- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Citi or Discover best for opening a high yield sav...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi or Discover best for opening a high yield savings account

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citi or Discover best for opening a high yield savings account

I have 20k in my chase savings account since I have my mortgage, checking, freedom unlimited, and amazon accounts with them. The APY of .02% on my savings is terrible but I want to keep using chase for checking due to how convenient chase is for me. However, I want to open a high yield savings account and move most my savings in there to get a good APY. I've narrowed myself down to Discover and Citi. Discover would have a $150 SUB for me but if I do Citi and end up getting any Citi cards it might be more convenient to go with them? Then again I know Discover has legendary customer service. For people who have dealt with both lenders, which is the better pick?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi or Discover best for opening a high yield savings account

Avoid Citi at all cost. Their IT is terrible. They once closed down my savings account before paying out a signup bonus, because they conveniently forgot to ask for my SSN (for tax purposes).

They refused to give an explanation until I complained to the CFPB. Then they apologized, reopened the account and paid out the bonus. Of course I immediately closed the account again and swore to never deal with Citi again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi or Discover best for opening a high yield savings account

Would go with a few CU's.. Several have 3.5 range with caps of course or can go CD route as well. Been trying to decide to do with my extra money and certainly don't trust the stock market atm so it isn't going there other then 401k and match of company

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi or Discover best for opening a high yield savings account

@rgd51 wrote:I have 20k in my chase savings account since I have my mortgage, checking, freedom unlimited, and amazon accounts with them. The APY of .02% on my savings is terrible but I want to keep using chase for checking due to how convenient chase is for me. However, I want to open a high yield savings account and move most my savings in there to get a good APY. I've narrowed myself down to Discover and Citi. Discover would have a $150 SUB for me but if I do Citi and end up getting any Citi cards it might be more convenient to go with them? Then again I know Discover has legendary customer service. For people who have dealt with both lenders, which is the better pick?

My answer would be neither of the above. I agree with @CreditCuriosity I would go with credit unions, like PenFed and Alliant.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi or Discover best for opening a high yield savings account

@rgd51 wrote:I have 20k in my chase savings account since I have my mortgage, checking, freedom unlimited, and amazon accounts with them. The APY of .02% on my savings is terrible but I want to keep using chase for checking due to how convenient chase is for me. However, I want to open a high yield savings account and move most my savings in there to get a good APY. I've narrowed myself down to Discover and Citi. Discover would have a $150 SUB for me but if I do Citi and end up getting any Citi cards it might be more convenient to go with them? Then again I know Discover has legendary customer service. For people who have dealt with both lenders, which is the better pick?

Over the last 4-5 years I have had HYS & CD's with many institutions (8). Banks and CU's. No one institution is the best, they all have strong and week points.

Many with the higher rates have some limits that you don't find out until you have money there. Slower transfer speed's, limits on amount per day, week or month you can transfer, a lot of paper requirements to link other accounts, etc.

My highest earning accounts 2 years ago are my lowest this year. My favorite long term accounts are "Barclay's" with a very close second of Marcus (GS). Both are HYS's only no checking accounts. However have always been competitive with interest and have the

least negative things from my perspective.

That said: I have never had an issue with Citi. It was not a high earner last year, so I had a low account balance and my money sitting elsewhere. They offered me a large ~350 bonus for putting 50k in my HYS account for 3 months (Rate Competitive). This year they have been excellent with rates. With the bonus it will be my top dog this year. Over the 5 years middle of the pack.

Discover was one of my accounts that I closed last year, no real issues just preferred others more. So-so interest, features, just liked others better.

I now only have 5 - HYS/CD institutions. Cutting both institutions and credit cards down in number

As @CreditCuriosity said if you are willing to open 3-4 CU accounts. Getting higher interest on first 2k or 3k will give higher earnings. This does however come with a little more work.. The simple way is just pick one and earn a lot more than you are currently.

I think you would be happy with either one.

Both have been neck/neck with very close rates.

You could just flip a coin and start earning some interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi or Discover best for opening a high yield savings account

@rgd51 wrote:I have 20k in my chase savings account since I have my mortgage, checking, freedom unlimited, and amazon accounts with them. The APY of .02% on my savings is terrible but I want to keep using chase for checking due to how convenient chase is for me. However, I want to open a high yield savings account and move most my savings in there to get a good APY. I've narrowed myself down to Discover and Citi. Discover would have a $150 SUB for me but if I do Citi and end up getting any Citi cards it might be more convenient to go with them? Then again I know Discover has legendary customer service. For people who have dealt with both lenders, which is the better pick?

