- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Evansville Federal Teachers Credit Union

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Evansville Federal Teachers Credit Union

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Evansville Federal Teachers Credit Union

A few weeks back I posted looking for advice regarding a high yield checking account. I've been side hustling some extra jobs while DH's small business is significantly affected by COVID-19. My income is stable and is guaranteed to remain that way for at least 5 years, probably longer. DH has been hustling too and we live pretty simply, but with everything going on I want to keep my extra income accessible, but I also don't want it earning nothing.

I already have the following accounts maxed out:

NFCU EzCert 3.5% - $3000

DCU 6% - $1000

Service CU 5% - $500

I have another $2000 at NFCU in a cert earning 2%, expires in Feb.

I was starting to grow a Service CU Holiday account at 3%/$3000 max and opened an Affinity FCU account for 2%/$2000 max. I put away about $700/month. Now with the side hustles it's going to be quite a bit more through at least January. I really don't want to maintain and have to worry about transfers for a bunch of savings accounts.

Someone linked me to a bunch of accounts/reviews and I ended up going with Evansville. They were not the absolute best rate, but had favorable reviews and manageable requirements. I've been really pleased so far.

They offer 3.3% on balances up to 20k. I may decide to sacrifice the 0.2% on the Navy EZ Cert next year just for the convenience of having the money available for withdrawal.

I applied online Tuesday, July 7th. Clearly they are not Chex sensitive given my recent flurry of CU apps. There was some concern from reading around that they might be.

They do not automatically grant the first month. So I advise you apply early in the month to ensure you can fulfill all of the requirements. I was able to fund via paypal, which is awesome because it's 5% via Discover and I'm still getting cash back match, so woot. I funded the max of $1200.

Requirements

- DD 1x per month. No minimum amount listed.

- 15x card swipes. Amazon gift cards work. Boo yah.

- Login to the app or mobile banking 1x per month.

- Enroll in estatements

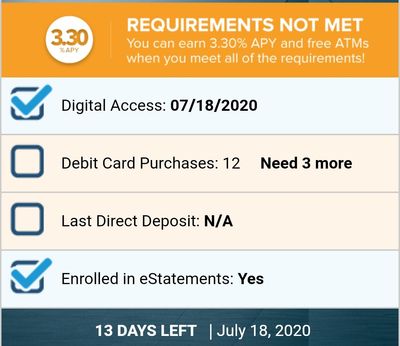

Pretty easy all around. I got my debit/master card 1 week after applying. You need your member number to create an online banking account. I did not see it in the stuff I got so far, but a rep was able to confirm my identity and provide it over the phone so I could get info and my DD set up with my employer. Did a test charge with Amazon and confirmed it counted in the app. The app let's you track your progress on the requirements so you know exactly where you stand. It acknowledged my enrollment in estatements 24 hours after. And most of the amazon charges have gone through within 12-24 hours. It does say to give up to 2 days though.

Here's a picture of the rewards checker:

Very satisfied so far. I think this is a great fit for what I was looking for. In an emergency I can write checks from this account, have a debit/MC, am earning a really decent %, and there are not an unreasonable amount of fiery hoops to jump through.

Desired BK recovery line up complete 7/12/2021. Planning to garden until 8/2023 and potentially try for AMEX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Evansville Federal Teachers Credit Union

How did you join, though? Did you choose the donation option? If so, did the application include it or did you have to do the donation separately? I can't figure it out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Evansville Federal Teachers Credit Union

@minski wrote:

I just joined, and **bleep**, I wish I thought about using Discover!

How did you join, though? Did you choose the donation option? If so, did the application include it or did you have to do the donation separately? I can't figure it out.

I said I would donate and I don't recall ever doing so. Also, I found out the other day that initiating an external transfer into the account seems to have satisfied the DD requirement.

Desired BK recovery line up complete 7/12/2021. Planning to garden until 8/2023 and potentially try for AMEX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Evansville Federal Teachers Credit Union

Awesome, thanks for paypal info

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Evansville Federal Teachers Credit Union

@recoveringfrombk7 wrote:A few weeks back I posted looking for advice regarding a high yield checking account. I've been side hustling some extra jobs while DH's small business is significantly affected by COVID-19. My income is stable and is guaranteed to remain that way for at least 5 years, probably longer. DH has been hustling too and we live pretty simply, but with everything going on I want to keep my extra income accessible, but I also don't want it earning nothing.

I already have the following accounts maxed out:

NFCU EzCert 3.5% - $3000

DCU 6% - $1000

Service CU 5% - $500

I have another $2000 at NFCU in a cert earning 2%, expires in Feb.

I was starting to grow a Service CU Holiday account at 3%/$3000 max and opened an Affinity FCU account for 2%/$2000 max. I put away about $700/month. Now with the side hustles it's going to be quite a bit more through at least January. I really don't want to maintain and have to worry about transfers for a bunch of savings accounts.

Someone linked me to a bunch of accounts/reviews and I ended up going with Evansville. They were not the absolute best rate, but had favorable reviews and manageable requirements. I've been really pleased so far.

They offer 3.3% on balances up to 20k. I may decide to sacrifice the 0.2% on the Navy EZ Cert next year just for the convenience of having the money available for withdrawal.

