- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- High-Yield Money Market Savings Experiences

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

High-Yield Money Market Savings Experiences

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

Also Blue FCU has 5.00% APY on up to $1k, with tiered rates after that.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

@LawStudentCivilis wrote:Capital One 360 Performance Savings is now 2.15% APY - there's no cap as far as I'm aware. Please correct me if I'm wrong.

I'll reserve my usual praises for Affinity, I know it has to be sickening at a certain point.

That's correct @LawStudentCivilis.

Capital One 360 has no minimum balance to earn the high yield rate, no monthly maintenance fees, no maximum balance that earns the high yield rate. I will note that like most other lenders, while there is no maximum deposits are only insured up to the FDIC limit of $250K per account, so keeping anything more than that would be more risky. And Capital One states that they reserve the right to restrict multiple accounts.

That's funny about the rate, though. My Capital One mobile app shows the rate at 2.00% but the website shows it's updated to 2.15%. The rate environment is changing rapidly!! ![]()

That makes my Capital One 360 and Goldman Sachs Marcus both 2.15%; Discover at 2.10%; and American Express at 1.90%. I appreciate that I have credit cards with all of those lenders and with three out of four of them, I can monitor my savings and credit card with a single log-in. I'm still evaluating whether I want to dabble in one of the higher yielding accounts.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

@Anonymalous wrote:Just a week makes a big difference (as of 9/22):

- 3.00% Dollar Savings Direct

- 2.87% Enzo

- 2.76% Republic Bank (money market account)

- 2.75% Axiom Bank (via SaveBetter)

- 2.61% Brio Direct

- 2.61% Brilliant Bank (money market account)

- 2.61% UFB (new accounts only)

That's very true, and the changes keep coming. This is a very volatile market, but in a good way. Here's some of the additional changes I see only about 12 days after I posted the list earlier this month. And to think that a few weeks ago, I was eyeing the E*Trade account at 2.00% which was better-than-average. Now it lags at 2.00%. Although that could change tomorrow. LOL ![]()

As of 09/27/2022, here are some of the best rates - above 2.25%. Recently changed rates since 09/15 are marked in red. BOLDED names are from the top 20 place holders on the August list. IE: they have been towards the top for three months. For comparison to market placement, I added some of the rankings. IMO, high volatility (such as Dollar Savings Direct's 55 to 45 to 2) is a little concerning if trying to find accounts that will consistently be near the top. Brilliant Bank's 4 to 1 to 4 movement is impressive, as-is Merchant's Bank 2 to 9 to 1. I also like Republic Bank's 3 to 11 to 5 and Bask Bank's 8 to 5 to 7. Ivy Bank raised their rates significantly since August but they've fallen behind from 1 to 8 to 10. Enzo also seems fairly consistent moving from 9 to 17 to 3.

- Merchants Bank – 3.05% (up from 2.28%)

*Merchants Bank moved from (2) to (9) to (1) since August.

- Dollar Savings Direct – 3.00% (up from 2.00%)

*Dollar Savings Direct moved from (55) to (45) to (2). ![]()

= = = = = = = = = = = = = = = = = = = = = = = = =

- Enzo – 2.87% (up from 2.18%)

*ENZO moved from (9) to (17) to (3)

- Brilliant Bank – 2.80% (up from 2.61%)

*Brilliant Bank moved from (4) to (1) to (4)

- Republic Bank – 2.76% (up from 2.26% APY) ($2.5K+; not available in IL, IN, WI, MI)

*Republic Bank moved from (3) to (11) to (5)

*Bask Bank moved from (8) to (5) to (7)

- First Foundation – 2.75% (up from 2.25%)

*First Foundation moved from (20) to (12) to (8)

- BankPurely – 2.75% (up from 2.15%) ($25K+)

*Bank Purely moved from (28) to (22) to (9)

= = = = = = = = = = = = = = = = = = = = = = = = =

- Ivy Bank – 2.70% (up from 2.30%) ($2.5K+; not available in CA)

*Ivy Bank moved from (1) to (8) to (10)

- TAB Bank – 2.66% (up from 2.16%)

*TAB Bank moved from (26) to (18) to (11)

- Lending Club Banking – 2.65% (up from 2.15%)

*Lending Club moved from (17) to (23) to (12)

- BrioDirect – 2.61% (up from 2.15%)

- UFB – 2.61% *for NEW accounts

- TotalDirectBank – 2.60% ($2.5K+)

- Wealthfront – 2.55% (up from 2.00%)

- Usalliance – 2.50%

- Redneck Bank also known as All America Bank– 2.50% (up from 2.25%) (maximum $50K)

- Vio Bank – 2.50% (up from 2.22%)

= = = = = = = = = = = = = = = = = = = = = = = = =

- Northpointe – 2.45% (up from 2.15%) ($25K+)

- CIT Bank – 2.40% (up from 2.10%)

- Citizens Access – 2.35% (up from 2.10%) ($5K+)

- CIBC – 2.32% ($1K+)

- Prime Alliance – 2.26% ($10K+)

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

@Aim_High wrote:

@LawStudentCivilis wrote:Capital One 360 Performance Savings is now 2.15% APY - there's no cap as far as I'm aware. Please correct me if I'm wrong.

I'll reserve my usual praises for Affinity, I know it has to be sickening at a certain point.

That's correct @LawStudentCivilis.

Capital One 360 has no minimum balance to earn the high yield rate, no monthly maintenance fees, no maximum balance that earns the high yield rate. I will note that like most other lenders, while there is no maximum deposits are only insured up to the FDIC limit of $250K per account, so keeping anything more than that would be more risky. And Capital One states that they reserve the right to restrict multiple accounts.

That's funny about the rate, though. My Capital One mobile app shows the rate at 2.00% but the website shows it's updated to 2.15%. The rate environment is changing rapidly!!

Same here! I haven't checked today though. Thanks for confirming, I didn't notice a cap on my end but I didn't know if I simply had not met it yet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

@M_Smart007 wrote:

A few that I hold ...

Digital CU Up to and including the first $1,000.00 6.00% 6.17%

Andrews CU $.01 - 1,000.00 4.906% 5.00%

Service CU Primary Saving $0.00 - $500.00 4.889% 5.00%

Service CU Holiday Club Savings $0.01 - $3,000.00 Tier 1 2.960% 3.00%

Affinity CU 3.50% APY* on the first $5,000—that’s $175 in dividends per year

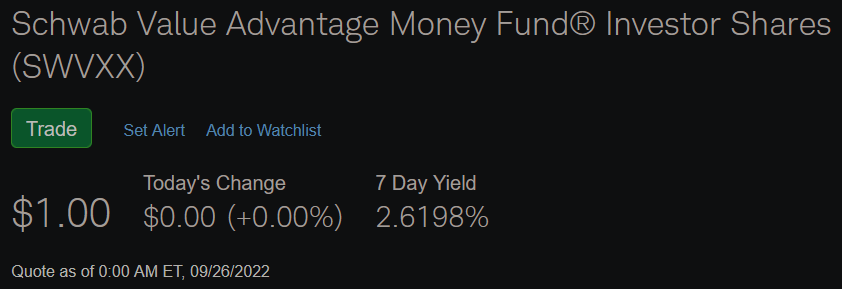

USALLIANCE CU High Dividend Savings 2.50%APY* / $500 minimum balance (to earn dividends)Charles Schwab Schwab Value Advantage Money Fund® Investor Shares (SWVXX) 7 Day Yield 2.6198%

@M_Smart007 Thank you for sharing your list. Have you or do you plan to add any others? What are your thoughts about US Alliance and Charles Schwab? I'm considering both.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

@Aim_High wrote:

@Anonymalous wrote:Just a week makes a big difference (as of 9/22):

- 3.00% Dollar Savings Direct

- 2.87% Enzo

- 2.76% Republic Bank (money market account)

- 2.75% Axiom Bank (via SaveBetter)

- 2.61% Brio Direct

- 2.61% Brilliant Bank (money market account)

- 2.61% UFB (new accounts only)

That's very true, and the changes keep coming. This is a very volatile market, but in a good way. Here's some of the additional changes I see only about 12 days after I posted the list earlier this month. And to think that a few weeks ago, I was eyeing the E*Trade account at 2.00% which was better-than-average. Now it lags at 2.00%. Although that could change tomorrow. LOL

As of 09/27/2022, here are some of the best rates - above 2.25%. Recently changed rates since 09/15 are marked in red. BOLDED names are from the top 20 place holders on the August list. IE: they have been towards the top for three months. For comparison to market placement, I added some of the rankings. IMO, high volatility (such as Dollar Savings Direct's 55 to 45 to 2) is a little concerning if trying to find accounts that will consistently be near the top. Brilliant Bank's 4 to 1 to 4 movement is impressive, as-is Merchant's Bank 2 to 9 to 1. I also like Republic Bank's 3 to 11 to 5 and Bask Bank's 8 to 5 to 7. Ivy Bank raised their rates significantly since August but they've fallen behind from 1 to 8 to 10. Enzo also seems fairly consistent moving from 9 to 17 to 3.

- Merchants Bank – 3.05% (up from 2.28%)

*Merchants Bank moved from (2) to (9) to (1) since August.

- Dollar Savings Direct – 3.00% (up from 2.00%)

*Dollar Savings Direct moved from (55) to (45) to (2).

= = = = = = = = = = = = = = = = = = = = = = = = =

- Enzo – 2.87% (up from 2.18%)

*ENZO moved from (9) to (17) to (3)

- Brilliant Bank – 2.80% (up from 2.61%)

*Brilliant Bank moved from (4) to (1) to (4)

- Republic Bank – 2.76% (up from 2.26% APY) ($2.5K+; not available in IL, IN, WI, MI)

*Republic Bank moved from (3) to (11) to (5)

*Bask Bank moved from (8) to (5) to (7)

- First Foundation – 2.75% (up from 2.25%)

*First Foundation moved from (20) to (12) to (8)

- BankPurely – 2.75% (up from 2.15%) ($25K+)

*Bank Purely moved from (28) to (22) to (9)

= = = = = = = = = = = = = = = = = = = = = = = = =

- Ivy Bank – 2.70% (up from 2.30%) ($2.5K+; not available in CA)

*Ivy Bank moved from (1) to (8) to (10)

- TAB Bank – 2.66% (up from 2.16%)

*TAB Bank moved from (26) to (18) to (11)

- Lending Club Banking – 2.65% (up from 2.15%)

*Lending Club moved from (17) to (23) to (12)

- BrioDirect – 2.61% (up from 2.15%)

- UFB – 2.61% *for NEW accounts

- TotalDirectBank – 2.60% ($2.5K+)

- Wealthfront – 2.55% (up from 2.00%)

- Usalliance – 2.50%

- Redneck Bank also known as All America Bank– 2.50% (up from 2.25%) (maximum $50K)

- Vio Bank – 2.50% (up from 2.22%)

= = = = = = = = = = = = = = = = = = = = = = = = =

- Northpointe – 2.45% (up from 2.15%) ($25K+)

- CIT Bank – 2.40% (up from 2.10%)

- Citizens Access – 2.35% (up from 2.10%) ($5K+)

- CIBC – 2.32% ($1K+)

- Prime Alliance – 2.26% ($10K+)

@Aim_High Thank you for updating this list. Do you have any accounts with these? I'm really just looking for another bank or two with overall great financial products to build a relationship now that will help better position me when I'm ready to get their credit cards, loans, etc. If anyone else has experiences with these, please feel free to share as well. It would be helpful. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

Finally my Vio Bank Cornerstone Money Market account is paying above ETFCU/Liberty FCU rewards checking, 3.52% (no requirement) va 3.45% (15 debit transactions per month and one ACH). Plus I beleive Vio is uncapped and the latter is up to $20K.

Not QUITE fair in that Vio isn't checking, but I never used ETFCU for that anyway (except to use the debit card to meet the debit requirement)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

@credit8502020 wrote:@Aim_High Thank you for updating this list. Do you have any accounts with these? I'm really just looking for another bank or two with overall great financial products to build a relationship now that will help better position me when I'm ready to get their credit cards, loans, etc. If anyone else has experiences with these, please feel free to share as well. It would be helpful. Thank you!

You're welcome, @credit8502020. I just have accounts with five of them. I mentioned the first four in posting number one (Goldman Sachs Marcus, Capital One 360, Discover Bank; and PenFed Premium Online Savings. The only one I added in the past few months was my AMEX online savings.

