- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Cheapest way to get POS swipes for high yield chec...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cheapest way to get POS swipes for high yield checking account?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cheapest way to get POS swipes for high yield checking account?

Hey everyone.

POINT ONE:

Recently opened a brand new account with Clackamas Federal Credit Union for a 2.275% APY on their Plus Checking account. Seems like a pretty great deal, cap is at $15k (I am aware others are better but they're local to me) and I thought this would be a good start for trying out high-yield checking.

So... at the branch the guy told me specifically only in-person POS transactions are going to be the only way to generate credit towards the APY. I need twelve transactions a month.

Capped out, what would be the best strategy? At $15,000, that's $341.25 yield per year. Twelve $1 purchases each month would wind up being $144 opportunity dollars being spent to net gain of of $197.25. :thinking: Does that put the actual value of my savings to 1.37%? Am I crazy or is that not .. awesome?

Or wait, is it 341.25 ÷ 144 = 2.37%? ... ?

POINT TWO:

I wish it wasn't this difficult. Selling my house and going to be sitting on a chunk of cash to buy my next house with burning a hole in my wallet while I work on some stuff. Want to diversify/save my nest egg in the best way possible to grow it while I wait about a year to purchase my next home. I am interested in as many considerations as possible. This is a new realm for me.

Thanks all!

Current Score:

Gardening Started with:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cheapest way to get POS swipes for high yield checking account?

@Azza wrote:Hey everyone.

POINT ONE:

Recently opened a brand new account with Clackamas Federal Credit Union for a 2.275% APY on their Plus Checking account. Seems like a pretty great deal, cap is at $15k (I am aware others are better but they're local to me) and I thought this would be a good start for trying out high-yield checking.

So... at the branch the guy told me specifically only in-person POS transactions are going to be the only way to generate credit towards the APY. I need twelve transactions a month.

Capped out, what would be the best strategy? At $15,000, that's $341.25 yield per year. Twelve $1 purchases each month would wind up being $144 opportunity dollars being spent to net gain of of $197.25. :thinking: Does that put the actual value of my savings to 1.37%? Am I crazy or is that not .. awesome?

Or wait, is it 341.25 ÷ 144 = 2.37%? ... ?

POINT TWO:

I wish it wasn't this difficult. Selling my house and going to be sitting on a chunk of cash to buy my next house with burning a hole in my wallet while I work on some stuff. Want to diversify/save my nest egg in the best way possible to grow it while I wait about a year to purchase my next home. I am interested in as many considerations as possible. This is a new realm for me.

Thanks all!

Many dollars have been lost striving for a little more yield.

To use a debit card which is attached to an account with a significant amount of money in it is risky. If there is fraud due to exposure at a card reader, your savings could be wiped out or frozen.

As to your arithmetic, no it makes no sense. The yield is 2.275%. But it's better to have your savings in a place where it's safe.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cheapest way to get POS swipes for high yield checking account?

@Azza wrote:.

Capped out, what would be the best strategy? At $15,000, that's $341.25 yield per year. Twelve $1 purchases each month would wind up being $144 opportunity dollars being spent to net gain of of $197.25. :thinking: Does that put the actual value of my savings to 1.37%? Am I crazy or is that not .. awesome?

The $144 opportunity dollars don't necessarily get fully subtracted (assuming they are spent on something that isn't useless). In the best possible case, you buy something that you would have bought anyway, then you just need to subtract 2 or 3% of that, depending on what credit card you could have used instead. In the worst case, when you buy something and throw it away, yes, subtract the $144.

As stated before, I think @SouthJamaica fears about security are over cautious.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cheapest way to get POS swipes for high yield checking account?

@SouthJamaica wrote:

Many dollars have been lost striving for a little more yield.

Very true, but most notably in institutional speculation. How widespread is it really with debit cards and High Yield accounts, especially when only used online?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cheapest way to get POS swipes for high yield checking account?

@Azza wrote:

So... at the branch the guy told me specifically only in-person POS transactions are going to be the only way to generate credit towards the APY. I need twelve transactions a month.

I'm guessing this means that only PIN transactions are counted. Does the system have a counter showing how near you are to the requirement? If so, I might be tempted to try say an Amazon reload (making sure to click the box making sure it is run as a debit card) and check!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cheapest way to get POS swipes for high yield checking account?

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cheapest way to get POS swipes for high yield checking account?

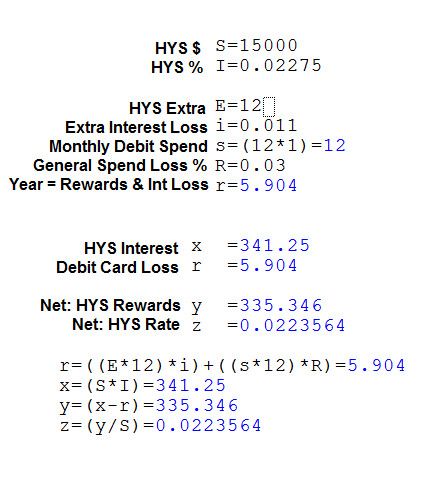

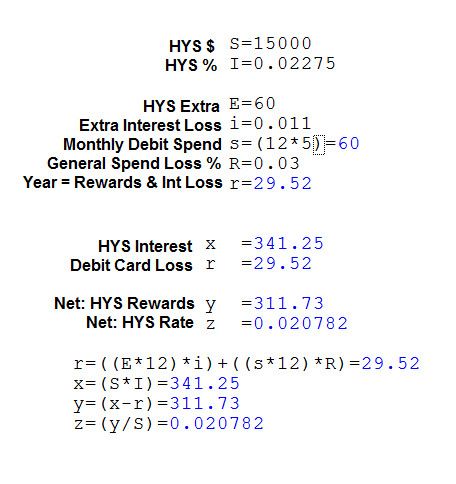

I believe the math is closer to this:

These numbers are with 12 - one dollar purchases and only losing 1.1% interest on 12 dollars a month extra sitting in the HYS for debits. Every month pushing an extra 12 to cover new charges. This also includes loss from switching debit spend from a 3% rewards card.

Same but with 12, 5$ purchases a month:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cheapest way to get POS swipes for high yield checking account?

@SouthJamaica wrote:

@Azza wrote:Hey everyone.

POINT ONE:

Recently opened a brand new account with Clackamas Federal Credit Union for a 2.275% APY on their Plus Checking account. Seems like a pretty great deal, cap is at $15k (I am aware others are better but they're local to me) and I thought this would be a good start for trying out high-yield checking.

So... at the branch the guy told me specifically only in-person POS transactions are going to be the only way to generate credit towards the APY. I need twelve transactions a month.

Capped out, what would be the best strategy? At $15,000, that's $341.25 yield per year. Twelve $1 purchases each month would wind up being $144 opportunity dollars being spent to net gain of of $197.25. :thinking: Does that put the actual value of my savings to 1.37%? Am I crazy or is that not .. awesome?

Or wait, is it 341.25 ÷ 144 = 2.37%? ... ?

POINT TWO:

I wish it wasn't this difficult. Selling my house and going to be sitting on a chunk of cash to buy my next house with burning a hole in my wallet while I work on some stuff. Want to diversify/save my nest egg in the best way possible to grow it while I wait about a year to purchase my next home. I am interested in as many considerations as possible. This is a new realm for me.

Thanks all!

Many dollars have been lost striving for a little more yield.

To use a debit card which is attached to an account with a significant amount of money in it is risky. If there is fraud due to exposure at a card reader, your savings could be wiped out or frozen.

As to your arithmetic, no it makes no sense. The yield is 2.275%. But it's better to have your savings in a place where it's safe.

@SouthJamaica, been there got the "T" shirt

If I remember correctly, someone recommended USALLIANCE FCU .. BTW, they are upping the high yield savings to 1.75% APY tomorrow,

and no gimmics to get that yield. No debit attached, no direct deposit, $500 minimum and no maximum.

Per the rep on the phone, the APY changes tomorrow.

https://www.usalliance.org/banking-products/high-dividend-savings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cheapest way to get POS swipes for high yield checking account?

Cash App usually codes as "POS"- I would suggest trying it out with one small trasaction to see how your CU codes it.

BIZ CCs: Chase Ink Preferred $15,000-Chase Ink Unlimited $6,500-Amex BBC $9,500-Amex BBP $22,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cheapest way to get POS swipes for high yield checking account?

@M_Smart007 wrote:

@SouthJamaica wrote:

@Azza wrote:Hey everyone.

POINT ONE:

Recently opened a brand new account with Clackamas Federal Credit Union for a 2.275% APY on their Plus Checking account. Seems like a pretty great deal, cap is at $15k (I am aware others are better but they're local to me) and I thought this would be a good start for trying out high-yield checking.

So... at the branch the guy told me specifically only in-person POS transactions are going to be the only way to generate credit towards the APY. I need twelve transactions a month.

Capped out, what would be the best strategy? At $15,000, that's $341.25 yield per year. Twelve $1 purchases each month would wind up being $144 opportunity dollars being spent to net gain of of $197.25. :thinking: Does that put the actual value of my savings to 1.37%? Am I crazy or is that not .. awesome?

Or wait, is it 341.25 ÷ 144 = 2.37%? ... ?

POINT TWO:

I wish it wasn't this difficult. Selling my house and going to be sitting on a chunk of cash to buy my next house with burning a hole in my wallet while I work on some stuff. Want to diversify/save my nest egg in the best way possible to grow it while I wait about a year to purchase my next home. I am interested in as many considerations as possible. This is a new realm for me.

Thanks all!

Many dollars have been lost striving for a little more yield.

To use a debit card which is attached to an account with a significant amount of money in it is risky. If there is fraud due to exposure at a card reader, your savings could be wiped out or frozen.

As to your arithmetic, no it makes no sense. The yield is 2.275%. But it's better to have your savings in a place where it's safe.

@SouthJamaica, been there got the "T" shirt

If I remember correctly, someone recommended USALLIANCE FCU .. BTW, they are upping the high yield savings to 1.75% APY tomorrow,

and no gimmics to get that yield. No debit attached, no direct deposit, $500 minimum and no maximum.

Per the rep on the phone, the APY changes tomorrow.

https://www.usalliance.org/banking-products/high-dividend-savings

USAlliance has horrible ACH limits on daily, transfers

They will take your money but it takes time to get it back.

OK, if you don't need it back quick for something. (YMMV)