- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Credit Karma Savings??

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Karma Savings??

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Karma Savings??

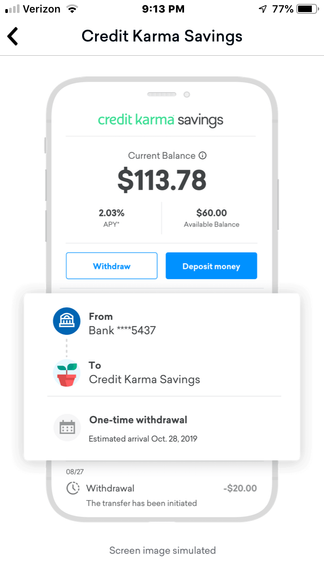

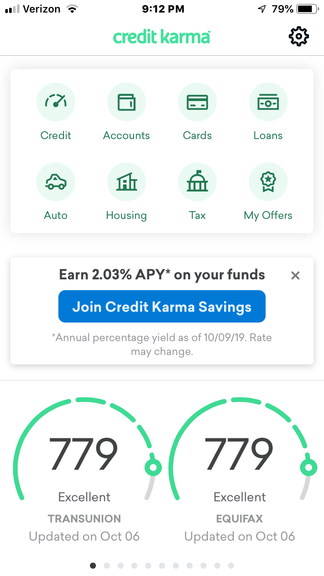

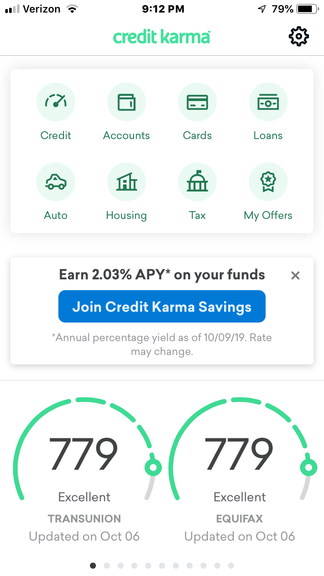

So I got an alert from CK and I guess they offer Savings Accounts now? snagged some screenshots from my phone. Have I just been out of the loop?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Savings??

Oh wow! Everyone is getting in on the savings game!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Savings??

@credit_is_crack wrote:So I got an alert from CK and I guess they offer Savings Accounts now? snagged some screenshots from my phone. Have I just been out of the loop?

@credit_is_crack.. so did you throw a few $Mill at it?![]() ...hmmm FDIC insured???

...hmmm FDIC insured???

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Savings??

@M_Smart007 wrote:@credit_is_crack.. so did you throw a few $Mill at it?

...hmmm FDIC insured???

It's apparently just a face bank and uses other banks to get that FDIC insurance. Since they use multiple banks the insurance can stack. Not sure how they got all the way to 5M but that's how they got more than 250k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Savings??

@ToxikPH wrote:

@M_Smart007 wrote:@credit_is_crack.. so did you throw a few $Mill at it?

...hmmm FDIC insured???

It's apparently just a face bank and uses other banks to get that FDIC insurance. Since they use multiple banks the insurance can stack. Not sure how they got all the way to 5M but that's how they got more than 250k.

A few solutions:

1. Put the money in one of a few (mostly? entirely?) Massachusetts-based banks that participate in the Depositors Insurance Fund. Unlikely in this case, since there's no cap for DIF and CK's offer is limited at $5M.

2. Partner with 20 or more different banks (not hard at all given CK's scale, and that CK likely handles all the marketing so the banks' costs are low).

3. Partner with one bank and let that bank spread the excess out to other banks.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Savings??

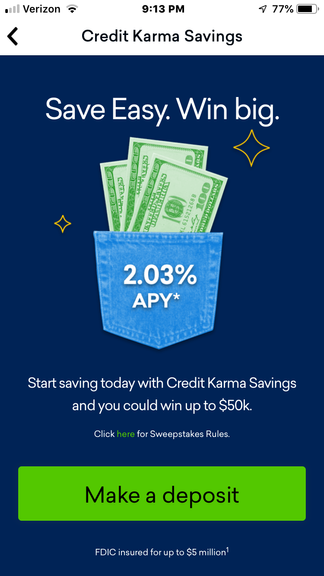

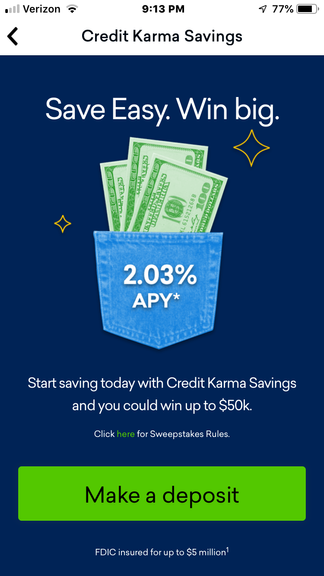

I got an email from CK. Now they have a $50K drawing if you open a savings account and deposit at least $1 into it.

"Thanks for being a valued Credit Karma member. As a reward, we're giving you early access to Credit Karma Savings and a chance to win up to $50,000!* Open and make a deposit (of at least $1) in your account by October 25th and you'll be automatically entered to win."

From reading the fine print, it's handled by MVB Bank and a quick google search shows they do a soft pull for opening an account. I'd like confirmation of this since I do NOT want a hard pull (my reports are frozen anyway). 2.03% APY is more than I get at my current CU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Savings??

Just opened an account because Goldam annoyed me and I needed another high yield APY. Very easy, used most of my Credit Karma profile and connected to my TD Bank account in a matter of seconds. No hard pull by any chance

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Savings??

ETA - Logged in and here is the fine print. Seems legit.

“The Annual Percentage Yield (APY) shown is current as of 10/25/2019. This rate is variable and may change. No minimum deposit to open account. Balance must be at least $0.01 to earn APY. Maximum 6 withdrawals per monthly statement cycle.

1. Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply. Maximum 6 withdrawals per monthly statement cycle.

2. Source: FDIC's national average savings rate as of 10/25/2019.

3. The balance in your savings account may be moved to one or more network banks where it is eligible for FDIC insurance up to $5,000,000 once the funds arrive at a network bank. Actual insured amounts may be lower or adversely affected based on any balances you hold at a network bank. Learn more at: https://www.fdic.gov/deposit/deposits.“

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Savings??

Oops, didn't realize this was already mentioned ![]()

TCL: $89,350 • If it ain't got rewards, I don't want it

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Karma Savings??

I hopped on this pretty much as soon as I got the email. Only thing I can't figure out is how to link more than one account to deposit from? I don't think that functionality exists.