- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- How I'm Managing My Credit Accounts

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How I'm Managing My Credit Accounts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I'm Managing My Credit Accounts

I thought I would share something I'm doing to help me with tracking my various personal finance accounts. This includes my installment accounts as well as my revolving credit cards.

Instead of using a spreadsheet, I'm using a combination spreadsheet and relation database known as AirTable (https://www.airtable.com). It has a nice web interface as well as a native mobile app for you to see/modify records on the road.

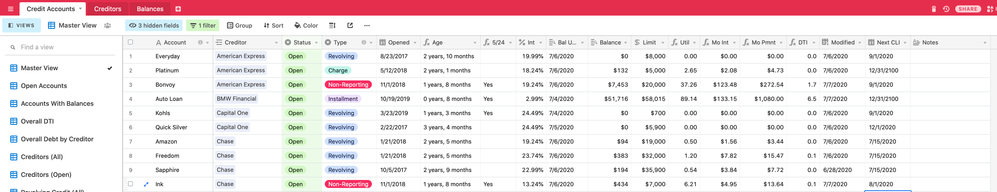

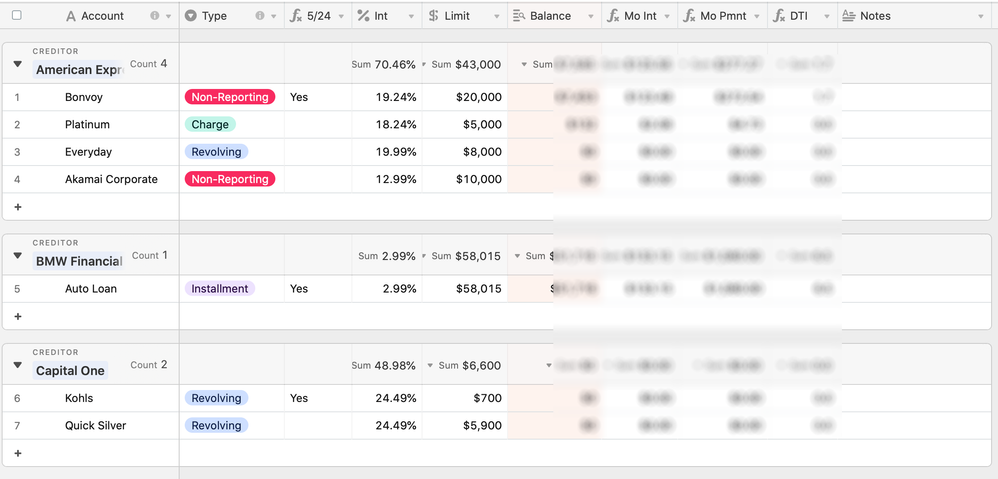

Here's an overview of my master table:

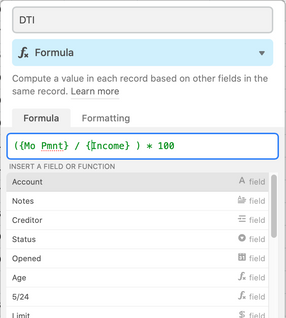

Instead of inserting a formula in each cell and copy/pasting it, you set it (or the field type/description) at the column level itself. For example, my DTI is calulated by setting the following column formula:

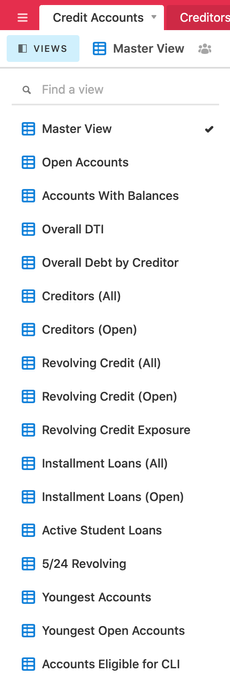

I have the Mo Pmnt auto calculated by taking the minimum payment (either 1 or 2% of balance) plus any interest if it's carrying a balance. What makes this very cool when compared to a spreadsheet is that it has a concept of views. So instead of only using the master view and rebuilding sorts/filters and pivot tables, I have the same data, but can define that data into multiple views.

For example, I have a view to show only accounts with balances, another with 5/24 accounts, another with installments, etc.