I am still monitoring these lenders and may eventually move some of my savings. I would like to put some funds in with a lender who consistently pays a higher yield than the ones I have, while offering the stability I get from these large national lenders. I do appreciate how all the accounts I have are with banks or credit unions where I already have deposit accounts and/or credit cards, which makes monitoring them easier.

Right now, my Capital One is leading the pack paying 3.00% APR. Discover just increased to 2.75%. Goldman Sachs Marcus and AMEX are both at 2.50%. That is surprising since Marcus is normally one of the highest and AMEX has been lagging the pack a little. I expect to see Marcus increase rates again soon. PenFed's rates are good ... much better than most savings accounts ... but they always lag behind. Their current rate is 1.70%. <yawn> Actually, there is one more. I have a Money Market Savings Account with Navy FCU, similar to the one from PenFed. Like PenFed, rates are way superior to normal banking but other online accounts offer better rates. NFCU MMSA currently yields 1.50%, a little behind PenFed.

Edit to Add: Wow, I just looked through these current rates. While the landscape is changing quite rapidly, there are several in the range of 3.50% to as high as 3.82%! The highest is still Merchant's Bank at 3.82%, up from 3.05% on my last update. ![]() Maybe I should get off my duff and make a decision since my highest rate is 3.00%.

Maybe I should get off my duff and make a decision since my highest rate is 3.00%. ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

@Aim_High wrote:

@credit8502020 wrote:@Aim_High Thank you for updating this list. Do you have any accounts with these? I'm really just looking for another bank or two with overall great financial products to build a relationship now that will help better position me when I'm ready to get their credit cards, loans, etc. If anyone else has experiences with these, please feel free to share as well. It would be helpful. Thank you!

You're welcome, @credit8502020. I just have accounts with five of them. I mentioned the first four in posting number one (Goldman Sachs Marcus, Capital One 360, Discover Bank; and PenFed Premium Online Savings. The only one I added in the past few months was my AMEX online savings.

I am still monitoring these lenders and may eventually move some of my savings. I would like to put some funds in with a lender who consistently pays a higher yield than the ones I have, while offering the stability I get from these large national lenders. I do appreciate how all the accounts I have are with banks or credit unions where I already have deposit accounts and/or credit cards, which makes monitoring them easier.

Right now, my Capital One is leading the pack paying 3.00% APR. Discover just increased to 2.75%. Goldman Sachs Marcus and AMEX are both at 2.50%. That is surprising since Marcus is normally one of the highest and AMEX has been lagging the pack a little. I expect to see Marcus increase rates again soon. PenFed's rates are good ... much better than most savings accounts ... but they always lag behind. Their current rate is 1.70%. <yawn> Actually, there is one more. I have a Money Market Savings Account with Navy FCU, similar to the one from PenFed. Like PenFed, rates are way superior to normal banking but other online accounts offer better rates. NFCU MMSA currently yields 1.50%, a little behind PenFed.

Edit to Add: Wow, I just looked through these current rates. While the landscape is changing quite rapidly, there are several in the range of 3.50% to as high as 3.82%! The highest is still Merchant's Bank at 3.82%, up from 3.05% on my last update.

Maybe I should get off my duff and make a decision since my highest rate is 3.00%.

@Aim_High Thank you! I agree & understand exactly what you mean by it being more ideal when the credit union/bank has other products that you want to or do use as well. I definitely want my next account(s) to be strong banks that will be consistent in having strong rates throughout the year. I've moved money from PenFed since it was lower than what I was getting at Alliant. Goldman Sachs Marcus, Capital One 360 & Barclays are definitely on my list. I don't know if this is ever a concern, but I'm being careful because I don't want opening too many accounts at the same time to cause any issues. Valley Bank is another that was on my list on the business side, so I may look into opening a HYSA there personally first. I just need to confirm it is still not geo-fenced.

To your edit: Yes things are changing quickly! Let's go @Aim_High ! LOL! Keep us posted on those changes you make. Thanks again! I'm excited for you. I know it may not be a lot of money, but if I have money that is in the bank I at least want to earn as much as possible!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

There's one that's higher: Current's APR is 4.0%.