GL2U

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi or Discover best for opening a high yield savings account

My confidence in Discover has shrank a bit over the last few months. It seems like they don't have a clue what they're doing with their checking account offering, so I guess why would one trust their ability to manage the savings accounts?

Months ago, they "temporarily" closed out new applications for their checking accounts and put a date that they'd open them back up again. That date came and went without the ability to apply for a new account -- and then they posted another -- and then guess what, that date came and went too. Now they don't have a date listed at all and there's no peep as to when people will be able to apply again.

Really, what new features could possibly take this long to integrate? Can't stand banks when they take a decade and a half to fix simple issues. Schwab's T&C's on their app is one example. Not being able to hide accounts on the Chase website is another. Discover's issue I just wrote about is a third example. Simple fixes take 6-12 months to fix apparently.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi or Discover best for opening a high yield savings account

@Kforce wrote:

@rgd51 wrote:I have 20k in my chase savings account since I have my mortgage, checking, freedom unlimited, and amazon accounts with them. The APY of .02% on my savings is terrible but I want to keep using chase for checking due to how convenient chase is for me. However, I want to open a high yield savings account and move most my savings in there to get a good APY. I've narrowed myself down to Discover and Citi. Discover would have a $150 SUB for me but if I do Citi and end up getting any Citi cards it might be more convenient to go with them? Then again I know Discover has legendary customer service. For people who have dealt with both lenders, which is the better pick?

Over the last 4-5 years I have had HYS & CD's with many institutions (8). Banks and CU's. No one institution is the best, they all have strong and week points.

Many with the higher rates have some limits that you don't find out until you have money there. Slower transfer speed's, limits on amount per day, week or month you can transfer, a lot of paper requirements to link other accounts, etc.

My highest earning accounts 2 years ago are my lowest this year. My favorite long term accounts are "Barclay's" with a very close second of Marcus (GS). Both are HYS's only no checking accounts. However have always been competitive with interest and have the

least negative things from my perspective.

That said: I have never had an issue with Citi. It was not a high earner last year, so I had a low account balance and my money sitting elsewhere. They offered me a large ~350 bonus for putting 50k in my HYS account for 3 months (Rate Competitive). This year they have been excellent with rates. With the bonus it will be my top dog this year. Over the 5 years middle of the pack.

Discover was one of my accounts that I closed last year, no real issues just preferred others more. So-so interest, features, just liked others better.

I now only have 5 - HYS/CD institutions. Cutting both institutions and credit cards down in number

As @CreditCuriosity said if you are willing to open 3-4 CU accounts. Getting higher interest on first 2k or 3k will give higher earnings. This does however come with a little more work.. The simple way is just pick one and earn a lot more than you are currently.

I think you would be happy with either one.

Both have been neck/neck with very close rates.

You could just flip a coin and start earning some interest.

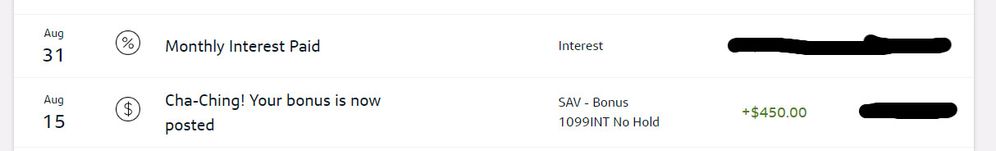

Error above :

Cap1-360 bonus was $450

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi or Discover best for opening a high yield savings account

Which one usually has the better customer service? I know JD Power will probably say Discover but what do the people on this site think?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi or Discover best for opening a high yield savings account

Discover has great 24 7 US based customer service. I have been with them 32 years credit card wise and 12 plus years checking and savings wise. Edited to add

Here is a link showing credit unions high hield savings rate. The region is set to where I live so you may need to adjust as needed.

https://www.depositaccounts.com/savings/

Also If you are thinking of a CD I would encourage you to check Lafayette Federal Credit Union

https://www.depositaccounts.com/banks/lafayette-cu.html#rates

Discover 09/90 19,000, JCPenney 10/2008 4,700 US Bank Cash 12,000 Citibank Custom Cash 5/2015 11,100 State Dept. FCU 15,000 06/2023 , 02/2024 Redstone FCU Signature VISA 10,000 Banking: Ally Bank Credit Unions: Lafayette FCU Fortera FCU State Department FCU Pelican CU

Pelican State CU Redstone FCU