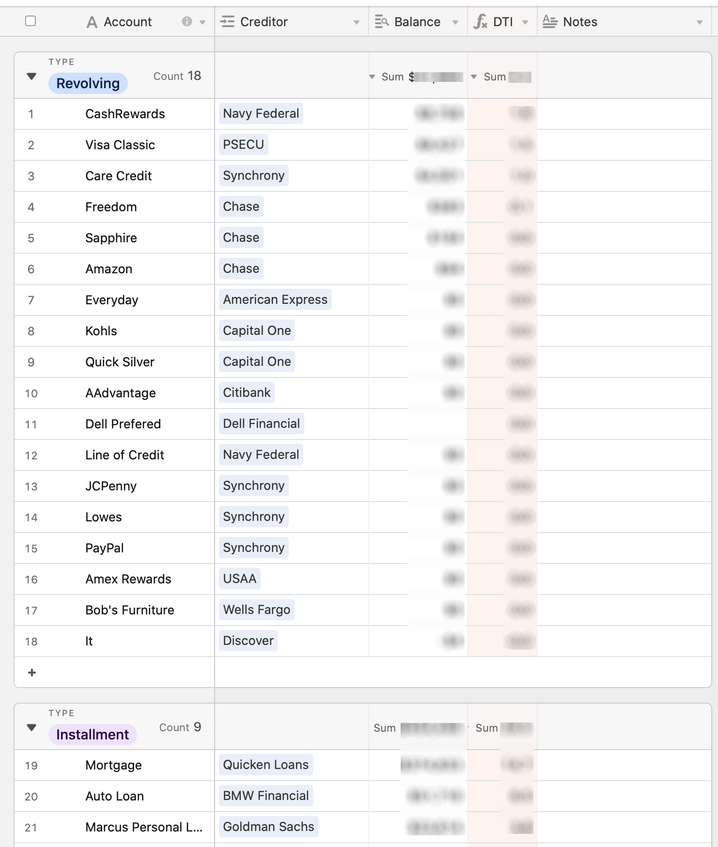

Once you create a view, you can choose what fields show for it and group data in different ways. For example, you could create a group around a specific company or type of credit. Below is an example of my DTI view that shows accounts groups based on type.

Below is an example of the debt by creditor which groups each credit company then shows each account sorted by balance.

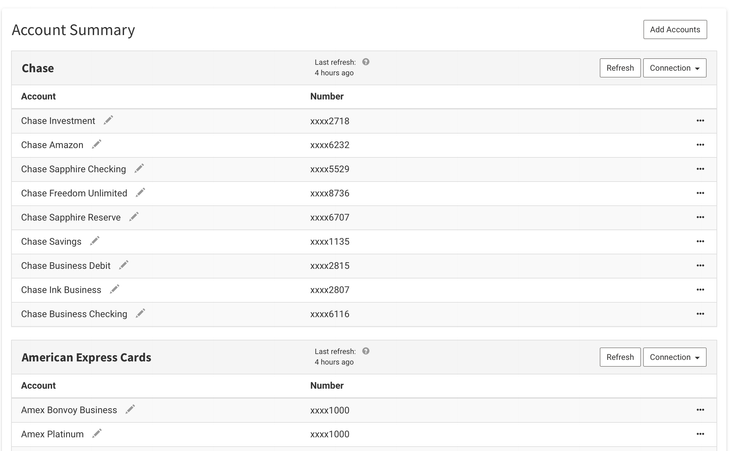

I've taken this further by linking the balance field to another table that gets automatically updated using Tiller Money (https://www.tillerhq.com). TillerMoney uses Yodlee to link to all of my various online accounts and pulling the balance automatically. TillerMoney exports that data automatically every few days (between 1-4 days refresh per account typically) into a Google spreadsheet. I then use Zapier to export that data into Airtable automatically.

This means I no longer have to maintain entering my current balance every few days. It automatically happens for me. I just have to check the Tiller dashboard occasionally to re-authenticate accounts that time-out the automated updates. (It's as simple as clicking a box that says "Refresh".)

What's cool is there are different views such as Kanban, calendar, etc. You could create a calendar view to show each due date on a calendar as a different way of visualizing the data. Or a Kanban view of accounts due this week, next week... or installment vs revolving, etc.