I applied online Tuesday, July 7th. Clearly they are not Chex sensitive given my recent flurry of CU apps. There was some concern from reading around that they might be.

They do not automatically grant the first month. So I advise you apply early in the month to ensure you can fulfill all of the requirements. I was able to fund via paypal, which is awesome because it's 5% via Discover and I'm still getting cash back match, so woot. I funded the max of $1200.

Requirements

- DD 1x per month. No minimum amount listed.

- 15x card swipes. Amazon gift cards work. Boo yah.

- Login to the app or mobile banking 1x per month.

- Enroll in estatements

Pretty easy all around. I got my debit/master card 1 week after applying. You need your member number to create an online banking account. I did not see it in the stuff I got so far, but a rep was able to confirm my identity and provide it over the phone so I could get info and my DD set up with my employer. Did a test charge with Amazon and confirmed it counted in the app. The app let's you track your progress on the requirements so you know exactly where you stand. It acknowledged my enrollment in estatements 24 hours after. And most of the amazon charges have gone through within 12-24 hours. It does say to give up to 2 days though.

Here's a picture of the rewards checker:

Very satisfied so far. I think this is a great fit for what I was looking for. In an emergency I can write checks from this account, have a debit/MC, am earning a really decent %, and there are not an unreasonable amount of fiery hoops to jump through.

Isn't it a lot of work to make 15 gift card purchases a month?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Evansville Federal Teachers Credit Union

@SouthJamaica wrote:

@recoveringfrombk7 wrote:A few weeks back I posted looking for advice regarding a high yield checking account. I've been side hustling some extra jobs while DH's small business is significantly affected by COVID-19. My income is stable and is guaranteed to remain that way for at least 5 years, probably longer. DH has been hustling too and we live pretty simply, but with everything going on I want to keep my extra income accessible, but I also don't want it earning nothing.

I already have the following accounts maxed out:

NFCU EzCert 3.5% - $3000

DCU 6% - $1000

Service CU 5% - $500

I have another $2000 at NFCU in a cert earning 2%, expires in Feb.

I was starting to grow a Service CU Holiday account at 3%/$3000 max and opened an Affinity FCU account for 2%/$2000 max. I put away about $700/month. Now with the side hustles it's going to be quite a bit more through at least January. I really don't want to maintain and have to worry about transfers for a bunch of savings accounts.

Someone linked me to a bunch of accounts/reviews and I ended up going with Evansville. They were not the absolute best rate, but had favorable reviews and manageable requirements. I've been really pleased so far.

They offer 3.3% on balances up to 20k. I may decide to sacrifice the 0.2% on the Navy EZ Cert next year just for the convenience of having the money available for withdrawal.

I applied online Tuesday, July 7th. Clearly they are not Chex sensitive given my recent flurry of CU apps. There was some concern from reading around that they might be.

They do not automatically grant the first month. So I advise you apply early in the month to ensure you can fulfill all of the requirements. I was able to fund via paypal, which is awesome because it's 5% via Discover and I'm still getting cash back match, so woot. I funded the max of $1200.

Requirements

- DD 1x per month. No minimum amount listed.

- 15x card swipes. Amazon gift cards work. Boo yah.

- Login to the app or mobile banking 1x per month.

- Enroll in estatements

Pretty easy all around. I got my debit/master card 1 week after applying. You need your member number to create an online banking account. I did not see it in the stuff I got so far, but a rep was able to confirm my identity and provide it over the phone so I could get info and my DD set up with my employer. Did a test charge with Amazon and confirmed it counted in the app. The app let's you track your progress on the requirements so you know exactly where you stand. It acknowledged my enrollment in estatements 24 hours after. And most of the amazon charges have gone through within 12-24 hours. It does say to give up to 2 days though.

Here's a picture of the rewards checker:

Very satisfied so far. I think this is a great fit for what I was looking for. In an emergency I can write checks from this account, have a debit/MC, am earning a really decent %, and there are not an unreasonable amount of fiery hoops to jump through.

Isn't it a lot of work to make 15 gift card purchases a month?

Did it in about 5-10 minutes while sitting on a conference call. I have a standing monthly order with Amazon, so there is no waste. And my 15 transactions were less than $20 so no big miss on returns for what I laid out. I think I could do smaller giftcards (I did varying amounts up to 1.50 just because I have OCD). For my purposes it is this or monitor several accounts across several institutions and remember to transfer the pennies I make every month somewhere else, etc. I also have been working a lot of extra jobs and such so I felt like I was joining a lot of CUs and was running out of options. There are no perfect solutions. 3.3% for up to 20k simplifies a lot for me. Plus I get free ATMs and a MC/debit and checks, which makes it a readily available emergency fund.

Desired BK recovery line up complete 7/12/2021. Planning to garden until 8/2023 and potentially try for AMEX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Evansville Federal Teachers Credit Union

How do you find their ACH? Fast? Slow? Free? Cumbersome?

Edit: I just checked it out and I am limited to $1000 max. Is this because account is new or is this the usual max limit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Evansville Federal Teachers Credit Union

I just got approved for an account.

Waiting on the debit card and account number.