- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: How to gain wealth?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How to gain wealth?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to gain wealth?

I'm very interested in increasing my net worth and hitting savings goals that would get me some banking status with some of the larger banks like maybe Citi Gold, US Bank Platinum, Chase Sapphire, or BofA Platinum Honors. Obviously this means getting some high amounts of money (up to 100k!). I'm not trying to do this overnight and I don't even think in the next five years but wanted to know how you would go from $0 to let's say $25k.

Would you use CDs? Investing? Savings? Others? Let me know your suggestions on moving up the ladder!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to gain wealth?

Unless you inherit an initial "seed", wealth tends to come from starting a business or getting a high-paying job.

*Or a moderate income job in a place with a low cost of living.

Were I in your shoes, I'd focus on keeping your finances fairly simple and putting free time to more profitable uses (a side business, longer work hours, training for a better job or promotion, keeping grades high, networking, etc.).

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to gain wealth?

Spend less than you earn.

It really is that simple. ![]()

Fico 9: EX 756 03/13/24, EQ 790 02/04/24, TU No idea.

Zero percent financing is where the devil lives...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to gain wealth?

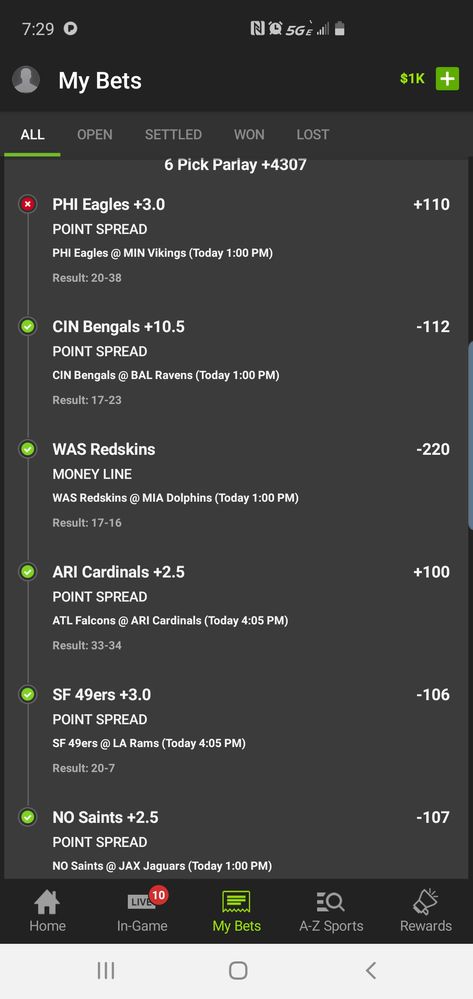

By not including the Eagles in parlays. Fml.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to gain wealth?

Make a budget so you can spend less and save more.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to gain wealth?

@ToxikPH wrote:I'm very interested in increasing my net worth and hitting savings goals that would get me some banking status with some of the larger banks like maybe Citi Gold, US Bank Platinum, Chase Sapphire, or BofA Platinum Honors. Obviously this means getting some high amounts of money (up to 100k!). I'm not trying to do this overnight and I don't even think in the next five years but wanted to know how you would go from $0 to let's say $25k.

Would you use CDs? Investing? Savings? Others? Let me know your suggestions on moving up the ladder!

I'm working on the same thing. Building my back end per say.

I ended up working part time with a company that is partially owned by Phill Knight. I'm working on residual income seperate of my regular job. Within the next year my goal is to match my full time job then exceed it the following year. Then I can work on my back end and try not to have a regular job anymore.

Good Luck!

Updated Feb 2023:

Citi Double Cash: $26,300

Citi Costco: $33,800

PenFed Power Cash: $50,000

Chase Freedom Unlimited: $33,400

NFCU Cash Rewards: $29,000

BoA Unlimited Cash: $99,900

Wells Fargo Active Cash: $50,000

Citi AAdvantage Executive: $30,500

Wells Fargo Mortgage 30yr fixed 3.625%

Business Cards:

BoA Business Advantage Unlimited Cash: $8,000

Chase Ink Business Unlimited: $75,000

Chase Ink Business Unlimited: $75,000

RIP: EECU PLOC | BBVA PLOC | Chase SP | Chase Amazon | Chase Freedom | WF Propel | Cap1 QS | AMEX Gold | BoA Custom Cash | Lowes | Barclays Aviator Red

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to gain wealth?

Everyone's top three expenses are housing, transportation and food. With that in mind:

Old cars (or no car!)

Cheap housing (family, friends, roommates)

Buying groceries, making coffee at home, eating at home, and taking your lunch to your work

Also as others have mentioned upping your hustle and getting multiple income streams going.

It really all starts with budgeting and saving a high percentage of your income. Look up FIRE (Financial independence retire early) stories on the internet and to books like The Millionaire Next Door for inspiration. Once you have the budgeting down and are saving 50+% of your income or more, that's the time to really think of the investment vehicles you'd like to use.

You actually don't need to earn a lot of money to get there (yes, it's very helpful though) but you just have to be very careful of where it goes.

My oldest nephew is 26, skipped college, and works two blue collar jobs and probably has more $$ socked away than most in our family. He just bought his first house and took in two roommates that are paying his mortgage. He's also a car nut and has a knack for finding deals that he will drive for fun for a while then sell for more $$.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to gain wealth?

@ToxikPH wrote:I'm very interested in increasing my net worth and hitting savings goals that would get me some banking status with some of the larger banks like maybe Citi Gold, US Bank Platinum, Chase Sapphire, or BofA Platinum Honors. Obviously this means getting some high amounts of money (up to 100k!). I'm not trying to do this overnight and I don't even think in the next five years but wanted to know how you would go from $0 to let's say $25k.

Would you use CDs? Investing? Savings? Others? Let me know your suggestions on moving up the ladder!

Seeing an account grow is certainly rewarding, but also keep in mind that banking status perks often don't mean much anymore, at least for younger people.

Discount brokerages now offer the free trades banking status required just a few weeks ago.

Major banks often pay negligible interest compared to a smaller bank or CU.

Not all branches offer safety deposit boxes, and the free-with-status ones can be very small.

A lot of banks offer free checking and waive/reimburse ATM fees for all customers.

Getting a good yield on savings at a no-frills bank may be a better overall value.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to gain wealth?

1. Make money

2. Don't spend that money

3. Invest that money

4. ???

5. Profit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to gain wealth?

+1 to all other replies

Also, can start saving a $ amount or a % amount.

The savings come from spending less or having more income(ing)

Keep growing that amount above and try to "beat" it over and over each month or year, etc.

I tend to make it a "game" on how little I can can spend.

It seems to be fun and challenging when I have a large home and 4 dependants and a stay at home misses.

Wealth is in the eye of the beholder.

A person could be making $7.25/hr working 20 hrs a week and be wealthier than a person

making $65/hr or $300k a year but spending it like there is no tomorrow or just have much larger bills, liabilities etc.

Be wise with how you spend and save and wealth can come sooner.