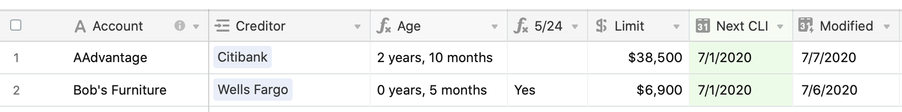

Building different views, and grouping, sorting, filtering is SUPER SIMPLE. That was always one of the biggest limitations I had when using Excel and Google Sheets. Anytime I update data in ANY view updates data EVERYWHERE. It's sometimes easier to see/manage different things while in a different view. (For example, when I go through my soft pull CLIs, I see only those accounts eligible based on the date field and as I get a new CLI, I simply enter the new limit and the next try date and save. BOOM!

The Age and 5/24 field is automatically updated based on the open date from my master table. (Since I don't need to know the exact open date or other fields, I hide them in my CLI view to only show the fields I actually care about when making a CLI request.). The modified field automatically updates anytime I change that record and all changes are logged so I can see the history of every single change I make for each field.

The free version of Airtable and Zapier are enough for me to maintain my accounts. Tiller has a 30 day trial and then is 79/year. So for $80 a year, I don't have to update my balances. Otherwise if you don't mind manually doing it, you don't need Zapier or Tiller.

I hope this preview of how I'm managing my finances helps someone else as well!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How I'm Managing My Credit Accounts

Looks great.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How I'm Managing My Credit Accounts

Nice! Thanks for sharing!

Last HP 08-07-2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How I'm Managing My Credit Accounts

I love this! I want to try to do something similar, but not as in depth.

Would you be willing to share some of your formulas if I run into problems?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How I'm Managing My Credit Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How I'm Managing My Credit Accounts

@RadioRob wrote:

Sure thing. I think I can also export a blank preconfigured base as well. I’ll see if I can do that later.

That would be awesome ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How I'm Managing My Credit Accounts

So I made a copy of the base without duplicating any of the records. I then created a few dummy records so you can see some example data.

https://airtable.com/shrCYvXCvPeNWTGLy

You can close the "Blocks" dashboard on the right. I have not set any up. (Blocks are part of the paid version and for my purposes did not add anything worthwhile.)

In the read-only guest view, it does not show the "Views" section automatically. Just click on "Master View" to show the various views that I've created for myself.

There are views that might not be applicable to you like my Student Loans that create a filter based on my student loan servicer (EdFinancial). If you choose to copy this base, just delete the views you don't care about.

If you copy the base, to get started go to the "Creditors" tab and just enter the name of each company you do business with. Don't fill out anything else there. Those will get setup automatically once you start creating accounts.

Once you've have your creditors setup, go to the Credit Accounts tab and start creating new accounts.

Here's the field info:

Account: Name of the account (such as Ink or CSP, or CashRewards, etc). You can make this whatever you like.

Creditor: Start typing the name of the creditor you created in the creditor tab. It will pull up a select option for you. Click the account you created. That will link the two fields together so they keep each other in sync.

Status: Dropdown of Open/Closed. Pick one!

Type: Installment, Revolving, Charge, or Non-Reporting. Charge is for cards that need to be PIF each month like Amex Platinum. Non-Reporting is for accounts that don't show up on any bureau report (like business accounts).

Opened: The date the account was opened (look at your bureau report if you don't remember.)

Age: AUTO-CALCULATED. Don't do anything.

5/24: AUTO-CALCULATED. Don't do anything

Int: Interest rate

Balance Update: This field is pulled from the Balances tab automatically. I do this because I have Airtable get balances automatically from Tiller. If you don't plan to do this, change the Balance Update column from Lookup to Single Line Text

Limit: What is the limit of the revolving account. For installment loans, enter the high balance.

Util: AUTO-CALCULATED. Don't do anything

Mo. Interest: AUTO-CALCULATED. Don't do anything

Inst Mo Pmnt: Installment Monthly Payment. If this is an installment loan, what is monthly payment.

Mo Pmnt: AUTO-CALCULATED. Adds up interest plus payment for the type.

DTI: AUTO-CALCULATED. Don't do anything

Modified: When was the last time this record was updated (so you know if it's up to date). AUTO-CALCULATED. Don't do anything

Next CLI: Date you want to hit them up again for more. If it's not applicable, make the date a long time in the future. I use 12/31/2100.

Notes: Anything you want to remember for yourself. A free-form field for your use.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How I'm Managing My Credit Accounts

Thank you SO MUCH for this and the detailed post! Just copied it over, excited to dig in ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How I'm Managing My Credit Accounts

as of 1/1/23

as of 1/1/23Current Cards: