- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Did banks get rid of the 6 limited transactions on...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple cards?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple cards?

Added the Chase Saphire card for the welcome bonus, which gives me 7 cards.

Had a few cards closed for inactivity...probably not a good thing given they were some of my first/oldest credit cards and I'm in my late 20s. So I decided to tie small payments (sirusXM, netflix, etc) to each card.

Keep all my money in an Ally savings, have a local bank but keep the min balance in it (mostly just to have a local bank).

(1) Reading conflictings reports if the government got rid of the 6 transactions per month on savings accounts. Ally said they are keeping track and giving me alert emails but they aren't charging me or closing my account. Technically I can add some money to my local bank and move the autopayment for the smaller credit cards with the local bank, but I'd prefer to keep all payments at one place (Ally bank).

(2) Three of my credit cards are capital one, I'm not sure if there is a such thing as combing the payments into one payment to capital one instead of paying each card individually?

(3) Although I have a good credit score 800+ "things affecting my credit" always list too many accounts with balances, not sure if this is something I should be concerned with and work around it (use the card randomly every 6 months) or if the hassle isn't worth it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple ca

1) Not sure, I thought they were suspended cause of COVID.

2) Nope, gotta pay each one individually. Doesn't matter that they're all with Capital One.

3) FICO will always give you stuff it doesn't like, but if your scores are already 800+, then it's probably not worth the hassle trying to address them all.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple ca

The Federal Reserve removed the 6 transactions limit on savings last year, but not all banks removed the limit, you need to check with each bank

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple ca

Citibank removoved the limit a month or so ago.

Just opened a savings account at Chase and it has the 6 monthly withdrawal limit.

Honestly if you need more than 6 withdrawals a month you should have a checking not a savings account.

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple ca

@MakingProgress wrote:

Honestly if you need more than 6 withdrawals a month you should have a checking not a savings account.

^This. OP, you're using your savings account like a checking account; that's really not how they're intended. Why not just open a checking account?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple ca

@SoCalGardener wrote:

@MakingProgress wrote:

Honestly if you need more than 6 withdrawals a month you should have a checking not a savings account.

^This. OP, you're using your savings account like a checking account; that's really not how they're intended. Why not just open a checking account?

I don't get the distinction, honestly. If I don't want to write checks why not let me use a savings account and just push or pull electronic payments? It's not like checks are much of a thing anymore, so I feel the two types of accounts could easily be merged.

Personally I have a CU savings account that I have always used like a checking account, with the exception of actually writing checks. I do transfers and payments and have never had an issue, and I will keep doing things the way I've been doing them unless the CU suddenly institutes a monthly limit on transactions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple ca

@disdreamin wrote:

@SoCalGardener wrote:

@MakingProgress wrote:

Honestly if you need more than 6 withdrawals a month you should have a checking not a savings account.

^This. OP, you're using your savings account like a checking account; that's really not how they're intended. Why not just open a checking account?

I don't get the distinction, honestly. If I don't want to write checks why not let me use a savings account and just push or pull electronic payments? It's not like checks are much of a thing anymore, so I feel the two types of accounts could easily be merged.

Personally I have a CU savings account that I have always used like a checking account, with the exception of actually writing checks. I do transfers and payments and have never had an issue, and I will keep doing things the way I've been doing them unless the CU suddenly institutes a monthly limit on transactions.

I actually see what you're saying, so all I can offer is this: it's tradition. Checking accounts--which one of these days will likely be called something else--were used for paying bills and buying groceries and so on. Savings accounts were for exactly that, saving money. Today, although physical checks are rare, they're not extinct. Not long ago I had a new sprinkler/irrigation system installed, very sophisticated with timers and remote controls and stuff. And the company, who's been in business here for decades, only takes checks. The California Earthquake Authority only takes checks. (I have my policy through Allstate, but unlike my other Allstate policies, when I make my payment for the CEA policy, Bank of America actually cuts a check and mails it to them; they don't accept electronic payments. Yet.)

It may seem like a matter of semantics, but really a checking account is what you ought to be using for the purposes you've described. That's what they're designed for, along with using their associated debit cards, ATMs, bill pay features, etc. But if you're happy doing things the way you've been and want to continue with that method, then stick with a bank/CU that works for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple ca

@Anonymous wrote:Added the Chase Saphire card for the welcome bonus, which gives me 7 cards.

Had a few cards closed for inactivity...probably not a good thing given they were some of my first/oldest credit cards and I'm in my late 20s. So I decided to tie small payments (sirusXM, netflix, etc) to each card.

Keep all my money in an Ally savings, have a local bank but keep the min balance in it (mostly just to have a local bank).

(1) Reading conflictings reports if the government got rid of the 6 transactions per month on savings accounts. Ally said they are keeping track and giving me alert emails but they aren't charging me or closing my account. Technically I can add some money to my local bank and move the autopayment for the smaller credit cards with the local bank, but I'd prefer to keep all payments at one place (Ally bank).

(2) Three of my credit cards are capital one, I'm not sure if there is a such thing as combing the payments into one payment to capital one instead of paying each card individually?

(3) Although I have a good credit score 800+ "things affecting my credit" always list too many accounts with balances, not sure if this is something I should be concerned with and work around it (use the card randomly every 6 months) or if the hassle isn't worth it.

Ally has a free checking account that you can transfer money from your savings instantly to pay your bills with. It even has an APY, not a great rate but better than a sharp stick in the eye.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple ca

CIT Bank (NOT! Citi) still charges a fee if you go over 6 withdrawals a month.

The distinction between checking and savings was because of different reserve requirements. When the reserve requirements for both types of accounts became the same (0?), it was decided there was no reason to make the distinction for a rule on number of withdrawals.

As far as what you "ought" to use? Whatever works best for you. I use my savings account (at Marcus/Goldman Sachs) to pay all my credit cards...because savings has a better interest rate than checking. At some point the banks may do something to enforce a distinction to preserve some rationale for different interest rates, but until they do, I'll use whichever account meets my needs and gives the best interest rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did banks get rid of the 6 limited transactions on savings accounts? Any way to pay multiple ca

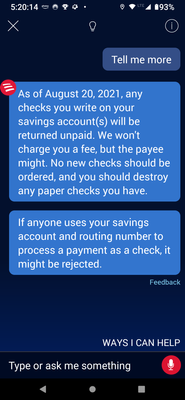

On a somewhat related note, I recently received a notice from BofA that checks could no longer be written on savings accounts. It included a date after which such checks would be returned unpaid. I saw this when I logged in last night on my phone: