking there.

I suppose if you don't know what a CLOC is and want to walk into a local branch its alright.

Chase Ultimate Rewards 661,525 | IHG One Rewards 144,443 | Hilton Honors 143,801 | AMEX Membership Rewards 102,729 | World of Hyatt 90,413 | Marriott Bonvoy 65,343 | Citi Thank You 62,712 | Wells Fargo Rewards 33,652 | Southwest Rapid Rewards 28,105 | United MileagePlus 13,316 | British Airways Avios 12,333 | Jet Blue TrueBlue 11,661 | NASA Platinum Rewards 1,883 | AA Advantage 1,744 | Navy Federal Rewards 792 | Delta Sky Miles 175 | Virgin Atlantic Virgin Points 100 | Lowes Business Rewards 6,992 ($69.92) | Amazon Rewards 475 ($4.75) | Discover CB 499 ($4.99)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase checking/savings offer

I am just not motivated by bank acct. offers.

Taxed at 50% personal income, end up with 1/2 ![]()

Tie up $15K for $300 (after tax).. just rather get a CC SUB.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase checking/savings offer

I go for the smaller ones that don't require all of my liquid Savings to be tied up for months, just a simple DD requirement.

Considering the few tax breaks I get, it doesn't these cash SUBs don't hurt me that much. It's not like I'm raking in an extra $5-10 in SUBs annually.